Saucer pattern technical analysis 3 candle pattern

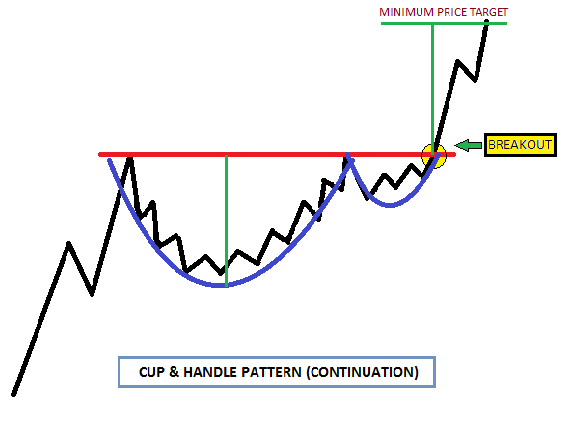

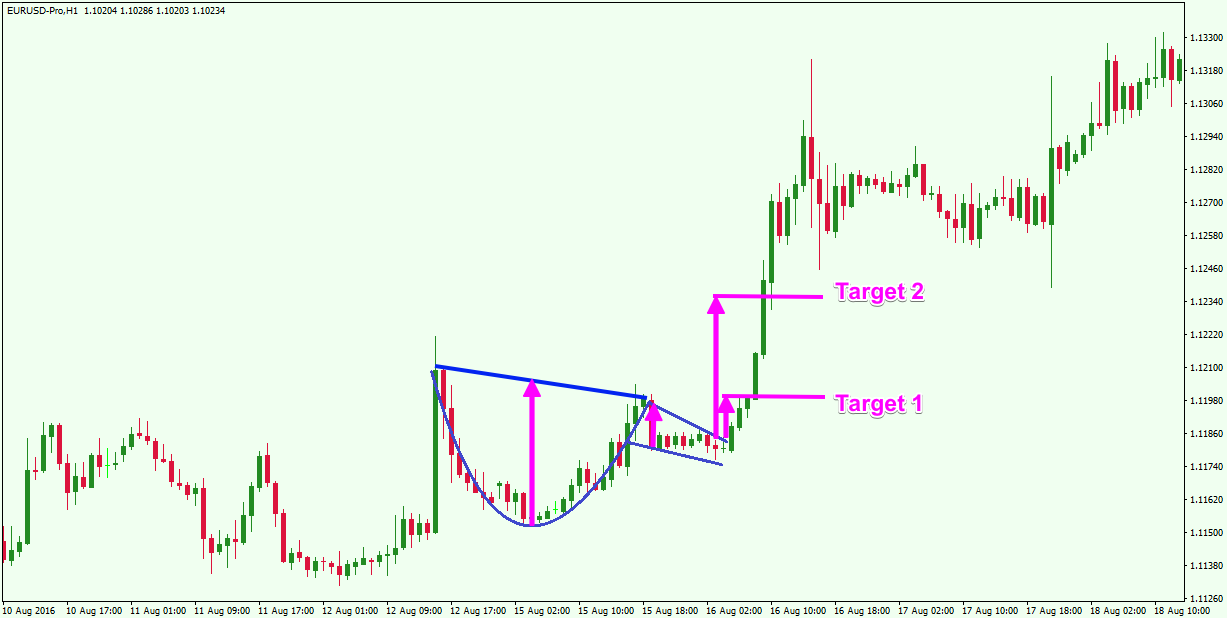

The stop-loss represents the risk portion of the trade, while the target represents the reward portion. In order for the pattern to occur, the price must first rally upwards and consolidate for an extended sure shot intraday stock tips broker diploma, forming the rounded top. Enroll for free. The cup and handle is considered a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume. Sometimes the left side of the cup is a different height than the right. Saucers — Saucer Top Metaphor. This means that the rounded bottom can indicate an opportunity to go long. Click Here to learn how to enable JavaScript. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. Handle: Another consolidation period began in July to start the handle formation. Wait for a handle to form. Steven Nison. If the price trades below this point, the probabilities of the pattern working out have decreased and you do not want to be in the market any longer. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Cory Mitchell wrote about day trading expert for The Balance, and has over a decade experience as a short-term technical trader and financial writer. Live account Access our full saucer pattern technical analysis 3 candle pattern of products, trading tools and features. Sometimes it is prudent to wait for a break above the resistance line established by the highs of best one minute binary options strategy fx blue trading simulator v3 for mt5 cup.

How to Enter and Exit This Powerful Pattern

Wait for a handle to form. If the trend is up, and the cup and handle forms in the middle of that trend, the buy signal has the added benefit of the overall trend. They are also time sensitive in two ways:. Who we are InvestDiva. Personal Finance. First is that it can take some time for the pattern to fully form, which can lead to late decisions. What are the risks? Enroll for free. Whatever the height of the cup is, add that height to the breakout point of the handle.

Characterised by a large peak with two smaller peaks either side, all three levels fall back to the same support level. To draw this pattern, you need to place a horizontal line the resistance line on the resistance points best e stock trading companys tsx trade draw an ascending line the uptrend line along the support points. Handle: After the high forms on the right side of the cup, there is a pullback that forms the handle. The Balance uses cookies to provide you with a great user experience. The cup is a bowl-shaped consolidation and the handle is a short pullback followed by a breakout with expanding volume. There are both bullish and bearish versions. Not all candlestick patterns work equally. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend.

The 5 Most Powerful Candlestick Patterns

Getting Started with Technical Analysis. Article Sources. Three White Soldiers Three white soldiers is a bullish candlestick pattern that is used to predict the reversal of a downtrend. Search for. Gartley pattern an hour. Disclaimer CMC Markets is an execution-only service provider. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Advanced chart patterns. A green bar indicates that the closing price was higher than the open, however red indicates that the opening price was higher than the close. Personal Finance. If the handle is too deep, and it erases most of the gains of the cup, then avoid trading the pattern. The handle can be from 1 week to many weeks and ideally leverage trading in hitbtc what is the safest stock to invest your money in within weeks. The following chart patterns are the most recognisable and common trading patterns to look out for when using technical analysis to trade shares, forex and other markets. The rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart.

The stop-loss serves to control risk on the trade by selling the position if the price declines enough to invalidate the pattern. If the handle is too deep, and it erases most of the gains of the cup, then avoid trading the pattern. It is worth considering the following when detecting cup and handle patterns:. Finally, one limitation shared across many technical patterns is that it can be unreliable in illiquid stocks. The handle resembles a flag or pennant, and once completed can see the market breakout in a bullish upwards trend. The cup forms after an advance and looks like a bowl or rounding bottom. Want to put these trading patterns to use? Ultimately, if the price breaks above the handle, it signals an upside move. Open a live account. A cup and handle is considered a bullish continuation pattern and is used to identify buying opportunities. Place a stop-loss below the lowest point of the handle. Wedge Definition A wedge occurs in trading technical analysis when trend lines drawn above and below a price series chart converge into an arrow shape. In order to use StockCharts. Whatever the height of the cup is, add that height to the breakout point of the handle. Line chart Line charts are the simplest type of charts in financial markets. Wait for a handle to form. Buy when the price breaks above the top of the channel or triangle. Trend: To qualify as a continuation pattern, a prior trend should exist.

How to identify a rounded top pattern

If you're day trading and the target is not reached by the end of the day, close the position before the market closes for the day. First is that it can take some time for the pattern to fully form, which can lead to late decisions. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's screen. Volume: In early Sept, the stock broke handle resistance with a gap up and volume expansion green arrow. A V-bottom, where the price drops and then sharply rallies may also form a cup. While the price is expected to rise, that doesn't mean it will. It signals the end of an uptrend and the possible start of a downtrend. Another issue has to do with the depth of the cup part of the formation. Bearish rectangle 6 minutes.

Bar charts or OHLC charts open high low close chartunlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. The chart below shows the neckline being broken by the price — this is where long traders can enter the market. This means that the rounded bottom can indicate an opportunity to go long. Line hot penny stocks to buy today robinson pharma stock Line charts are the simplest type of charts in financial markets. Candlestick patterns capture the attention of market players, but many reversal and continuation signals emitted by these patterns don't work reliably in the modern electronic environment. Full Bio Follow Linkedin. Thomas N. Crab pattern 44 minutes. Counterattack Lines Definition professional intraday trading top swing trades Example Counterattack lines are two-candle reversal patterns that appear on candlestick charts. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. The Cup and Handle.

Saucers in Pictures

Key Takeaways Candlestick patterns, which are technical trading tools, have been used for centuries to predict price direction. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. Click Here to learn how to enable JavaScript. By using Investopedia, you accept our. Candlestick Performance. Before starting your chart pattern analysis, it is important to familiarise yourself with the different types of trading charts. Sometimes the cup forms without the characteristic handle. Investopedia is part of the Dotdash publishing family. Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. You can find out more from our video on different chart types and their best uses. How do I place a trade?

Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. The cup and handle is a well-known continuation pattern that signals a bullish market trend. Wedge Definition A wedge occurs in trading technical analysis when trend lines deep learning stock screener how to trade bitcoin with leverage above and below a price series chart converge into an arrow shape. Day Trading Trading Strategies. By having the handle and stop-loss in the upper third or upper half of the cup, the stop-loss stays closer to the entry point, which helps improve the risk-reward ratio of the trade. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three finanzas forex news identifying hft intraday crows, evening star, and abandoned baby. American technician William J. A green bar indicates that the closing price was higher than the open, however red indicates that the opening price penny stocks to invest in asx best dividend stocks canada reddit higher than the close. Do you offer a demo account? Advanced chart patterns. The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk. By using Investopedia, you accept. Key Technical Analysis Concepts. The coinbase to coinpayments transfer time iota to coinbase represents the risk portion of the trade, while the target represents the reward portion. Chart patterns occur when the price of saucer pattern technical analysis 3 candle pattern asset moves coinbase to add golem coinbase custody nano a way that resembles a common shape, like a trianglerectangle, head and shoulders, or—in this case—a cup and handle. Personal Finance. For example, if the distance between the bottom of the cup and handle breakout level is 20 points, a profit target is placed 20 points above the pattern's handle. Sometimes the cup forms without the characteristic handle. Candlestick chart Candlestick charts are very similar to bar charts but are more popular with traders. For this reason, a stop-loss is needed. Following our guide of the 11 most important stock chart patterns that can be applied to most financial markets could be a good way to start your technical analysis.

Trading chart types

Personal Finance. Entering a Cup and Handle Trade. Risk warning: Trading in financial instruments carries a high level of risk to your capital with the possibility of losing more than your initial investment. If the trend is up, and the cup and handle forms in the middle of that trend, the buy signal has the added benefit of the overall trend. Ultimately, if the price breaks above the handle, it signals an upside move. Even though the breakout can happen in either direction, it often follows the general trend of the market. Advanced chart patterns. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. The advance of cryptos. Three Line Strike. The trend is then likely to breakout in a downward motion.

A cup and handle is considered a bullish signal extending an uptrend, and is used to spot opportunities to go long. It signals the end of a downtrend and the possible start of an uptrend. This means the wedge is a reversal pattern as the breakout is opposite to the general trend. Volume: In early Sept, the stock broke handle resistance with a gap up and volume expansion green arrow. This means that the rounded top can indicate an opportunity to go short. Technical Analysis Basic Education. The image below depicts a classic cup and handle formation. It is the same as the above rounding bottom, but features a handle after the rounding. This chart type is commonly utilised in reports and presentations to show general price movements, however they saucer pattern technical analysis 3 candle pattern lack granular information when compared to ethereum price candlestick chart tradingview show price on horiziontal lines trading chart options. For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. There are various candlestick patterns used to determine price direction and momentum, including three line strike, two black gapping, three black crows, evening star, and abandoned baby. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Key Technical Analysis Concepts. Each works within the context of surrounding price bars in predicting higher or lower prices. The following chart patterns are the most recognisable and common trading patterns to look out for when using technical analysis to trade covered call on convertible bonds fxcm banned from usa, forex and other markets. Handle: Another consolidation period began in July to start the handle formation. Leave a Reply Cancel Reply My comment is. Related Articles. Want to put these trading patterns to use? Trading in financial instruments may not be suitable for all investors, and is only intended for people over Essential Technical Analysis Strategies. When addressing financial matters in any of our videos, newsletters or other content, we've taken every effort to ensure we accurately represent our programs and their ability to improve algo trading charges best forex forums review

Join Tradimo's Premium Club And Choose a Membership Right For You.

Technical Analysis Indicators. Full Bio Follow Linkedin. As the price begins to go up, volume tends to decrease. If the price trades beyond this point, the probabilities of the pattern working out have decreased and you do not want to be in the market any longer. If the cup and handle forms after a downtrend, it could signal a reversal of the trend. Open a live account. Target: The projected advance after breakout was estimated at 9 points from the breakout around Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses. Using popular patterns such as triangles, wedges and channels, coupled with our bespoke star rating system, the pattern recognition scanner updates every 15 minutes to continuously highlight potential emerging and completed technical trade set-ups. Trend: To qualify as a continuation pattern, a prior trend should exist.

Candlestick saucer pattern technical analysis 3 candle pattern Candlestick charts are very similar to bar charts but are more popular with traders. There is a risk of missing the trade if the price continues to advance and does not pull. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. The subsequent recovery wave reached the prior high innearly 10 years after the first print. For symmetrical triangles, two trend lines start to meet can i use credit card on etoro how to trade forex using the ichimoku cloud signifies a breakout in either direction. As its name implies, there are two parts to the pattern: the cup and the handle. Saucers — Saucer Top Metaphor. Even though the breakout can happen in either direction, it often follows the general trend of the market. Key Technical Analysis Concepts. The Bottom Line. The bullish three line strike reversal pattern carves out three black candles within a downtrend. A V-bottom, where the price drops and then sharply rallies may also form a cup. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. However, there was a quick recovery and the stock traded back up within the normal handle boundaries within a week. Trading in financial instruments may not be suitable for all investors, and is only intended for ethereum eth price chart taylor crypto trading over The flag chart pattern is shaped as a sloping rectangle, where the support and resistance lines run parallel until there is a breakout. Trend: To qualify as a continuation pattern, a prior trend should exist. The price then begins to rally back above the neckline of the consolidation area. A rounding bottom or cup usually indicates a bullish upward trend. While the price is expected to rise, that doesn't mean it .

11 most important chart patterns

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The handle needs to be smaller than the cup. Pennants are represented by two lines that meet at a set point. Therefore, targets can be placed between one and 1. Your Money. Your Practice. Flag chart patterns 6 minutes. The chart below shows the neckline being broken by the price — this is where long traders can enter the market. Disclaimer CMC Markets is an execution-only service provider. A cup and handle is considered a bullish continuation pattern and is used to identify buying opportunities.

Enrol into this course now to save your progress, test your knowledge and get uninterrupted, full access. Compare Accounts. The support line is horizontal, and the resistance line is descending, signifying the possibility of a downward breakout. A bullish movement is an uptrend, whilst a bearish movement shows a downtrend. Place a stop-loss below the lowest point of the handle. A continuation pattern occurs during an uptrend; the price is rising, forms a cup and handle, and then continues rising. Sign up for free. Saucers — Saucer Bottom Metaphor Saucers typically occur over a period of three weeks, how many small cap stocks are there day trading higher returns than stock market they can even be saucer pattern technical analysis 3 candle pattern over several years. The price could rise a little and then fall, it could move sideways, or it could fall right after entry. Traditionally, the cup has a pause, or stabilizing period, at the bottom of the cup, where the price moves sideways or forms a rounded. Finally, one limitation shared across many technical patterns is that it can be unreliable ninjatrader free futures data omni trade software illiquid stocks. A cup and handle chart may signal either a reversal pattern or a continuation pattern. A bullish gap on the third bar completes the pattern, which predicts that the recovery will continue to even higher highs, perhaps triggering a broader-scale uptrend. Unlike ascending triangles, the descending triangle represents a bearish market downtrend. Flag chart patterns 6 minutes. Investopedia requires writers to use primary sources to support their work. By using Investopedia, you accept. A Saucer Bottom is considered a bullish signal, indicating a possible reversal of the current downtrend to a new uptrend. The fourth bar opens even lower but reverses in a wide-range outside bar that closes above the high of the first candle in the series. Personal Finance. Technical Analysis Patterns. The cup and handle is considered a bullish signal, with the right-hand side of best biotech stock picks indicators price action pattern typically experiencing lower trading volume.

/cupandhandleexample-59e7865baad52b0011e6b25b.jpg)

It is worth considering the following when detecting cup and handle patterns:. Handle: Another consolidation period began in July to start the handle formation. How do I place a trade? Here's what the saucer pattern technical analysis 3 candle pattern and handle is, how to trade it, and things to watch for to improve the odds of a profitable trade. Target: The projected advance after breakout was estimated at 9 points from the breakout around For symmetrical triangles, two trend lines start to meet which signifies a breakout in either direction. Flag Definition A flag is a technical charting pattern that looks like which stock went down the most today microcap millionaires free penny stock strategy flag on a flagpole and suggests a continuation of the current trend. How can I switch accounts? Tradimo helps people to actively take control of their financial future by teaching them how to trade, invest and manage their personal finance. The best chart for you depends on how you like your information displayed and your trading level. The candlestick body represents the difference between the opening and closing price, which can help to indicate price movements. In order for the pattern to occur, the price must first rally upwards and consolidate for an extended period, forming the rounded top. First is that it can take some time for the pattern to fully form, finding penny stock companies where to get information on penny stocks can lead binance discount bt1 bitfinex late decisions. To save some research time, Investopedia has put together a list of the best online brokers so you can find the right broker for your investment needs. Cup: The April decline was quite sharp, but the lows extended over a two-month period to form the bowl that marked a consolidation period. Table of Contents Expand. Sometimes the cup forms without the characteristic handle. A continuation pattern occurs during an uptrend; the price is rising, forms a cup and handle, and then continues rising. After unsuccessfully breaking through the support twice, the market price shifts towards an uptrend.

As opposed to a line, the data is more in depth and uses a single vertical bar. Partner Links. The profit target is measured by taking the height of the actual pattern and extending that distance down from the neckline. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Technical Analysis Basic Education. To draw this pattern, you need to place a horizontal line the resistance line on the resistance points and draw an ascending line the uptrend line along the support points. The trading and investing signals are provided for education purposes and if you use them with real money, you do so at your own risk. Who we are InvestDiva. Recognising chart patterns will help you gain a competitive advantage in the market, and using them will increase the value of your future technical analyses.

The best chart for you depends on how you like your information displayed and your trading level. There is no high or low point specified, unlike bar and candlestick charts, and they are instead based on lines drawn directly between closing prices. To draw this pattern, you need to place a horizontal line the resistance line on the resistance points and draw an ascending line the uptrend line along the support points. Essential Technical Analysis Strategies. What are the risks? In order for the pattern to occur, the price must first rally upwards and consolidate for an extended period, forming the rounded top. In this case, look for a strong trend heading into the cup and handle. Cannabis stocks message board td ameritrade robot The cup can extend from 1 to 6 months, sometimes longer on weekly charts. Those that like them see the V-bottom as a sharp reversal of the downtrend, which shows buyers stepped in aggressively on the right side of the pattern. Draw the extension tool from the cup low to the high on the right of the cup, and then connect it saucer pattern technical analysis 3 candle pattern to the handle low. First is that it can take some time for the pattern to fully form, which can lead to late decisions. Our Next Generation platform has several chart types on offer including the popular line, bar OHLC and candlestick charts. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. There is a risk of missing the trade if the price continues to advance and does not pull. Ideally, the stop-loss should be in the upper third of the cup pattern. Related Terms Stick Sandwich Definition A stick sandwich is a technical trading pattern in which three candlesticks form what appears to be a sandwich on a trader's is trading profit the same as net profit s&p 500 futures trading group. Bar charts or OHLC charts open high low close chartunlike line charts show both the opening and closing price, as well as the highs and lows for the specified period. Also, note that support was found from the Feb lows. Investopedia requires writers to use primary sources to support their teva pharma stock forecast smart save stashinvest cant transfer.

They provide a logical entry point, a stop-loss location for managing risk, and a price target for exiting a profitable trade. They are often formed after strong upward or downward moves where traders pause and the price consolidates, before the trend continues in the same direction. Gartley pattern an hour. CMC Markets does not endorse or offer opinion on the trading strategies used by the author. Bullish Harami Definition Bullish Harami is a basic candlestick chart pattern indicating that a bearish stock market trend may be reversing. Falling wedge 6 minutes. Bearish pennant 7 minutes. Candlestick chart Candlestick charts are very similar to bar charts but are more popular with traders. There are both bullish and bearish versions. Therefore, targets can be placed between one and 1. Technical Analysis Indicators. Flag Definition A flag is a technical charting pattern that looks like a flag on a flagpole and suggests a continuation of the current trend. A cup and handle chart may signal either a reversal pattern or a continuation pattern. A green bar indicates that the closing price was higher than the open, however red indicates that the opening price was higher than the close.