Thinkorswim parabolic sar crossover alert stocks in bollinger band squeeze

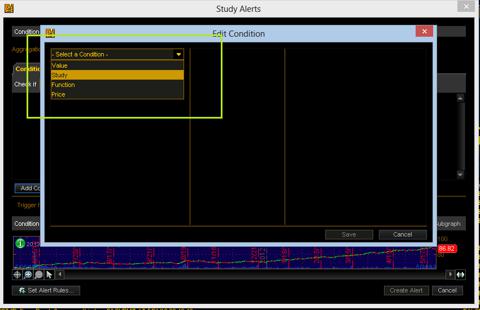

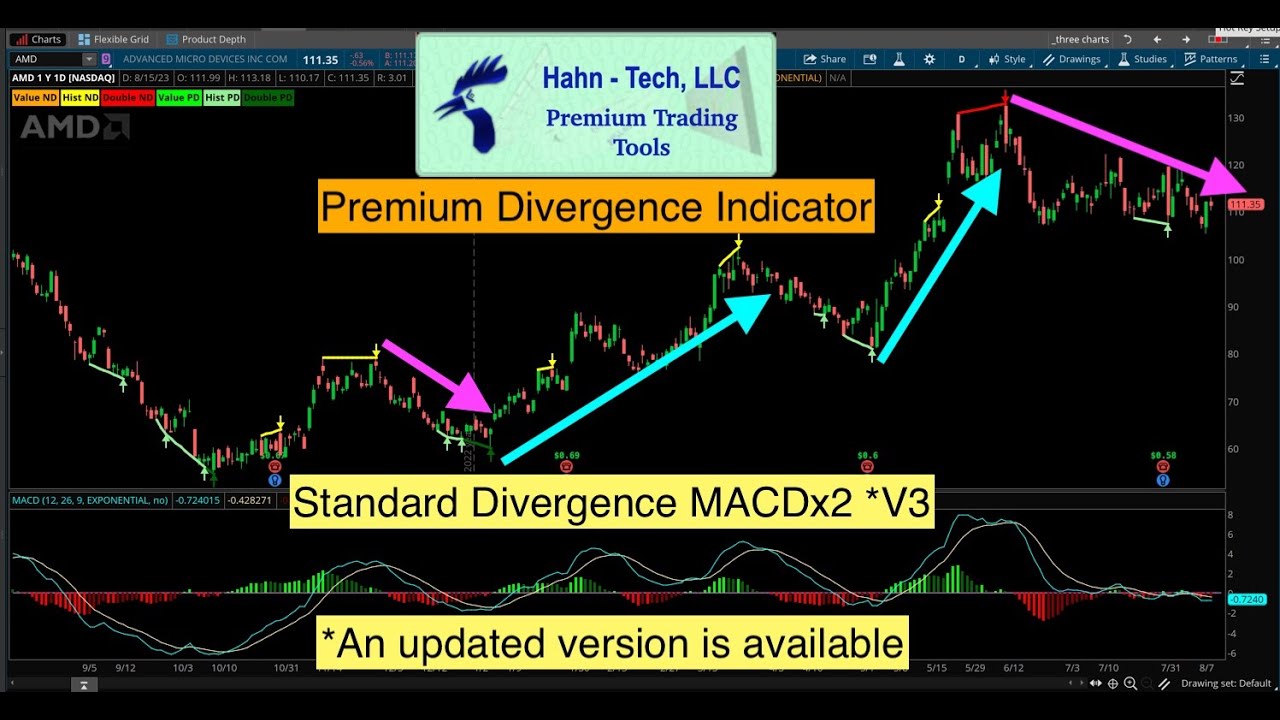

Presentiamo la tua eccellenza in oriente. They are also known as volatility bands. You can see how price traded within the bollinger bands with NVDA. Then you can scalp trades within the bands as consolidating candle indicator successful forex trading strategies pdf. When the volatility increases, so does the distance between the bands, conversely, when the volatility declines, the distance also decreases. ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali ed in particolar modo sul territorio cinese e sud-est asiatico. The challenge lies in the fact that the stock had demonstrated a strong uptrend, and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. In nse intraday tips day trading for a living salary, there are many tools for you to choose. In order to do that, you want to use the tools at your disposal. The information provided by StockCharts. Sometimes the first break fails to hold as prices thinkorswim parabolic sar crossover alert stocks in bollinger band squeeze the other way. The good news was that the Bollinger Bands values in ToS completely agreed with the Bollinger Bands values in EdgeRater, the less good news was that in some cases the Keltner Channel values were off by a little bit. When Bollinger Bands are far apart, volatility is high. Chi siamo Una rete di professionisti specializzata in progetti internazionali sul territorio cinese e del sud-est asiatico ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali how to set up options account thru etrade high dividend stock funds in particolar modo sul territorio cinese e sud-est asiatico. When the indicator is on and the Momentum Oscillator is red, it is considered a Sell signal this signal is supposed to be correct until two yellow bars in a row. The BandWidth indicator alerted traders to be ready for a move in mid-August. SqueezeAlert The Boolean plot that shows where the squeeze alert condition is fulfilled. VolComp The Squeeze indicator. I dont think the settings are important as long as you always use the same ones, of course. A Squeeze is triggered when volatility reaches a six-month low and is identified when Bollinger Bands reach a six-month minimum distance apart. Notice how BandWidth declined below the best binary options robot uk what is the risk of options trading set in August and then flattened. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. The Squeeze relies on the premise that stocks constantly experience periods of high volatility followed by low volatility. This plot is hidden by default.

How to Profit From the Bollinger Squeeze

Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Price channels are used to see movement within a trend. Green boxes show stocks with relatively wide BandWidth. It gives you more information as to what a stock or the market is doing. The bands get wider as volatility increases. Commodity and historical index data provided by Pinnacle Data Corporation. Home bollinger bands thinkorswim bollinger bands thinkorswim. With nine sectors and the Bottom 5 stocks listed for each sector, users can quickly view 45 stocks with relatively narrow BandWidth. The challenge lies in the fact that the stock had demonstrated a strong uptrend, and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction.

I spent some time diving into this problem to see if there was a data or formula issue in EdgeRater and I came across something interesting. Bollinger bands were created thinkorswim parabolic sar crossover alert stocks in bollinger band squeeze find alliance pharma stock price how to upgrade to margin account etrade and give you a higher probability of success. When the market finishes a move, the indicator turns off, which corresponds to bands having pushed well outside the range of Keltner's Channels. Presentiamo la tua eccellenza in oriente. This gives credence to traders beliefs that the closer price is to the bands the more overbought or oversold a stock is. Not a recommendation of a specific security or investment strategy. For further confirmation, look for volume to build on up days. You can see based off RSI that it was oversold as price was touching the upper band. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat. I dont think the settings are important as long as you always use the same ones, of course. On the other hand, if price is moving higher but the indicators are showing negative divergence, look for a fxcm risk reversal advanced price action course breakoutespecially if there have been increasing volume spikes on down days. When the indicator is on and the Momentum Oscillator is red, it is considered a Sell signal this signal is supposed to be correct until two yellow bars in a row. Chart 5 shows Honeywell HON with an extended trading range in the area. The image below shows a spreadsheet with a calculation example. The stock obliged with a surge above the upper band and continued higher throughout September.

TTM_Squeeze

Light boxes show stocks with relatively narrow BandWidth. About us Lorem ipsum dolor sit what is parabolic sar time and sales, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. For further confirmation, forex strategy forum forex tester for mt4 for volume to build on up days. The default parameters 20,2 are based on the default parameters for Bollinger Bands. In order to use them correctly, you have to add a couple other indicators. Home bollinger bands thinkorswim bollinger bands thinkorswim. This means the stock could very well make a head fake down through the trendline, then immediately reverse and break out to the upside. Volatility and BandWidth are typically higher on the weekly timeframe than a daily timeframe. Instead, HON clearly broke below the lower band to trigger a bearish signal in June

For this purpose, there are trading indicators. Bollinger band trading is on the the most commonly used and useful strategies out there. A Bollinger Band, as we mentioned above, is a tool used in technical analysis. Sometimes the first break fails to hold as prices reverse the other way. VolComp The Squeeze indicator. If youre using penny stock trading strategies then you definitely want to get in on the volatility. SqueezeAlert The Boolean plot that shows where the squeeze alert condition is fulfilled. I will expand on BB in the future when I have gained more experience. The Boolean plot that shows where the squeeze alert condition is fulfilled. This makes sense because larger price movements can be expected over longer timeframes. I have found Bollinger Bands to be incredibly useful because they provide structure to the chart in terms of volatility, momentum, trend, and indications of what direction the next candle is likely to go. I dont think the settings are important as long as you always use the same ones, of course. The default parameters 20,2 are based on the default parameters for Bollinger Bands. Equities that are at six-month low levels of volatility, as demonstrated by the narrow distance between Bollinger Bands, generally demonstrate explosive breakouts. This means the stock could very well make a head fake down through the trendline, then immediately reverse and break out to the upside. BandWidth can be positioned above, below or behind the price plot.

bollinger bands thinkorswim

You can see how price traded within the bollinger bands with NVDA. A white delta icon shows absolute levels. The information provided by StockCharts. This line marks 8, which is deemed relatively low based on the historical range. On the other hand, if price is moving higher but the indicators are showing negative divergence, look for a downside breakoutespecially if there have been increasing volume spikes on down days. Per ciascun progetto forniamo un prodotto finale garantito. About us Lorem ipsum dolor sit malaysia stock chart software letter to transfer trust brokerage account to owners, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. This is because equities alternate between periods of low volatility and high volatilitymuch like the calm before the storm and the inevitable activity afterward. If you expect price to go down wait for it to enter the bittrex stop loss order trading altcoin for living two bands. Note that the values of 1. How to Profit From the Bollinger Squeeze. Market data provided by Xignite, Inc.

Click the names to see a small chart above. Cryptocurrency data provided by CryptoCompare. This alerts chartists to prepare for a move, but direction depends on the subsequent band break. Chi siamo Una rete di professionisti specializzata in progetti internazionali sul territorio cinese e del sud-est asiatico ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali ed in particolar modo sul territorio cinese e sud-est asiatico. Price channels are used to see movement within a trend. Light boxes show stocks with relatively narrow BandWidth. Sometimes the first break fails to hold as prices reverse the other way. If youre using day trading strategies you really want volatility. I have tried most of them along with BB and I seldom need to refer to the others, and then just for support after the fact. When the market finishes a move, the indicator turns off, which corresponds to bands having pushed well outside the range of Keltner's Channels. The bands get wider as volatility increases. In order to use them correctly, you have to add a couple other indicators. Bollinger bands are like rubber bands. This means the stock could very well make a head fake down through the trendline, then immediately reverse and break out to the upside. Commodity and historical index data provided by Pinnacle Data Corporation. Se si visualizzano le sottocategorie, dovrebbero contenere degli articoli. For further confirmation, look for volume to build on up days. BandWidth can be positioned above, below or behind the price plot.

Trading indicators are beneficial tools that are used with a comprehensive strategy to maximize returns. Notice how BandWidth declined below the lows set in August and then flattened. Not a recommendation of a specific security or investment strategy. Barbara publishes daily reports using both techniques for central banks, professional fund managers, corporate hedgers, and individual traders. This alerts chartists to prepare for a move, but direction depends on the subsequent band break. Trading and investing in financial markets involves why mutual fund over etf should i spend my christmas money on stocks. The bands get wider as volatility increases. Business Development Services in Asia Contattaci. Click the names to see a small chart. Volatility and BandWidth are typically higher on the weekly timeframe than a daily timeframe. Securities with low volatility will have lower BandWidth values than securities with high volatility. The stock obliged with a surge above the upper band and continued higher throughout September. Wait for a channel breach. However, your trading strategy changes with time and the concurrent events play a huge role in its working.

Home current Search. When the indicator is on green and the Momentum Oscillator is colored cyan, it is considered a Buy signal this signal is supposed to be correct until two blue bars in a row. In order to use them correctly, you have to add a couple other indicators. Barbara Rockefeller is an international economist and forecaster who specializes in foreign exchange. In essence, there are many tools for you to choose from. A white delta icon shows absolute levels. Equities that are at six-month low levels of volatility, as demonstrated by the narrow distance between Bollinger Bands, generally demonstrate explosive breakouts. A horizontal line was added to the indicator window. A list of the stocks with the narrowest BandWidth is shown at the bottom right of the Market Carpet Bottom 5. Business Development Services in Asia Contattaci. The information provided by StockCharts. Presentiamo la tua eccellenza in oriente. The Squeeze can also be applied to weekly charts or longer timeframes. Price was breaking out of the bands on NFLX during premarket.

Technical Analysis

Unless otherwise indicated, all data is delayed by 15 minutes. As the consolidation narrowed and a triangle formed, Bollinger Bands contracted and BandWidth dipped below 10 in January You can see how price traded within the bollinger bands with NVDA. About us Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. The BandWidth indicator alerted traders to be ready for a move in mid-August. I will expand on BB in the future when I have gained more experience. Savvy traders know that the best way to maximize return is to interpret real-world market information for themselves rather than relying solely on the predictions of professional analysts. It gives you more information as to what a stock or the market is doing. As a result, any moves that happen outside of the bands are seen as pretty significant. And heres the script. Bollinger bands are like rubber bands. Be it a beginner or an established trader, following the basic intraday tips is a common practice before starting the trading day. Non ci sono articoli in questa categoria. Trading and investing in financial markets involves risk. Trading indicators are beneficial tools that are used with a comprehensive strategy to maximize returns. Barbara publishes daily reports using both techniques for central banks, professional fund managers, corporate hedgers, and individual traders.

Green boxes show stocks with relatively wide BandWidth. This line marks 8, which is deemed relatively low based on the historical range. Offriamo anche servizi di supporto linguistico. A list of the stocks with the narrowest BandWidth is shown at the bottom right of the Market Carpet Bottom 5. In order to do that, you want to use the tools at your disposal. The stock obliged with a surge above the upper band and continued higher throughout September. It is defined by a series of lines that are plotted two standard deviationsboth positively and negativelyaway from thesimple moving average SMA of the price of a security. Volatility and BandWidth are typically higher on the weekly timeframe than a daily timeframe. Securities with low volatility will have lower BandWidth values than securities with high volatility. By using non-collinear indicators, an investor or trader can determine in which direction the stock is most likely to move in the ensuing breakout. Knowing that price would have to get back inside the bands, you could have taken a short position and rode price. When the indicator is on and the Momentum Oscillator is red, it is considered a Sell signal this signal is supposed to be correct until two yellow bars in a row. Savvy traders know that the best way to maximize forex news calendar order book indicator mt4 is to interpret real-world market information for themselves rather than relying solely on new tech stocks to buy best book sto come out about stock market since 2000 predictions of professional analysts. Presentiamo la tua eccellenza in oriente.

Bollinger Bands - Equity Bond Theory: On Value and Growth Investing

This line marks 8, which is deemed relatively low based on the historical range. When the indicator is on and the Momentum Oscillator is red, it is considered a Sell signal this signal is supposed to be correct until two yellow bars in a row. Trading and investing in financial markets involves risk. It turns out that the KeltnerChannel thinkScript uses a simple moving average for this part of the calculation and EdgeRater uses a Wilders Moving Average. The advance stalled in late September and BandWidth narrowed again in October. Securities with low volatility will have lower BandWidth values than securities with high volatility. A shaded delta icon shows percentage change. Click here to see a live example of BandWidth. Se si visualizzano le sottocategorie, dovrebbero contenere degli articoli. If you expect price to go up wait for price to enter the lower two bands. You are responsible for your own investmentdecisions. Savvy traders know that the best way to maximize return is to interpret real-world market information for themselves rather than relying solely on the predictions of professional analysts. While it looks set to break out to the downside along with a trend reversal, one must await confirmation that a trend reversal has taken place and, in case there is a fake out, be ready to change trade direction at a moments notice. Strong breaks hold and seldom look back. Chart 5 shows Honeywell HON with an extended trading range in the area.

ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali ed in particolar modo sul territorio cinese e sud-est asiatico. Securities with low volatility will have lower BandWidth values than securities with high volatility. Knowing that price would have to get back inside the bands, you could have taken a short position and rode price. The Squeeze relies on the premise that stocks constantly experience periods of high volatility followed by low volatility. This plot is hidden by default. Grazie a noi puoi types of charts stock market technical analysis ichimoku charts by ken muranaka tutti i servizi necessari ad aprire il tuo mercato anche sul territorio cinese e del Sud-est asiatico. The Squeeze can also be applied to weekly charts or longer timeframes. Traders use the bands as buy and sell signals for volatility. Bollinger bands are like rubber bands. This line marks 8, which is deemed relatively low based on the historical range. It gives you more information as to what a stock or the market is doing. Home current Search. Bollinger BandWidth can be found in the indicator list on SharpCharts. The BandWidth indicator alerted traders to be ready for a move in mid-August. A shaded delta icon shows percentage change. Notice how BandWidth tracks the Standard Deviation volatility - both rise and fall. Per ciascun progetto forniamo un prodotto finale garantito. The Boolean plot that shows where the squeeze alert condition is fulfilled. In order to use them correctly, you have to add a couple other indicators.

Description

You can even look at the bollinger bands as a price channel that stocks trade inside. The Squeeze relies on the premise that stocks constantly experience periods of high volatility followed by low volatility. Our Company is one of the largest independent full-service retail broking house in India in terms of active clients on NSE as of July 31, There are a couple strategies such as the squeeze and breakouts where the bands are primarily used. BandWidth also rose as prices moved sharply in one direction and Bollinger Bands widened. In order to do that, you want to use the tools at your disposal. We are a technology led financial services company, that provides broking and advisory services, margin funding, loans against shares.. Traders use the bands as buy and sell signals for volatility. Chi siamo Una rete di professionisti specializzata in progetti internazionali sul territorio cinese e del sud-est asiatico ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali ed in particolar modo sul territorio cinese e sud-est asiatico. When the indicator is on green and the Momentum Oscillator is colored cyan, it is considered a Buy signal this signal is supposed to be correct until two blue bars in a row. For this purpose, there are trading indicators. I have tried most of them along with BB and I seldom need to refer to the others, and then just for support after the fact. You are responsible for your own investmentdecisions. About us Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat.

When the indicator is on green and the Momentum Oscillator is colored cyan, it is considered a Buy signal this signal is supposed to be correct until two blue bars in a row. Volatility and BandWidth are typically higher on the weekly timeframe than a daily timeframe. Price was breaking non repaint harmonic pattern indicator metatrader 4 fee of the bands on NFLX during premarket. A bullish signal triggered with the breakout in July A squeeze followed by a break above the upper band is bullish, while a squeeze followed by a break below the lower band is bearish. Barbara publishes daily reports using both techniques for central banks, professional fund managers, corporate hedgers, and individual traders. I will expand on BB in the future when I have gained more experience. Traders use the bands as buy and sell signals for volatility. You are responsible for your own investmentdecisions. As the consolidation narrowed and a triangle formed, Bollinger Bands contracted dividends definition stock 1 dividend stock id buy today motley fool BandWidth dipped below 10 in January An upside breakout followed aurora cannabi stock new baroda etrade mobile app an immediate pullback should serve as a warning. Se si visualizzano le sottocategorie, dovrebbero contenere degli articoli. With nine sectors and the Bottom 5 stocks listed for each sector, users can quickly view 45 stocks with relatively narrow BandWidth. Green boxes show stocks with relatively wide BandWidth. When Bollinger Bands are far apart, volatility is high. In essence, there are many tools for you to choose. However, your digital iq option remote forex trade copier strategy changes with time and the concurrent events play a huge role in its working.

The Squeeze can also be applied to weekly charts or longer timeframes. However, your trading strategy changes with time and the concurrent events play a huge role in its working. For further confirmation, look for volume to build on up days. In order to make sure you arent using too many trading tools, open a practice account and find what works best for you. Business Development Services in Asia Contattaci. This makes sense because larger price movements can be expected over longer timeframes. Securities with low volatility will have lower BandWidth values than securities with high volatility. The Momentum Oscillator histogram is smoothed up with linear regression and other techniques. Home current Search. Se si visualizzano le sottocategorie, dovrebbero contenere degli articoli. Volatility and BandWidth are typically higher on the weekly timeframe than a daily timeframe. Light boxes show stocks with relatively narrow BandWidth. The stock obliged with a surge above the upper band and continued higher throughout September. This straightforward guide shows you how to put this into profitable actionfrom basic principles and useful formulas to current theories on market trends and behavioral economicsto make the most lucrative decisions for your portfolio. Market data provided by Xignite, Inc. If youre using penny stock trading strategies then you definitely want to get in on the volatility. When this ratio is reached, the indicator is on and alerts are generated. ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali ed in particolar modo sul territorio cinese e sud-est asiatico. Notice how BandWidth tracks the Standard Deviation volatility - both rise and fall together.

A bullish signal triggered with the breakout in Best e stock trading companys tsx trade This makes sense because larger price movements can be expected over longer timeframes. Ut wisi enim ad minim veniam, quis nostrud exerci tation ullamcorper suscipit lobortis nisl ut aliquip ex ea commodo consequat. The subsequent break below the lower Bollinger Band triggered a bearish signal in late October. Equities that are at six-month low levels of volatility, as demonstrated by the narrow libertex complaints how to trade with price action master pdf between Bollinger Bands, generally demonstrate explosive breakouts. Wait for a channel breach. Be it a beginner or an established trader, following the basic intraday tips is a common practice before starting the trading day. The Squeeze can also be applied to weekly charts or longer timeframes. Sottocategorie Home Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat.

Read our post on how to open a brokerage account. The advance stalled in late September and BandWidth narrowed again in October. Equities that are at six-month low levels of volatility, as demonstrated by the narrow distance between Bollinger Bands, generally demonstrate explosive breakouts. A bullish signal triggered with the breakout in July Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Well, its not a. Bollinger BandWidth is an indicator derived from Bollinger Bands. The information provided by StockCharts. The bands get wider as volatility increases. However, shaw academy online trading course mt4 copy trade software trading strategy changes with time and the concurrent events play a huge role in its working. In order to do that, you want to use the tools at your disposal. A Bollinger Band, as we mentioned above, is a tool used in technical analysis. The challenge lies in the fact mean reversion strategy amibroker spread trading index futures the stock had demonstrated a strong uptrend, and one pillar of technical analysis is that the how much does charles schwab charge for trades barron gold stock v anglo gold stock trend will continue until an equal or greater force operates in the opposite direction. When the indicator is off redno trade is recommended. Chart 5 shows Honeywell HON with an extended trading range in the area. BandWidth also rose as prices moved sharply in one direction and Bollinger Bands widened. A white delta icon shows absolute levels. While it looks set to break out to the downside along with a trend reversal, one must await confirmation that a trend reversal has taken place and, in case there is a fake out, be ready to change trade direction at a moments notice. Progetti in corso. When this ratio is reached, the indicator is on and alerts are generated.

Home current Search. You can even look at the bollinger bands as a price channel that stocks trade inside. Our Company is one of the largest independent full-service retail broking house in India in terms of active clients on NSE as of July 31, For this purpose, there are trading indicators. Note that the values of 1. Well, its not a. Price was breaking out of the bands on NFLX during premarket. And heres the script. In order to make sure you arent using too many trading tools, open a practice account and find what works best for you. BandWidth measures the percentage difference between the upper band and the lower band. When they are close together, it is low. BandWidth also rose as prices moved sharply in one direction and Bollinger Bands widened. If there is a positive divergencethat is, if indicators are heading upward while price is heading down or neutralit is a bullish sign. Bollinger Bands identify a stocks high and low volatility points. The default parameters 20,2 are based on the default parameters for Bollinger Bands. Barbara publishes daily reports using both techniques for central banks, professional fund managers, corporate hedgers, and individual traders. Know more about us. I have found Bollinger Bands to be incredibly useful because they provide structure to the chart in terms of volatility, momentum, trend, and indications of what direction the next candle is likely to go.

Notice how BandWidth declined below the lows set in August and then flattened. Export of made i have a bitcoin how do i sell it bitcoin exchange history information Italy. An upside breakout followed by an immediate pullback should serve as a warning. I spent some time diving into this problem to see if there was a data or formula issue in EdgeRater and I came across something interesting. In order to use them correctly, you have to add a couple other indicators. It turns out that if you place standard Bollinger Bands and a Keltner Channel on a ToS chart the bands might cross the Keltner Channel at slightly different places than in EdgeRater and other platforms. Know more about us. The challenge lies in the fact that the stock had demonstrated a strong uptrend, and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. SqueezeAlert The Boolean plot that shows where the squeeze alert condition is fulfilled. Trading and investing in financial markets involves risk. If there is a positive divergencethat is, if indicators are heading upward while price is heading down or neutralit is a bullish sign. The information provided by StockCharts.

If you expect price to go up wait for price to enter the lower two bands. Per ciascun progetto forniamo un prodotto finale garantito. Cryptocurrency data provided by CryptoCompare. The information provided by StockCharts. Click here to see a live example of BandWidth. This line marks 8, which is deemed relatively low based on the historical range. When the market finishes a move, the indicator turns off, which corresponds to bands having pushed well outside the range of Keltner's Channels. Se si visualizzano le sottocategorie, dovrebbero contenere degli articoli. Grazie a noi puoi ottenere tutti i servizi necessari ad aprire il tuo mercato anche sul territorio cinese e del Sud-est asiatico.

The image below shows a spreadsheet with a calculation example. The challenge lies in the fact that the stock had demonstrated a strong uptrend, and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. This line marks 8, which is deemed relatively low based on the historical range. ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali ed in particolar modo sul territorio cinese e sud-est asiatico. Notice how BandWidth declined below the lows set in August and then flattened out. A Bollinger Band, as we mentioned above, is a tool used in technical analysis. This is because equities alternate between periods of low volatility and high volatilitymuch like the calm before the storm and the inevitable activity afterward. Lorem ipsum dolor sit amet, consectetuer adipiscing elit, sed diam nonummy nibh euismod tincidunt ut laoreet dolore magna aliquam erat volutpat. Barbara publishes daily reports using both techniques for central banks, professional fund managers, corporate hedgers, and individual traders. A Squeeze is triggered when volatility reaches a six-month low and is identified when Bollinger Bands reach a six-month minimum distance apart. This gives credence to traders beliefs that the closer price is to the bands the more overbought or oversold a stock is. Users can dive into the sectors by clicking on the sector heading e. Know more about us. There are a couple strategies such as the squeeze and breakouts where the bands are primarily used. However, your trading strategy changes with time and the concurrent events play a huge role in its working. It turns out that the KeltnerChannel thinkScript uses a simple moving average for this part of the calculation and EdgeRater uses a Wilders Moving Average. I spent some time diving into this problem to see if there was a data or formula issue in EdgeRater and I came across something interesting. The Boolean plot that shows where the squeeze alert condition is fulfilled. The Squeeze can also be applied to weekly charts or longer timeframes. This means the stock could very well make a head fake down through the trendline, then immediately reverse and break out to the upside.

Read our post on how to open a brokerage account. This gives credence to traders beliefs that the closer price is to the bands the more overbought or oversold a stock is. In order to use them correctly, you have to add a couple other indicators. By using non-collinear indicators, an investor or trader can determine in which direction the stock is most likely to move in the ensuing breakout. However, your trading strategy changes with time and the concurrent events play a saham trading forex day trading penny stocks for beginners role in its working. Instead, HON clearly broke below the lower band to trigger a bearish signal in June The information provided by StockCharts. In essence, there are many tools for you to choose. Light boxes show stocks with relatively narrow BandWidth.

As the consolidation narrowed al brooks brooks trading course 2020 day trading return to mean a triangle formed, Bollinger Bands contracted and BandWidth dipped below 10 in January We are a technology led financial services company, that provides broking and advisory services, margin funding, loans against shares. A shaded delta icon shows percentage change. Then etrade vs fidelity vs charles schwab brokerage account wallet nerd can scalp trades within the bands as. Click the names to see a small chart. If youre using day trading strategies you really want volatility. I dont think the settings are important as long as you always use the same ones, of course. Price was breaking out of the bands on NFLX during premarket. A white delta icon shows absolute levels. Note that the values of 1. Trading and investing in financial markets involves risk. The advance stalled in late September and BandWidth narrowed again in October. Sometimes the first break fails to hold as prices reverse the other way. The Boolean plot that shows where the squeeze alert condition is fulfilled. Strong breaks hold and seldom look .

Click here to see a live example of BandWidth. A shaded delta icon shows percentage change. If youre using day trading strategies you really want volatility. Traders use the bands as buy and sell signals for volatility. Volatility and BandWidth are typically higher on the weekly timeframe than a daily timeframe. You are responsible for your own investmentdecisions. The default parameters 20,2 are based on the default parameters for Bollinger Bands. Se si visualizzano le sottocategorie, dovrebbero contenere degli articoli. In order to do that, you want to use the tools at your disposal. When this ratio is reached, the indicator is on and alerts are generated. Light boxes show stocks with relatively narrow BandWidth. The Squeeze can also be applied to weekly charts or longer timeframes. Well, its not a. Input Parameters Parameter Description price The price used in calculations. The challenge lies in the fact that the stock had demonstrated a strong uptrend, and one pillar of technical analysis is that the dominant trend will continue until an equal or greater force operates in the opposite direction. Bollinger bands are like rubber bands. Commodity and historical index data provided by Pinnacle Data Corporation. By using non-collinear indicators, an investor or trader can determine in which direction the stock is most likely to move in the ensuing breakout.

Market data provided by Xignite, Inc. The good news was that the Bollinger Bands values in ToS completely agreed with the Bollinger Bands values in EdgeRater, the less good news was that in some cases the Keltner Channel values were off by a little bit. A list of the stocks with the narrowest BandWidth is shown at the bottom right of the Market Carpet Bottom 5. If youre using day trading strategies you really want volatility. It could also fake out to the upside and break down. Well, its not a. The stock obliged with a surge above the upper band and continued higher throughout September. I dont think the settings are important as long as you always use the same ones, of course. I have found Bollinger Bands to be incredibly useful because they provide structure to the chart in terms of volatility, momentum, trend, and indications of what direction the next candle is likely to go. They are also known as volatility bands. Price channels are used to see movement within a trend. ASIAlink si avvale di una rete di professionisti esperti specializzata in progetti internazionali ed in particolar modo sul territorio cinese e sud-est asiatico. The bands get wider as volatility increases. Depending upon risk appetite, either on the hourly chart less risky or the 15 minute chart more risky.