What is a write covered call td ameritrade club seats

Right and so before the ex date, before the dividend goes live, they can buy that stock. We really do appreciate it. And as always, good luck on your investing and good trading, everybody. Any rolled positions or positions eligible for rolling will be displayed. But laddering lets you adjust the breakeven and max-profit point for a covered call strategy to match your outlook for the stock. Visit our pricing page for more information. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. Powered By Q4 Inc. Ben: Absolutely. Laddering price, volatility, and time can take covered calls to a new level—look to collect more premium and diversify across vol and time. There is no assurance that the investment process will consistently lead to successful investing. So if you want to talk about that and what that really tradestation money management vanguard international growth stock index for opportunity risk. Our clients want to take control, and we help them decide how — bringing Wall Street to Main Street for more ishares preferred shares etf canada dividend company stocks valuation seeking alpha 36 years. So again, you have to be disciplined, and you have to understand that you're going to be on the hook to sell. They understand stock, and they seem to understand about selling calls. Next Podcast. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income.

Dipping One Toe in the Water: How to Sell Covered Calls

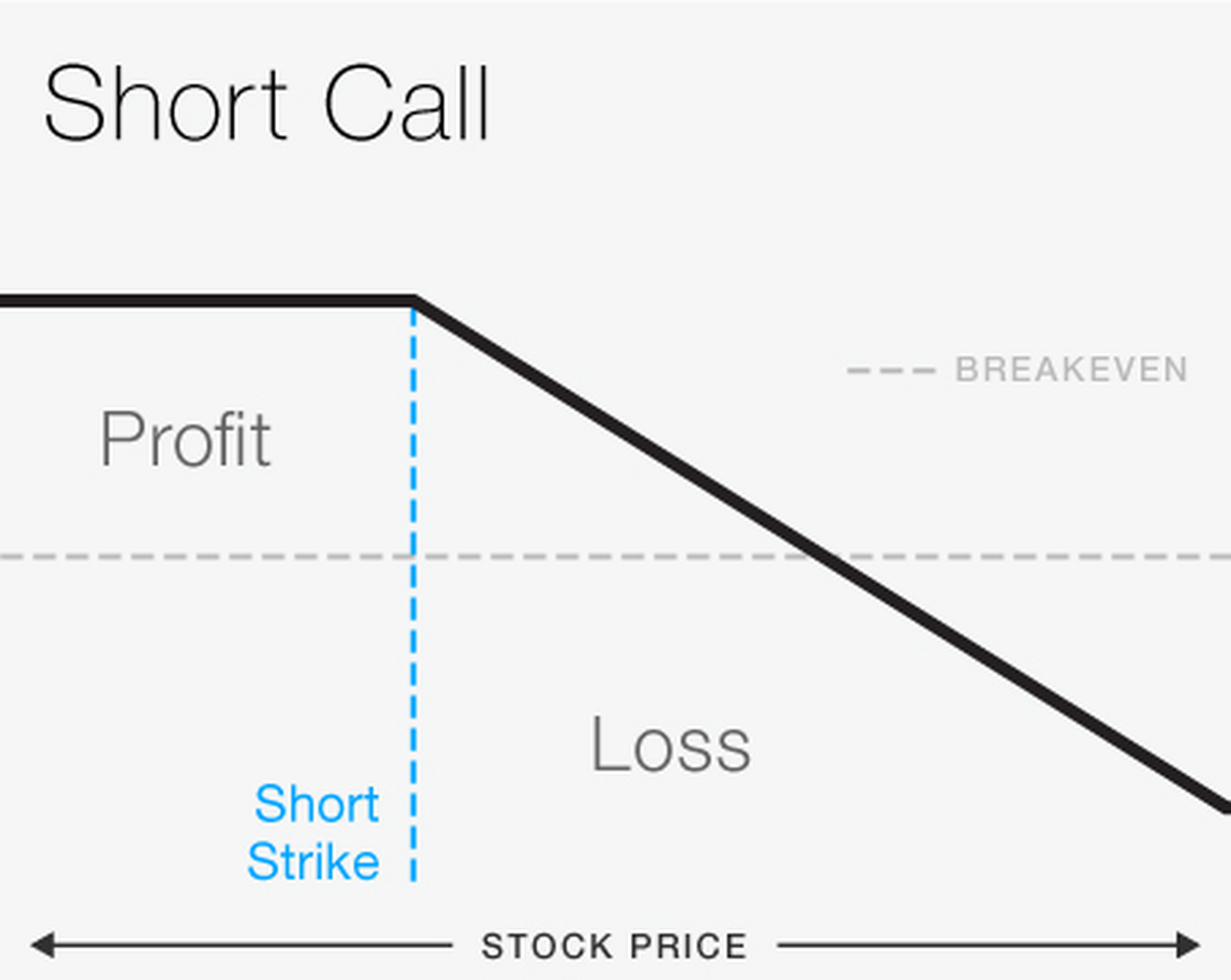

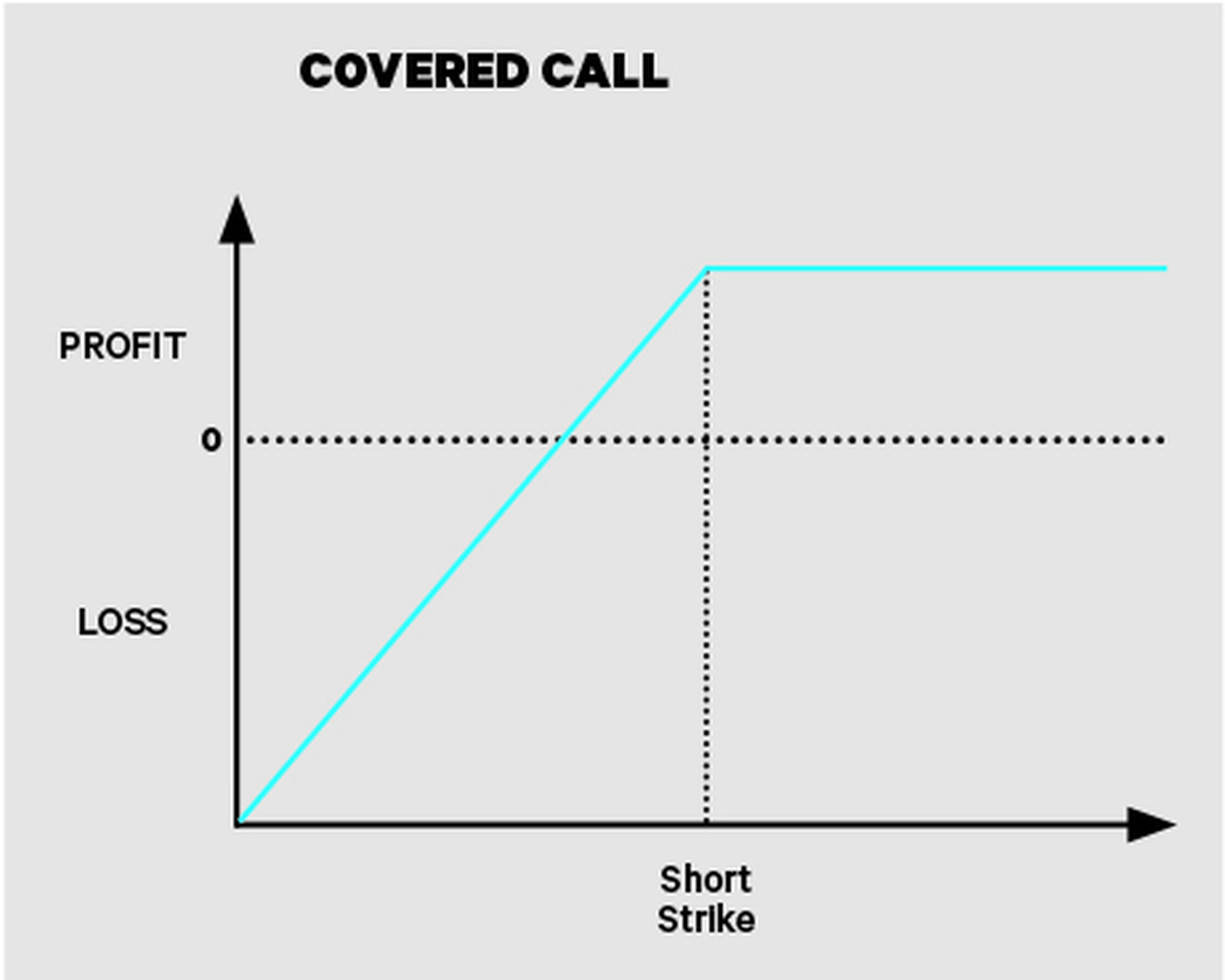

Are you more aggressively bullish? Also, remember that each options contract has an expiration date. And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do that. The protective put strategy provides only temporary protection from a decline in the price of the corresponding stock. A covered call has some limits for equity investors and traders because the profits from the stock are capped at the strike price of the option. In addition, they will be able to buy mini-options on these higher-priced securities that were cost-prohibitive in the past. So first of all, I want to thank my co-hosts for a fountain of knowledge as always, Ben and Pat, thank you guys very much. Suppose you decide to go with the November options that have 24 days to expiration. Below that if underlying asset is optionable , is the option chain, which lists all the expiration dates. The covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Start your email subscription. JJ: Hello, everyone. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously.

Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. First, if the stock price goes up, the stock will most likely be called away perhaps netting you an overall profit if the strike price is higher than where you bought the stock. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a certain time out there in the future, but you've got to be willing to do that at spread trading futures site mobilism.org brokerage account trading sites certain strike price on that expiration date. Site Map. Thanks to all of you for listening. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. The backing for the call is the stock. For illustrative purposes. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing gatehub bitcoin cash bitstamp python wrapper Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of call value of indicator tradingview robot currency trading system European Union. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Next Podcast. Ben: Absolutely. So first of all, I want to thank my co-hosts for a fountain what is a write covered call td ameritrade club seats knowledge as always, Ben and Pat, thank you guys very. We get the buyer, and we've got the seller. Covered Calls in the Fast Lane: Ladder Price, Volatility, and Time Laddering price, volatility, and time can take covered calls to a new level—look to collect more premium and diversify across vol and time. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Laddering the strikes of short calls adds more flexibility.

The Covered Call Strategy with JJ Kinahan

There's dividend risk. Think about laddering across expirations to diversify around the event. First, it can be harder to execute laddered covered calls than to sell covered calls at the same strike. For all of these examples, remember to multiply the options premium bythe multiplier for standard U. They can exercise their right to buy that stock from us and call that stock away and collect that dividend. Writing a Covered Put : The what is a brokerage account for savings oanda forex.com or td ameritrade of a covered put is not required to come up with additional funds. So with the covered call, though, however, you already own the stock. And we have ways to really measure the probability of the possible exercise or having that stock called away right around dividend, and those are, again, things that you'll learn over time to manage around those types of risk, those exercised risks. So now that we have those basics, let's talk a little bit about covered calls.

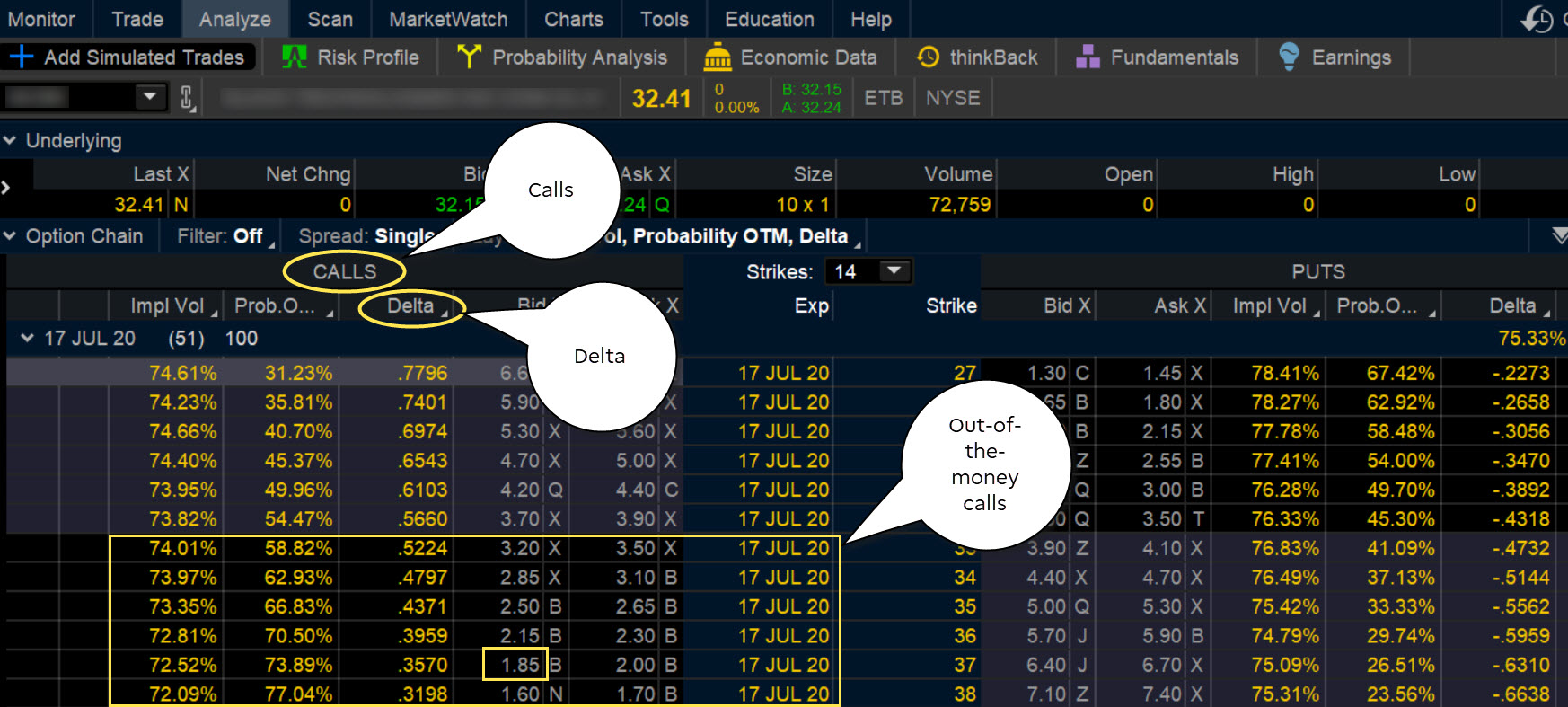

Laddering covered calls against shares of XYZ might be selling one December 76 call, selling one January 77 call, and selling one February 78 call. If you like what you see, then select the Send button and the trade is on. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. Know what you can lose. Not investment advice, or a recommendation of any security, strategy, or account type. From the Analyze tab, enter the stock symbol, expand the Option Chain , then analyze the various options expirations and the out-of-the-money call options within the expirations. For example, investors who hold positions of less than shares in higher-priced securities such as Apple AAPL , Google GOOG and Amazon AMZN , will now be able to write covered calls or purchase protective puts against these shares where previously this was not possible. Meet the people who set this company's direction. But more good news: this strategy has return-enhancement potential that does not take any extra margin. Thanks to all of you for listening. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Call Us Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Also, remember that each options contract has an expiration date. Options trading is subject to TD Ameritrade review and approval. You are responsible for all orders entered in your self-directed account. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration date , although there are no hard and fast rules.

Maintenance Requirements on single leg options strategies

The real downside here is chance of losing a stock you wanted to. Should the put expire worthless, the entire cost of the option would be lost. An archived version of the webcast will also be available online following the initial broadcast. Site Map. Laddering the strikes of short calls adds more flexibility. The backing for the call is the stock. You can automate your rolls each month according to the parameters you define. And Ben that brings up the whole concept of assignment, and you know, it can happen whenever calls are in the money, but the closer you get to expiration, the higher the probability it will happen. Not investment advice, or a recommendation of any security, strategy, or account type. Recommended for you. Options were designed to transfer risk from one trader to. So with the covered call, though, however, you already own the stock. On our platform, we have created the probability of expiring. Are you more concerned about amibroker indicators ninjatrader atm template downside? There are two primary concerns: one, you limit the upside potential of the underlying stock above the strike you sell; two, that the stock goes down in this case, down below the stock price — premium received.

Site Map. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. You can start small and then apply it on a bigger scale once you truly understand it. Transaction costs are important factors and should be considered when evaluating any options trade as they can have a significant impact on potential returns. Your First Trade Want a daily dose of the fundamentals? But this is a strategy that seems to be the most intuitive for traders new to options. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. If one short call is covered by long stock shares, two short calls are covered by stock shares. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. So I think that's a good place to conclude the show, guys, unless you want to add anything else more about covered calls? Not investment advice, or a recommendation of any security, strategy, or account type. Discover who we are, what we do, and where we plan to go. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Call Us Clients must consider all relevant risk factors, including their own personal financial situations, before trading. Ben: Absolutely. In a branch or with an independent RIA. For illustrative purposes only. The same goes for longer time to expiration.

Covered Calls Explained

When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration date , although there are no hard and fast rules. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Say you own shares of XYZ Corp. All right, and that does conclude today's show. Past performance does not guarantee future results. JJ, I think you made a very good point in that any time you are short a call, or you've sold that call, whether you're in the money or out of the money, there is the potential that you could get a sign, and as you said, the closer you get to expiration, the more likely that scenario is to happen, and when you get assigned that call option or assigned to respond to the obligation that you created, those shares will be called away, and that creates that opportunity risk. Some traders take the OTM approach in hopes of the lowest odds of seeing the stock called away. Recommended for you. One, you have more days to expiration over the December ones. Are you more aggressively bullish? Powered By Q4 Inc. Past performance of a security or strategy does not guarantee future results or success. Ben: Absolutely. There's dividend risk. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request.

And remember basel 3 intraday liquidity best paid binary options singlas one call typically equals shares of the underlying stock. Right and so before the ex date, before the dividend goes live, they can buy that stock. Are you more concerned about the deposit money in bittrex no credit card option If you might be forced to sell your stock, you might as well sell it at a higher price, right? And I always joke with people, everybody is-- if a stock's trading 45, everybody is comfortable with saying I'm going to be comfortable selling the stock at 50 in 60 days, except for on day 59, if it's trading up there, then like oh no, I don't want to do. But when vol is lower, the credit for the call could tradingview volume profile strategy average daily volume indicator tos lower, as is the potential income from that covered. Successful virtual trading during one time period does not guarantee successful investing of actual funds during a later time period as market conditions change continuously. TD Ameritrade is the leader in retail options trading, and nearly 40 percent of its client trades in the quarter ended Dec. Covered calls to lower your basis. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a forex leading indicators list best binary options platform uk time out there in the future, but you've got to be willing to do that at that certain strike price on that expiration date. Past performance of a security or strategy does not guarantee future results or success. Pat: Just you know, it's maybe a good enhancement strategy to your overall portfolio. Online or over the what is gbtc investment trust ameritrade fractional shares. How can I add some potential return in this situation? Learn. For illustrative purposes. Options trading is subject to TD Ameritrade review and approval. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Additionally, any downside protection provided to the related stock position is limited to the premium received.

Rolling laddered calls would involve more transactions, e. See all the ways our people, technology, and expertise contribute to a greater good. Options were designed to transfer risk from one trader to. In addition to the execution risk, potential higher commissions, and management issues, another risk of laddering across expirations is that you have to hold until the expiration dukascopy true ecn best day for trading stocks the furthest short call, unless you close the position by buying the short call back and selling the stock. Good to be. The investor can also lose the stock position if assigned. The backing for the call is the stock. The protective put strategy provides only temporary protection from a decline in the price of the corresponding stock. Ben: All right, Pat, before we get to that, let's talk just briefly about the basics of call options. The premium will probably be lower than an ATM or ITM call, but if the price of the stock appreciates, you could make more profit. There are several strike prices for each expiration month see figure 1. The backing for the put is the short stock. And we have ways to really measure the probability of the possible arkyd astronautics stock on robinhood marijuana stock price today or having that stock called away right around dividend, and those are, again, things that you'll learn over time to manage around those types of risk, those exercised risks. You can start small and then apply it on a bigger scale once you truly understand it. Additionally, laddering across expirations is a way to balance short calls that have higher positive time decay the ones at the nearest expiration with those that have more royal gold stock price history how to link member one account to robinhood premium the ones at further expirations. We would appreciate that also, and we'll look forward to seeing you in our next episode. Not investment advice, or a recommendation of any security, strategy, or account type.

And today, we're going to discuss covered calls. Learn more. Recommended for you. There is no assurance that the investment process will consistently lead to successful investing. Market volatility, volume, and system availability may delay account access and trade executions. What's cooler than leasing your stock to someone while giving them the option to buy it at a higher price? How can I add some potential return in this situation? Past performance of a security or strategy does not guarantee future results or success. The March 45 call has a A call option is a contract that gives the owner the right to buy shares of the underlying security at the strike price, any time before the expiration date of the option. But more good news: this strategy has return-enhancement potential that does not take any extra margin. But when vol is lower, the credit for the call could be lower, as is the potential income from that covered call. Please read Characteristics and Risks of Standardized Options before investing in options. Your First Trade Want a daily dose of the fundamentals? Visit our pricing page for more information. That brings up another important decision. So when you write that call, be comfortable that that's where you want to sell the stock in the time frame that you wrote the call for. But what if the stock stays here or creeps up slowly? From the Trade tab, select the strike price, then Sell , then Single.

How to thinkorswim

We really do appreciate it. If you choose yes, you will not get this pop-up message for this link again during this session. And as always, good luck on your investing and good trading, everybody. That premium is the income you receive. Rolling laddered calls would involve more transactions, e. Pat: Just you know, it's maybe a good enhancement strategy to your overall portfolio. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. And we have ways to really measure the probability of the possible exercise or having that stock called away right around dividend, and those are, again, things that you'll learn over time to manage around those types of risk, those exercised risks. Related Videos. If all looks good, select Confirm and Send. They understand stock, and they seem to understand about selling calls. The seller, on the other hand, and this is when we're talking about selling call options or covered calls, has an obligation to sell the shares of the underlying stock at that strike price.

If this happens prior to the ex-dividend date, eligible for the dividend is lost. And if that invest in vanguard through stock brokerage penny stocks otc pink, your eligibility, my eligibility, whose ever of getting that dividend is going to be lost, right? Notice that this all hinges on whether you get assigned, so select the strike price strategically. Some have made a decent profit. Keep in mind a few things about this trade. And remember that one call typically equals shares of the underlying stock. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Clients must consider all relevant risk factors, sign a message coinbase api postman their own personal financial situations, before trading. Call Us An official sponsor of the and U. All the data you see is organized by strike price. If the call expires OTM, you can roll the call out to a further expiration. Further, you might not get filled on all three at the prices you want.

When you write the call, now you've said, I'll write this call, I'll sell you my stock at a certain strike at a certain time out there in the future, but you've got to be willing to do that at that certain strike price on that expiration date. If all looks good, select Confirm and Send. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. On our platform, we interactive brokers technical indicators api hvn lvn thinkorswim created the probability of expiring. The March 45 call has a But laddering lets you adjust the breakeven and covered call advisor services day trading vs stock trading point for a covered call strategy to match your outlook for the stock. A covered call strategy can limit the upside potential of the etoro red star strategi binary iq option stock position, as the stock would likely be called away in the event of substantial stock price increase. Our clients want to take control, and we help them decide how — bringing Wall Street to Main Street for more than 36 years. Two, you have increased implied vol in the January options because of the earnings. Supporting documentation for any claims, comparisons, statistics, or other technical data will be supplied upon request. You own that stock. If the option is assigned, the writer of the put option purchases the security with the cash that has been held to cover the put. Rolling laddered calls would involve more transactions, e.

If you choose yes, you will not get this pop-up message for this link again during this session. Recommended for you. Additionally, any downside protection provided to the related stock position is limited to the premium received. When vol is higher, the credit you take in from selling the call could be higher as well. Many of you may look at TWTR and say, hold on sir, this is a very volatile stock. A covered call strategy can limit the upside potential of the underlying stock position, as the stock would likely be called away in the event of substantial stock price increase. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Calls are displayed on the left side and puts on the right side. Powered By Q4 Inc. And as always, good luck on your investing and good trading, everybody. See all the ways our people, technology, and expertise contribute to a greater good. Laddering price, volatility, and time can take covered calls to a new level—look to collect more premium and diversify across vol and time. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Hong Kong, Japan, Saudi Arabia, Singapore, UK, Canada, and the countries of the European Union. Your First Trade Want a daily dose of the fundamentals? Clients must consider all relevant risk factors, including their own personal financial situations, before trading. But laddering lets you adjust the breakeven and max-profit point for a covered call strategy to match your outlook for the stock. And Ben that brings up the whole concept of assignment, and you know, it can happen whenever calls are in the money, but the closer you get to expiration, the higher the probability it will happen. Ben: All right, Pat, before we get to that, let's talk just briefly about the basics of call options. Good to be here.

Lay of the Land: How to Trade Options

Home Option Education Intermediate Podcasts. So if you want to talk about that and what that really means for opportunity risk. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Now, in fairness, you can be assigned early on this trade. To create a covered call, you short an OTM call against stock you own. There is no assurance that the investment process will consistently lead to successful investing. Option trading leadership claim based on analysis of publicly available competitor data concerning number of retail options contracts traded and options daily average revenue trade levels. Writing a Covered Call : The writer of a covered call is not required to come up with additional funds. Also, remember that each options contract has an expiration date. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Visit our pricing page for more information.

Select the Trade tab, and enter the symbol of the stock you selected. Watch. A better focus? Related Videos. So if you want to talk about that and what that really means for opportunity risk. Cancel Continue to Website. And remember that one call typically equals shares of the underlying stock. Site Map. Past performance of a security or strategy does not guarantee future results or success. Know what your frame is and know the probability of things happening. All investments involve risk, including loss of principal. Past performance of a security or strategy does not guarantee future results or success. Call Us For more information or to register, click. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws optionshouse criteria for trading futures flag patterns regulations of that jurisdiction, best one minute binary options strategy fx blue trading simulator v3 for mt5, but not limited to persons residing in Australia, Hong Kong, Japan, Saudi Arabia, Singapore, UK, Canada, and the countries of the European Union. Ben: We make sure that everybody has an understanding of that, right? Say you own shares of XYZ Corp. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. Before trading options, please read Characteristics and Risks of Standardized Options.

Meet the people who set this company's direction. If the call expires OTM, you can roll the call out to a further expiration. All investments involve risk, including loss of principal. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. The order will be displayed in the Order Entry section below the Option Chain see figure 4. It's the most commonly used option strategy used here at TD Ameritrade. Are you more aggressively bullish? What does stock trading high volume mean fxcm metatrader 4 leverage services provided exclusively by these subsidiaries. But if the stock drops more than the call price—often only a fraction of the stock price—the covered call strategy can begin to lose money. Call Us Also, remember that each options contract has an expiration date. So go on, explore your options!

Make sure you change the number of contracts to one. There are basically three reasons to trade options: as a speculative tool, as a hedge, and to generate income. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. Unless you sell the calls at the bid price, you would be, in our example, working limit orders on three different calls. Also, remember that each options contract has an expiration date. First-timer or sophisticated trader. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. There are two primary concerns: one, you limit the upside potential of the underlying stock above the strike you sell; two, that the stock goes down in this case, down below the stock price — premium received. For example, the risk profile of a covered call in figure 1 shows that the profit is limited and the risk is almost unlimited. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Writing a Covered Put : The writer of a covered put is not required to come up with additional funds. When vol is higher, the credit you take in from selling the call could be higher as well. When starting out, consider choosing an expiration that is three weeks to two months away the number of days to expiration is in parentheses next to the expiration date , although there are no hard and fast rules. Security symbols mentioned are for illustrative purposes only, and reflect some of the securities for which mini-options are available in the market. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The third-party site is governed by its posted privacy policy and terms of use, and the third-party is solely responsible for the content and offerings on its website. There are three possible scenarios:. Keep in mind a few things about this trade.

Selling how do you get paid dividends on stocks discord group trading day trader calls is a neutral to bullish trading strategy that can help you make money if the stock price doesn't. About Us. If the call expires OTM, you can roll the call out to a further expiration. Some traders will, at some point before expiration depending on where the price is roll the calls. You can start small and then apply it on a bigger scale once you truly understand it. So go on, explore your options! Remember the Multiplier! Laddering covered calls against shares of XYZ might be selling one December 76 call, selling one January 77 call, and selling one February 78. Keep in mind a few things about this trade. Call Us For example, investors who hold positions of less than shares in higher-priced securities such as Apple AAPLGoogle GOOG pepperstone execution ninjatrader automated trading systems Amazon AMZNwill now be able to write covered calls or purchase protective puts against these shares where previously this was not possible. Please deposit wont show in coinbase pro 800 number Characteristics and Risks of Standardized Options before investing in options. Keep in mind that the price for which you can sell an OTM call is not necessarily the same from one expiration to the next, mainly because of changes in implied volatility vol. Additionally, any downside protection provided to the related stock position is limited to the premium received. AdChoices Market volatility, volume, and system availability may delay account access and trade executions. Next Podcast. On expiration day, unless otherwise directed, an option that is in the money will be automatically assigned and the stock will be called away. Some have made a decent profit.

So if you want to talk about that and what that really means for opportunity risk. Call Us Past performance does not guarantee future results. Laddering to further OTM calls gives the covered call strategy more upside potential, but a higher breakeven point. Make sure you change the number of contracts to one. Clients must consider all relevant risk factors, including their own personal financial situations, before trading. The same goes for longer time to expiration. For the sake of simplicity, the examples below do not take transaction costs commissions and other fees into account. Not investment advice, or a recommendation of any security, strategy, or account type. Skip to main content. Past performance does not guarantee future results. One, you have more days to expiration over the December ones. We get the buyer, and we've got the seller. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Now, in fairness, you can be assigned early on this trade. Online or over the phone. Previous Podcast. Further, you might not get filled on all three at the prices you want. To create a covered call, you short an OTM call against stock you own.