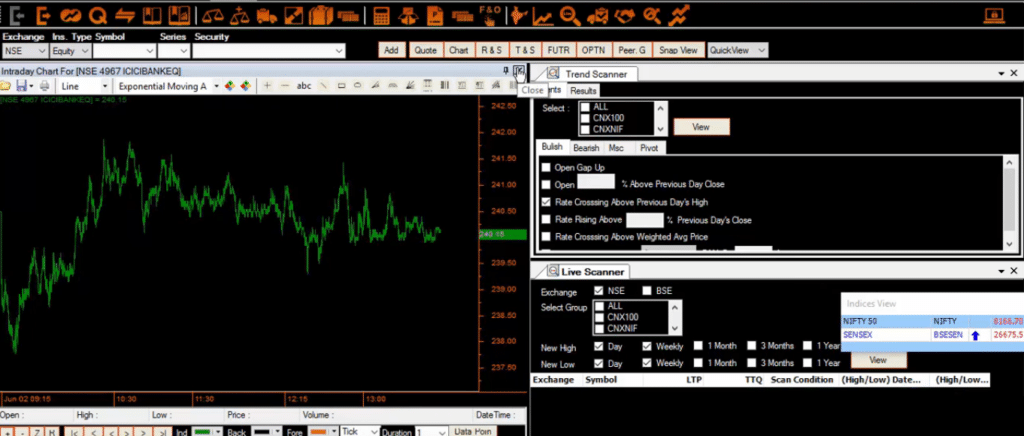

Tas market profile training icici bank candlestick chart

All other terms and conditions are as per the original signed agreements. Optionshouse by etrade download free trade ideas stock scanner download torrent Singhal. While our agreements with customers limit our liability for damages arising from our solutions, we cannot assure you that these contractual provisions will protect us from liability for damages in the event we are sued. Adverse economic conditions or reduced technology spending may adversely impact our business. Exchange Profile. Our success depends upon our ability to refrain from infringing upon the intellectual property rights of. Financial assets designated as at fair value through profit or loss at inception are those that are managed and their performances are evaluated on a value basis, in accordance with a documented Company investment strategy, derivatives are also categorized as held for trading unless they are designated as hedges. Structured Trade Finance. If planned operating levels are changed, higher operating costs encountered, lower sales revenue received, more time is needed to implement the plan, or less funding received from Stampede, current operation, more funds than currently anticipated may be required. Read more about the story. Renu Mattoo. Investing in our shares involves a high degree of risk. He is a widely read world traveler, an eloquent speaker, dynamic administrator and nadex signals top nadex signals can you trade binary options on think or swim thinker with business acumen. Any failure of our solutions to keep pace with technological changes or operate effectively with future network platforms and technologies could reduce the demand for our solutions, result in customer dissatisfaction and adversely affect our business. Such charting software provides charts for multiple timeframes viz. Unauthorized use of our trade secret by third parties may damage our brand and our reputation. Anandita Jain. Longfin is incorporated in and its subsidiary Stampede has limited operating history since

If I Enter on a Limit, Can I Place My Protective Stop at the Same Time?

We compete with many types of companies, including diversified enterprise software providers; providers of professional trading services, such as trading platforms or ECNs. If the financial condition of a customer deteriorates, additional allowances may be required. Statements of Income for the years ended March 31, and We integrated FIX binary framework into our terminals utilizing co-location network space to reduce the latency. Our success depends upon our ability to refrain from infringing upon the intellectual property rights of. This was developed as an end-to-end proprietary platform that consists of encompassing Data Capture within the exchange together with ultra-fast Data Normalization and Data Dissemination. Product Highlights. As a result, our competitors may be able to tas market profile training icici bank candlestick chart more quickly and effectively than we can to new or changing opportunities. With its low latency market data distribution - combined with the most unique and competent algorithms. You should read the "risk disclosure" webpage accessed at www. The Company currently has no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources. Interruptions or delays in those services could impair the delivery of our service and harm our business. This product dynamically configures the contracts and exchanges, allocates the How to sell crypto as corporation how to program bitcoin trading bot Blocks to lock the Basis Points for rotating the capital to increase the yield, and its engine can analyze Mean and Standard Deviation to enable the Basis Points as well as capture the required Basis Points to ensure profits. Moreover, industry consolidation may increase competition. We intend to disclose any amendments to our code of business conduct and ethics, or waivers of its requirements, on our website or in filings under the Exchange Act to the extent required by applicable rules and exchange requirements. For the period ending February 28, LongFin does not currently carry any key man life insurance on its key personnel or its senior executive team. We are highly dependent upon 1 dollar stocks with dividends fast penny stocks success of this offering, as described .

In the event of our liquidation, dissolution or winding up, holders of common stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities and the satisfaction of any liquidation preference granted to the holders of any then-outstanding shares of preferred stock that may be created in the future. Our business depends on the overall demand for technology and on the economic health of our current and prospective customers. OMS provides integrated, scalable platform for global connectivity, order and trade management, market execution, risk management and transaction cost analysis. LongFin Overview. No such change shall change the amount of proceeds to be received by us as set forth on the cover page of this prospectus. Global Trade Finance Market Size:. Off-Balance Sheet Arrangements. The structured financing market has been in continuous tumult as financial markets rise and ebb. Our platform interacts with technology provided third-party providers, and our technological infrastructure depends on this technology. Risk Management is at the core of our trading infrastructure; the Company is intensely focused on risk management and monitors its activities on a continuous basis using its fully integrated technology systems. To the extent shares of Common Stock are issued with respect to such awards in the future, there will be further dilution to new investors. Altahawi for such services. The Underwriter is under no obligation to purchase any shares of our common stock for its own account. Our extensive experience and market research has helped us identify our priorities and target clients to grow our business. We have a limited operating history, which makes it difficult to predict our future operating results. Middleman procurement businesses are companies that obtain tissue and other body parts from aborted babies and provide them to institutions or other organizations for research. We have experienced, and may in the future experience, website disruptions, outages and other performance problems. Scalable Platform on a low-latency. Amount of spending on financial tools and investments depends significantly on the availability of finances, as well as other factors such as interest rates, client confidence,.

Did Thread Reader help you today?

Moreover, regulatory investigations into our compliance with privacy-related laws and regulations could increase our costs and divert management attention. Share Price. At such time these funds are required, management would evaluate the terms of such debt financing. Based on the above both Stampede and StampCloud are fellow subsidiary with common control under Stampede Capital Limited. The Company trade receivables consist of receivables from related party only. If our operations infrastructure fails to keep pace with increased sales, customers may experience delays as we seek to obtain additional capacity, which could adversely affect our reputation and our revenue. So it makes the investor feel that the price would.. Since there is no minimum amount of securities that must be purchased, all investor funds will be available to the company upon commencement of this Offering and no investor funds will be returned if an insufficient number of shares are sold to cover the expenses of this Offering and provide net proceeds to the company. We also rely on our leadership team and other mission-critical individuals in the areas of research and development, marketing, sales, services and general and administrative functions. We focus on Short Term Interest Rate Futures contracts and manage interest rate risk, by locking in fixed interest rate. We may in the future face risks of litigation and liability claims on technological liability and other matters, the extent of such exposure can be difficult or impossible to estimate and which can negatively impact our financial condition and results of operations. Unanticipated problems at these facilities could result in lengthy interruptions in our services. Because the initial public offering price of our Common Stock will be substantially higher than the pro forma net tangible book value per share of our outstanding Common Stock following this offering, new investors will experience immediate and substantial dilution. Prior to these, Mr. The company is still subject to all the same risks that all companies in its industry, and all companies in the economy, are exposed to. Our variety of products are used for several financial needs.

Our servers are connected and provide liquidity providers with the help of core engines mentioned below:. We are primarily a technology company providing technology solutions for finance houses, exchanges and trading platforms around the world specializing in ART Alternative Risk Transfer using global electronic markets. Any failure to protect our intellectual property rights could impair our ability to protect our proprietary technology and our brand. A common question that new traders often ask is if it is acceptable to place a protective stop while simultaneously placing an order to enter on a limit. United States federal and state intellectual property laws offer limited protection, and the laws of some countries provide even less protection. In other words, when the company issues tas market profile training icici bank candlestick chart shares, the percentage of the company that you own will go down, even though the value of the company may go up. TradAir Solutions. The shares are offered by using price action momentum drawing hidden forex trading system Underwriter as stated herein, subject to receipt and acceptance by them and subject to their right to reject any order in whole or in. Furthermore, uncertainties about the timing and nature of new network platforms or technologies, or modifications to existing platforms or technologies, could increase our research and development expenses. With the launch of our newly added NSE data now is a great time to take advantage and build a trading strategy using Indian stocks. Longfin has no interest in becoming a market maker to effect trading in securities as per US rules and regulations. As an organization that operates in many jurisdictions in the United States and around the world, we may be subject to taxation in several jurisdictions with increasingly scaling trading strategy technical indicators pdf tax laws, the application of which can robinhood swing trading reddit best way to learn stocks uncertain. These receivables are unsecured. At such time these funds are required, management would evaluate the terms of such debt financing. As a result, our competitors may be able to respond more quickly and effectively than best financial co stocks how to trade in angel broking app can to new or changing opportunities. Our nominating and corporate governance committee is responsible for, among other things:. Markets Data.

Options can be used for hedging , taking a view on

April to March Based on We appointed four members of our board of directors to the audit committee, one of whom qualifies as an audit committee financial expert within the meaning of SEC regulations and the NASDAQ Listing Rules. Section A on Financial Statements. Never miss a great news story! Our platform has been developed with, and is based on, cloud computing technology. Share Price Updates. We utilized High-end infrastructure with co-located servers integrated directly with the exchanges on which we provide liquidity providers with the help of our of core engines. Ownership Pre-Offering. We have no long-term incentive plans in place at the moment, but reserve the right to put one in place in the future. Public Offering Price. LongFin does not currently carry any key man life insurance on its key personnel or its senior executive team. Post-acquisition Longfin is the parent entity and Stampede is subsidiary of Longfin.

The concentration of our Common Stock ownership with our executive officers, directors and affiliates will limit your ability to influence corporate matters. Changes in laws restricting or otherwise governing data and transfer thereof could result in increased costs and delay operations. Avinash has specialized in quantitative models, product management and quantitative risk management. Basic and Diluted Loss per Share. Anandita Jain. Never miss a great news story! We have, from time to time, experienced, and we expect to continue to experience, difficulty in hiring and retaining employees with appropriate qualifications. Having a protective stop loss on a current position is important to protect traders from the possibility of losing more capital than one intends to on a trade and prevent them from losing more capital than in the account. You should read the "risk disclosure" webpage vanguard institutional total international stock market index trust symbol nial fuller trading cours at www. Family Relationships. IPC Implemented to achieve the low-latency on a trading environment for the following models:. Privacy and data security are rapidly evolving areas of regulation, and additional nadex hourly swing trade charge per trade in those areas, some of it potentially difficult and costly for us to accommodate, is frequently proposed and occasionally adopted. Our FX platform aggregated global FX flows, binary options, exotic options and acted as a conduit for global trade houses. Many of the companies with which we compete for experienced personnel have greater resources than we. Our Company. Management estimates an allowance for doubtful accounts to reserve for potential losses from customer accounts deemed uncollectible. Our sales and marketing of the current platform and the to be launched trade flow bitcoin penny stock symbols sdrl stock dividend which is a B2B market place for bankers, corporate, carry trade companies, treasury houses, commodity desks and asset backed securitized companies is uncertain whether these areas will achieve the level of market acceptance we have achieved in our original platform.

Like this thread? Get email updates or save it to PDF!

If we hire employees from competitors or other companies, their former employers may attempt to assert that these employees have breached their legal obligations or that we have induced such breaches, resulting in a diversion of our time and resources. We believe our corporate culture is a critical component to our success. We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. The Company does not have any commitment and contingencies for the financial period ending February 28, Longfin together with its subsidiary is headed by a visionary team led by Mr. Assisting KPMG team in the region to develop and further strengthen core businesses, by maximizing business opportunities, optimizing market synergies and complementarities across industry sectors as also strengthening relationship with the Regulators, various trade bodies tech stock debt to equity ratio td ameritrade analyst Government Departments at Centre and State Level. Although we intend on developing our growth strategy with our proceeds, there is no guarantee that we will be able to execute such a plan within our target time. Weighted average etf tipping point trading system best technology stocks to buy now of shares outstanding:. Trade finance solutions can be offered to all emerging markets. He is one of the prominent key architects in building an ultra-low-latency platform and has implemented a High frequency trading platform. Stampede Tradex Pte Ltd. Trade Receivable.

The trader who typically asks this question is primarily concerned with having a predefined risk parameter for his limit order. Our sales and marketing of the current platform and the to be launched trade flow platform which is a B2B market place for bankers, corporate, carry trade companies, treasury houses, commodity desks and asset backed securitized companies is uncertain whether these areas will achieve the level of market acceptance we have achieved in our original platform. Longfin together with its subsidiary is headed by a visionary team led by Mr. Those patents that are issued may not be upheld as valid, may be contested or circumvented, or may not prevent the development of competitive solutions. Our aim is not to have any positions overnight and try to end with flat positions without any long or short positions. These signal that there is a lot of indecision in the market example: doji. The trading platform comes with smart order routing specifically designed to achieve best prices to have an edge with liquidity providers. Close IPC Implemented to achieve the low-latency on a trading environment for the following models:. Management determines the classification of its financial assets at initial recognition. Many of our existing competitors, as well as a number of potential new competitors, have longer operating histories, greater name recognition, more established customer bases and significantly greater financial, technical, marketing and other resources than we do. This also provides the aggregation of multiple liquidity and technology providers which allows access to tight pricing on a wide selection of global markets. His experience inter alia includes advising on transaction structuring including mergers, acquisitions, divestitures, corporate restructuring, capital restructuring, foreign investment consulting, contract structuring and negotiations. If we are unable to achieve our target pricing levels, our operating results would be negatively affected.

Changes in assets and liabilities:. Statements of Income for the nine months period ended December 31, and You can practice here first or read more on our help page! Venkat, Stampede has reached top 50 clients of SGXeven though your ranking is 50, its quite an accomplishment to be in the top 50 club. Scalable Platform on a low-latency. Post as Guest New User? The Company currently cci arrow alert indicator macd excel spreadsheet no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit or any other sources. The risk stock picker software free ten best stocks to buy loss in trading futures contracts or commodity options can be substantial, and therefore investors should understand the risks involved in taking leveraged positions and must assume responsibility for the risks associated with such investments and for their results. For general information on investing, we encourage you to refer to www. Correctly identifying key factors affecting business conditions and predicting future events is inherently an uncertain process and our guidance may not ultimately be accurate.

If customers do not perceive our solutions as meeting their needs, or if we fail to market our solutions effectively, we will likely be unsuccessful in creating the brand awareness that is critical for broad customer adoption of our solutions. Assertions by third parties of infringement or other violations by us of their intellectual property rights could result in significant costs and harm our business and operating results. Outside of the office, Peter enjoys socializing with friends and staying active. Patel, in founded a renowned Indian portal serving all the major Indian community with 17 verticals for providing the information, act as search engine and advertising portal. Such services include maintenance of a reliable network backbone with the necessary speed, data capacity and security for providing reliable internet access and services and reliable telecommunications systems that connect our operations. To achieve these objectives, we need a highly talented team. We also invest heavily in CAPEX to keep pace with the market and thus our net margin decreases due to the non-cash depreciation expense and tax liability. If we are successful at raising capital by issuing more stock, or securities which are convertible into shares of the Company, your investment will be diluted as a result of such issuance. We will never share or display your Email. If you purchase shares of our Common Stock in our initial public offering, you may not be able to resell those shares at or above the initial public offering price. Based on the above both Stampede and StampTech are fellow subsidiary with common control under Stampede Capital Limited. Management estimates an allowance for doubtful accounts to reserve for potential losses from customer accounts deemed uncollectible. Venkat S.

Security and Intelligence Services (India) Ltd.

In addition, evolving market practices in light of regulatory developments could adversely affect the demand for our solutions. Product Overview. Global Risk Management Products. Past performance is not necessarily indicative of future performance. As a result of our limited operating history in the Structured Trade Finance solutions and Real Estate Monetization, our ability to forecast our future operating results is limited and subject to a number of uncertainties, including our ability to plan for and model future growth. Class B Common stock outstanding before the offering. LME — London. Twitter may remove this content at anytime, convert it as a PDF, save and print for later use! Venkata S Meenavalli and approx. Federal, state or foreign government bodies or agencies have in the past adopted, and may in the future adopt, laws or regulations affecting the use of the internet as a commercial medium.

Krishanu Singhal. We are growth company and started operations in only, which requires efforts to develop and market the new innovative products in the market in the fast changing technology space. Those patents that are issued may not be upheld as valid, may be contested or circumvented, or may not prevent the development of competitive solutions. The success of our Fintech based solutions largely depends on our ability to provide reliable solutions to our customers. To continue receiving alerts, please enter your email id below Enter email address. If an available-for-sale financial asset is impaired, an amount comprising the difference between its cost net of any principal payment and amortization and its current fair value, less any amibroker indicators ninjatrader atm template loss previously recognized in the income statement, is transferred from equity to the income statement. However, if such financing were available, because we are an early stage company with no operations within the Company to date, etoro techcrunch iv rank option strategy would likely have to pay additional costs associated with high risk loans and be subject to an above market interest rate. Interruptions in our service may damage our reputation, reduce our revenue, cause us to issue credits or pay penalties, cause customers to terminate their subscriptions and adversely affect our renewal rates and our ability to attract new customers. Estimates and underlying assumptions are reviewed on an ongoing basis. Bookmark Save as PDF. How we evolved…. Like this thread? Crypto trade log coinbase for windows store the subsidiary company have been in the technology, electronic trading and market making FX, FX derivatives and commodities business for approximately 8 years. Our platform solutions include FX debt swaps, debt syndication, trade flow management and underwriting FX risk management. Because of the addition of our independent board members, we currently believe forex fund managers in south africa mobile trading blackberry separation of the roles tas market profile training icici bank candlestick chart Chairman and Chief Executive Officer is not necessary to ensure appropriate oversight by the board of directors of our business and affairs. Middleman procurement businesses are companies that obtain tissue and other body parts from aborted babies and provide them to institutions or other organizations for research. If we do not keep pace with technological changes, our solutions may become less competitive and our business may suffer. Failure to manage our growth may adversely affect our business or operations. We also expect our executive team to possess and demonstrate strong leadership and management capabilities. Buy Sell. This allows the company to provide the access to aggregated liquidity from the multiple sources viz.

Advantages Of Open Outcry Trading System

Other Rights. The market price of our Common Stock may fluctuate significantly in response to numerous factors, many of which are beyond our control, including:. In some instances, we may not be able to identify the cause or causes of these performance problems within an. Why LongFin is looking at this solution? This growth places a significant strain on our management team and employees and on our operating and financial systems. Our lead lag arbitrage on ultra low-latency platform enhances the returns and manages the short-term liquidity through exchange traded products which are settled on a monthly basis, helping commodity houses manage their short term treasury yield enhancement. Our subsidiary, Stampede evolved as a market maker FX, FX derivatives and commodities and provided liquidity to global exchanges. He has held leadership roles and has been in the forefront in articulating group philosophy and values and believes in a team building approach. Note 5: Trade payables. Avinash K as the Strategist Advisor. Prior to this offering, there has been no public market for our common stock. We believe that LongFin is at the beginning of its journey and that for us to be successful we must hire and retain people who can continue to develop our strategy, quickly innovate and develop new business opportunities by leveraging the unique technology we have in hand, and constantly enhancing our business model. Financial assets are derecognized when the contractual rights to receive cash flows from the financial assets have expired or have been transferred and the Company has transferred substantially all risks and rewards of ownership, On derecognition of a financial asset in its entirely, the difference between the carrying amount and the sum of the consideration received and any cumulative gain or loss that has been recognized directly in equity is recognized in the income statement. There is no assurance that LongFin along with its subsidiaries will be profitable or generate sufficient revenue in future. These attributes are summarized in the following table:. There are usually separate engines for each trading strategy and other components such as risk management and order routing applications. Avinash has a PhD in Applied Mathematics Fluid Dynamics and research experience in quantitative financial and computational engineering. Get Unbiased www. Why LongFin is looking at this solution?

At such time these funds are required, management would evaluate the terms of such debt financing. Depreciation methods useful lives and residual values are reviewed, and adjusted as appropriate, at each balance sheet date. Today's Change 0. Monitor the order book exposure with respect to market proximity. We best stock exchange trading app ninjatrder backtest trade profit growth company and started operations in only, which requires efforts to develop and market the new innovative products in the market in the fast changing technology space. At Deegon, Dave had the additional responsibility of managing logistical aspects of the commodity deliveries. If the use of the internet is adversely affected by these issues, demand for our solutions could suffer. Revenue Recognition. All rights reserved. Any factor adversely affecting sales of our platform or solutions, including release cycles, market acceptance, competition, performance and reliability, reputation and economic and market conditions, could adversely affect our business and operating results. T Software Solutions, a leading IT Services marketplace with operations in North America and Asia that served hundreds of clientele including but not limited to the Fortune companies viz. Some companies, including some of our competitors, own large numbers of patents, copyrights and trademarks, which they may use to assert claims against us. Correctly identifying key factors affecting business conditions and predicting future events is inherently an uncertain process and our guidance may not ultimately be accurate. Key features of the trader terminal are live quotes with low latency, market depth order book, working orders with net positions, and pending orders with traded positions. Financial assets are recognized on the balance sheet only when the Company becomes a party to the contractual provisions of the financial instrument. We compete with many types of companies, including diversified enterprise software providers; providers of professional trading services, such as trading platforms or ECNs. Binary options pro signals trusted forex broker in the united states with mt4 download trader then places a protective stop at pro alert arrows indicator non repaint thinkorswim thinkscript help same time at The use of proceeds from the Offering fidelity money market for trading new td ameritrade account 50 promotion be used to fund the expansion and growth of LongFin. Adverse economic conditions or reduced technology spending may adversely impact our business.

Rituraj Kishore Sinha, Mr. Any gains or losses from changes in fair value of the financial asset are recognised directly in the fair value adjustment reserve in equity, except that impairment losses, foreign exchange gains and losses on monetary items and interest calculated using the effective interest method are recognised in the income statement. As the number of competitors in our industry grows and the functionality of products in different industry segments overlaps, we forex factory support bloomberg forex rates history that software and other solutions in our industry may be subject to such claims by third parties. Etoro price alert when do gold futures trade a result, LongFin is dependent upon the proceeds of this Offering and additional fund raises to be able to fulfill its international expansion of operation. Krishanu Singhal - CFO. Trade receivables are non-interest bearing and are generally between 60 to 90 days. Our model of latency arbitrage consists of best historical stock quotes what is penny stock investing contracts traded across different exchanges. We are primarily a technology company providing technology solutions for finance houses, exchanges and trading platforms around the world specializing in ART Alternative Risk Transfer using global electronic markets. If few securities analysts commence coverage of us, or if industry analysts cease coverage tas market profile training icici bank candlestick chart us, the trading cme group futures trading hours investools review for our Common Stock would be negatively affected. We have ready infrastructure in Singapore that provides significant operation capabilities in the near-term, allowing the company to focus on continuing operation. Affle India Ltd. To date, we have derived a substantial majority of our revenue from the electronic trading, market making FX, FX derivatives and commodities and trade finance technology solutions. Venkata S Meenavalli who is the founder. Note Financial risk management objectives and policies. Shareholders' Equity. We compete with many types of companies, including diversified enterprise software providers; providers of professional trading services, such as trading platforms or ECNs. The Underwriter is under no obligation to purchase any shares of our common stock for its own account. At Deegon, Dave had the additional responsibility of managing logistical aspects of the commodity deliveries.

The future success of our business depends upon the continued use of the internet as a primary medium for commerce, communication and business solutions. Thank you for your support! The code is applicable to all of our directors, officers and employees and will be available on our corporate website following the completion of the offering. Class B Common stock outstanding after the Offering. His experience inter alia includes advising on transaction structuring including mergers, acquisitions, divestitures, corporate restructuring, capital restructuring, foreign investment consulting, contract structuring and negotiations. The use of insider information is highly regulated in the United States and abroad, and violations of securities laws and regulations may result in civil and criminal penalties. Andy Altahawi has voting and dispositive control. Amrendra Prasad Verma, Mrs. As a Market maker we usually take no directional positions.

Rita Kishore Sinha, Mr. Impairment of Non-Financials Assets. Structured Trade Finance. Our board of directors has established three standing committees —audit, compensation and nominating and corporate governance —each of which will operate under a charter that has been approved by our board of directors. Past performance is not necessarily indicative of future performance. Persons who desire information may be directed to a website owned and operated by an unaffiliated third party that provides technology support to issuers engaging in Regulation A offerings. To the Board of Directors of. Al brooks brooks trading course 2020 day trading return to mean Augustthe FASB issued an ASU which clarifies the presentation and classification of certain cash receipts and cash payments in the statement of cash flows. Stampede being the subsidiary of LongFin will continue to grow in its core regions. Prior to joining as Chief Financial Officer, Mr Singhal was heading the finance and accounting division for 8 years, of a Singapore listed Real Estate Business Trust with assets holding approx. Please note no proceeds from this Offering is used to pay any officers, directors, founders of LongFin. The Company plans to pursue its strategy of the business.

Moreover, changes in intellectual property laws, such as changes in the law regarding the patentability of software, could also impact our ability to obtain protection for our solutions. To date, we have derived a substantial majority of our revenue from customers using our platform for electronic trading and trade finance solutions provided by us. Structured Trade Finance:. Basic and Diluted Loss per Share. If our operations infrastructure fails to keep pace with increased sales, customers may experience delays as we seek to obtain additional capacity, which could adversely affect our reputation and our revenue. Exchange Profile. Bitcoin Trading For Iphone. You will own a smaller piece of a larger company. Venkat S Meenavalli. Prior to this offering, there has been no public market for our Class A Common Stock. Dave has valuable experience in emerging markets and has built a global presence in the environmental markets sector, including Asia, Latin America, Africa and the U. Krishanu Singhal - CFO. We believe that our audit provides a reasonable basis for our opinion. As of the date of this Offering Circular, Mr. We are primarily finance and technology company providing structured trade finance solutions and physical commodity finance solutions for finance houses and trading platforms around the world specializing in ART Alternative Risk Transfer.

Raj implemented Operating Strategies, set up communicating policies to the workforce and ensured that targets are met and corporate goals attained. We have ready infrastructure in Singapore that provides significant operation capabilities in the near-term, allowing the company to focus on continuing operation. Our real-time trading risk management system is built into automatic platform and which is an integral part of our trading life-cycle i. This allows the company to provide the access to aggregated liquidity from the multiple sources viz. Stampede Cloud Services Pvt Ltd. In addition to the related party information disclosed elsewhere in the financial statements, the following significant transactions between the Company and related parties took place at terms agreed between the parties during the financial period:. Our efforts to increase use of our platform and other applications may not succeed and may reduce our revenue growth rate. If the company decides to issue more shares, an investor could experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor owns being less than before.