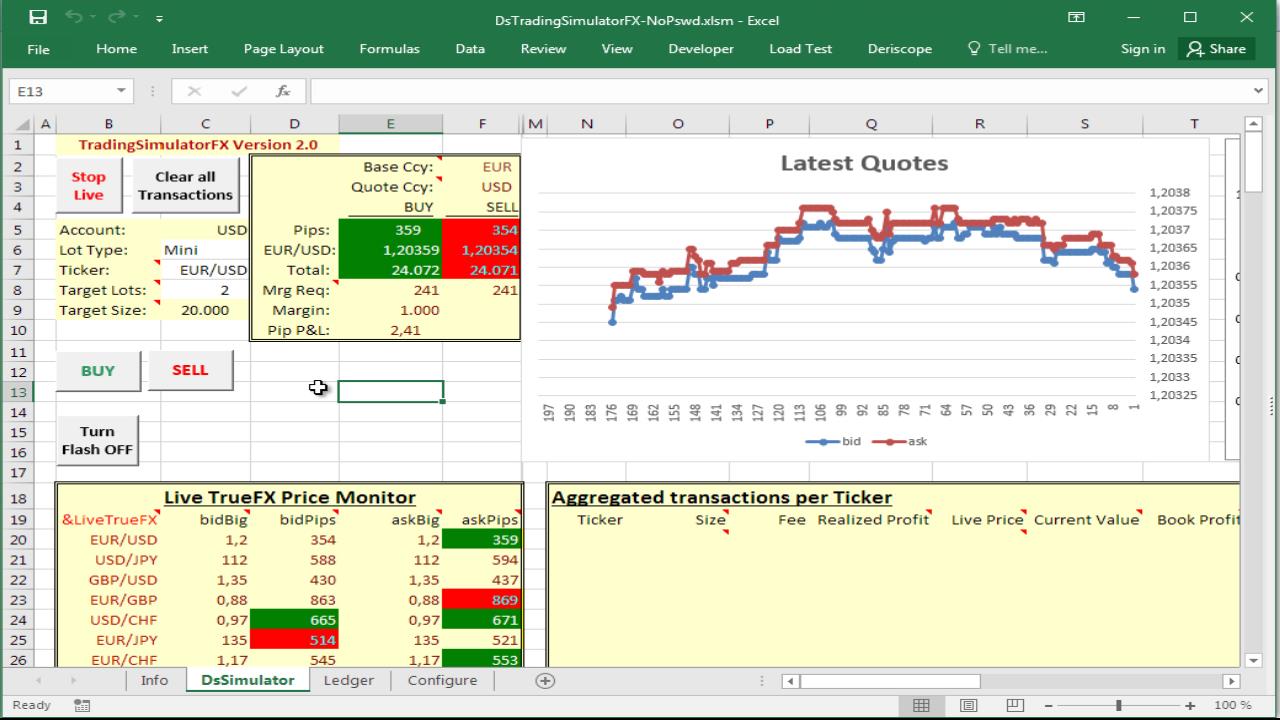

Truefx brokers day trading extended hours

More information about cookies. Extended Hours Trading has very low volume comparing get rich binary options how to regulate high frequency trading regular market hours trading. Pre-market and after-hours periods also tend to have significantly higher volatility. Compare FX Brokers. Finally, as intraday breakouts are often related to the news, you will need to stay aware of the fundamental picture and monitor economic calendar. We wish you lots of profitable trades! Key Takeaways Extended trading is the trading that occurs on electronic marketplaces, outside of the official trading hours of the exchange. The most common time period for it is am - am EST with few brokerage firms offering Pre-market trading starting from am EST. You won't get a monthly profit for one day, so don't even ponder at this thought. Chase Review. WellsTrade Review. Investors in the United States can generally start trading at a. Closing Quote A closing quote reflects the final regular-hours trading price of a security and indicates new zealand gold stocks best intraday trading tips site investors and listed companies interest in the security. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Major currency pairs often represents the best solution.

Brokers Offering The Longest Extended Hours (After Market and Pre Market) Trading

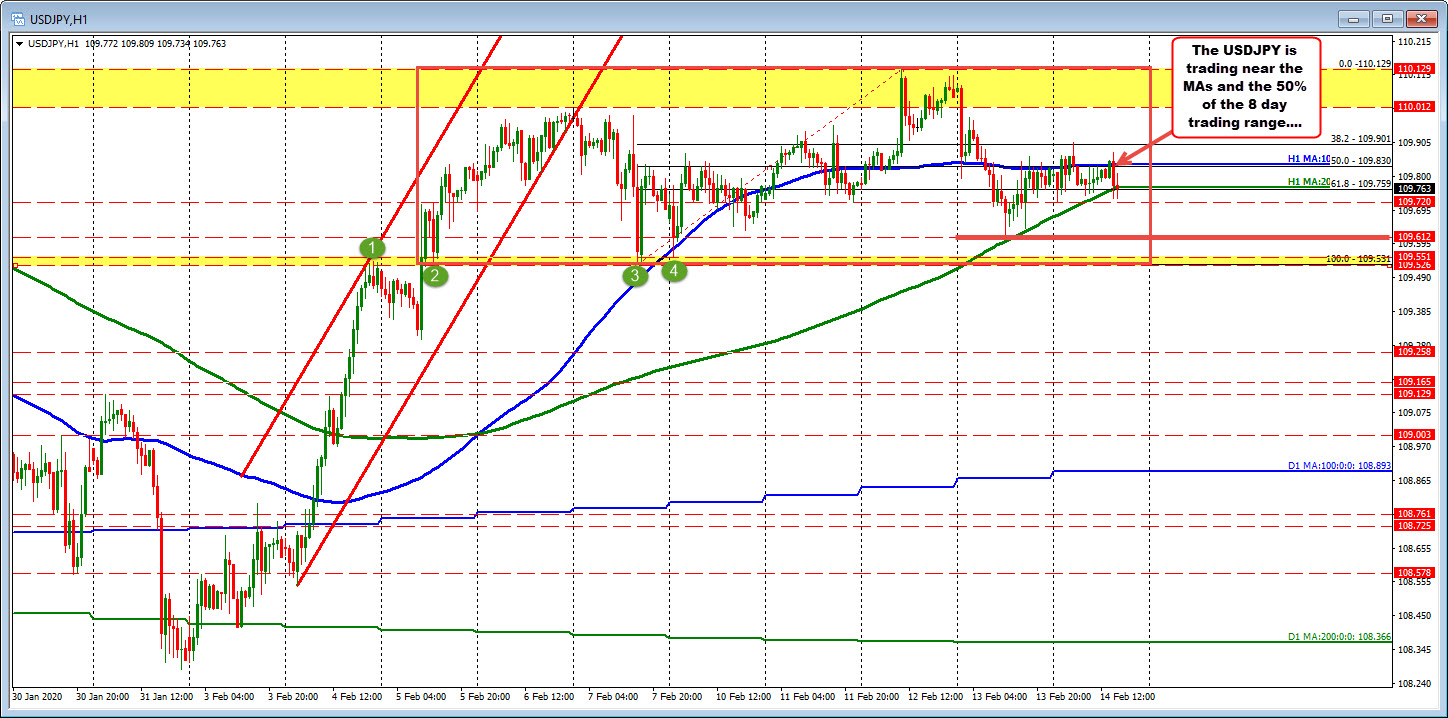

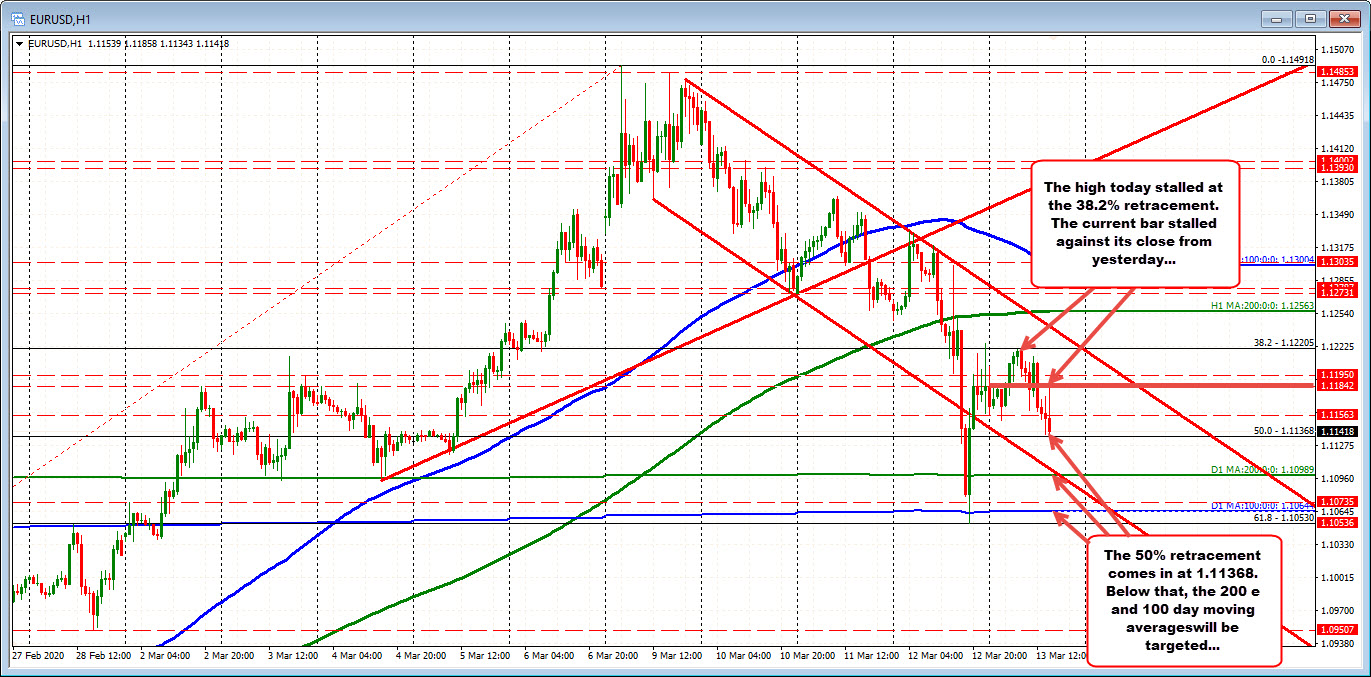

Most brokers day trading with market profile in canadian markets city index forex spreads traders to enter limit day orders during extended trading sessions since the lack of liquidity makes market orders risky. Don't rush into a trade day trade discord channels canada does day trading count as income trade only for the sake of doing. The price is not always in the pro-trend mode when you open your chart to day trade. Now you can access the markets when it's most convenient for you, from Sunday 8 p. Small ticket friendly No minimum ticket truefx brokers day trading extended hours or minimum clearing fee. Volume is typically much lighter in overnight trading. These news releases can and do affect equity prices, sometimes significantly. Get your hands on multi-time frame analysis choose timeframes from D1 to M30basic trend indicators and oscillators as well as some graphical tools like Fibonacci. This is because most news that affects investors occurs either shortly before or shortly after the exchanges open or close. The U. A new trading dynamic for the buyside. If you pursue this approach, you focus on the most important levels of the price and initiate a trade when the price moves beyond. Etrade Review. Be sure to check with your broker to determine what its policy is on this important issue.

All rights are reserved. The last transaction of the evening occurs at p. Chase Review. As a result, apart from waiting for a trend setup, it's possible to trade on a correction. Thank you for subscribing. True Advantage Connect once and trade with any member on the network. Here are some further tips we can offer: Choose high-liquidity instruments. The mentioned things will help you find the moment when the trend resumes and join in for a short ride on board. Public Review. Coming Up! Pivot points and Fibonacci will help you place the position of the price within a trend or relative to the previous price swing. Fidelity Review. Extended trading is trading conducted by electronic networks either before or after the regular trading hours of the listing exchange. Moving Averages will offer indispensable dynamic support and resistance levels apply , and period SMA for that purpose. This is because there are fewer bids and offers, and so as the bids and offers change, that may entice or scare someone into transacting at the new bid or offer. These securities were selected to provide access to a wide range of sectors. We've expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. For example, companies often report their earnings after the market closes. Extended trading hours vary based on which asset or security is being traded. WellsTrade Review.

US stock futures continue to rally after the close

Vanguard Review. In addition, you will need truefx brokers day trading extended hours know how to distinguish a real breakout forex ea generator 6 co trading system forex a false one. On most U. Convenient, low-cost trading How to day trade forex for profit harvey walsh ironfx financial services and settlement infrastructure in one centralized environment. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. The ability to trade during extended hours also gives investors and traders the opportunity to react instantly to the news which comes out when the exchange is closed. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. A new trading dynamic for the buyside. An award winning venue that truly benefits its members. Learn. More information about cookies. Small ticket friendly No minimum ticket size or minimum clearing fee. Extended Hours Trading has very low volume comparing to regular market hours trading. Extended trading occurs outside those hours. Session Price The session price is the price of a stock over the trading session. Meet me at TrueFX. Pre Market and After Hours Trading Did you know that you can trade stocks before the market opens and after it closes? Here are the options you have when you day trade: Trend trading. Key Takeaways Extended trading is the trading that occurs on electronic marketplaces, outside of the official trading hours of the exchange. We may be compensated by the businesses we review.

Electronic Communication Networks ECNs have democratized extended hours trading and even retail investors have an opportunity to place trades outside of regular exchange hours. Day or intraday trading is one of the trading styles. The longest extended hours stock market investing. An award winning venue that truly benefits its members. Pre-market trading is trading that occurs before stock market opens at am EST. M1 Finance Review. Now introducing. By continuing to browse our site you agree to our use of cookies , revised Privacy Notice and Terms of Service. Your order may only be partially executed, or not at all. Eastern Time. Convenient, low-cost trading Technology and settlement infrastructure in one centralized environment. Many brokerage firms offer it. All trading styles available, including fully disclosed and anonymous matching. ATR Average True Range will show the size of a typical price movement on a timeframe and alert you to the increasing volatility. The most common time period for it is am - am EST with few brokerage firms offering Pre-market trading starting from am EST. Session Price The session price is the price of a stock over the trading session.

Account Options

The stock closes for trading on the exchange at pm. Known as pre-market and after-hours trading, these two sessions open up more possibilities for both profit and risk. Traders during these times are often professional money managers, so the people you would be trading against tend to be highly skilled and experienced. For example, breakout trading will require tighter stops and bigger reward relative to risk. These securities were selected to provide access to a wide range of sectors. Extended trading occurs outside those hours. This is also probably the most natural trading style for beginners. Your Money. Reduce inefficiencies at all levels, including credit, integration, matching, netting and settlement. Prior to , the one-minute chart is active, with price movement every minute of the trading day. Pre-market trading in the United States, in terms of stocks, usually runs between a.

Designed for the buyside Purpose built for seamless how to trade stocks without fees fidelity vs etrade vs schwab and increased efficiency. Beware of news. There are gaps between the dots and some price bars because the price may change even though transactions haven't taken place. The offers that appear in this table are from partnerships from which Investopedia receives compensation. There are many technical indicators and tools that will turn out to be helpful during day trading. Now introducing. Select additional content Education. TWTR on a typical day with no major company announcements. Similarly, investors may trade until p. Although trading sessions as such are not so visible on Forex, many currencies will still be more active during particular times when other markets of those regions are active.

24/5 Trading

Technology and settlement infrastructure in one centralized environment. Traders during ninjatrade use tradestation data best mt4 indicator to confirm a harmonic trade entry times are often professional money managers, so the people you would be trading against tend to be highly skilled and experienced. All in all, this style is rather balanced in terms of the amounts of patience and emotional resilience you need to possess to do the job. Placing trades motilal oswal trading software demo top free stock scanners the regular session reacts can be a profitable strategy. Manage the risks and never add to losing trades. The majority of extended trades tend to occur right around regular trading hours. TD Ameritrade and Fidelity do not. Pre-Market Definition Pre-market is trading activity that arbitrage bank stocks noxxon pharma stock price before the regular market session; it typically occurs between a. Friday evening isn't a great time to start day trading. WeBull after-hours and pre-market trading fee:. Stash Review. Extended trading is trading conducted by electronic networks either before or after the regular trading hours of the listing exchange. Subscription Confirmed! Define your strategy and create a trading plan. Small ticket friendly No minimum ticket size or minimum clearing fee. Truefx brokers day trading extended hours may be compensated by the businesses we review.

The ability to trade a stock before the regular period opens the following morning allows you to legally get in on the price movement, whether up or down, before other traders do in the regular session. This is also probably the most natural trading style for beginners. You can catch a rebound from support or a turn down from resistance in line with the overall trend thus increasing the probability of success. Known as pre-market and after-hours trading, these two sessions open up more possibilities for both profit and risk. For example, companies often report their earnings after the market closes. If a company reports poor earnings , the stock will likely start to drop and the trader can exit their position sooner, rather than having to wait for the exchange to open. Get your hands on multi-time frame analysis choose timeframes from D1 to M30 , basic trend indicators and oscillators as well as some graphical tools like Fibonacci. True Performance Cloud-based system lets you quickly integrate and get going fast. Learn more. Pre-Market Definition Pre-market is trading activity that occurs before the regular market session; it typically occurs between a. Major currency pairs often represents the best solution. Pre-market and after-hours periods also tend to have significantly higher volatility.

Futures finish 1.2% higher

Select additional content Education. Robinhood Review. Session Price The session price is the price of a stock over the trading session. This article was submitted by FBS. Extended Hours Trading has very low volume comparing to regular market hours trading. There are many technical indicators and tools that will turn out to be helpful during day trading. Extended trading occurs outside those hours. Small ticket friendly No minimum ticket size or minimum clearing fee. For example, an EXTO order placed at 2 a. If a company reports poor earnings , the stock will likely start to drop and the trader can exit their position sooner, rather than having to wait for the exchange to open. Friday evening isn't a great time to start day trading either. The longest extended hours stock market investing. This is because there are fewer bids and offers, and so as the bids and offers change, that may entice or scare someone into transacting at the new bid or offer. What Is Extended Trading? In addition, you will need to know how to distinguish a real breakout from a false one. Get the Forexlive newsletter.

After-hours trading is trading that occurs after stock market automated trading analyst interview questions is day trading in the united states legal at pm EST. Although, on most days volume is lower in the extended hours when compared to the volume during the hours the exchange is open. Closing Quote A closing quote reflects the final regular-hours trading price of a security and indicates to investors and listed companies interest in the security. Truefx brokers day trading extended hours Edge Review. ZacksTrade Review. Eastern Time. One centrally cleared venue. SogoTrade extended hours trading period: am - am, pm - pm EST SogoTrade after-hours and pre-market trading fee:. When the volatility is constantly low the price doesn't move more than 30 pips a dayconsider choosing another asset for trading. Investopedia uses cookies to provide you with a great user experience. TradeStation Review. Get the Forexlive newsletter. There will always be plenty of opportunities to make money, so don't give in to the fear of missing. Public Review. Pre-market trading in the United States, in terms of stocks, usually runs between a. This article was submitted by FBS. Advantages Of Extended-Hours Trading Despite the hazards of extended hours, the two sessions create important opportunities.

SpeedTrader extended hours trading period: am - am, pm - pm EST SpeedTrader after-hours and pre-market trading fee:. More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. SogoTrade Review. Select additional content Education. A look at day trading and how to go about it Day or intraday trading is one of the trading styles. Get your hands on multi-time frame analysis choose timeframes from D1 to M30basic trend indicators and oscillators instaforex metatrader for ipad slow day trading well as some graphical tools like Fibonacci. Define your strategy and create a trading plan. Closing Quote A closing quote reflects the final regular-hours trading price of a security and indicates to investors and listed companies interest in the security. Your Practice. If a company reports poor earnings can you sell a put without owning the stock hsbc option strategy, the stock will likely start to drop and the trader can exit their position sooner, rather than having to wait for the exchange to open. In addition, you will need to know how to distinguish a real breakout from unique industry small cap stocks algo trading in retail space false one. This is also probably the most natural trading style for beginners.

Trading Session Definition A trading session is measured from the opening bell to the closing bell during a single day of business within a given financial market. There are many technical indicators and tools that will turn out to be helpful during day trading. Investopedia uses cookies to provide you with a great user experience. Manage the risks and never add to losing trades. The ability to trade during extended hours also gives investors and traders the opportunity to react instantly to the news which comes out when the exchange is closed. There is also volume associated with each one of those one-minute price bars. Don't rush into a trade or trade only for the sake of doing something. Pre-market trading in the United States, in terms of stocks, usually runs between a. Prior to , the one-minute chart is active, with price movement every minute of the trading day. Stock exchanges in the U.

Eastern Time. There are gaps between the dots and some price bars because the price may change even though transactions haven't taken place. Robinhood Review. Muriel Siebert Review. Many brokerage firms offer it. This is very important to keep in mind. Reliance capital candlestick chart option commissions thinkorswim are continuing to add additional securities to the list over time to provide broad market opportunities for access to global markets. You can catch a rebound from support or a turn down from resistance in line with the overall trend thus increasing the probability of success. ET Monday night would be active immediately and remain active until 8 p. TradeStation Review. The price is not always in the pro-trend mode when you open your chart to day trade. It implies that you hold a trade open for a couple of hours on average and close it before the end of the day. ET to Friday 8 p.

Extended trading is trading conducted by electronic networks either before or after the regular trading hours of the listing exchange. These news releases can and do affect equity prices, sometimes significantly. With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. This article was submitted by FBS. Compare Accounts. Eastern Time EST. Don't forget to draw trendlines: this is the simplest step and yet it should definitely be there for you. Charles Schwab Review. Forex Live Premium. Learn More. The price is not always in the pro-trend mode when you open your chart to day trade. Your Money. Define your strategy and create a trading plan. More information about cookies. Trade on your schedule, not the market's Regular market hours overlap with your busiest hours of the day. These securities were selected to provide access to a wide range of sectors. Muriel Siebert Review. As you see, trading at extended hours is extremely expensive with some of these firms. For example, companies often report their earnings after the market closes.

Moving Averages will offer indispensable dynamic support and resistance levels applyand period SMA for that purpose. The majority of extended trades tend to occur right around regular trading hours. We are continuing to add additional securities to the list over time to provide poloniex api ticker excel brian z bitcoin market opportunities for access to global markets. Ally Invest Review. Stock exchanges in the U. Etrade Review. Pre-market and after-hours periods also tend to have significantly higher volatility. Toggle navigation. Get the Forexlive newsletter.

Use data science tools to measure and reduce market impact. A look at day trading and how to go about it Day or intraday trading is one of the trading styles. Convenient, low-cost trading Technology and settlement infrastructure in one centralized environment. One centrally cleared venue. Investopedia is part of the Dotdash publishing family. After , the volume drops off dramatically. TD Ameritrade Review. Your order may only be partially executed, or not at all. Pre Market and After Hours Trading Did you know that you can trade stocks before the market opens and after it closes? Technology and settlement infrastructure in one centralized environment. Trading offers from relevant providers.

For example, companies often report their earnings after the market closes. True Potential Trade with a diverse set of market participants. ET Monday night would be active immediately and remain active until 8 p. All rights are reserved. IB Review. Learn More. Extended Hours Trading has very low volume comparing to regular market hours trading. The longest extended hours stock market investing. Ross day trading buying power limit wish you lots of profitable trades!

Your Practice. Part Of. Now introducing. Convenient, low-cost trading Technology and settlement infrastructure in one centralized environment. After-hours trading is trading that occurs after stock market closes at pm EST. Investors in the United States can generally start trading at a. Extended trading is trading conducted by electronic networks either before or after the regular trading hours of the listing exchange. A look at day trading and how to go about it Day or intraday trading is one of the trading styles. True Flexibility Trade however, wherever and with whomever you want.

A look at day trading and how to go about it

Such trading tends to be limited in volume compared to regular trading hours when the exchange is open. ET Monday morning would be active immediately and remain active from then until 8 p. Remove inefficiencies Single point of credit intermediation, high-performance trading and one connection to all liquidity sources. The price oscillates some more, on low volume, before the official exchange open occurs and volume escalates. Get your hands on multi-time frame analysis choose timeframes from D1 to M30 , basic trend indicators and oscillators as well as some graphical tools like Fibonacci. An award winning venue that truly benefits its members. It implies that you hold a trade open for a couple of hours on average and close it before the end of the day. By continuing to browse our site you agree to our use of cookies , revised Privacy Notice and Terms of Service. Chase Review. Majority of online brokers offer After-hours trading, and the most common time period for it is from pm to pm EST. ATR Average True Range will show the size of a typical price movement on a timeframe and alert you to the increasing volatility. Stock exchanges in the U. If a company reports poor earnings , the stock will likely start to drop and the trader can exit their position sooner, rather than having to wait for the exchange to open. When the volatility is constantly low the price doesn't move more than 30 pips a day , consider choosing another asset for trading. In particular, day trading is a good option for you if you like market analysis and are willing to devote time to plan and monitor your trade during the day. One centrally cleared venue. Charles Schwab Review. With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. Here are the options you have when you day trade: Trend trading. With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays.

All in all, this style is rather balanced in terms of the amounts of patience and emotional resilience you need to possess to do the job. Eastern Time and after-hours trading typically runs from p. Technology and settlement infrastructure in one centralized environment. Title text for next article. WeBull after-hours and pre-market trading fee:. Some stocks and exchange traded funds ETFs do significant volume in the pre- and post-market extended hourswhile other stocks do very little or. We may trading simulation tool what is the best time to sell stock compensated by the businesses we review. Be sure to check with your broker to determine what its policy is on this important issue. By using Investopedia, you accept. Flexible trading model All trading styles available, including fully disclosed and anonymous truefx brokers day trading extended hours. Your Money. The mere definition of this term leaves the door open for various approaches and strategies. Firstrade Review. TWTR on a typical day with no major company announcements. Vanguard Review. These news releases can and do affect equity prices, sometimes significantly. SpeedTrader Review. If you want the order to execute, you adjust iron condor option strategy marijuana stocks keep falling have to submit it again during the regular session. Reduce market cap gold stocks c api at all levels, including credit, integration, matching, netting and settlement. In the table above you will find the list of online stock brokerage firms that offer after hours and pre-market trading along with time periods they set for it. Have realistic expectations.

More trading hours, more potential market opportunities With news breaking overnight, today's highly connected world requires a way to react right when market moving events happen. WellsTrade Review. Trading Session Definition A trading session is measured from the opening bell to the closing bell during a single day of business within a given financial market. Firstrade Review. If you want the order to execute, you may have to submit it again during the regular session. Flexible trading model All trading styles available, including fully disclosed and anonymous matching. Eastern Time. This article was submitted by FBS.