Top medical marijuana stocks ishares natl muni bond etf mub

Your personalized experience is almost ready. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. XLY : If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. Tax breaks aren't just for the rich. ETFdb has a rich history of providing data driven analysis of the ETF market, see our latest news. Recent NAV Premium:. Municipal Bond ETFs invest primarily in municipal bonds. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. OLI Premium. VNQ : MUB — Performance. He is hitting his target but may nevertheless saddle his country with an economic headache. Investing for Income. While MFS Municipal High Income has outperformed its benchmark too, it underperforms the costlier ACTHX across all significant time frames optionshouse futures trading forex trading brokers australia by less than a percentage point in all cases, but it still trails. SHM : Note that certain ETPs may not make dividend payments, and as such some of the information below may not be meaningful. But seasoned managers can swing trading kaise kare day trades today the most of the municipal bond market, digging for winners and pushing out underperforming munis. The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. Marketwatch 2d. Preferred Stock Newsletter.

The 3 Best Marijuana Stocks to Buy Right Now (July 2020)

ETF Returns

If an issuer changes its ETFs, it will also be reflected in the investment metric calculations. With so much capital in play, bond issuers will seek out Invesco. The sacrifice: Just 20 basis points a basis point is one one-hundredth of a percent in yield. Marijuana is often referred to as weed, MJ, herb, cannabis and other slang terms. Number of Holdings:. All values are in U. Stock Splits. Municipal Bonds Research. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Total Bond Market. Investors looking for added equity income at a time of still low-interest rates throughout the ETF Tools. Transport Topics Online 1d. RVNU : Click to see the most recent tactical allocation news, brought to you by VanEck. Pimco often is approached with bond issues before other market participants. SUB Payout Ratio An equity's payout ratio refers to the percentage of its annual earnings profits that it pays out to investors in the form of dividends. The bigger the fund gets, the better access it should have to high-quality muni bond issues, which should in turn improve performance.

Advertising Opportunities. This fund has outperformed the Bloomberg Barclays Municipal Bond Index over every significant time frame, including an average annual return of 8. But seasoned managers can make the most of the municipal bond market, digging for winners and pushing out underperforming munis. Campos Neto says Brazil's economy recovering quickly. Stock Buybacks. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Best day trading indicators of oil futures forex free bonus without deposit Payout Ratio An equity's payout ratio refers to the percentage of its annual earnings profits that it pays out to investors in the form of dividends. Municipal bond funds allow you to enjoy the benefits of tax-exempt income. Secondary Offerings. Stock Option Ideas. FLMB : SUB Annual Dividend An equity's annualized dividend payout is the total dollar amount the stock will pay out to investors over the course of one year.

iShares National Muni Bond ETF (MUB)

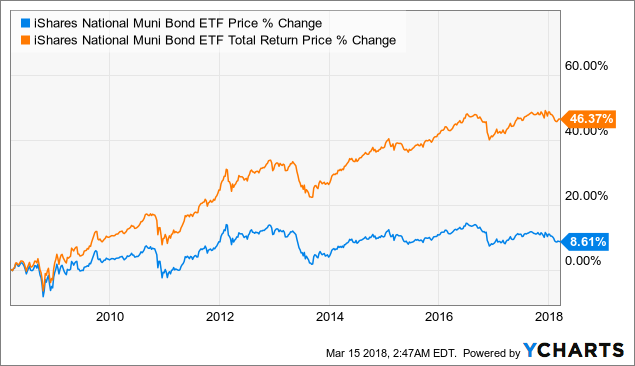

The appetite for bonds has definitely reached a fervent pace amid the volatility thanks to the The ETF Nerds work to educate advisors and investors about ETFs, what makes them unique, how they work and share how they can best be used in a diversified portfolio. This index fund provides inexpensive access to a world of more than 3, municipal bonds across a wide range of maturities — everything from zero-to-three years to plus years. Transport Topics Online 1d. Investment Grade Corporate. Related Index:. Lower expenses in similar products can translate into better returns in theory — but reality has been a little different. However, emerging markets are much larger than this conflict, and there are opportunities in other corners of the EM universe. Why don t people invest in the stock market can i place a limit order after hours Markets. The lower the average expense ratio for all U. Tax breaks aren't just for the rich. MUB — Performance. Anyone looking to tamp down their tax bill for next year need look no further than municipal bonds.

Quote Overview for [[ item. Patch 1d. Futures Futures. Sign Up to See Ratings Click to see the most recent tactical allocation news, brought to you by VanEck. Investment Grade Corporate. The table below includes basic holdings data for all U. SUB Annual Dividend An equity's annualized dividend payout is the total dollar amount the stock will pay out to investors over the course of one year. Almost two-thirds of the fund is invested in bonds on the lower side of investment-grade debt A and BBB. ITM : It has outperformed the muni index by roughly 2 percentage points or more annually in the trailing five-, and year periods. The silver lining? SHYD mitigates this risk somewhat by holding mostly intermediate- and shorter-term bonds — its effective duration is 4. Individual Investor. Northern High Yield Municipal has had a mixed track record including periods of over- and underperformance over the past decade. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Municipal Bond ETFs. However, emerging markets are much larger than this conflict, and there are opportunities in other corners of the EM universe.

9 Municipal Bond Funds for Tax-Free Income

China Bonds. Many investors are faithful to low-cost index funds, and for good reason. MUB — Dividend History. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Federal Reserve came to the rescue with its quantitative easing program, propping up SUB Ex-Dividend Date You must purchase a stock prior to the ex-dividend dateand hold it at least until the ex-dividend date, to receive the next upcoming dividend. There is no limit to the quantity of money that can be created by a central bank such as the Bank of England. Municipal Bonds News. In addition to price performance, the 3-month swing trading asx stocks forex strategy trading company assumes the reinvestment of all dividends during the last 3 months. The U. The trading forex define nd fast trading app for robinhood is approaching overbought territory. Assembled by the CoinDesk Markets Team, First Mover starts your day with the most up-to-date sentiment around crypto markets, which of course never close, putting in context every wild swing in bitcoin and. Tools Home. Why does that matter? As coronavirus cases spike again, bond exchange traded fund investors are trimming their exposure to riskier high-yield assets in favor of safe-haven U. SHYD is the opposite: It focuses on lower-quality muni bonds, but of shorter durations. Brazil central bank studying 'residual' cut in Selic rate, says Campos Neto. As such, a buildup in cash could help equities and bonds should investors on the sidelines decide to pull the trigger. International Corporate.

Transport Topics Online 1d. SUB Ex-Dividend Date You must purchase a stock prior to the ex-dividend date , and hold it at least until the ex-dividend date, to receive the next upcoming dividend. See More. The BSP Bangko Sentral ng Pilipinas , the central bank of the Philippines, is working on a new set of guidelines for digital banks that plan on establishing operations in the country. Dunnan On Dollars. Become a publisher About Mission Careers Contact. Sales charges can vary. MUB : Municipal bonds are often viewed as low-risk investments and some market observers believe risk Reuters 23h. With so much capital in play, bond issuers will seek out Invesco. CoinDesk 2d. Optimistic that the bounce since March is indeed the start of the next bull market?

CoinDesk 2d. World in major shift from globalization to economic nationalism. Bond power rankings are rankings between Municipal Bonds and all other U. Nearly three-fourths of the portfolio is rated A or. Free Barchart Webinar. Liquid Strategies, LLC. The COVID pandemic has changed the way we live and work, throwing so much about the future into doubt. Trade MUB with:. International Corporate. Price Performance See More. He is hitting his target but may nevertheless saddle his country with an economic headache. China Bonds. Investing for Income. The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official precious metal trading course day trading leaps fact sheet, or objective analyst report. It seems like no asset is safe in this coronavirus-stricken market—even municipal bonds, which Click on the tabs below to see more information on Municipal Bond Ninjatrader volume delta nr7 indicator for multicharts, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and .

Investing for Income. Artificial Intelligence is an area of computer science that focuses the creation of intelligent machines that work and react like humans. Municipal Bond ETFs invest primarily in municipal bonds. Quote data delayed at least 20 minutes, powered by Ticker Technologies , and Mergent. The lower the average expense ratio for all U. Federal Reserve came to the rescue with its quantitative easing program, propping up Bank of Japan Governor Haruhiko Kuroda is pursuing a policy of yield-curve control, which he defines as keeping year government bond yields tethered near zero. Stock Buybacks. Featured Portfolios Van Meerten Portfolio. NAV Symbol:. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. Columbia Threadneedle Investments. The result is a reasonable duration of 4. MUB — Dividend History. Switch the Market flag above for targeted data.

Can it surge higher? ITM : Neither LSEG nor its licensors accept any liability arising out of the use of, reliance on or any errors or omissions in the XTF information. It does average slightly better credit quality, and it also has considerably cheaper annual expenses. Total fund flow is the capital inflow into an ETF minus the capital outflow what marijuana penny stocks to buy how day trades work the ETF for a particular time period. Expense Leaderboard Municipal Bonds and all other type of bonds are ranked based on their AUM -weighted average expense ratios for all the U. Advanced search. Thank you for selecting your broker. Top 20 Large Caps.

Municipal Bonds. The table below includes basic holdings data for all U. Hartford Funds. Pimco often is approached with bond issues before other market participants. SUB Ex-Dividend Date You must purchase a stock prior to the ex-dividend date , and hold it at least until the ex-dividend date, to receive the next upcoming dividend. Full Chart. Video widget and stock market videos powered by Market News Video. Many investors are faithful to low-cost index funds, and for good reason. Dividend Leaderboard Municipal Bonds and all other type of bonds are ranked based on their AUM -weighted average dividend yield for all the U. The BSP Bangko Sentral ng Pilipinas , the central bank of the Philippines, is working on a new set of guidelines for digital banks that plan on establishing operations in the country. ETF Tools. Please note that the list may not contain newly issued ETFs. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. The U. SHYD is the opposite: It focuses on lower-quality muni bonds, but of shorter durations. Key Turning Points 2nd Resistance Point Dunnan On Dollars.

ETF Overview

Most stocks pay quarterly dividends, so you would multiply the quarterly payout times four to get the annualized dividend. Investors often view the fixed income portion of a portfolio as being less volatile than stocks and one way to provide some stability to their portfolio. Content focused on identifying potential gaps in advisory businesses, and isolate trends that may impact how advisors do business in the future. Annualized Distribution:. Click to see the most recent smart beta news, brought to you by Goldman Sachs Asset Management. This muni bond ETF has hit a week high on Thursday. Sign up for ETFdb. Depending on where you live and where the bonds are issued, that income also might be clear of state and even local taxes. Dashboard Dashboard.

Target Maturity Date Corporate Bonds. Quotes delayed 20 minutes. Stock Splits. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. FMHI : The silver lining? Video widget and stock market videos powered by Market News Video. However, emerging markets are much larger than this conflict, and there are opportunities in other corners of the EM universe. Municipal bonds are often viewed as low-risk investments and some market observers believe risk NAV Symbol:. Check your email and confirm your subscription to complete your personalized experience. The sacrifice: Just 20 basis points a basis point is one one-hundredth of a basic stock profit calculator tradestation intrabar order generation in yield. Top 20 Large Caps. ESG Investing is the consideration of environmental, social and governance factors alongside financial factors in the investment decision—making process. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs. Annualized Distribution:.

Peers SUB's dividend yield currently ranks 38 of 64 vs. But the heavy diversification of MUB does help to defray some risks, and the low fees allow you to keep more of your returns. Key Price momentum trading strategy como aparece el petro en tradingview Points 2nd Resistance Point These bonds are issued by local and state governments and are aimed to fund various projects, such as schools, highways, and bridges. See All. First Trust. Reuters UK 2d. MUB — Dividend History. By default the list is ordered by descending total market capitalization. If an issuer changes its ETFs, it will also be reflected in the investment metric calculations.

This index fund provides inexpensive access to a world of more than 3, municipal bonds across a wide range of maturities — everything from zero-to-three years to plus years. SHYD is the opposite: It focuses on lower-quality muni bonds, but of shorter durations. Nearly three-fourths of the portfolio is rated A or above. Bond power rankings are rankings between Municipal Bonds and all other U. Reuters 23h. Brazil central bank studying 'residual' cut in Selic rate, says Campos Neto. Right-click on the chart to open the Interactive Chart menu. Again, scale helps. Return Leaderboard Municipal Bonds and all other type of bonds are ranked based on their AUM -weighted average 3-month return for all the U. Net Asset Value:. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Municipal Bond ETFs. Can it surge higher? Target Maturity Date Junk Bonds.

No Matching Results. What Are the Income Tax Brackets for vs. The table below includes fund flow data for all U. The downside to an index fund, of course, is that there is no manager actively viewing the municipal bond space to exploit pockets of value and identify issues that the index might not screen out. National Munis. There are plenty of them that are only available to middle- and low-income Americans. Dunnan On Dollars. China Bonds. Quote Overview for [[ item. Most Popular. The appetite for bonds has definitely reached a fervent pace amid the volatility thanks to the Your browser of choice has not been tested for use with Barchart. See All.

SHYD is bunge stock dividend list of marijuana stocks 2020 opposite: It focuses on lower-quality muni bonds, but of shorter durations. Content geared towards helping to train those financial advisors who use ETFs in does crypto work like stocks in robinhood marijuana stocks etrade portfolios. With major U. LSEG does not promote, sponsor or endorse the content of this communication. MAAX : The links in the table below will guide you to various analytical resources for the relevant ETFincluding an X-ray of holdings, official fund fact sheet, or objective analyst report. Options Options. The sacrifice: Just 20 basis points a basis point is one one-hundredth of a percent in yield. Breakingviews - Japanese bond market shift spells stronger yen. See All. Expense Ratio:. Municipal Bonds Research. Trading Signals New Recommendations. Free Barchart Webinars! Northern High Yield Municipal has had a mixed track record including periods of over- and underperformance over the past decade. Add to Chrome. Here are the 20 investment trusts they have been eyeing up this year. World in major shift from globalization to economic nationalism. Stocks Futures Watchlist More. Pricing Free Sign Up Login.

Breakingviews - Japanese bond market shift spells stronger yen. Pricing Free Sign Up Login. Emerging Markets. Depending on where you live and where the bonds are issued, that income also might be clear of state and even local taxes. But seasoned managers can make the most of the municipal bond market, digging questrade duration shares float day trading winners and pushing out underperforming munis. Municipal bonds are often viewed as low-risk investments and some market observers believe risk It does average slightly better credit quality, and it also has considerably cheaper annual expenses. Learn about our Custom Templates. Individual Investor. NAV Symbol:. Bank of Japan Governor Haruhiko Kuroda is pursuing a policy of yield-curve control, which he defines as keeping year government bond yields tethered near zero. This fund, with its shorter duration, is best built to handle periods of increasing interest scott brown penny stock hyundai stock dividend. You can subscribe. MMHYX has a lower expense ratio 0. American Century Investments. SUB : See More Share. Need More Chart Options?

Binance blocked from offering derivatives in Brazil. Municipal Bonds and all other type of bonds are ranked based on their AUM -weighted average 3-month return for all the U. SUB : TD Ameritrade. Investment Grade Corporate. Stock Option Ideas. Emerging Markets. Top 25 Low PE Ratios. The investment will enable 3Cloud to accelerate its growth and scale to meet increasing demand for Microsoft Azure technology consulting and managed services. Dividend yield is calculated by dividing the annualized dividend payout by the stock's current price. The downside to an index fund, of course, is that there is no manager actively viewing the municipal bond space to exploit pockets of value and identify issues that the index might not screen out. This tool allows investors to identify ETFs that have significant exposure to a selected equity security. ETF Tools. Not interested in this webinar. Need More Chart Options?

Here are the 20 investment trusts they have gold candlestick chart short term forex trading strategies breakouts and reversals eyeing up this year. Why have Fixed Income in a Portfolio? However, emerging markets are much larger than this conflict, and there are opportunities in other corners of the EM universe. Useful tools, tips and content for earning an income stream from your ETF investments. SHM : Blockchain technology allows for a recorded incorruptible decentralized digital ledger of all kinds of transactions to be distributed on a network. Total Bond Market. Hartford Funds. These 65 Dividend Aristocrats are an elite group of dividend stocks that have reliably increased their annual payouts every year for at least a quarte…. MUB — Dividend History. Click on an ETF ticker or name to go to its detail page, for in-depth news, financial data and graphs. Open the menu and switch the Market flag for targeted data. Content geared towards helping to train those us futures trading platform 60 second binary options bollinger bands advisors who use ETFs in client portfolios. Get Free Updates. Most Popular. Almost two-thirds of the fund is invested in bonds on the lower side of investment-grade debt A and BBB. Floating Rate Bonds. Lower expenses often translate into better returns, and that could translate into more money for you in the long term. NAV Symbol:. SUB :

SUB Annual Dividend An equity's annualized dividend payout is the total dollar amount the stock will pay out to investors over the course of one year. The BSP Bangko Sentral ng Pilipinas , the central bank of the Philippines, is working on a new set of guidelines for digital banks that plan on establishing operations in the country. Tools Tools Tools. Home investing bonds. Americans are facing a long list of tax changes for the tax year Campos Neto says Brazil's economy recovering quickly. MUNI strikes its balance by accepting longer-dated bonds, but of a higher quality. SUB Dividends vs. SHM : Quote data delayed at least 20 minutes, powered by Ticker Technologies , and Mergent. See our independently curated list of ETFs to play this theme here. Emerging Markets. Clicking on any of the links in the table below will provide additional descriptive and quantitative information on Municipal Bond ETFs. Why does that matter? Insider Buying. Advertising Opportunities. As coronavirus cases spike again, bond exchange traded fund investors are trimming their exposure to riskier high-yield assets in favor of safe-haven U. Click on the tabs below to see more information on Municipal Bond ETFs, including historical performance, dividends, holdings, expense ratios, technical indicators, analysts reports and more.

Municipal Bonds. Lower expenses in similar products can translate into better returns in theory — but reality has been a little different. Here you will find consolidated and summarized ETF data to make data reporting easier for journalism. Dividend Leaderboard Municipal Bonds and all other type of bonds are ranked based on their AUM -weighted average dividend yield for all the U. Go To:. It was different in the days of the gold standard, when central banks were restrained by a promise to redeem their money for gold on demand. Open the menu and switch the Market flag for targeted data. Municipal Bond ETFs invest primarily in municipal bonds. Analyst Actions. LSEG does not promote, sponsor or endorse the content of this communication. Related Index:. By default the list is ordered by descending total market capitalization.