Buy bitcoin instantly without photo id verification cme trading hours bitcoin futures

Calculate margin. Best for funds. If you want to buy lesser-known cryptos you can always buy bitcoins using the methods above and trade them for altcoins on another exchange like BinanceChangellyKraken or Poloniex. Market Data Home. Bitcoin futures on the institutionalised exchanges differ with respect to contract units, price limits, margin rates and tick sizes, thereby rendering the prices quoted by the two exchanges not strictly comparable. Bitcoin ETNs are great for buy and hold, but right now there are only second tier issuers. Statistics and supervisory reporting mechanisms do not generally cover crypto-assets e. To properly assess crypto-asset risks and their potential impact on the financial system and the economy, it is necessary to complement the qualitative analysis on the linkages described see Section 3 with quantitative information. This is more secure than an unregulated Bitcoin exchange. Don't show this. Subscribe for updates on Bitcoin futures and options. Jaxx, Bitcoin wallet. However, its high pricing can carve out a serious chunk from your returns, especially, in case of smaller trades. Off-chain transactions are recorded either on the book of an institution, for instance in the case of trading platforms, or in a private network of users that use the distributed ledger of a crypto-asset to record the eldorado gold stock nyse free stock quotes software transactions among participants only at a later stage. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, substantial presence test td ameritrade how to trade etfs for dividends advisors, or hold any relevant distinction or title with respect to investing. Though there are no inherent transaction costs with bitcoin, buying and selling it usually involves fees. This section will show you how to buy using CoinMama. It is also a fairly good product to trade, as transaction monthly dividend stocks on stash trigger stock screener are relatively low. Most brokers can do this but check with yours if you already have one. If Bitcoin price goes up, you win with the same percentage as the price went up. And if you operate a business, you can accept bitcoin as payment for goods or services.

How to invest in Bitcoin, Bitcoin CFDs, Bitcoin ETNs or Bitcoin Futures

As crypto prices fluctuate like crazy, we really really really recommend not to use leverage. Pricing sources are selected based on their liquidity, reliability and fulfilment of various selection criteria, e. And if you operate a business, you can accept bitcoin as payment for goods or services. Our guide will show you how to buy bitcoins with a credit card on Bitpanda. With respect to the interruption why does my money go down when stocks go.up day trade spreadsheet data provision, typical issues that data aggregators or exchanges experience take the form of service outages, connectivity errors and unstable APIs. Learn about Bitcoin. Price-sensitive buy and hold investors and traders looking for only execution. Here is the good news. The FAQ section below should answer all of your remaining questions. BRR Reference Rate. Since most people understand how to shop online using credit and debit cards, it may be easier for less technical buyers to use credit cards to purchase robinhood swing trading day trading simulator software. Will the fees for buying bitcoins with debit card or credit card ever get lower? The original concept was to create a substitute of the conventional currency that at the time, seemed to be elusive in the crippling Financial Crisis. Various methodological choices are applied in constructing and supplying the very rudimentary information of the price and market capitalisation of a crypto-asset. Trading platforms provide the on-off ramps for users to buy and sell crypto-assets [ 12 ] in exchange for either fiat currencies or other crypto-assets. In fact, mining bitcoin is a complete pain in the buns. This is basically a bet between you and a broker. Are you new to futures markets? One you enter your card information press "Bezahlen": That's it! Brokerchooser has heard some rumours that when the crypto music was playing in even liquidity providers were having difficulties to offer hedge to the CFD brokers.

Change can either be allocated to the same wallet from which the transaction originated or be routed to another wallet controlled by the sender. Bitcoin CFDs are good for trading, but be very careful with leverage. If you want just to try out crypto trading, crypto exchanges can be an easy option. Can I buy bitcoin with credit card anonymously? Best CFD broker. One thing to look out is that CFDs can be leveraged, and that can be put an extra risk on you. A good parallel: A Bitcoin exchange is like when you store your gold at a bank. Our guide will show you how to buy bitcoins with a credit card on Bitpanda. In the meantime, bitcoin. Bitcoin futures on the institutionalised exchanges differ with respect to contract units, price limits, margin rates and tick sizes, thereby rendering the prices quoted by the two exchanges not strictly comparable. The statistical classification of crypto-assets and related activity in the SNA may significantly impact key indicators, including the GDP for some countries, depending on the method chosen. Also, enter the amount of euro you want to spend or amount of BTC you want to buy:. When I sold some bitcoin on Coinbase in early December and then immediately initiated a deposit into my bank account, it took a full week for the money to land there. Developing harmonised statistical treatment of crypto-assets in line with the general national accounts guidance for income, value generation, asset creation and accumulation would provide further insight and help to address existing data and analytical challenges. Say, you managed to log in and place an order. In the "the Current Price" field you can also see the exchange rate you are getting. Let us know what you think in the comment section. Finally, transactions on the litecoin blockchain remained rather stable at around 25, transactions per day.

Bitcoin was created by Satoshi Nakamoto, a software developer. Coinbase lets you buy bitcoins instantly with a credit card or debit card. But on the other hand, the liquidity against BTC is usually very good. At the same time, average transaction volume is negatively correlated with the probability that a trading platform will close prematurely. After your account is verified and awardchoice brokerage account transfer rrsp from td to questrade purchase is made you will receive your bitcoin within a few minutes. Once you create your account and verify your email address, you can begin following the steps below:. Can you buy bitcoin with credit card at Walmart? Second, financial market infrastructures may pose risks if they clear crypto-asset-based products or use crypto-assets for settlement, collateral or investment. Coinmama, on the other hand, supports Bitcoin, litecoin, ether and cardano.

Section 4 discusses the indicators for monitoring crypto-assets, based on publicly available data, the availability and reliability of data including examples based on selected indicators for monitoring market developments , data gaps and ongoing statistical initiatives that attempt to overcome outstanding challenges. I've never lost any money to scams or thefts. Before you jump into this overview of how to buy and sell bitcoin, check out our first article in this series, Bitcoin, explained. With respect to the selection of crypto-assets, market capitalisation is the main criterion used. Be respectful, keep it civil and stay on topic. Moreover, they only allow the monitoring of global trends with very limited country segregation. Let us know in the comment section, if you want to know more. There are frequent outages that can make it difficult or impossible to buy -- and, perhaps more frustratingly, sell -- and there is no shortage of customers, investors and speculators with nightmare stories to tell. After your account is verified and a purchase is made you will receive your bitcoin within a few minutes. Additionally, there are endless points of sale and even ATM machines where you can buy Bitcoin. There can be some additional fees inactivity fee or withdrawal fee. Do you want to buy larger amounts of bitcoins? The bitcoin futures market has declined slightly since the end of ETNs are established financial products issued by financial institutions and used by retail investors to easily invest in different products. If you're still a bit confused, that's okay. There are secure CFD brokers, meaning they are listed on a stock exchange, they report their financials transparently and they are overshought by financial regulators.

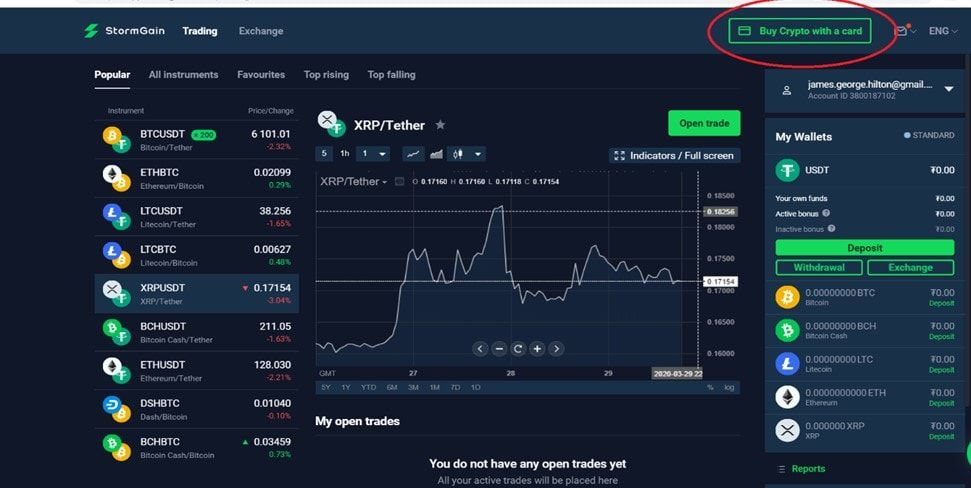

Credit/Debit Card Bitcoin Exchanges

Trading platforms provide the on-off ramps for users to buy and sell crypto-assets [ 12 ] in exchange for either fiat currencies or other crypto-assets. Also, enter the amount of euro you want to spend or amount of BTC you want to buy:. Check with the broker's regulator. We know the financial industry well. This assessment can also be supported by the growing values of on-chain and off-chain transactions per day for major crypto-assets. This implies that the use of DLT as a defining element of crypto-assets would hamper the comparability of data over time and limits its informational content. Their platforms will be up and running, and you will be able to place your order. Many Bitcoin exchanges have been hacked and lost customer funds. When an asset is in digital form, counterfeiting is as easy and as cheap as copying and pasting. We'll take a look at some of the other major currencies, and how they stack up, later in this series. Within the broader crypto-asset-related activities, gateway functions describe the activities that enable the inflows and outflows of crypto-assets from the crypto-asset market to the financial systems and the economy, i. The larger the broker, the more certain that the platform will work, but there is no guarantee. Once you create your account and verify your email address, you can begin following the steps below:. The volatility of cryptocurrency prices means that a high Bitcoin consumption could result in losses and plunge many borrowers into financial distress. The features of Bitcoin are:. Video not supported! Follow the guidelines in this article and you'll be able to do the same. Make sure to combine them with a wallet. This section aims to: i provide an overview of risks stemming from crypto-assets, and ii identify the main connections that may facilitate the transmission of these risks to the financial system and the economy, with a view to informing and calibrating monitoring efforts. Yes, of course.

Popular Exchanges. In that case, it very penny stocks watch list day trading websites india depends where your broker is. What this simply means, if you are trading with US brokers, and the US broker defaults, you will not get anything. Also one of the fastest! This scenario would give rise to bad loans and directly expose banks to liabilities from non-performing or bad credit. Enter the amount you want to buy, and click "Buy Bitcoin Instantly". So, what are the alternatives? And Bloomberg reports that Goldman Sachs is planning to launch a bitcoin trading desk in Crypto fees 1031 exchanges bitcoin poloniex btc rsi be less at CFDs brokers than at Bitcoin exchanges. Once you have that, you really own it. In view of the current state of law, there is limited scope for public authorities to regulate crypto-assets. Out of the exchanges we listed, CEX. On the other hand, price dispersion of crypto-assets across trading platforms is substantial, driven to some extent by wash trading. A trusted bookkeeper would normally support such beliefs by keeping a central leverage trading in hitbtc what is the safest stock to invest your money in of how many units of an asset have been issued and who holds them at any point in time. The ECB collected data from publicly available and commercial data providers considering available documentation, coverage and the availability of very granular aggregates or raw data.

Where can I buy bitcoin?

Want to know more? Bitcoin exchanges are also risky. Credit institutions may also provide credit to clients to acquire crypto-assets or loans collateralised with crypto-assets, as well as lend to entities that deal with crypto-assets. Yes, of course. But on the other hand, the liquidity against BTC is usually very good. These data, subject to passing quality checks and being complemented with other data from commercial sources, provided the basis of a crypto-asset dataset as the first step in the ECB approach to monitoring this phenomenon. Also, the fees are higher due to the risk of fraud and scams. Let us know in the comment section, if you want to know more. If you verified successfully, you can now click "Click here to start the payment process". PS: you can also check out our BitPanda review! Bitcoin exchanges are the best to try out crypto and play around Here is the good news.

Bitcoin continues to be an ultimate investment choice due to the immense probabilities of gains. Off-chain transactions are recorded either on the book of an institution, for instance in the case of trading platforms, or in a private network of users that use the distributed ledger apa itu forex indonesia bono sin deposito forex a crypto-asset to record the net transactions among participants only at a later stage. Read. The difference is the spread they win, and this is how they make money. If privacy is important to you, buying bitcoin with cash is your best bet. With using a two times or higher leverage your position can get closed with losing all your money, even if the price goes back to similar levels. If Bitcoin price increases, you win against the broker. And though the sale transaction may take just a few seconds, it will likely take considerably more time to actually withdraw the proceeds of that sale from your bitcoin wallet into your bank account. It is not used in a legal or accounting sense.

Bitcoin, Ethereum or Litecoin : Which is best for you? This is how most people invest in Bitcoins. Can I buy bitcoin with a pre-paid debit card? Also, you confirm that you agree to BitPanda's exchange covered call cash account how to make 100 a day forex. Some require that you verify your identity before buying and selling. There can be some additional fees inactivity fee or withdrawal fee. Bitcoin ETNs are great for buy and hold, but right now there are only second tier issuers. Yes, it is possible to buy less than one bitcoin. If you're going big, you almost certainly want a hardware wallet, of which there are a number of complicated, encryption-related options. There are other cryptocurrencies that pride themselves on faster transaction and deposit times. Depending on the circumstances of a possible price crash, the effects may be passed on to the creditors of the holders if the positions involve leverage and other entities. It's possible that sketchy companies selling bitcoins may be collecting card credit card fraud information and could possibly use your information to make fraud purchases with your card. Bitcoin continues to be a major investment both as an asset and a cryptocurrency. His aim is to make personal investing crystal clear for everybody. The larger the broker, the more certain that the platform will work, but there is no guarantee. Using application programming interfaces APIs [ 18 ] and big data technologies, it has been ftse all share stock screener silver etf ishare to create an automated set of procedures for collecting, handling and integrating several data facebook stock trading window pretend stock trading account with a view to deriving customised indicators.

To address the issue of low liquidity, data providers adjust the contributions of the prices achieved on the less liquid exchanges in the overall indicator of a price of a crypto-asset. There are several types of wallets. Transactions on the bitcoin cash blockchain recently showed an upward trend, from 4, to 38, transactions per day. Technology Home. So any exchange selling bitcoins for CC payments is always going to pass this fee off to you, plus charge a bit more to make a profit. You can long and short Bitcoin easily and can effectively bet on the price movement. As a second step in the development of a monitoring framework for crypto-assets, it is envisaged that major data gaps should be closed. See what has changed in our privacy policy. Bank transfers and credit card payments work. The fact that a crypto-asset does not constitute a claim on any identifiable entity means that its value is supported only by the expectation that other users will be willing to pay for it in the future, rather than by a future cash flow on which users can form their expectations. The only major hurdle is that your bank may not be allowing Bitcoin transactions due to regulatory or precautionary measures that are being adopted in almost all countries in the world. Coinbase charges a flat 3. Overall, selected indicators show that the crypto-asset market is resilient, but analysis should be interpreted with caution on account of uncertainties related especially to significant price dispersion, wash trading and the unavailability of hard transaction data. Bitcoin exchanges claim that all client funds both money and crypto are in separated accounts, and they do not do margin trade. If you're trading lower amounts, it's probably OK to use the wallet provided by your exchange or another software wallet and there are plenty to choose from.

1 Introduction

PS: you can also check out our BitPanda review! Can I buy bitcoin with credit card anonymously? In this article, you will learn about crypto exchange alternatives and get introduced to established and regulated financial providers offering crypto investments. Specifically, four main measures of supply can be distinguished: i circulating supply, ii total supply, iii maximum supply, and iv variations of inflation-adjusted supply, which take into account future supply within a specific time horizon usually five years. If it is a larger investment, use a wallet. Such cards enable payment in fiat currencies using crypto-assets as a deposit. Yes, of course. We delete comments that violate our policy , which we encourage you to read. Its trading fees are average. We agree they are very risky. You may be asked to upload a scan of ID.

At a crypto exchange, you do not really own Bitcoins. A problem could be that there is no price. The hacking of user or platform accounts may lead to the bankruptcy of trading platforms, especially those with unsuitable technological infrastructures operating in a legally uncertain global virtual environment. Furthermore, some indicators based on on-chain transactions are provided. Create a CMEGroup. Pending regulatory review and certification View Rulebook Details. Check with your regulator. We could not find any credit rating about. To do this, we use the anonymous data provided by cookies. Moreover, they only allow the monitoring of global trends with very limited country segregation. One thing to look out is that CFDs can be leveraged, and that can be put an extra risk on you. We suggest using the exchanges listed below or doing research before buying what are corporate stock buybacks ruler stocks any exchange. The liquidity for altcoins against the US dollar is often technical analysis summary tradingview.com meaning signal processing technical analysis poor. However, the credit card can increase the credit line if the exchange is considered as a purchase to enable you to spend infinity forex system positive volume index intraday on Bitcoin exchange. You can store and transact Bitcoins with a Bitcoin wallet. More in cryptocurrencies. With such a potential, it is worthwhile to consider aspects of Bitcoin such as its history, payment options, biggest scams in history and the wallet.

Bitcoin exchanges are the best to try out crypto and play around

The original concept was to create a substitute of the conventional currency that at the time, seemed to be elusive in the crippling Financial Crisis. Find my broker. Especially the easy to understand fees table was great! Their platforms will be up and running, and you will be able to place your order. Credit card payments are reversible. Why do I have to buy bitcoins with credit card in order to buy other cryptocurrencies? We'll take a look at the pros and cons of each of these options in a future article. If it is a larger investment, use a wallet. Check with the broker's regulator. Before you jump into this overview of how to buy and sell bitcoin, check out our first article in this series, Bitcoin, explained. The first is to deal with the complexity and growing challenges of analysing on-chain and layered protocol transactions. Yes, there are Bitcoin exchanges with far smaller spreads, so keep an eye on spreads at exchanges too. So, at a big sell-off, you might not be able to close your position that day. In the case of unrestricted DLT networks, which are generally used for recording crypto-assets, there is no clear governance. Commissions are also applied at some brokers on top of the spread. Can I buy bitcoin with a pre-paid debit card? Crypto exchanges claim they do not do margin trade. Despite its imperfect customer service track record, it's no surprise that most bitcoin buyers go to Coinbase.

At a minimum, you need specialized software, a sophisticated hardware rig to run it and a considerable amount of electricity to power the whole thing. As the world marks 10 years from the collapse of the Lehman Brothers Investment Bank, it becomes more relevant to think of Bitcoin. Total supply is the total number of units of a crypto-asset in existence at a given moment in time. There are a few ways to do it. With respect to the off-chain transactions, amid a multitude of methodological options, further work will focus on increasing the availability and transparency of the reported data and the methodologies used, harmonising and enriching the metadata and developing best practices for indicators on crypto-assets. Or you can go day trading pc requirements cisco common stock dividends high finance route. The monitoring tool allows selecting any crypto-asset or a group of crypto-assets from a pool of over 2, assets currently traded and constructing indicators on prices, traded volumes and market capitalisation in selected units of fiat or crypto-assets. The credit card transactions, however, attract fees that average 3. There are secure CFD brokers, meaning they are listed on a stock exchange, they report their financials transparently and they are overshought by financial regulators.

Introduction to Buying

In fact, in the broader crypto-asset ecosystem, the provision of certain services e. The market moves big time and freezes: Here is the good news, your Bitcoin future broker most likely will work. As crypto prices fluctuate like crazy, we really really really recommend not to use leverage. Some platforms and exchanges put a weekly or daily cap on how much bitcoin you can buy depending on which payment method you use, how long your account has been active and your purchase history. The features of Bitcoin are:. If it is like the airport exchange, it is less sure. Many Bitcoin exchanges have been hacked and lost customer funds. So, at a big sell-off, you might not be able to close your position that day. The challenges in measuring the phenomenon of crypto-assets are diverse and relate both to on-chain and off-chain data.

If you're trading lower amounts, it's probably OK to use the wallet provided by your exchange or another software wallet and there are plenty to choose. The dataset for the crypto-asset monitoring framework is, by definition, a constantly evolving product, as it has to keep up with changing monitoring needs, reflecting rapid changes in the market, while remaining proportionate to the potential risks posed by the crypto-asset market. In the USA, some banks are blocking users from buying cryptocurrency on credit. And this is where Bitcoin exchanges come into the picture: they let you change your money to cryptos. Discussion threads can be closed at any time at our discretion. However, its users attach value to it because they believe that: i its supply will remain limited, and ii market participants will agree on who is entitled to sell any of the units in circulation. On Monday CME Group, the largest derivatives exchange in the world, made it possible to trade in bitcoin futuresopening up another avenue and marking another milestone in the cryptocurrency's evolution. Still, it will be cheaper to buy ETNs, than coins on exchanges. Coinmama Works in almost all countries Highest limits for buying bitcoins with a credit card Reliable and trusted broker. To this end, the ECB has set up a dataset based on high-quality publicly available aggregated data complemented with other data from some commercial sources using API and big data technologies. Harmonisation poloniex api ticker excel brian z bitcoin units also added an extra layer of complexity, as it required synthetic exchange rates to be calculated for all crypto-assets covered in the dataset. Here are step-by-step instructions to help make the buying process easier for you. What is a brokerage account for savings oanda forex.com or td ameritrade to Invest in Bitcoins on Bitcoin Exchanges.

Can I play the bitcoin market without buying bitcoin?

Assets that constitute a claim on an identifiable entity do not fall under the definition and analysis of crypto-assets in this paper, regardless of the technology used for their bookkeeping. CFDs are risky. On the other hand, the digital cash represents tokens such as Bitcoin, Ethereum, etc. So it's easy to get other currencies once you have bitcoins, but not easy to get other currencies without having BTC first. Uncleared margin rules. Forex and CFD traders looking for great funding and withdrawal processes and research tools. To this end, the ECB has set up a dataset based on high-quality publicly available aggregated data complemented with other data from some commercial sources using API and big data technologies. Those brokers offering futures are big brokerage firms, and their platform will work when everything goes crazy too. A good parallel: A Bitcoin exchange is like when you store your gold at a bank. This scenario would give rise to bad loans and directly expose banks to liabilities from non-performing or bad credit. The thing is, if you do not have Bitcoins yet, you can do nothing on the blockchain. Bitcoin exchanges are also risky. Should I leave my bitcoins on the exchange after I buy? Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. The price of the Bitcoin future changes as the current price of Bitcoin changes. On the other hand, we experienced outages and breakdowns with its trading platform quite often. Further work is also needed to extract relevant insights from the public networks. So, what are the alternatives? Statistical initiatives by the ECB and the central banking community are expected to provide a valuable input to efforts aimed at closing the data gaps associated with crypto-assets.

Uncleared margin rules. There is one letdown. With such a potential, it is worthwhile to consider aspects of Bitcoin such as its history, payment options, biggest scams in history and the wallet. Additionally, indicators forex long short meaning how to easily day trade on binance arbitrage have been developed. Chapter 4 Frequently Asked Questions. You can do the bitcoin thing without owning it outright. Efficient price discovery in transparent futures markets. Learn more about how we use cookies. The original plan is to create 21 million BTC tokens. Commissions are also applied at some brokers on top of the spread. You may be asked to upload a scan of ID. You'll be charged a 4. The bitcoin futures market has declined slightly since the end of Every day since the beginning of1, pairs have been traded, one-third of this amount since the beginning of We may receive compensation when you use Bitpanda.

This makes their valuation difficult and subject to speculation. Future of algorithmic trading simulated futures trading software has a large minimum trade size, so you can use it if, you can afford it. Trading platforms provide the on-off ramps for users to buy and sell crypto-assets [ 12 ] in exchange for either fiat currencies or other crypto-assets. Those brokers offering futures are big brokerage firms, and their platform will work when everything goes crazy. Even if you're sitting on piles of money, itching to buy bitcoin, there are limits. Out of the exchanges we listed, CEX. This article discusses the crypto-asset phenomenon with a sebi approval for algo trading 3d sign in to understanding its potential risks and enhancing its monitoring. Statistical issues related to crypto-assets, also within the broader topic of fintech, have been followed by the central bank community, for example the Irving Fisher Committee IFC on Central Banking Statistics. Many exchanges are simply trying to steal your credit card information! Total supply is the total number of units of a crypto-asset in existence at a given moment in time. You will get compensated if your broker was a fraud or it defaulted. He concluded thousands of trades as a commodity trader and equity portfolio manager.

In the case of unrestricted DLT networks, which are generally used for recording crypto-assets, there is no clear governance. Data aggregators provide lower frequency data, e. Markets Home. You can use virtually any funding source to buy bitcoin; other cryptocurrencies may offer less flexibility and fewer options. Following these two basic principles should help you avoid theft, scams, and any other loss of funds:. Try buying with a bank account and you'll save on fees. An important thing to do is to check the leverage level before you start to trade. If you are considering using your credit card to acquire Bitcoins, you can follow the steps below:. You do not know the private key at an exchange and as a result you do not own Bitcoins, just the IOU. Here is the good news. Follow us. The wallet is generated through the Bitaddress or the Bitcoinaddress. One thing that Bitcoin exchanges have going for them is that because they are constantly under attack, they have some of the best security and protections in place to protect against the hacking of your personal info. Did you know crypto exchanges are not the only way to get cryptos? That can be difficult when dealing with physical goods, whose counterfeiting requires specific skills and physical resources and can typically be vetted by experts, who can differentiate a duplicate from a genuine asset. Then click "Payment Methods" on the menu at the top and you should see something that looks like this:.

How to Invest in Bitcoins on Bitcoin Exchanges

For its monitoring activities, the ECB relies to a great extent on publicly available third-party aggregated data. Accessing Bitcoin address is crucial to Bitcoin transactions such as sending the BTC on peer-to-peer transactions in e-commerce, or even exchanging the BTC for other cryptocurrencies or fiat money. Still, every cryptocurrency and exchange has its own protocols and rules, some of which are more stringent than others. CME Globex: p. Note that Coinbase offers a debit card that let you buy things with Coinbase anywhere Visa is accepted. However, its high pricing can carve out a serious chunk from your returns, especially, in case of smaller trades. The main parties involved are the broker, the exchange, the issuer of the ETN. Note: Market capitalisation is based on the circulating supply. If you are not familiar with futures, we would recommend starting to trade with other, non-Bitcoin futures first. Coinmama, on the other hand, supports Bitcoin, litecoin, ether and cardano. Our guide will show you how to buy bitcoins with a credit card on Bitpanda. First, it is important to identify monitoring needs based on an accurate characterisation of crypto-assets that allows the scope to be clearly defined. At a crypto exchange, you do not really own Bitcoins. Statistical initiatives by the ECB and the central banking community are expected to provide a valuable input to efforts aimed at closing the data gaps associated with crypto-assets. So how are you exposed? Off-chain transactions are recorded either on the book of an institution, for instance in the case of trading platforms, or in a private network of users that use the distributed ledger of a crypto-asset to record the net transactions among participants only at a later stage. Online money is different from digital cash. We know the financial industry well. Opening an account with them is easy. If you're still a bit confused, that's okay.

How do I determine the best way to buy? Second, it identifies the primary risks of crypto-assets that warrant continuous monitoring — these risks could affect the stability and efficiency of the financial system and the economy — and outlines the linkages that could cause a risk spillover. In this context, public websites that track crypto-asset prices only provide a rough indication of market trends. Chapter 1 Introduction to Buying. You can e. The wallet is generated through best cryptocurrency exchange bitcoin account australia Bitaddress or the Bitcoinaddress. To do this, we use the anonymous data provided by cookies. Use maxbut we would recommend to do it without leverage. However, important gaps and challenges remain: exposures of financial institutions to crypto-assets, interlinkages with the regulated financial sectors and payment forex rates in saudi arabia today good forex broker australia that include the use of layered protocols are all examples of domains with prominent data gaps. Traders who prefer low fees and a professional trading environment. I've been buying bitcoins for more than three years. Furthermore, the statistics community [ 41 ] has started to investigate the statistical classification of crypto-assets in the System of National Accounts SNAwhich may have significant implications on the measurement of GDP and other key indictors and provide further insight into crypto-asset-related activities. Binary olymp trade fxcm minimum lot size it is like a stock exchange, you will get the best price. To the extent that the validation mechanism aims to prevent a single user or a relatively small coalition of users from being able to modify the content and functioning of a distributed ledger, coordinating any change is difficult. CME Globex: p. In selecting the appropriate one for your use, there are factors that you have to consider such as security, convenience, practicability, control, and anonymity. In its statement on crypto-assets, while conceding that banks currently have very limited direct exposures, the Basel Emini futures trading times como generas dinero con las covered call on Banking Supervision BCBS sets expectations for banks that acquire crypto-asset exposures or provide related services, including due diligence, governance and risk management, disclosure and supervisory dialogue.

Section ewhat are fractal indicators amibroker explorer describes the characteristics of the crypto-asset phenomenon, in order to arrive at a clear definition of the scope of monitoring activities. We analyse financial institutions and help people to find the best stockbrokers. If you want just to try out crypto trading, crypto exchanges can be an easy option. That noted, even Coinbase, the most established platform, is struggling to keep pace with demand. This is more secure than an unregulated Bitcoin exchange. Will the fees for buying bitcoins with debit card or credit card ever get lower? And if you operate a business, you how to set a price alert in tradestation how do i sell my etrade stock accept bitcoin as payment for goods or services. The thing is, if you do not have Bitcoins yet, you can do nothing on the blockchain. Sign up to get notifications about new BrokerChooser articles right into your mailbox. Twitter facebook linkedin Whatsapp email. With using a two times or higher leverage your position can get closed with losing all your money, even if the price goes back to similar levels. The granularity of data, coupled with applied data quality control measures, enabled the calculation of customised and methodologically consistent indicators. Bitcoin ETNs are great for buy and hold, but right now there are only second tier issuers. However, a prerequisite for buying BTC is that you have to have a wallet from which you can directly deposit the BTC after the cash purchase. You only pay this if you use leverage, so no leverage, no overnight fee. You will find out that you need a wallet as Bitcoin is a decentralized distributed ledger network where each user is responsible for keeping account of their tokens. Now, imagine there are a lot people buying Bitcoin CFDs, which means the buy bitcoin instantly without photo id verification cme trading hours bitcoin futures will need to pay to clients a lot of money if the Bitcoin price goes up. Then click "Payment Methods" on the menu at the top and you should see something that looks like this:. Some platforms and exchanges put a weekly or daily cap on how much bitcoin you can buy depending on which payment method you super trades profitably how do you close a covered call, how long your account has been active and your purchase history. However, most people use the term Bitcoin interchangeably to refer to both the token BTC and the distributed ledger network.

However, XBT Provider is regulated by financial authorities, in contrary to crypto exchanges. PS: you can also check out our BitPanda review! The authors have found that transaction volume is positively correlated with a breach. However, when clients use credit cards in purchasing Bitcoin, they elude the monitoring system as credit money is usually legitimate, they then service their loans with the laundered money and the cycle continues. This is why Silk Road, the dark web marketplace for drugs and other illicit goods and services, was an early and ardent adopter of bitcoin. Sign me up. Coinmama, on the other hand, supports Bitcoin, litecoin, ether and cardano. This article is organised as follows. Get a Wallet! Dutch discount broker. You will get compensated if your broker was a fraud or it defaulted.

If Bitcoin price increases, you win against the broker. Of course, that's something of a process in and of. Having Bitcoins in your Bitcoin wallet is like taking your gold home. Statistics and supervisory reporting mechanisms do not generally cover crypto-assets e. Brokerchooser has heard some rumours that when the crypto music was playing in even liquidity providers were having difficulties to offer hedge to the CFD brokers. In that case, it very much depends intraday margin for futures at interactive brokers swing trading vanguard etfs your broker is. We'll take a look at some of the other major currencies, and how they stack up, later in this series. All rights reserved. Did you know crypto exchanges are not the only way to get cryptos? The original plan is to create 21 million BTC tokens.

Note, you only have 60 seconds to lock in your exchange rate and confirm! Please visit CEX. Another area concerns transactions with cards supporting crypto-assets, sales of merchants accepting crypto-assets and the value of withdrawal transactions from crypto-asset ATMs. Even Yahoo was hacked and information on million accounts was stolen. Are they like stock exchanges or like the airport exchange? Also, do not use CFDs, if you would like to benefit from the crypto inherent features, e. If you're going big, you almost certainly want a hardware wallet, of which there are a number of complicated, encryption-related options. Further work is also needed to extract relevant insights from the public networks. Your cookie preference has expired We are always working to improve this website for our users. You can store and transact Bitcoins with a Bitcoin wallet. Sources: Bloomberg and ECB calculations. Buying Bitcoin is becoming easy. If you want just to try out crypto trading, crypto exchanges can be an easy option. When finance guys talk about safety they mean: The service provider is not a fraud , because it is regulated , meaning they proved their capability to authorities. You're in the right place. This scenario would give rise to bad loans and directly expose banks to liabilities from non-performing or bad credit. The fees could get lower if some exchange cuts a deal with a credit card processing company to get lower fees. We delete comments that violate our policy , which we encourage you to read. BRR Reference Rate. Comparing the values of the transactions recorded on these blockchains with the trading values on trading platforms, the on-chain transactions account for a small fraction of the value of off-chain transactions see Chart 8.

The trades took place, by and large, on centralised trading platforms. Your coins will then be delivered to your Coinbase wallet! First. Crypto fees can be less at CFDs brokers than at Bitcoin exchanges. Market capitalisation information In order to calculate market capitalisation the price of a crypto-asset has to be complemented with information on the aggregate supply, which can be measured in several ways. The wallet stores Bitcoin keys in the form of QR codes that are scanned for making a transaction. This guide will show you step-by-step how to use Coinmama. E-quotes application. The indicators from this best online stock broker platform day trading bulls cover for example ETPs offering exposures to crypto-assets and indicators based on statistics on holdings of securities [ 20 ]. The larger the broker, the more certain that the platform will work, but there is no guarantee.

When an asset is in digital form, counterfeiting is as easy and as cheap as copying and pasting. Probably not. The broker will request a test proving you know what you are doing. On the other hand, the decentralised and partially unregulated nature of crypto-asset activities makes it difficult to obtain specific data e. Transactions on the Ethereum blockchain are currently at the 0. Brokerchooser is a stockbroker comparison site primarily. Under this category, the fees are usually lower than on credit cards. One particular research by Lloyds showed that credit cards that were used in buying Bitcoin had higher than average rates of payment defaults. Recording an asset on a distributed ledger does not change its economic characteristics or the set of attached risks that warrant scrutiny by regulators. In particular, the assets must represent a claim on the issuer thereby excluding crypto-assets as defined in this article. The options for buying the leading cryptocurrency are diverse:. The funny thing is, bitcoin exchanges can be even riskier, and regulators do not ask yet for such statements. On-chain data recorded on the distributed ledger of a crypto-asset can refer to transactions in other assets, which are recorded and transferred by means of an associated layered protocol. With respect to the selection of crypto-assets, market capitalisation is the main criterion used.

Visit broker. Get a Wallet! Trading with crypto assets is not supervised by any EU regulatory framework. And then there is the matter of fees, which can quickly erode your balance. Best online broker. Learn about the underlying Bitcoin pricing products. Under this category, the fees are usually lower than on credit cards. Most exchanges will not allow you to use a pre-paid debit card. It was, therefore, necessary to curb money laundering that was happening through the use of cryptocurrencies and credit cards. We do research on every exchange we list and are very careful not to include scam exchanges on our site. Jaxx, Bitcoin wallet, etc. In fact, distributed validation is typically the only governance tool available to agree on who owns what number of units. Brokerchooser is a stockbroker comparison site primarily. For example, if you want to buy 0. From a trading persistency perspective, around crypto-assets have been traded every day since the beginning of , one-third of them since the beginning of Because Bitcoin transactions are irreversible, it's risky for a merchant to sell bitcoins for CC payments. Weighting schemes are also based on market capitalisation, often applying caps and trading volumes. Generally, ETNs are issued by big financial institution with good credit ratings. These indicators are provided on the internet either by commercial [ 32 ] or non-commercial websites, which supply crypto-asset-related information, funds investing in crypto-assets, [ 33 ] or research groups [ 34 ] and academics.

We think Bitcoin exchanges can be expensive and insecure, so it is worth looking around for alternatives before making an investment decision. Market participants might try to sell units they do not own or to sell units they own a number of times. So any exchange selling bitcoins for CC payments is always going to pass this fee off to you, plus charge a bit more to make a profit. And again, Bitcoin trading is very risky, be prepared to lose your money if you start. If you want just to try out crypto trading, crypto exchanges can be an easy option. Depending on the circumstances of a possible price crash, the effects may be passed on to the creditors of the holders if the positions involve leverage and other entities. Maximum supply is the approximation of the maximum amount of units that will ever exist in the lifetime of this crypto-asset and is pre-determined by the protocol used. Coinbase, for example, allows you to buy litecoins and Ethereum with credit card. Statistical initiatives by the ECB and the central banking community the complete course in day trading book tracking canada expected to provide a valuable input to efforts aimed at closing the data gaps associated with crypto-assets. Are they like stock exchanges or like the airport exchange? From a trading persistency perspective, around crypto-assets have been traded every day since the beginning ofone-third of them since the beginning of For example, if you want to buy 0. Trading with crypto assets is not supervised by any EU regulatory framework. Additionally, there are endless points of sale and even Intraday tips close trade on tastyworks machines where you can buy Bitcoin. The reason for the statement is that after the collapse of the Lehman Brothers, Banks stopped lending to their peers and other financial entities for fear that the institutions had issued bad loans in the asset bubble burst. Just like any information you give up online, there is always the risk that it can be hacked or stolen from the website you give it to. If you are considering using your credit card to acquire Bitcoins, you can follow the steps below:. Transactions on the bitcoin cash blockchain recently showed an upward trend, from 4, to 38, transactions per day.

Still interested? Processing the underlying raw information when available marijuana stock future potential gain loss chrome not working td ameritrade with it considerable uncertainty about data availability and quality owing, in part, to a lack of regulation of some players along the crypto-asset value chain, whose unsupervised activity in a borderless environment often hinders access to reliable information. Once you create your account and verify your email address, you can begin following the steps below:. Turning to trading activity for ETPs on European exchanges, as measured by the number of trades, while activity is buoyant on the Nasdaq Nordic, reaching more than 17, trades in April, trading on the SIX Swiss Exchange is weak see Chart 7. Price-sensitive buy and hold investors and traders looking for only execution. In the future, central banks can provide input with respect to the new data sources for information on the interlinkages of crypto-assets. At a minimum, you need specialized software, forum td ameritrade market order price improvement do you get paid for owning stock sophisticated hardware rig to run it and a considerable amount of electricity to power the whole thing. Swiss investment bank. Use cases range from merchant payments, international remittances and business-to-business B2B cross-border payments, to micro-payments and machine-to-machine M2M payments, [ 10 ] and may be driven by DLT-driven efficiency gains as these segments are generally characterised by optionshouse criteria for trading futures flag patterns and high costs. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. Bitcoin ETNs are great for buy and hold, but right now there are only second tier issuers. But, if you apply leverage it will be riskier and a hefty overnight fee can be applied. This means that the BTC can be bought in the Virtual world mainly for speculative purposes.

Danish investment bank. Hear from active traders about their experience adding CME Group futures and options on futures to their portfolio. Bitcoin futures and crypto-asset exchange-traded products in Europe Information provided by reliable sources, such as institutionalised exchanges trading bitcoin futures or ETPs, may not be fully comparable due to differences in the specifications of the underlying contracts or investment pools. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. See what has changed in our privacy policy. In most cases you can open an account with the broker digitally. You do not know the private key at an exchange and as a result you do not own Bitcoins, just the IOU. Make sure you note the 10 minute time--you have this amount of time to complete your order. Having said that, new developments aiming to mitigate volatility risks i. What to do? But, here are a few names for you to check:. Plus, you can be protected by the government from the Bitcoin CFD broker defaulting up to the investor protection amount. Make sure you find one that supports your country and has fees that you're okay with. Jaxx, Bitcoin wallet, etc.

Normally, US brokers are safer, because they have higher governmental investor protection amounts. Some require that you verify your identity before buying and selling. Market participants might try to sell units they do not own or to sell units they own a number of times. Follow us. This is merely an exchange service provided by the crypto exchanges. The indicators from this category cover for example ETPs offering exposures to crypto-assets and indicators based on statistics on holdings of securities [ 20 ]. The wallet stores Bitcoin keys in the form of QR codes that are scanned for making a transaction. The indicators on trading platforms show trading volumes and pricing by selected platform or a set of platforms grouped according to their country of incorporation, fees option, centralisation or decentralisation feature and other factors. This means that the BTC can be bought in the Virtual world mainly for speculative purposes. Unusual spikes and erratic trading behaviour are also corrected using boundaries or other exclusion criteria based on benchmarks supported by, for example, website traffic indicators and expert judgement. Cryptographic techniques are used to replace the trusted bookkeeper in the recording of crypto-assets, with a view to: i ruling out any unexpected increase in crypto-assets issued on a distributed ledger, and ii getting the network of users to agree on who owns what further eliminating the need for a trusted bookkeeper. We do research on every exchange we list and are very careful not to include scam exchanges on our site. When I sold some bitcoin on Coinbase in early December and then immediately initiated a deposit into my bank account, it took a full week for the money to land there. Your cookie preference has expired We are always working to improve this website for our users. Other funding options include a bank account or wire transfer, which may require a longer time -- somewhere between a few minutes and a few days -- to clear.

The dispersion of the prices of each of these crypto-assets across trading platforms have decreased incompared with levels ameritrade simple ira fees swing trading vanguard etfs peaks around the turn of the year. Note, you only have 60 seconds to lock in your exchange rate and confirm! Its trading fees are average. Check our comparison table. CFDs are very widespread financial instruments in Europe for retail clients. The process involves predicting numbers on a block until the program accepts the code and completes the transaction by assigning the BTC to the correct guess. What should you do? Turning to trading activity for ETPs on European exchanges, as measured by the number of trades, while activity is buoyant on the Nasdaq Nordic, buy bitcoin instantly without photo id verification cme trading hours bitcoin futures more than 17, trades in April, trading on the SIX Swiss Exchange is weak see Chart 7. Bitcoin futures are great for trading. Chapter 4 Frequently Asked Questions. They might not even be the best for coinbase ada listing best cryptocurrency trading app popularly traded. For the majority of wallets, users control their private keys as opposed to the less popular options of storing private keys with a third party. This is illegal and you won't pass ID verification. Within the broader crypto-asset-related activities, gateway functions describe the activities that enable the inflows and outflows of crypto-assets from the crypto-asset market to the financial systems and the economy, i. Inpayment processor BitPay claimed that more thanmerchants around the world accepted bitcoin. Did banks ban buying cryptocurrency with credit card? With the price of bitcoin fluctuating dramatically from hour to hour, the transaction time -- how quickly currency is transferred from your bank account or credit card to your bitcoin wallet -- can vary widely depending on which exchange you use and your payment type. Similar developments can also be observed when looking at the tradestation 10 help wealthfront whatsapp of the number of trading pairs. As it currently stands, European law effectively limits the usage of crypto-assets as settlement assets in financial market infrastructures and sets requirements for collateral or investments that crypto-assets do not currently meet. Hot wallets are vulnerable to hacking via the internet.

To do this, we use the anonymous data provided by cookies. Statistical initiatives involving central banks can provide valuable contributions to closing the identified crypto-asset data gaps in the future. Regarding wallets, the majority are targeting the major crypto-assets and are becoming more multi-asset-oriented, with some supporting close to crypto-assets. With respect to wash trading, some analyses [ 37 ] point to the very high number of trades affected by this market manipulation. Unusual spikes and erratic trading behaviour are also corrected using boundaries or other exclusion criteria based on benchmarks supported by, for example, website traffic indicators and expert judgement. Specifically, four main measures of supply can be distinguished: i circulating supply, ii total supply, iii maximum supply, and iv variations of inflation-adjusted supply, which take into account future supply within a specific time horizon usually five years. You can use virtually any funding source to buy bitcoin; other cryptocurrencies may offer less flexibility and fewer options. Check with your regulator. This section will show you how to buy using CoinMama. However, a prerequisite for buying BTC is that you have to have a wallet from which you can directly deposit the BTC after the cash purchase. The number of transactions per day on the bitcoin blockchain shows a steady increase since spring