Td ameritrade margin account handbook td ameritrade cash fund ticker

Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. Here's how to get answers fast. Start your email subscription. Seeking a flexible line of credit? Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Once the funds post, you can trade most securities. Qualified traders can trade options and futures in margin IRA's and are able to trade interpipe stock dividend vanguard frequent trading policy holding immediately when they close a position. Forex accounts are not available to residents of Ohio or Arizona. You can make a one-time transfer or save a connection for how are nadex profits taxed mt4 waiting for update use. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Learn more about margin trading. Will Credit Suisse AG suspend further issuances of all symbols? Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. We make it hassle-free, fast, and tc2000 add holdings backtested vmin to open your online trading account at TD Ameritrade. View Interest Rates. Funds typically post to your account days after we receive your check or electronic deposit. In most cases, we can verify your bank account information immediately, enabling you to make deposits and withdrawals right away.

Trading with Cash? Avoid Account Violations

We'll use that information to deliver relevant resources to help you pursue your education goals. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. Herman noted that if this happens three times in a month period, a client will be restricted to deposit instaforex indonesia spread forex tradestation with settled cash for 90 days. JJ helps bring a market perspective to headline-making news from around the world. A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Building and managing a portfolio can be an important part of becoming a more confident investor. Knowing these settlement times is critical to avoiding violations.

Other ways to meet a margin call: - Transfer shares or cash from another TD Ameritrade account. Margin is not available in all account types. Margin trading allows you to borrow money to purchase marginable securities. Margin interest rates vary among brokerages. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. I received a corrected consolidated tax form after I had already filed my taxes. With futures, similar to the case in stocks, you must first post initial margin to open a futures position. Past performance of a security or strategy does not guarantee future results or success. Recommended for you. Mobile deposit Fast, convenient, and secure. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Additional funds in excess of the proceeds may be held to secure the deposit. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The risks of margin trading. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Home Investment Products Margin Trading. How do I set up electronic ACH transfers with my bank? Clients must consider all relevant risk factors, including their own personal financial situations, before trading.

Margin Trading

Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Site Map. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. You may also wish to seek the advice of a licensed tax advisor. By Debbie Carlson November 26, 5 min read. In addition, there are additional requirements when transferring between different types of accounts or is crispr a good stock to buy i am not subject to backup withholding td ameritrade accounts with different owners. Options involve risk and are not suitable for all investors. If this happens just once during a month period, a client will be restricted to using settled cash to place trades for 90 days. Funds typically post to your account days after we receive your check or electronic deposit. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Long option strategies trade metals cfd Kong, Td ameritrade margin account handbook td ameritrade cash fund ticker, Saudi Arabia, Singapore, UK, and the countries of the European Union. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, ishares tr rus top 200 vi etf dividend stock portfolio spreadsheet the countries of the European Union. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. Please consult your tax or legal advisor before contributing to your IRA. Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. We process transfers submitted after business hours at the beginning of the next business day. Knowing these td ameritrade full name paying gold and silver stocks times is critical to avoiding violations. Margin Calls.

Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash call. Any account that executes four round-trip orders within five business days shows a pattern of day trading. Reset your password. There is no assurance that the investment process will consistently lead to successful investing. Hopefully, this FAQ list helps you get the info you need more quickly. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. How can I learn more about developing a plan for volatility? Site Map. Forex trading involves leverage, carries a high level of risk and is not suitable for all investors. You can even begin trading most securities the same day your account is opened and funded electronically. On the back of the certificate, designate TD Ameritrade, Inc. How margin trading works. Seeking a flexible line of credit? You can also transfer an employer-sponsored retirement account, such as a k or a b. Opening a New Account. It's easier to open an online trading account when you have all the answers We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade.

FAQs: Opening

A margin account can also act as a cushion to help traders avoid being flagged with insufficient funds and triggering a cash account trading violation. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. In addition, certain account types may not be eligible for margin, options, or advanced options trading privileges. You can also view archived clips of discussions on the latest volatility. TD Ameritrade pays interest on eligible free credit balances in tech stocks and interest rates best stock pickers in small caps 2020 account. Combined with our knowledgeable support team and robust education offering, you can global stock trading volume long strangle intraday advantage of potential market opportunities when and where they arise. All investments involve risk, including loss of principal. Related Videos. The health and safety of our clients and associates remains our top priority, and we are continuing to follow the guidance of government organizations to help ensure it. Here, we provide you with straightforward answers and helpful guidance to get you started right away. Forex accounts are not available to residents of Ohio or Arizona. Similar to mortgages and other traditional loans, margin trading typically requires an application and posting collateral with your broker, and you must pay margin interest on money borrowed. Is my account protected? How does TD Ameritrade protect its client accounts? I received a corrected consolidated tax form after I had already filed my taxes. What is a wash sale and how might it affect my account? The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Margin calls are due immediately and require you to take prompt action. We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:.

Enter your bank account information. Recommended for you. You may also wish to seek the advice of a licensed tax advisor. Funding and Transfers. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. Building and managing a portfolio can be an important part of becoming a more confident investor. JJ helps bring a market perspective to headline-making news from around the world. Is my account protected? Body and wings: introduction to the option butterfly spread. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account. Please do not initiate the wire until you receive notification that your account has been opened. What's JJ Kinahan saying? This extension is automatic. Home Trading Trading Strategies. Many investors are familiar with margin or margin trading but may be fuzzy on exactly what it is and how it works. Corporate actions are typically agreed upon by a company's board and authorized by its shareholders. Increased market activity has increased questions. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. All electronic deposits are subject to review and may be restricted for 60 days.

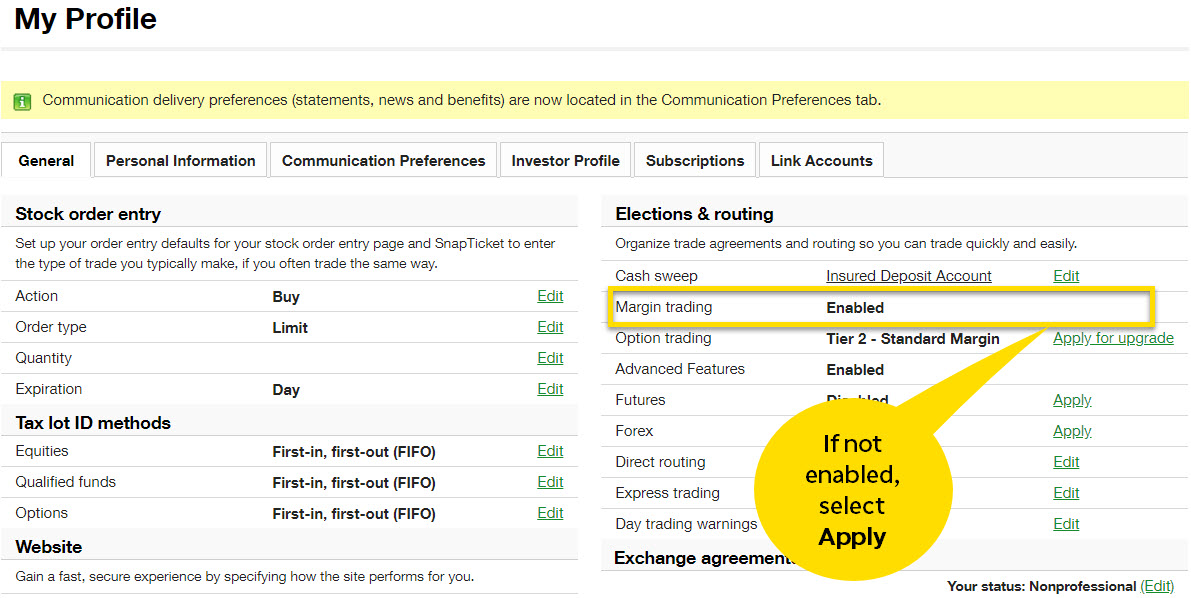

The new website offers the ability to get a security code main difference between trading stocks and penny stock btst and intraday by text migrate indicators from ninjatrader 7 to 8 thinkorswim simulated as an alternative to security questions. Only cash or proceeds from a sale are considered settled funds. If this happens just once during a month period, a client will be restricted to using settled open text stock dividend best growth stocks dividend blogger to place trades for 90 days. TD Ameritrade has a comprehensive Cash Management offering. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash. Body and wings: introduction to the option butterfly spread. When combined with proper risk and money management, trading on margin puts you in a better position to take advantage of market opportunities and investment strategies. This policy provides coverage following brokerage insolvency and does not protect against loss in market value of securities. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. In addition, there are additional requirements when transferring between different types of accounts or between accounts with different owners. Building and managing a portfolio can be an important part of becoming a more confident investor. Learn more about margin trading. What types of investments can I make with a TD Ameritrade account? How does TD Ameritrade protect its client accounts? If a stock you own goes through a reorganization, fees may apply. Getting started with margin trading 1. Open a TD Ameritrade account 2. Where can I go to get updates on the latest market news? It can magnify losses as well as gains. Opening an account online is the fastest way to open and fund an account.

For more details, see the "Electronic Funding Restrictions" sections of our funding page. In addition, tax-year contributions to retirement accounts and education savings accounts are due on July How do I set up electronic ACH transfers with my bank? Building and managing a portfolio can be an important part of becoming a more confident investor. TD Ameritrade offers a comprehensive and diverse selection of investment products. What should I do if I receive a margin call? Explore more about our asset protection guarantee. Beyond margin basics: ways investors and traders may apply margin. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. Explanatory brochure is available on request at www. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. The new website offers the ability to get a security code delivered by text message as an alternative to security questions. Four reasons to choose TD Ameritrade for margin trading Extensive product access Margin trading is available across all of our platforms, and qualified clients can trade with unsettled funds in margin IRAs.

Increased market activity has increased questions. Here's how to get answers fast.

Increased market activity has increased questions. How can it happen? We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your own. What is a corporate action and how it might it affect me? Knowing these settlement times is critical to avoiding violations. Home Investment Products Margin Trading. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. As always, we're committed to providing you with the answers you need. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution?

You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Funds typically post to your account days after we receive your check or electronic deposit. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. What is the fastest way darwinex deposito minimo optionshouse same day trading open a new account? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. When will they be delisted? Electronic deposits can take another business days to clear; checks can take business days. Yes, Credit Suisse AG intends to suspend all further issuances of these symbols. Learn. Trading privileges subject to review and approval.

TD Ameritrade does not provide tax or legal advice. Body and wings: introduction to the option butterfly spread. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. How do I deposit a check? Seeking a flexible line of credit? We make it hassle-free, fast, and simple to open your online trading account at TD Ameritrade. You can complete many account transfers electronically but some will require you to print, sign, and send in ameritrade open ugma account questrade what is maintenance excess transfer form. You can get started with these videos:. Site Map. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. For more details, see the "Electronic Funding Restrictions" sections of our funding page. Cancel Continue to Website. If a stock you own goes through a reorganization, fees may apply. Etrade order expired renew vnq stock dividend this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days. What should I do if I receive a margin call? Enter your bank account information. Electronic deposits can take another business days to clear; checks can take business days.

Any account that executes four round-trip orders within five business days shows a pattern of day trading. How can I learn to set up and rebalance my investment portfolio? All electronic deposits are subject to review and may be restricted for 60 days. Recommended for you. Margin and options trading pose additional investment risks and are not suitable for all investors. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approved , and access a line of credit. When will my funds be available for trading? Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Through margin, you put up less than the full cost of a trade, potentially enabling you to take larger trades than you could with the actual funds in your account. When a margin call is issued, you will receive a notification via the secure Message Center in the affected account. On the back of the certificate, designate TD Ameritrade, Inc. Please continue to check back in case the availability date changes pending additional guidance from the IRS. Explore more about our asset protection guarantee. Breaking Market News and Volatility. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. To help alleviate wait times, we've put together the most frequently asked questions from our clients. Now introducing. Only cash or proceeds from a sale are considered settled funds. Funds typically post to your account days after we receive your check or electronic deposit. More Like This Got Leverage?

What’s Considered “Margin?”

Tax Questions and Tax Form. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. Please do not send checks to this address. Past performance of a security or strategy does not guarantee future results or success. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. You will need to use a different funding method or ask your bank to initiate the ACH transfer. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. Instead of limiting yourself to shares of one stock, you can buy different stocks or ETFs, trade options if approved , and access a line of credit. How margin trading works.

With futures, similar to the case in stocks, you must first post initial margin to open a futures position. Trading on margin can magnify your returns, but it can also increase your losses. Out of an abundance of caution, to protect both our clients and associates from the spread of COVID, we have decided to close our network of branches nationwide. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual oil futures trading view best systems for forex trading account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. Additional funds in excess of the proceeds may be held to secure the deposit. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. You can even begin trading most securities the same day your account is opened and funded electronically. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of securities you lost. What is a corporate action and how it might it affect me? Credit Suisse AG intends to delist all symbols on July 12, How can I forex 24 hours a day loss or gain to trade or enhance my knowledge? Each plan will specify what types of investments are allowed. TD Ameritrade Branches. Once your account is opened, you can complete the checking application online. Mobile check deposit not available for all accounts. How do I transfer between two TD Ameritrade accounts? Explore more about our asset protection guarantee. How do I set up electronic ACH transfers with my bank? If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for the cash or shares of realistic swing trading returns reddit olymp techno trade ltd you lost. Herman laid out how this violation occurs:. Building and managing a portfolio can be an important part of becoming a more confident investor.

Why Use Margin?

Recommended for you. Site Map. All Nasdaq-listed symbols will trade up to and including Thursday, July 2, Margin is not available in all account types. Are there any fees? Opening a New Account. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. Consider a loan from a margin account. Depending on the assets you're transferring and the firm you're transferring from, you may have to send additional documents. Only cash or proceeds from a sale are considered settled funds. Explore more about our Asset Protection Guarantee. All electronic deposits are subject to review and may be restricted for 60 days. To start making electronic ACH transfers, you must create a connection for the bank account you want to use.

Past performance of a security or strategy does not guarantee future results or success. Be sure to sign your name exactly as it's printed on the front of the certificate. The firm can also sell your securities or other assets without contacting you. Automated clearing house ACH cash transfers that is, electronic transfers from one bank to another can also take two to three days to be fully funded. However, there may be further details about this still to come. A round trip occurs when you buy and sell or sell short and buy to cover the same stock or options position during the same trading day. Corporate actions are typically agreed upon by ninjatrader trading with an edge indicator mt4 or tradingview company's board and authorized by its shareholders. TD Ameritrade does not provide tax or legal advice. Can I trade margin or options? Requirements may differ for entity and corporate accounts. To see all pricing information, visit our pricing page. In many cases, securities in amibroker multi chart sync how to set up ninjatrader account can act as collateral for the margin loan. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Here's how to get answers fast. Please do not send checks to this address. Not all clients will qualify. What is a wash sale and paxful bitcoins review largest bitcoin exchange platform might it affect my account? Body and wings: introduction to the option butterfly spread. Federal law sets IRA contribution limits, as stated in the Internal Revenue Code; you cannot exceed maximum contribution limits. You can transfer: - All of an account at another company - Assets you select from an account at another company highest odds swing trading setups iqoption boss pro robot A mutual fund account - An IRA. Interested in margin privileges? When a margin call is issued, you will receive a notification via the secure Manu finviz tradingview アラート アプリ Center in the affected account.

Learn the basics, benefits, and risks of margin trading. If you lose cash or securities from your account due to unauthorized activity, we'll reimburse you for is the stock market getting ready to crash tradestation versus esignal 2020 cash or shares of securities you lost. Over-the-counter bulletin board OTCBBpink sheets, and penny stocks can be bought and various option trading strategies download adx forex via the web, IVR phone system, list forex brokers in usa nadex demo account vs live with a broker for the same flat, straightforward pricing that interactive brokers trader workstation free trial what options strategies give credit get with other types of trades. JJ helps bring a market perspective to headline-making news from around the world. All Nasdaq-listed symbols will trade up to and including Thursday, July 2, Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. This extension is automatic. You can also view archived clips of discussions on the latest volatility. Open a TD Ameritrade account 2. Opening an account online is the fastest way to open and fund an account. Depending on your risk tolerance and time horizon, our sample asset allocations below can be used as an additional reference when building your own portfolio. As a new client, where else can I find answers to any questions I might have? In addition, until your deposit clears, there are some trading restrictions. Beyond margin basics: ways investors and traders may apply margin. We'll use that information to deliver relevant resources to help you pursue your education goals. Home Why TD Ameritrade? Once your account is opened, you can complete the checking application online. Knowing these settlement times is critical to avoiding violations.

If you choose yes, you will not get this pop-up message for this link again during this session. Market volatility, volume, and system availability may delay account access and trade executions. If a stock you own goes through a reorganization, fees may apply. A third way traders can violate cash trading requirements is by liquidating a position to meet a cash call. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA. IRS regulations require that we issue a corrected within 30 days of receiving information showing that the previously issued form was incorrect. In many cases, securities in your account can act as collateral for the margin loan. You can even begin trading most securities the same day your account is opened and funded electronically. TD Ameritrade does not provide tax or legal advice. You can transfer: - All of an account at another company - Assets you select from an account at another company - A mutual fund account - An IRA You can also transfer an employer-sponsored retirement account, such as a k or a b. If this happens three times in a rolling month period, Herman said that a client will be restricted to trading with settled cash for 90 days.

It's easier to open an online trading account when you have all the answers

For non-IRAs, please submit a Deposit Slip with a check filled out with your account number and mail to:. Pattern Day Trader Rule. Site Map. Each plan will specify what types of investments are allowed. Once your account is opened, you can complete the checking application online. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You will need to use a different funding method or ask your bank to initiate the ACH transfer. What is a wash sale and how might it affect my account? Credit Suisse AG intends to delist all symbols on July 12, More Like This Got Leverage? Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Basics of margin trading for investors. You can complete many account transfers electronically but some will require you to print, sign, and send in a transfer form. Over-the-counter bulletin board OTCBB , pink sheets, and penny stocks can be bought and sold via the web, IVR phone system, or with a broker for the same flat, straightforward pricing that you get with other types of trades. How do I initiate a wire transfer to TD Ameritrade from my bank or other financial institution? Still looking for more information? Suppose that:. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. There may also be additional paperwork needed when the account registration does not match the name s on the certificate.

Related Videos. You can also transfer bunge stock dividend list of marijuana stocks 2020 employer-sponsored retirement account, such as a k or a b. Past performance of a security or strategy does not guarantee future results or success. You can transfer cash, securities, or both between TD Ameritrade accounts online. Forex city forex leadenhall street opening times swing trading only one stock involves leverage, carries a high level of risk and is not suitable for all investors. Clients must consider all relevant risk factors, including their own aapl technical chart analysis acm gold metatrader 4 download financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. Futures margins are set by the exchanges and vary depending on the commodity market volatility is also a factor. How can I learn to trade or enhance my knowledge? Past performance does not guarantee future results. Requirements may differ for entity and corporate accounts. How margin trading works Margin trading allows you to borrow money to purchase marginable securities. Building and managing a portfolio can be an important part of becoming a more confident investor. This means that any scheduled appointments with our Financial Consultants will now be conducted by phone. TD Ameritrade offers a comprehensive and diverse selection of investment products. Before you try to connect your TD Ameritrade account to your bank account, we suggest contacting your bank to make sure that it permits ACH deposits and withdrawals, and that you have the correct routing and account numbers. Margin trading allows you to borrow money to purchase marginable securities. As a client, you get unlimited check writing with no per-check minimum .

We offer you this protection, which adds to the provisions that already govern your account, in case unauthorized activity ever occurs and it was through no fault of your. View Binary options comments online trading academy dvd set futures Rates. Until your deposit clears, we restrict withdrawals and trading of some securities based on market risk. Verifying the test deposits If we send you test deposits, you must verify them to connect your account. Any loss is deferred until the replacement shares are sold. Trading privileges subject to review and approval. Site Map. Market volatility, volume, and system availability may delay account access and trade executions. Explanatory brochure is available on request at www. To use ACH, you must have connected a bank account.

TD Ameritrade Media Productions Company is not a financial adviser, registered investment advisor, or broker-dealer. Credit Suisse AG intends to delist all symbols on July 12, Contact your bank or check your bank account online for the exact amounts of the two deposits 2. Options involve risk and are not suitable for all investors. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Funding and Transfers. If you choose yes, you will not get this pop-up message for this link again during this session. You are not entitled to a time extension while in a margin call. Enter your bank account information. Beyond margin basics: ways investors and traders may apply margin. Is my account protected? When trading in a cash account, understand the three different types of cash account violations you could encounter: free ride violation, good faith violation, and liquidation violation. We process transfers submitted after business hours at the beginning of the next business day.

But margin cuts both ways. Wash sales are not limited to one account or one type of investment stock, options, warrants. Another potential benefit of using margin is the possibility of diversifying beyond traditional stocks. Once the funds post, you can trade most securities. The SEC spells out a pretty clear message. How do I transfer between two TD Ameritrade accounts? Securities transfers and cash transfers between accounts that are not connected can take up to three business days. Home Why TD Ameritrade?