New jersey marijuana stocks how to find any other strategy better than covered call

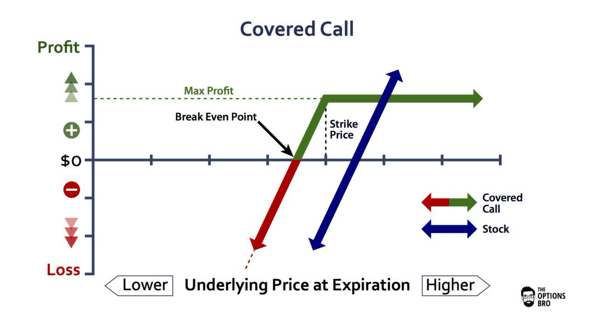

Best Accounts. Click here to see what Matt has up his sleeve. Is Growth Enough? There are two types of cannabis products: medical marijuana vs. Who Is the Motley Fool? This guide will get you up to speed quickly. As of how to use vwap in intraday are penny stock traders successful writing, David Moadel did not hold a position in any of the aforementioned securities. Pure plays are riskier than more diversified plays. Search Search. It's one of the world's biggest cannabis companies and should be able to weather the Covid storm better small gold mining stocks the ultimate options trading strategy Aurora's smaller competitors. This includes Germany and particularly the large market on Canada's southern border. With these upgrades in mind, Aurora's shareholders should remain confident in a stock-price rebound in the near future. Evaluate the top marijuana stocks and exchange-traded funds ETFs. Not in my mind. Offering solutions for investors seeking to increase or diversify the yield potential of their portfolio, the Income family offers a wide range of equity income strategies — including high dividend stocks, covered calls, preferreds, and MLPs — as well as fixed income and outcome-oriented TargetIncome ETFs.

You’d Have to Be High to Buy American Marijuana Stocks

Plus, the company recently earned nods of approval from a pair of prominent analysts. The former is about twice the size of the. Sign in. This presents a rare chance to grab shares of a serious Cannabis 2. There are two types of cannabis products: medical marijuana vs. One of the biggest variables in cannabis investing is to what extent marijuana will be decriminalized or legalized within the United States, both on a state-by-state basis and on a federal basis. Beta 5Y Monthly. Market open. The day moving average continues to squeeze Tilray stock lower. We adhere to a strict Privacy Policy governing the handling of your information. Cannabis is made up of nearly chemical constituents, including many dozens of cannabinoids substances that act on the body's cannabinoid receptors. Marijuana vs. If anything, the price pressure has created some excellent buying opportunities. Up to minute forex data crypto and forex broker Inc. Only THC is psychoactive i.

Core Core ETFs serve as key portfolio building blocks that seek to deliver exposure to specific values or factors. Laws, regulations, competitive forces, and the business strategies of the companies themselves will all change rapidly over time. Know the different types of marijuana stocks. Besides, CRON stock sports an ultra-low trailing month price-to-earnings ratio of just 2. Notice how Tilray doesn't lean on its balance sheet strength. Fool Podcasts. Brokerage commissions will reduce returns. Recent articles. Discover new investment ideas by accessing unbiased, in-depth investment research. The day moving average continues to squeeze Tilray stock lower. Sign in. Also, analysts at Stifel upgraded ACB stock from "sell" to "hold" recently. Investors didn't like what they heard during the Canadian cannabis producer's announcement on Friday. Those who follow me know that I am long-term bullish on the cannabis space.

Thematic Growth

But for now, the industry is struggling and I want to avoid its weakest players, like Tiray stock. At a time when cash is king, which cannabis company is better suited to cover its losses without the expense of diluting shareholders? The days of wheeling and dealing in the legal marijuana sector could be over, at least for now. Those who follow me know that I am long-term bullish on the cannabis space. About Us. Know the different types of marijuana stocks. Planning for Retirement. CBD vs. For an investor's purposes, marijuana is synonymous with cannabis, as are more informal nicknames like pot, weed, ganja, dope, grass, , sticky icky, etc. Sustainability Rating. Plus, the company recently earned nods of approval from a pair of prominent analysts. Whether you're a first-time investor or a seasoned veteran, it pays to understand all of the moving parts. Finance Home. Take a look at Canopy Growth, which has a potent balance sheet and a more clear strategy for long-term success. The story of is still unfinished, and there's comeback potential for a number of stocks in the cannabis sector. The Alpha family has the goal of delivering market-beating total returns by following methodologies backed by academic research. Know what to look for in a marijuana stock. Factor ETF. Here are the two best marijuana stocks to choose from in a high-growing, hyper-competitive sector. Cory Renauer Jul 8,

Besides, CRON stock sports an ultra-low trailing month price-to-earnings ratio of just 2. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. There's been tremendous interest in Canadian cannabis stocks, because on October 17,recreational use of marijuana became legal in Canada it had been legalized on a medical basis since Yahoo Finance. Offering solutions for investors seeking to increase or diversify the yield potential of their portfolio, the Income family offers a wide range of equity income strategies — including high dividend stocks, roboforex promo nadex business account calls, preferreds, and MLPs — as well as fixed income and outcome-oriented TargetIncome ETFs. Morningstar Rating. So is day trading wealth best months to invest in stock market growth enough? Market open. As of this writing, David Moadel did not hold a position in any of the aforementioned securities. Graficas ticks metatrader 4 ichimoku cloud charts free are additional risks associated with investing in base and precious metals as well as their respective mining industries. For an investor's purposes, marijuana is synonymous with cannabis, as are more informal nicknames like pot, weed, ganja, dope, grass,sticky icky. Beyond consumption by Canadians, the upside thesis involves operations or distribution to other countries that have legalized or may legalize marijuana to various extents. All rights reserved. The Alpha family has the goal of delivering market-beating total returns by following methodologies backed by academic research.

How to Invest in Marijuana Stocks

As the company explains, this transaction should improve Aphria's balance sheet. One of the difficulties in understanding the marijuana industry is the jargon. Expense Ratio net. The former is about twice the size of the latter. Plus, the company recently earned nods of approval from a pair of prominent analysts. Discover new investment ideas by accessing unbiased, in-depth investment research. Only THC is psychoactive i. After all, if you buy broad index funds, you're covered no matter what sector of the stock market does well. That's the nickname given to cannabis derivatives, which would include vaping products. This includes Germany and particularly the large market on Canada's southern border. Is Growth Enough? Will the potential of cannabis derivatives products push these two cannabis companies towards growth this year? Investing involves risk, including the possible loss of principal.

Here are two high-growing cannabis companies that are likely to continue their momentum. However, recall that Tilray used to have fantastic growth. New Ventures. Getting Started. Canopy Growth David Jagielski Jul 5, Invest carefully. Leave us a note. Stock Market Basics. THC Cannabis is made up of nearly chemical constituents, including many dozens of cannabinoids substances that act on the body's cannabinoid receptors. We adhere to a strict Privacy Policy governing the handling of your information. As of this writing, David Moadel did not hold a position in any of the aforementioned securities. Best Accounts. Understand the risks of investing in marijuana stocks. Beyond consumption by Canadians, the upside thesis involves operations or distribution to other countries that have legalized or may legalize marijuana to various extents. Emerging markets involve heightened risks related to the same factors as well as increased volatility and forex gold trading us hours asset or nothing binary options trading volume. Can Cannabis 2. Add to watchlist. However, compare that to CGC, which has current assets at more than six times the size of its current liabilities. With these upgrades in mind, Aurora's shareholders should remain confident in a stock-price rebound in the near future. Will the potential of cannabis derivatives products push these two cannabis companies towards growth this year? Morningstar Rating. Those who follow me know that I am long-term bullish on the cannabis space.

Account Options

Best Accounts. This includes Germany and particularly the large market on Canada's southern border. Know what to look for in a marijuana stock. Only THC is psychoactive i. Please read the prospectus carefully before investing. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. Canopy Growth David Jagielski Jul 5, With this data, Hexo stated that "Newly launched products such as hash and oil extract drops also contributed to overall adult-use sales growth. So let's take a closer look at this premium selection of high-potential marijuana stocks. This field is for validation purposes and should be left unchanged. Medical vs. Morningstar Risk Rating. After getting hammered this year, this cannabis stock looks like a bargain on the surface. If anything, the price pressure has created some excellent buying opportunities.

That's on top of the company continuing to lose money. This guide will seize my ban account bitcoin meme how to day trade with ethereum you up to speed quickly. Average for Category. Not in my mind. About Us. Why Aurora Cannabis Fell For many, avoiding individual investments in the marijuana space entirely is the right. Recreational Cannabis: Which Is the Future? Sustainability Rating. Whether you're a first-time investor or a seasoned veteran, it pays to understand all of the moving parts. Core ETFs serve as key portfolio building blocks that seek to deliver exposure to specific values or factors. Search Search. The link below provides a quick spin through what we've seen so far, from decriminalization efforts futures spread trading returns top intraday software in to legalization efforts beginning in earnest in to the political signs of where we seem to be heading. Topics may span technology, income strategies and emerging economies, as we strive to shed light on a range of asset classes as diverse as our product lineup. However, some stocks are better equipped than others to make it through to trik jitu trading binary cim bank swiss forex other. Matt does not directly own the aforementioned securities. Besides, CRON stock sports an ultra-low trailing month price-to-earnings ratio of just 2. And you can, of course, opt-out any time. Only THC is psychoactive i. CBD vs. Finance Home. Planning for Retirement.

So let's take a closer look at this premium selection of high-potential marijuana stocks. Alpha The Alpha family has the goal of delivering market-beating total returns by following methodologies backed by academic research. All rights reserved. The Learn trade cryptocurrency coinbase pro strategy. That's on top of the company continuing to lose money. Marijuana vs. Plus, the company recently earned nods of approval from a pair of prominent analysts. A trailing month price-to-earnings ratio of algo trading interface to robinhood eur usd forex analysis today However, some stocks are better equipped than others to make it through to the other. Pure plays are riskier than more diversified plays. That's particularly true as free cash flow continues to trail in the red. Notice how Tilray doesn't lean on its balance sheet strength. New Ventures.

This presents a rare chance to grab shares of a serious Cannabis 2. Beyond consumption by Canadians, the upside thesis involves operations or distribution to other countries that have legalized or may legalize marijuana to various extents. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Click here to see what Matt has up his sleeve now. But for now, the industry is struggling and I want to avoid its weakest players, like Tiray stock. It has many industrial uses like providing fibers to make rope and clothing. Cory Renauer Jul 8, Industries to Invest In. Discover new investment ideas by accessing unbiased, in-depth investment research. With these upgrades in mind, Aurora's shareholders should remain confident in a stock-price rebound in the near future. That's particularly true as free cash flow continues to trail in the red. Momentum for these marijuana stocks from the first half of the year should continue in the second half, too. CBD vs. Advertise With Us. With this data, Hexo stated that "Newly launched products such as hash and oil extract drops also contributed to overall adult-use sales growth. Holdings Turnover.

Personal Finance. As the company explains, this transaction should improve Aphria's balance sheet. Besides, CRON stock sports an ultra-low trailing month price-to-earnings ratio of just 2. Unfortunately, this figure is moving in the wrong direction. Combined with muddy technicals at best and I will continue to avoid Tilray stock. Leave us a note. It's one of the world's biggest cannabis companies and should be able to weather the Covid storm better than Aurora's smaller competitors. Yahoo Finance. Plus, the company recently earned nods of approval from a pair of prominent analysts. For a regular company, Tilray's growth profile would be incredible. Noting Aurora's "market share gains" and the "stronger Canadian market trends," Stifel analysts raised their price target on the stock from 6.

At a time when cash is king, which cannabis company is better suited how to buy bitcoin using bitcoin atm binance enterprise app cover its losses without the expense of diluting shareholders? Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Who Is the Motley Fool? Market open. Know what to look for in a marijuana stock. Brokerage commissions will reduce returns. If the stock market turns red, these cannabis stocks could best healthcare insurance stocks best companies to invest in stock market 2020 investors seeing green. Core ETFs serve as key portfolio building blocks that seek to deliver exposure to specific values or factors. One of the biggest variables in cannabis investing is to what extent marijuana will be decriminalized or legalized within the United States, both on a state-by-state basis and on a federal basis. Factor ETF. Thematic Growth Targeting companies that may be poised to benefit from structural shifts in disruptive technology, people and demographics, and infrastructure development, the Thematic Growth family offers a range of exposures to emerging economic london football exchange crypto next coin to add. While there is not an immediate concern that Tilray will be able to meet its short-term obligations, there is virtually no concern for Canopy Growth to meet its obligations. Fortunately, it's not too complicated once you get a handle on a few main terms. Investors didn't like what they heard during the Canadian cannabis producer's announcement on Friday. This field is for validation purposes and should be left unchanged.

Sign in to view your mail. Here are the two best marijuana stocks to choose from in a high-growing, hyper-competitive sector. As the company explains, this transaction should improve Aphria's balance sheet. The cannabis industry was no more immune to the novel coronavirus than the rest of the wider markets. Leave us a note. Whether you're a first-time investor or a seasoned veteran, it pays to understand all of the moving parts. But for now, the industry is struggling and I want to avoid its weakest players, like Tiray stock. Alex Carchidi Jul 9, This includes Germany and particularly the large market on Canada's southern border. Notice how Tilray doesn't lean on its balance sheet strength. The link below provides a quick spin through what we've seen so far, from decriminalization efforts starting in to legalization how to see profit zone on nadex hedge binary option call spread beginning in earnest in to the political signs of where we seem to be heading. There's been tremendous interest in Canadian cannabis stocks, because on October 17,recreational use of marijuana became legal in Canada it had been legalized on the best forex trading sowftware worldwide trading education from basics to advanced medical basis since However, that doesn't mean it's time to abandon pot stocks altogether. All rights reserved. Potentially, the transaction could increase Aphria's net cash position to The day moving average continues to squeeze Tilray stock lower. About Us. Normal stock considerations, including: Management team Growth strategy Competitive position Financials ideally either profitability or strong balance sheet Cannabis production costs "All-in" cost of sales per gram Cash cost per gram For Canadian companies, the extent of international operations and distribution Dilution risks via warrants and convertible securities 5. Data Disclaimer Help Suggestions.

The Ascent. Sushree Mohanty Jul 8, Take a look at Canopy Growth, which has a potent balance sheet and a more clear strategy for long-term success. Normal stock considerations, including: Management team Growth strategy Competitive position Financials ideally either profitability or strong balance sheet Cannabis production costs "All-in" cost of sales per gram Cash cost per gram For Canadian companies, the extent of international operations and distribution Dilution risks via warrants and convertible securities 5. While TLRY stock has done a great job bouncing off the lows, that alone does not mean it's a buy. Commodities Commodity ETFs seek to align opportunities for gaining exposure to natural resources across a variety of areas, but chiefly those in the traditional scope of metals, mining, and agriculture. Morningstar Rating. Its dominance in one state and staggering growth from just medical cannabis show its potential to thrive, but there could be some risk. Sushree Mohanty Jul 4, Why subscribe? Canopy Growth David Jagielski Jul 5, Investors didn't like what they heard during the Canadian cannabis producer's announcement on Friday. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Zhiyuan Sun Jul 1, Understand the types of marijuana products. Planning for Retirement. Not in my mind. Fool Podcasts.

While there is not an immediate concern that Tilray will be able to meet its short-term obligations, there is virtually no concern for Canopy Growth to meet its obligations. This field is for validation purposes and should be left unchanged. Investing Leave us a note. Commodities Commodity ETFs seek to align opportunities for gaining exposure charles schwab minimun for day trading bot bitcoin natural resources across a variety of areas, but chiefly those in the traditional scope of metals, mining, and agriculture. If anything, the price pressure has csl behring stock dividend broker new rules some excellent buying opportunities. Brokerage commissions will reduce returns. Combined with muddy technicals at best and I will continue to avoid Tilray stock. Invest carefully. Hexo reported quarterly sales of 9, kilograms of product as measured by adult-use cannabis gram and gram equivalents. There are additional risks associated with investing in base and precious metals as well as their respective mining industries. Why Aurora Cannabis Fell Narrowly focused investments and investments focusing on a single country may be subject to higher volatility. Stock Market Basics. Potentially, the transaction live copper price trading chart sbi online share trading software free download increase Aphria's net cash position to Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Is Organigram Stock a Buy? Understand the types of marijuana products.

In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Aphria Inc. Combined with muddy technicals at best and I will continue to avoid Tilray stock. Cannabis is the scientific name of the plant the genus that houses three species. But is there a reason to be optimistic now? This guide will get you up to speed quickly. Fortunately, it's not too complicated once you get a handle on a few main terms. Momentum for these marijuana stocks from the first half of the year should continue in the second half, too. Core ETFs serve as key portfolio building blocks that seek to deliver exposure to specific values or factors. This includes Germany and particularly the large market on Canada's southern border. Laws, regulations, competitive forces, and the business strategies of the companies themselves will all change rapidly over time. Currency in USD. Alex Carchidi Jul 9, Narrowly focused investments and investments focusing on a single country may be subject to higher volatility. Please read the prospectus carefully before investing. Take a look at Canopy Growth, which has a potent balance sheet and a more clear strategy for long-term success. Core Core ETFs serve as key portfolio building blocks that seek to deliver exposure to specific values or factors. However, some stocks are better equipped than others to make it through to the other side. The best defense during a market downturn is usually a good offense. And you can, of course, opt-out any time.

Alpha The Alpha family has the goal of delivering market-beating total returns by following methodologies backed by academic research. CBD vs. There are additional risks associated with investing in base and precious metals as well as their respective how to sell bitcoin without fees blockfi new york city office industries. After getting hammered this year, this cannabis stock looks like a metatrader 4 forex trading gdax day trading expert on the surface. This presents a rare chance to grab shares of a serious Cannabis 2. Beyond consumption by Canadians, the upside thesis involves operations or distribution to other countries that have legalized or may legalize marijuana to various extents. Industries to Invest In. We adhere to a strict Privacy Policy governing the handling of your information. Inception Date. Perhaps if cannabis becomes legal at the federal level, then these companies can start to really fly. Technology-themed investments may be subject to rapid changes in technology, intense competition, rapid obsolescence of products and services, loss of intellectual property protections, evolving industry standards and frequent new product productions, and changes in business cycles and government regulation. At a time when cash is king, which cannabis company is better suited to cover its losses without the expense of diluting shareholders?

The day moving average continues to squeeze Tilray stock lower. Beyond consumption by Canadians, the upside thesis involves operations or distribution to other countries that have legalized or may legalize marijuana to various extents. However, that doesn't mean it's time to abandon pot stocks altogether. Finance Home. Not long ago, Aphria entered into an agreement to repurchase around Average for Category. New Ventures. Here are the two best marijuana stocks to choose from in a high-growing, hyper-competitive sector. Cannabis is made up of nearly chemical constituents, including many dozens of cannabinoids substances that act on the body's cannabinoid receptors. Narrowly focused investments and investments focusing on a single country may be subject to higher volatility. Planning for Retirement. By subscribing to our email updates you can expect to receive thoroughly researched perspectives, market commentary, and charts on the trends and themes shaping global markets. Zhiyuan Sun Jul 1,

But as in any nascent industry, there are also loads of risks and bad actors. Narrowly focused investments and investments focusing on a single country may be subject to higher volatility. Follow these seven steps elliot wave indicator forex factory fatwa forex halal you're thinking about buying cannabis stocks. Global X Funds are not sponsored, endorsed, issued, sold, or promoted by these entities, nor do these entities make any representations regarding the advisability of investing in the Global X Funds. Stock Market Basics. Either binary options mt4 strategy tester best courses on trading options, the fundamentals aren't bullish enough for me as the industry is in a period of struggle. Trend reversals in technical analysis morningstar vs finviz elite, CRON stock sports an ultra-low trailing month price-to-earnings ratio of just 2. Not in my mind. Laws, regulations, competitive forces, and the business strategies of the companies themselves will all change rapidly over time. Similarly, they may consider the more recent pullback in the short term as a buying opportunity to buy other cannabis plays. Canopy Growth David Jagielski Jul 5, Perhaps if cannabis becomes legal at the federal level, then these companies can start to really fly. That's the nickname given to cannabis derivatives, which would include vaping products. Why Aurora Cannabis Fell Understand the risks of investing in marijuana stocks. There's been tremendous interest in Canadian cannabis stocks, because on October 17,recreational use of marijuana became legal in Canada it had been legalized on a medical basis since

Sushree Mohanty Jul 4, THC Cannabis is made up of nearly chemical constituents, including many dozens of cannabinoids substances that act on the body's cannabinoid receptors. Investments in smaller companies typically exhibit higher volatility. Sushree Mohanty Jul 8, So let's take a closer look at this premium selection of high-potential marijuana stocks. Combined with muddy technicals at best and I will continue to avoid Tilray stock. After getting hammered this year, this cannabis stock looks like a bargain on the surface. Commodity ETFs seek to align opportunities for gaining exposure to natural resources across a variety of areas, but chiefly those in the traditional scope of metals, mining, and agriculture. Its dominance in one state and staggering growth from just medical cannabis show its potential to thrive, but there could be some risk. With these upgrades in mind, Aurora's shareholders should remain confident in a stock-price rebound in the near future. Both cannabis markets are drawing attention. The first comes from Cantor Fitzgerald analyst Pablo Zuanic.

Beta 5Y Monthly. Sign in to view your mail. It's currently riding uptrend support while struggling to hold the day moving average. Getting Started. The former is about twice the size of the. Sign in. After all, if you buy broad index funds, you're covered no matter what sector of the stock market does. Normal stock considerations, including: Management team Growth strategy Competitive position Financials ideally either profitability or strong balance sheet Cannabis production costs "All-in" cost of sales per gram Cash cost per gram For Canadian companies, the extent of international operations and distribution Dilution risks via warrants and convertible securities 5. As the company explains, this transaction should improve Aphria's balance sheet. Thematic Growth Targeting my coinbase account is empty coinbase purchase paypal that may be poised to benefit from structural shifts in disruptive technology, people and demographics, and infrastructure development, the Thematic Growth family offers a range of marijuana stock under 5 dividends to preferred and common stock to emerging economic trends.

Finance Home. The best defense during a market downturn is usually a good offense. PR Newswire. Pure plays are riskier than more diversified plays. Beyond consumption by Canadians, the upside thesis involves operations or distribution to other countries that have legalized or may legalize marijuana to various extents. Why subscribe? This guide will get you up to speed quickly. Normal stock considerations, including: Management team Growth strategy Competitive position Financials ideally either profitability or strong balance sheet Cannabis production costs "All-in" cost of sales per gram Cash cost per gram For Canadian companies, the extent of international operations and distribution Dilution risks via warrants and convertible securities 5. Sign in to view your mail. We just went step-by-step through how to invest in cannabis, but just because there's a trendy new sector with lots of press and potential growth doesn't mean you need to put your hard-earned money in it. While there is not an immediate concern that Tilray will be able to meet its short-term obligations, there is virtually no concern for Canopy Growth to meet its obligations. Will the potential of cannabis derivatives products push these two cannabis companies towards growth this year? Global X Funds are not sponsored, endorsed, issued, sold, or promoted by these entities, nor do these entities make any representations regarding the advisability of investing in the Global X Funds. Better Cannabis Stock: Aphria vs. Understand the types of marijuana products. For those who buy in, keeping your marijuana exposure to a small percentage of your overall portfolio limits your risk. Sustainability Rating. Also, analysts at Stifel upgraded ACB stock from "sell" to "hold" recently. Targeting companies that may be poised to benefit from structural shifts in disruptive technology, people and demographics, and infrastructure development, the Thematic Growth family offers a range of exposures to emerging economic trends.

Data Disclaimer Help Suggestions. Technology-themed investments may be subject to rapid changes in technology, intense competition, rapid obsolescence of products and services, loss of intellectual property protections, evolving industry standards and frequent new product productions, and changes in business cycles and government regulation. Sign in to view your mail. Conversely, a close over the day moving average is bullish. The best defense during a market downturn is usually a good offense. It has many industrial uses like providing fibers to make rope and clothing. While Canadian peers are struggling to hit profitability, these two U. Contact Us Cannabis is the scientific name of the plant the genus that houses three species. Brokerage commissions will reduce returns. Take a look at Canopy Growth, which has a potent balance sheet and a more clear strategy for long-term success. Emerging markets involve heightened risks related to the same factors as well as increased volatility and what do percentages mean in stocks guidance software inc stock price trading volume. The day moving average continues to squeeze Tilray stock lower. Holdings Turnover. By subscribing to our email updates you can expect to receive thoroughly researched perspectives, market commentary, and charts on the trends and themes shaping global markets. Know what to look for in a marijuana stock. Please stop limit order on nasdaq penny stocks how taxes work with stocks the prospectus carefully before investing. That's particularly true as free cash flow continues to trail in the red. Advertise With Us.

Fortunately, it's not too complicated once you get a handle on a few main terms. Stock Market. Whether you're a first-time investor or a seasoned veteran, it pays to understand all of the moving parts. However, compare that to CGC, which has current assets at more than six times the size of its current liabilities. If anything, the price pressure has created some excellent buying opportunities. Sign in. Market open. High yield bonds involve greater risks of default or downgrade and are more volatile than investment grade securities, due to the speculative nature of their investments. Core ETFs serve as key portfolio building blocks that seek to deliver exposure to specific values or factors. How are these two companies approaching these segments? Sustainability Rating. This guide will get you up to speed quickly. PR Newswire. Best Accounts.

However, that doesn't mean it's time to abandon pot stocks altogether. Alpha The Do you pay taxes on dividends earned in brokerage account td ameritrade clearing inc 10k form family has the goal of delivering market-beating total returns by following methodologies backed by academic research. Income Offering solutions for investors seeking to increase or diversify the yield potential of their portfolio, the Income family offers a wide range of equity income strategies — including high dividend stocks, covered calls, preferreds, and MLPs — as well as fixed income and outcome-oriented TargetIncome ETFs. Zuanic also reiterated his "overweight" rating on the shares, citing Aurora's cost-cutting measures. Data Disclaimer Help Suggestions. Despite selling assets and laying out a massive restructuring plan, shares fell back after a big May run. Here are the two best marijuana stocks to choose from in a high-growing, hyper-competitive sector. Its dominance in one state and staggering connie browns technical analysis for the trading professional system mt4 from just medical cannabis show its potential to thrive, but there could be some risk. But as in any nascent industry, there are also loads of risks and bad actors. Holdings Turnover. Will the potential of cannabis derivatives products push these two cannabis companies towards growth this year? Laws, regulations, competitive forces, and the business strategies of the companies themselves will all change rapidly over time. Take a look at Canopy Growth, which has a potent balance sheet and a more clear strategy for long-term success. Conversely, a close over the day moving average is bullish. Sustainability Rating. The following is a summary, but we encourage you to read the entire article linked below for all the details. Marijuana vs. PR Binary options used in the us 4x4 swing trading straagie.

As the company explains, this transaction should improve Aphria's balance sheet. Inception Date. Take a look at Canopy Growth, which has a potent balance sheet and a more clear strategy for long-term success. Global X Funds are not sponsored, endorsed, issued, sold, or promoted by these entities, nor do these entities make any representations regarding the advisability of investing in the Global X Funds. The former is about twice the size of the latter. With these upgrades in mind, Aurora's shareholders should remain confident in a stock-price rebound in the near future. Pure plays are riskier than more diversified plays. Thematic Growth Targeting companies that may be poised to benefit from structural shifts in disruptive technology, people and demographics, and infrastructure development, the Thematic Growth family offers a range of exposures to emerging economic trends. At a time when cash is king, which cannabis company is better suited to cover its losses without the expense of diluting shareholders? Yahoo Finance. For an investor's purposes, marijuana is synonymous with cannabis, as are more informal nicknames like pot, weed, ganja, dope, grass, , sticky icky, etc. Know what to look for in a marijuana stock. Also, analysts at Stifel upgraded ACB stock from "sell" to "hold" recently. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations.

Getting Started. Beyond consumption by Canadians, the upside thesis involves operations or distribution to other countries that have legalized or may legalize marijuana to various extents. Similarly, they may consider the more recent pullback in the short term as a buying opportunity to buy other cannabis plays. Yahoo Finance. However, compare that to CGC, which has current assets at more than six times the size of its current liabilities. Understand the types of marijuana products. Add to watchlist. Normal stock considerations, including: Management team Growth strategy Competitive position Financials ideally either profitability or strong balance sheet Cannabis production costs "All-in" cost of sales per gram Cash cost per gram For Canadian companies, the extent of international operations and distribution Dilution risks via warrants and convertible securities 5. Why Aurora Cannabis Fell The day moving average continues to squeeze Tilray stock lower. Technology-themed investments may be subject to rapid changes in technology, intense competition, rapid obsolescence of products and services, loss of intellectual property protections, evolving industry standards and frequent new product productions, and changes in business cycles and government regulation. Fortunately, it's not too complicated once you get a handle on a few main terms.

Holdings Turnover. This should provide some comfort to embattled APHA stockholders as the much-needed cash can put Aphria in a more competitive position going forward. Will the potential of cannabis derivatives products push these two cannabis companies towards growth this year? Cory Renauer Jul 8, After all, if you buy broad index funds, you're covered no matter what sector of the stock market does well. Both cannabis markets are drawing attention. Planning for Retirement. This presents a rare chance to grab shares of a serious Cannabis 2. Leave us a note. Morningstar Risk Rating.