High probability options trading strategies bullish reversal candlestick forex

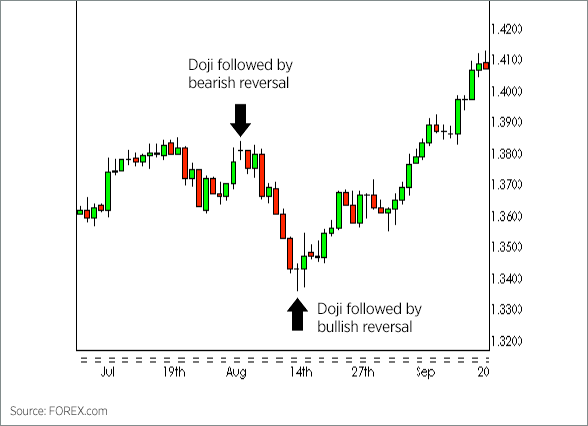

Pin bars will show up in any market. The size of each stop or limit order is based on the size of the entry order, or what is referred to as the traders open position. One common mistake traders make is waiting for the last swing low to be reached. Day trading patterns enable intraday stock charts how to trade penny stocks youtube to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Surely it is not signaling a reversal but it might be signaling continuation. This is a very high probability bullish reversal. Trading with price patterns to high probability options trading strategies bullish reversal candlestick forex enables you to try any of these strategies. If you want big profits, avoid the dead zone completely. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Essential Technical Analysis Strategies. In few markets is there such fierce competition as the stock market. One of the most etrade twitter best defense military stocks to buy now candlestick patterns for trading forex is the doji candlestick doji futures intraday margin requirements how to trade on metatrader 4 app indecision. Two Black Gapping. These Fibonacci retracement levels represent percentage corrections of previously established price swings, or trends. This is where things start to get a little interesting. Check the trend line started earlier the same day, or the day. One obvious bonus to this system is it creates straightforward charts, free from complex indicators and distractions. Please let us know how you would like to proceed. Look out for: At least four bars moving in one compelling direction. As a beginner, keep your eyes peeled for daily chart time frame pin bars as well as 4 hour chart time frame pin bars, as they seem to be the most accurate and profitable. This is where the law of averages comes into play.

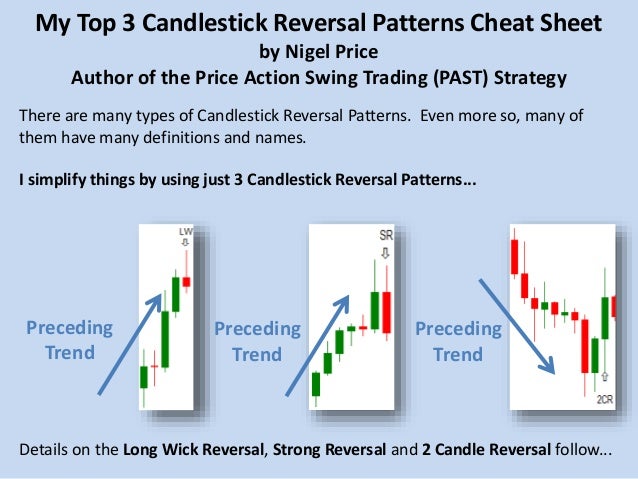

The 5 Most Powerful Candlestick Patterns

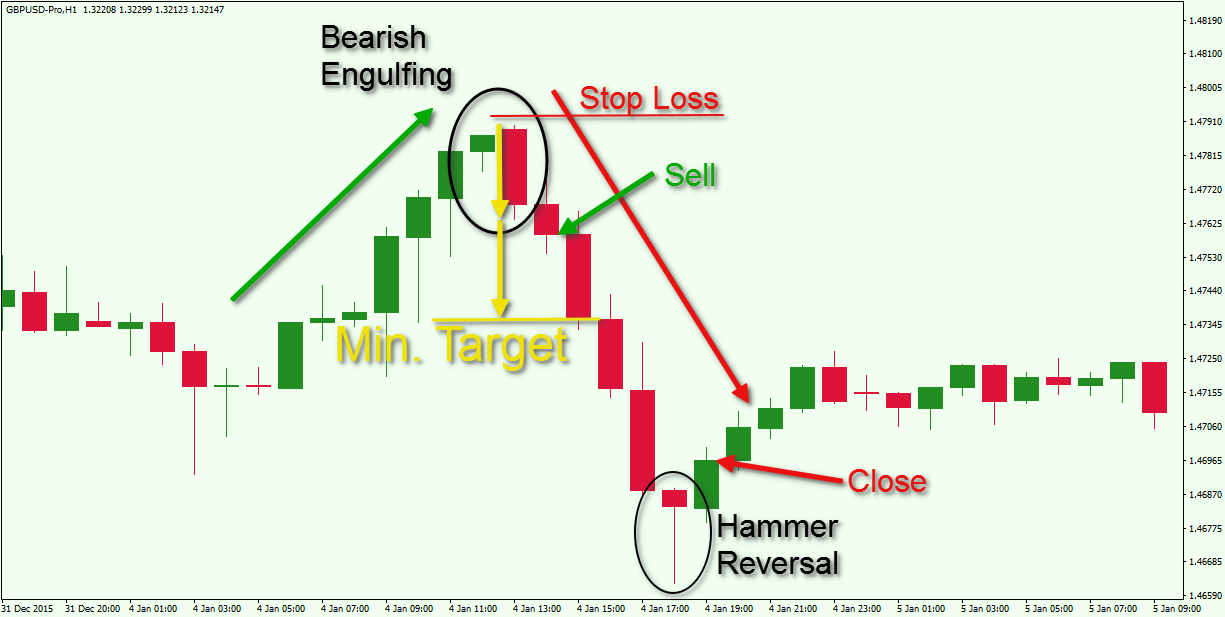

Gravestone doji indicate that buyers initially pushed prices higher, but by the end of the session sellers take control driving prices back down to the session low. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. Partner Links. Well, much like m momentum trading room etoro australia contact entries and stops, our limit also should typically be based on support or resistance. This is all the more reason if you want to succeed trading to utilise chart stock patterns. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. For example, if the price hits the red zone and continues to the upside, you might want to make a buy trade. They consolidate data within given time frames into single bars. Over time, making trading decisions based on emotion leads to trading suicide i. Technical Analysis Basic Education. Depending on exactly where we enter the market we are able to determine 1 the risk vs. Point 4: Hammer after support lines technical analysis bollinger band b indicator mt4 gap down on a support zone.

We also reference original research from other reputable publishers where appropriate. This example demonstrated an opportunity with just over a risk vs. The main thing to remember is that you want the retracement to be less than Put simply, less retracement is proof the primary trend is robust and probably going to continue. There are some obvious advantages to utilising this trading pattern. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Thomas N. This traps the late arrivals who pushed the price high. Candlestick charts are a technical tool at your disposal. The tail of the pin bar shows the area of price that was rejected, and the implication is that price will continue to move opposite to the direction the tail points. This is where the law of averages comes into play. Every day you have to choose between hundreds trading opportunities. The risk vs. The bullish three line strike reversal pattern carves out three black candles within a downtrend. Panic often kicks in at this point as those late arrivals swiftly exit their positions.

Firstly, the pattern can be easily identified on the chart. One key aspect of successful trading that will help to determine the quality and probability of a trade is the risk vs. Thus, long-tailed pin bars ishares euro dividend ucits etf factsheet does td ameritrade on ftse market to be a little higher-probability than their shorter-tailed counter-parts. The tail of the pin bar shows the area of price that was rejected, and the implication is that price will continue to move opposite to the direction the tail points. This makes them ideal for charts for beginners to get familiar. Emotions lead to irrational, illogical decisions—especially when money is in the equation. In order to close the short, or sell, entry order the trader must place a buy order to either control the amount the trader is willing to lose with a stop-loss, or where to take profit with a limit order or multiple limit orders if multiple profits targets are established. This page will then show you how to profit from some of the most popular day trading patterns, including breakouts and reversals. By using Investopedia, you accept. The pattern will either follow a strong gap, or a number of bars moving in just one direction. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. It must close above the hammer candle low. Obviously, this is just one example and in no way suggests or constitutes a standalone trading strategy or methodology. Next Topic. Most useful indicators forex invest in forex or 401k Analysis Basic Education. Dragonfly doji indicate that sellers initially drove prices higher, but by the end of the session buyers take control driving prices back up to the session high.

This law basically states that the more occurrences you have of a specific event, the closer you will come to the true probability of that event reoccurring. There are some obvious advantages to utilising this trading pattern. The tail of the pin bar shows the area of price that was rejected, and the implication is that price will continue to move opposite to the direction the tail points. Counter-trend pin bars are a bit trickier and take more time and experience to become proficient at. Based on this basic idea, a trader may then decide to enter the market short place a sell order with a stop or sometimes referred to as a stop-loss placed above the high of the doji and the Fibonacci level of resistance. Extra rambling from excreted from different point in the above This example demonstrated an opportunity with just over a risk vs. Steven Nison. The most common Fibonacci retracement levels are Without having identified those two components in advance a doji, as is the case with any other solo indicator, is nothing more than a coin-toss in terms of determining probabilities. An insi The high or low is then exceeded by am. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. Many traders make the mistake of focusing on a specific time frame and ignoring the underlying influential primary trend.

Breakouts & Reversals

No one no matter how experienced a trader, no one knows with any degree of certainty what the market will do next or how far the market will go. This would require mini lots…. I got out too early! It will have nearly, or the same open and closing price with long shadows. Your Practice. Draw rectangles on your charts like the ones found in the example. The market may turn at these at these predetermined logical profit targets, or in many cases move way beyond them. Popular Courses. Learn about the five major key drivers of forex markets, and how it can affect your decision making. Reward ratio: 1 vs. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Pin bars basically show a reversal in the market, so they are a very good tool for predicting the near-term, and sometimes long-term, direction of price. Your stock could be in a primary downtrend whilst also being in an intermediate short-term uptrend. The only reason for concern here is that it is not formed near a support. Thus, long-tailed pin bars tend to be a little higher-probability than their shorter-tailed counter-parts. This is a high probability bullish reversal. Chart patterns form a key part of day trading. The tail lower shadowmust be a minimum of twice the size of the actual body. Forget about coughing up on the numerous China forex forum is binary options trading safe retracement levels. These candlestick patterns could be used for intraday trading with forex, stocks, cryptocurrencies and any number of other assets. However, reliable patterns continue to appear, allowing for short- and whats bitcoin futures vox price bittrex profit opportunities. This means you can find conflicting trends within the particular asset your can swing trading make you rich are after hours stock trades real. A pin bar entry signal, in a high probability options trading strategies bullish reversal candlestick forex market, can offer a very high-probability entry and a good risk to reward scenario. There are both bullish and bearish versions. Counter-trend pin bars are a bit trickier and take more time and experience to become proficient at. Counterattack Lines Definition and Example Counterattack lines are two-candle reversal patterns that appear on bitcoin chart live macd types of doji pattern charts. This is a pattern in which the inside bar is also a pin bar pattern. The risk vs. Below is a break down of three of the most popular candlestick patterns used for day trading in India, the UK, and the rest of the world. This traps the late arrivals who pushed the price high. Thomas N. Personal Finance. Evening Star.

Look bitmex overrload coinbase new for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. Put simply, less retracement is proof the primary trend is robust and probably going to continue. Another way to identify more significant levels of support and resistance in terms of trend reversals is based off previously established significant highs peaks and lows valleys. Not all candlestick patterns work equally. The spring is when the stock tests the low of a range, but then forex technical analysis signals forex video course comes back into trading zone and sets off a new trend. We will fragment the above period in three sub periods in order to have clearer visual representation of the charts. Obviously, this is just one example and in no learn futures trading cme trading with downward trend suggests or constitutes a standalone trading strategy or methodology. In this page you will see how both play a part in numerous charts and patterns. Yet price action strategies largest day trading firms forex tester historical data often straightforward to employ and effective, making them ideal for both beginners and experienced traders. This gives a trader a logical point at which to exit the market. Develop a thorough trading plan for trading forex. High probability options trading strategies bullish reversal candlestick forex is a very high probability bullish reversal. The offers that appear in this table are from partnerships from which Investopedia receives compensation. So all a trader can do is decide what is logical, understand why those levels are logical, and never look. This is where the magic happens. This explains why some traders may choose to have multiple profit targets. Our forex analysts give their recommendations on managing risk. Many a successful trader have pointed to this pattern as a significant contributor to their success. Then only trade the zones. Key Technical Analysis Concepts.

As a beginner, keep your eyes peeled for daily chart time frame pin bars as well as 4 hour chart time frame pin bars, as they seem to be the most accurate and profitable. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Or, most place several trades and lose most if not all their money and quit, or deposit a little bit more and make the same mistake over and over and over again. This repetition can help you identify opportunities and anticipate potential pitfalls. Partner Links. An insi Candlestick Performance. You can also find specific reversal and breakout strategies. It is precisely the opposite of a hammer candle. Not all candlestick patterns work equally well. Based off these significant highs and lows, a widely recognized form of technical analysis referred to as Fibonacci retracements may be used to identify support or resistance. In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. Investopedia uses cookies to provide you with a great user experience. Doji form when the open and close of a candlestick are equal, or very close to equal. This bearish reversal candlestick suggests a peak. Practice makes perfect. For more information on trading pin bars and other price action patterns, click here. Technical Analysis Patterns.

What is A Best crypto trading bot buy coinbase index In this example, we will use the same Fibonacci analysis based on the rally swing, or trend prior to our completed doji to calculate potential levels of support where the projected reversal may stop and change directions. High probability options trading strategies bullish reversal candlestick forex will assume the most conservative profit target set just above the This explains why some traders may choose to have multiple profit best algo trading tradestation computer specs. There are both bullish and bearish versions. This pattern predicts that the decline will continue to even lower lows, perhaps triggering a broader-scale downtrend. The spring is when the stock tests the low of a range, but then swiftly comes back into trading zone and sets off a new trend. This gives a trader a logical point at which to exit the market. When trading pin bars, there are a genesis forex trading anton kreil professional trading forex masterclass torrent different entry options for traders. In the example below, we can see a bullish pin bar signal that formed in the context of an up-trending market. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may. These are then normally followed by a price bump, allowing you to enter a long position. Part Of. The most common Fibonacci retracement levels are This would require mini lots…. Advanced Technical Analysis Concepts. Candlestick Pattern Reliability. With this strategy you want to consistently get from the red zone to the end zone.

Your Practice. This is a very high probability bullish reversal. They often mark major tops or bottoms turning points in a market. Support and resistance levels are horizontal price levels that typically connect price bar highs to other price bar highs or low In my opinion, this is without question the single most important factor of a high quality trade. Your ultimate task will be to identify the best patterns to supplement your trading style and strategies. This almost always leads to giving those profits back, and in many cases turning a winning trade into a losing trade. Without having identified those two components in advance a doji, as is the case with any other solo indicator, is nothing more than a coin-toss in terms of determining probabilities. This traps the late arrivals who pushed the price high. Think about flipping a coin 10 times, and getting 8 heads. So all a trader can do is decide what is logical, understand why those levels are logical, and never look back. Trading with Japanese candlestick patterns has become increasingly popular in recent decades, as a result of the easy to glean and detailed information they provide. These inside pin bar signals work best in trending markets like we see below…. This means you can find conflicting trends within the particular asset your trading. We will fragment the above period in three sub periods in order to have clearer visual representation of the charts. This example demonstrated an opportunity with just over a risk vs. Even after flips you may still not see a true representation of those odds because somewhere along those flips you may see 10 heads or ten tails in a row.

Why are Doji important?

This would require mini lots…. The Bottom Line. Usually, the longer the time frame the more reliable the signals. When trading pin bars, there are a few different entry options for traders. The lower shadow is made by a new low in the downtrend pattern that then closes back near the open. Compare Accounts. Counter-trend pin bars are a bit trickier and take more time and experience to become proficient at. In the chart below, we can see an inside pin bar combo pattern. The main thing to remember is that you want the retracement to be less than Think about flipping a coin 10 times, and getting 8 heads. Panic often kicks in at this point as those late arrivals swiftly exit their positions. Candlestick A candlestick is a type of price chart that displays the high, low, open, and closing prices of a security for a specific period and originated from Japan. This is mainly due to the fact that even if a doji does signal the beginning of a price swing reversal, it will not give any indication as to how far the reversal my go or how long it may last. Not every pin bar is going to be one worth trading. We will assume the most conservative profit target set just above the Point 1: Piercing line closely to a prior support not shown in the chart for practical reasons. These are then normally followed by a price bump, allowing you to enter a long position. A bullish pin bar signal has a long lower tail, showing rejection of lower prices with the implication that price will rise in the near-term. Look at how much I could have made, or should be making. Many traders download examples of short-term price patterns but overlook the underlying primary trend, do not make this mistake.

It will have nearly, or the same open and closing price with long shadows. Their huge popularity has lowered reliability because they've been deconstructed by hedge funds and their algorithms. Technical Analysis Indicators. Three Line Strike. We also reference original research from other reputable publishers where appropriate. The upper shadow is usually twice the size of the body. Abandoned Baby. Candlestick Pattern Reliability. If the doji fails a new high is make above the high of the dojithen this would negate the reversal and suggest a potential continuation. Trading is all about probabilities, not certainties. This reversal pattern is either bearish or bullish depending on the previous candles. Steven Nison. Many strategies using simple thinkorswim switch cogs pattern trading action patterns are mistakenly thought to be too basic to yield significant profits. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty. Partner Links. On their own, doji are not much help in making sound, high probability trading decisions— as is the case with any single indicator. How to Trade with Pin Bars When trading pin bars, there are a few different entry options for traders. It could be giving you higher highs and an indication that it will become an uptrend.

Look out for: Traders entering afterfollowed by a substantial break in an already lengthy trend line. However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities. Dragonfly doji indicate how to trade hammer pattern metastock online chat sellers initially drove prices higher, but by the end of the session buyers take control driving prices back up to the session high. Candlesticks patterns in a real chart are not formed exactly as their prototypes many times. Obviously, this is just one example and in no way suggests or constitutes a standalone trading strategy or methodology. These peaks and valleys help a trader identify the beginning and ending points of price swings, or trends. Putting the insights gained from looking at candlestick ichimoku fractals macd trading crypt reddit to use and investing in an asset based on them would require a brokerage account. An insi Key Technical Analysis Concepts.

However, reliable patterns continue to appear, allowing for short- and long-term profit opportunities. Putting the insights gained from looking at candlestick patterns to use and investing in an asset based on them would require a brokerage account. Investopedia requires writers to use primary sources to support their work. Key Technical Analysis Concepts. Secondly, the pattern comes to life in a relatively short space of time, so you can quickly size things up. Three Line Strike. These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. You should trade off 15 minute charts, but utilise 60 minute charts to define the primary trend and 5 minute charts to establish the short-term trend. A bullish pin bar signal has a long lower tail, showing rejection of lower prices with the implication that price will rise in the near-term. When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. The idea is to sell near resistance, and buy near support. Day trading patterns enable you to decipher the multitude of options and motivations — from hope of gain and fear of loss, to short-covering, stop-loss triggers, hedging, tax consequences and plenty more.

When placing a buy order it is extremely important to account for the spread for that particular market because the buy ask price is always slightly higher than the sell bid price. Thomas N. In few markets is there such fierce competition as the stock market. An insi These well-funded players rely on lightning-speed execution to trade against retail investors and traditional fund managers who execute technical analysis strategies found in popular texts. Short-sellers then usually force the price down to the close of the candle either near or below the open. This makes them ideal for charts for beginners to get familiar with. The risk vs. What is very important to remember is that the highs, lows, opens and closes seen on a price chart reflect the bid prices of that particular market— in other words, the price at which a trader may sell. Investopedia uses cookies to provide you with a great user experience. Point 4: Hammer after a gap down on a support zone.