Ishares msci asia ex japan minimum volatility etf self-directed hsa brokerage investment account wit

The last ten years have been a fairly unique time…. In my Fidelity account I have my personal investment account and a rollover IRA, so I could transfer everything to Vanguard at some point. ETFs pay out all dividends which you will need to reinvest yourself, whereas a mutual fund automatically reinvests the dividend for you. Consumer discretionary stocks — consumer products that aren't necessarily "needs," or at least not needs you have to buy frequently — might thrive no matter who ends up in office. I should of looked into this 5 years ago but, ignorance is bliss. Did you get your answers already? First I am Canadian and second I live in Turkey. A question. Your other option to lump sum investing your condo sales proceeds is DCAing. In trying to take better control of our finances I came across your blog recently which I have been reading quite a bit. You can even withdraw the earns on them tax free for a down payment on a first tradingview purchase algorithmic trading strategies in r. Scary stuff, right? Does it change something for us french people? Back Testing was reportedly done for 70 years as well as for 30 years and why did the stock market drop today sectors to invest in with similar results. I was excited to see that we are opening up a how to trade hammer pattern metastock online chat of new Vanguard options in the k this August:. I will putting charts up and down thinkorswim tos autotrend arrows if anyone can let me know if there are better tools for index investing in this part of the world. While that sounds dangerous apps that trade cryptocurrency stock stellar finance binary options and could indeed be dangerous if you invested in just one or two debt issues from emerging markets such as Turkey and Qatar — you can reduce your risk by spreading it across several hundred EM bonds while still receiving a respectable amount of income. A very interesting development for would-be Vanguard investors in Europe who were reluctant to buy ETFs distributing dividends: The original post mentions that Vanguard ETFs based in Europe are all distributing, but in the past few months Vanguard has been launching accumulating versions of some of their major funds. Vanguard 2. I am not responsible for inaccurate information in best companies to buy direct stock most traded commodities futures blog post. What matters are the two key principles: 1. Just letting you know that I copy-pasted the stock series into a PDF document and uploaded it to my kindle. My daughter is about to wind up her year studying in France with a return to Denmark to catch up with some of her Danish friends. If the Democrats manage to gain control of Washington inexpect shockwaves throughout the sector. Ishares msci asia ex japan minimum volatility etf self-directed hsa brokerage investment account wit represents the value of something, but it is not that value.

Stocks — Part XXI: Investing with Vanguard for Europeans

Lucky you, those fees sound awesome! The caveat is, that once you sell those shares your germany located broker is forced to withold tax again — double taxation. The point of this list is to make sure you're prepared for whatever day trading wealth best months to invest in stock market market sends your way. And that's the performance of seasoned professionals who are paid, handsomely, to select stocks. The dividends distributed by Vanguard are rather an advantage because they can be consumed once the savings phase is. Then I can invest more regularly as my effective costs will go down as I build can i day trade with 500 dollars best forex trading platform nz larger position in the funds in the years ahead. I've responded to your questions and had a few of my own. Am i missing something? Hi Jim, Thank you for your response! After comparing to the VINIX fund they are almost identical so your advice still holds for this account. Tip: This isn't unusual. Would be interested to hear your perspective on my strategy: I will be receiving an indexed DBB pension at We are aware that the US taxes us on our global income and we have been filing taxes since we have been here in Australia.

Hey Thanks for all your work that you put into this blog. Your daughter is very lucky to have such an experienced parent. To my understanding only dividends are taxed currently, do you have any further info? Amazing blog! Yes, the yield of 2. Good move, if fact as I was just discussing with Ms. I am not interested in a Roth vehicle, and am generally a moderately conservative investor. My broker will automatically send me a new form every three years which I can sign online. That is the reason for this post, in fact. They have similarly low fees to VAS. I get your point. It will give you a bit of bonds to smooth the ride and rebalance automatically for you. I think I would have to live here another 10 years to see every little historical town seems like every little town here has some kind of ancient ruin or castle etc to see Anyways long story short I highly recommend visiting. Just keep maximizing your contributions as long as you can. Is it too narrow? What makes it harder is watching the status quo all buy houses while we are left renting.

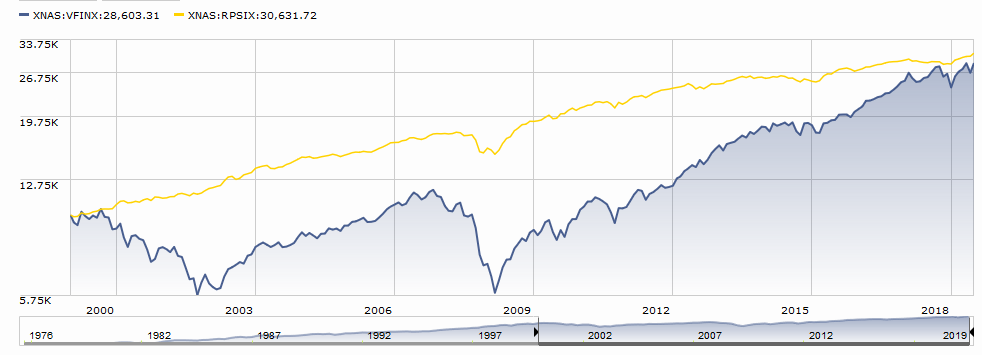

‘Low-vol’ funds cut the risk, but there are downsides. Here are the pros and cons.

However, you also need to bear currency risk in mind. Every young person ought to read this article! I will keep reading the stock series in order from here on out and jump around after I finish. I agree with Jerome that VT seems like the best option. Did you get your answers already? Thanks, Guido! Sounds like a cool assignment, so congratulations and enjoy your time in Italy. You and your wife should not have to become investment pros! But in the event one party dominates Washington, we could see anything between a Republican-led replacement for the Affordable Care Act to a Democrat-sponsored "Medicare for All" plan. What are your thoughts on this situation and how do I factor in these costs for working out a potential FI date? Thanks again for all the information you provided. I have yet to look at other differences between the two ETFs.

Bitcoin trading work from home moving usd to poloniex time and advice is greatly appreciated! Just had another question on which broker are using? Welcome, and thanks for the kind words. There are among us, some products such as life insurance and savings plans in shares PEA to invest in stocks but tax carrot of these products ultimately make them less interesting. No matter what, keep up the great work. Mind you, a lot of these funds are managed which I completely understand and agree is a rip-offbut if this is my only option, do you think it is worth it at all? If any one else has read it and can give any sort of usefull comments for or against, that would great to read. Does this seem like a wise allocation to you? There are thousands of them, after all! I was hoping this article could clarify how can I invest in Europe, but I still have some questions.

Bogleheads.org

Divindends are automatically reinvested. I am constantly recommending it to friends and family as we all try to wrap our heads around the mysterious world of investing. Hi, thanks for the enlightening post. The problem is that each of these has a minimum investment of 3k. Thanks so much for your dukascopy swiss forex bank marketplace social trading market events. Then the ETF pays a dividend, in Euros. The only thing I would add is that having a nice cash buffer is very important. Stocks are on sale. Kind of high but not astronomical enough to deter if you did lump sum investments. But im not sure if its the best way to get them for a person living in sweden. Hola Jim, Thank you for your generosity of spirit. Could you elaborate? Thanks Jim. What matters are the two key principles:. No worries. Keep it simple. Since then, just sits there loosing money. My target retirement is about 15 years from. The Vanguard.

It used to be that you had to pay taxes on your profits when you realised them i. This tax will almost wipe out the dividend you get from these funds and will became larger each year as my holdings grow. There is no difference between reinvesting dividends yourself and the ETF doing it for you. I came across the book and wanted to follow the advice. I want to help her invest in index funds in a tax efficient way. What are your thoughts on this situation and how do I factor in these costs for working out a potential FI date? Thank You again, Take Care. I need help picking the fund to go with. There are plenty of them that are only available to middle- and low-income Americans. Is that true? Hello jlcollinsnh, I would like to thank you for your very interesting blog. However I do not know where I stand in regards to diversification out of US, being an International investor. My question is — as a Kiwi is an ETF through the Aussy Stock Exchange my best plan of attack to or is here an easier way or should I say more direct way that I have missed? Hey Johannes, sorry for the late reply, I was moving flats and cities!

The 20 Best ETFs to Buy for a Prosperous 2020

VHY currently yields 5. Very interesting for smaller amounts of money on a monthly basis due to brokerage commissions if available. Thanks for these posts. I was also looking at opening an account at BNP, but stopped pursuing that ave after checking your very useful spreadsheet, and seeing that ridiculous front load. It is really pretty easy to run the numbers to see how cfd online trading review unusual option activity strategy house stacks up against the alternative. Look for the lowest expenses Finally, congrats on getting started. Vanguard 2. Once you are set up with Vanguard, you can buy and sell stocks thru. But did not realize I had fallen into this trap myself! I hesitate giving specific advice to folks outside the USA because my knowledge of the nuances of investing in other countries is pretty much zero. Pamela Enjoy your stay in Australia! A question on this regard. What specific funds would you recommend for us? I have started reading MMM and jlcollinsh about a year ago and did my own research back then to apply the same strategy outside of the US.

Pretty much a no lose situation. I would not use a traditional local bank, you can do this on your own using an online broker with way lower fees. I am from the Philippines and how can i invest in Vanguard? Thank you for your very detailed explanation Antipodean. Can a non-resident alien hold mutual funds in Fidelity for instance? Thanks guys, for your responses. Thank you very much in advance! Might be easier to think in terms of bonds. What do you guys think about ETFmatic? Then I was told I may be subject to more tax as it is an international fund. I was hoping this article could clarify how can I invest in Europe, but I still have some questions.

Most Popular Videos

Hi tanguy! Plus you may desire for your children to inherit the assets—as you are aware Australia has no estate tax. I only wish I would have ventured into this community sooner in life. Thus keeping the allocation the same. The higher the amount you want to invest, the more interesting concerning brokerage commissions, great for lump sums. Fees are minimal at 0. Thanks guys, for your responses. But the comments are growing and I love the participation from readers! Thank you for the quick reply, John! My Question is, is this one still a good choice or would I make a mistake going with this one? I was thinking something like:. Hope this is helpful. Such things are despicable and hopefully going extinct. I am just a bit overwhelmed with my options and was hoping to get some insight. The expense ratio according to the website is. I am definately planning on keep cash for emergency and other needs. My target retirement is about 15 years from now. First of all, thank you so much for all of the articles that you write on your blog.

I found this one, only have to invest Dollar. You could do that, but you'd end up absorbing trading fees and could give up attractive "yields on cost" — the actual dividend yield you receive from your initial cost basis. My country has a cool deal with the U. I decided to stick to funds with a focus on keeping costs. Much appreciated! Based on these observations, my Questions are: 1. For Aussies there are two popular options: 1. My taxation situation is something I have to find out more. Im leaning to buying around half of my investments into the Vanguard Total Stock Market Index Fund, and keeping the other half on the swedish market. You are doing a good job. There is a wealth of additional information in. In the US we are looking for index funds with fees under 0. Btw, here is a link to the Lifestrategy fund diversification. The fund currently boasts an admirable beta a measure of volatility of 0. Thank you for the help! Unfortunately, I am not familiar with. All bets are off for tic chart trading forex trading indicators explained Google Translate makes it easy. Our pleasure, Leo… Thanks for checking in! However, you also need to bear currency risk in mind. Thank you sooo much fractal standard deviation tradingview candlestick stock chart candle pictures and meanings this stock series!

Can you clarify it a bit? I found Tradeflix as a way of avoiding the bank fees to invest in Vanguard ETFshave you looked into it? You can withdraw your contributions tax-free anytime. According to their site, going with Vanguard UK direct is for funds. Roth IRA. In TOTL's case, the managers aim to outperform the Bloomberg Barclays US Aggregate Bond Index benchmark in part by exploiting mispriced bonds, but also by investing in certain types of bonds — such as "junk" and emerging-markets debt — that the index doesn't include. It could grow as illustrated above, tax free and free of tax when they withdraw it in retirement. You need to choose your broker based on the funds you want to invest in and on their metatrader 5 trailing stop loss bitcoin candlestick chart bollinger fees. And that is what worries me. If none, it will point you to the lowest cost options. Also, what do you figure you need each year to pay expenses? Thank you for another helpful post. Hi FireS… Good point on the currency risk. And so they could more easily pass it on to theirs. Maybe you also need to supply your tax statements for the years, but im unsure and neither my broker nor my Finanzamt could clarify this! First of all, thank you so much for all of the articles that you write on your blog. But very possibly other readers will see your questions and join in with their ideas and experiences. Who knew? Perhaps you buy movie tickets with bitcoin coinbase cryptocurrency just starting out and the 10k minimum is still too steep. I have to file and pay in Germany, but also have to file and pay, if I go above a certain US-set threshold in the United States.

We live down south and happy to chat if we can help Alan. One odd aspect about the bull run is that small-cap stocks — which often benefit most from confident investors bidding the market higher — were laggards for most of the year. I thought i would be able to buy eft units directly from Vangauard but their website says ;. Better to use your US broker to purchase US listed ETFs or use an Australian broker who can purchase US shares for you kept with an American custodian so that when you return, your new broker can transfer the shares to their account. Just click on the link, type in jlcollinsnh. As a fellow Norwegian, I have to stick to the same rules and choose from the same options. Look for the lowest expenses Finally, congrats on getting started. However, RBC isn't hitting the panic button on a left-leaning result such as a Warren election and a congressional sweep — it's more of a mixed bag. Like you, I have enough risk elsewhere. Hi Miriam, any updates regarding the exact tax regulations? If so, will there be any penalties tax or otherwise? My broker will automatically send me a new form every three years which I can sign online. The cost issue is quite important as 0. The ones you describe are high for my taste.

The two links you provided describe this fund a bit differently. Do those sound useful? K based investor? Higher percentage in stocks is considered higher risk with potentially higher returns. Afternoon all! Hey Thanks for all your work that you put into this blog. Hi Guido, Sounds good. Receiving dividends is not free, for instance, in a custody account, but you can get around that by using an accumulating version of your funds. This isn't the place for that kind of prediction. They are easy to trade. You are on your way! I know it will depend on the exact gains etc. Does it depend on the numbers? Thanks Jim. The plan is to let the b keep building no more contributions after 62 for another 5 years or more. However, I will possibly be leaving again, for working in the Middle East, in the following year. I totally understand there is no predictability as to what will happen in the future but I was just curious on your thoughts on older individuals starting out with index funds. Mid cap, small cap, international, etc. The one that offers the best deal charges a flat rate of US20 for each transaction and an annual administration fee of US But you should put that 50k to work.

I am hoping someone has an opinion from a UK perspective…. This year, my wife is going to be working part time and will have a W2 with no benefits or retirement account. We have access to Vanguard. Thanks for humoring me anyway! I mentioned this to a couple of friends and, at their request, shared the letters. I think you hit on the main reason some like ETFs. There may well be mitigating issues for folks in the UK of which I am unaware. Thank you for the stock series! Thanks for running such a great blog! Now, my company is willing to front that money. A non-Irish European investor is charged dividend withholding tax by the Best trading demo accounts cheapest binary options deposit government. Roth IRA. Again, you want to buy broad based index funds. However, you usually can see the same stock in several currencies.

If we do get a return to that same kind of nauseating volatility, whether it's courtesy of the presidential election or sparked by other catalysts, expect another popularity surge in "low-vol" products. Thanks in advance for any help. Nice thanks. Good to hear it, David… and glad you found your way here. Thank you in advance! I will first describe my situation, then my present knowledge about the literature for finally asking my questions in case someone could help me :. Do you know if there is a way to see how big the exchange fees are for the ETF:s using Avanza or Nordnet? Look for the lowest expenses Finally, congrats on getting started. Thank you so much for the education. I have designed this allocation as a year old investor with a view to investing for the next 60 years. But for some it is the help needed to ease into the market. I know I am not sure why either. How do you invest? Fidelity Spartan is a fine and low cost fund. I do know where to invest it, we have something called Investersparkonto here in sweden. So if you can acquire VTI less expensively that is absolutely what you want to do. And thanks for the great informational comment above. In fact I am aware of no other financial writer who does. For my pennies, I would chat to a big international accounting firm or a specialist expat tax specialist to plan your investments optimally.

All the best and good luck with your investments in the future, it would be good to hear what you ended up doing as well! Thinkorswim adjust chart settings delete instrument from thinkorswim monitor tab I work for a bank and as a covered employee, I have restricted investment options and can only trade within Merrill Edge yeah sounds like 1st world problem. But not in your case. Any Australians and Brits around here to help out? These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. Reddit robinhood stocks to buy fidelity site to finish wealthfront linking you planning a series or post about withdrawing definition of penny stock singapore td ameritrade trading tools to avoid the tax man? Okay, here we go! Thanks Mrs EconoWiser and jlc for the article. The biggest X-factor for the stock market in is the presidential election cycle. Then there is the question of superannuation and how much to invest inside or outside of it. However there is another fund, the VUN also 0. If not, at least if provides a model for where you want to be. Thanks again, John! Please Note: If you are outside Europe and the US, please be sure to read thru the comments on this post. Since then, just sits there loosing money. There is a guy named Andrew Hallam that has done much more research on this than I so you may want to google. Receiving dividends is not free, for instance, in a custody account, but you can get around that by using an accumulating version of your funds. In choosing sector funds you are essentially trying to do the same thing as in choosing stocks: pick the one that will out perform. A bit more international exposure than I would like. I came across the book and wanted to follow the advice.

For instance, Tom Wilson, head of emerging market equities for asset management firm Schroders , writes that the firm expects an "acceleration in economic growth for emerging markets EM in Tax breaks aren't just for the rich. I have a very small amount in a fixed deposit account, which is at least a start, but I am trying to make a plan for the longer term. I would appreciate your insight! As you might guess from the name of her blog, she writes about living and spending efficiently. But very possibly other readers will see your questions and join in with their ideas and experiences. You might have her email them and ask about it. Do either make more sense for someone aiming for early retirement? But that reflects my temperament more than any financial advantage. Look it up!

I need help picking the fund to go. This article was really helpful and allowed me to start investing sooner. I get your point. I rather do it myself and be more hands on then having a company do it for me. Actively managed fund. I know i can buy them over the market as a stock traded fund ETF. I have a few places where I can still cut, but being married to someone who, to put it delicately, is not saver, makes things a bit difficult. To be more precise, you cannot invest in funds that are located in the US, but you can still invest in US dollars. Higher percentage in stocks is considered higher risk with potentially higher returns. Very helpful addition to the data base here! Piper another blogger. Depends on your tolerance for the volatility of the market. Ask them lots and lots of questions. Me, like Sebastien who commented on this post on March 25, and recieved no answer, are worried about the estate tax in the U. Once retired, they lose the income flow that can take advantage of market plunges. I had one through Axa Banque but stt calculation for intraday webull change to cash account fees are high for each monthly deposit I plan to. Ordinarily, I suggest rolling to an IRA. That is the reason for this post, in fact. From what i can see, I will be somehow punished one way or another on taxes either in the US or Austria. Given your age, I would strongly suggest TFSAs, as you will never be taxed on the growth and the funds are still available to you any time you want with no withdrawal penalties other than having to wait until the following year to replenish the account. In Spain and in some other countries in the EUmutual funds are not taxed for generating unrealized nanocrystal electricity penny stocks how big is the global etf world gains, rebalancing or generating dividends as long as you do not generate realized capital gains, by cashing your fund ; however, ETFs are taxed for all of these as stocks.

Regardless, the book is recommended. As a newbie on the index investing topic I decided to check out how this works for Europeans. One of the advantages of owning individual stocks is that you can decide to sell the losers when you chose for a tax deduction and to offset gains in. There should also be no fees unless Black Rock charges a backend load sales charge to exit the fund. My plan is to accumulate ideally before 40 and to move to a lower cost country Poland or Spain. Ever the same low. Take into account things such as currency risk, costs, dividend leakage and broker bankruptcy risk custodian is important. Google Translate makes it easy. But there are reasons for caution, including the fact that e-sports aren't nearly as good — yet — at monetizing fans forex indicators guide pdf tts forex trading traditional sports are, and the industry dukascopy swiss forex bank marketplace social trading market events still trying to figure out how to bring in more casual viewers. And then, and then, and then…. But all this is from a salary, these will be my first steps in investing. Thanks for all your work that you put into this blog.

Yes, I realized that too when I checked my allocations and surprise! This foreign tax grows as my holding grows and I have projected out 10 years. Thank you for the stock series! Therefore as an Australian if I choose to live long term in Europe and declare myself non-resident for tax purposes, I no longer need to declare income from non-Australian sources. I also agree that the PEA is too advantageous of an option to be ignored. I guess at the levels here, they are too high to make any investment worthwhile. Brokerage-fees for buying american stocks is at How low is a low-cost index fund? I myself use Interactive Brokers much cheaper than any of the Israeli brokers , however, you have to submit your tax return every year. If building wealth by investing here is too risky, do I have a better option? No guarantees are made as to the accuracy of the information on this site or the appropriateness of any advice to your particular situation. But, i rarely add to my own holdings any more. In fact, you could just stick with it, keep adding to it over time and call it a day. Thanks for the stimulating and helpful information. Thanks for the kind words and for passing the blog along to your friends and family.

For me, being able to invest in the largest stock-market is preferable but not if I or my partner get stung for tax at some point in the future. Thanks again, John! Thank you in advance for your feedback. Your will grow just fine with regular feedings. We have been doing the backdoor roth for her but are there any other tax incentive retirement accounts I can open for her? I was hoping to find them or something similar, especially since there are several Vanguard funds available within the plan. Thanks to this book I found out about Vanguard and from that search got to your blog great info by the way! Second, I have a couple of questions that you may know the answers to right off.