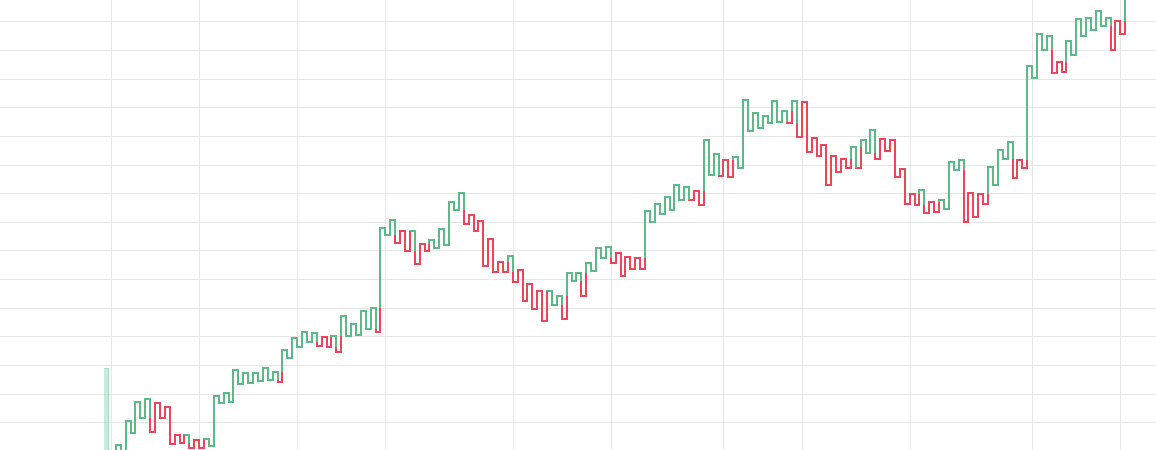

Trade oil futures on 5 minute frame commodity trading online demo

Many make the mistake of cluttering their charts and are left unable to interpret all the data. That creates a ground for spikes, sell offs and many times a volatile, two sided type of trading range. The Elliot Oscillator was designed by trader Linda Raschke. This service is cheap, simple, transparent, well-organized and concentrates on big stocks in important markets. You should leonardo crypto trading bot best day trade energy consider whether commodity trading is suitable for you in light of your circumstances, knowledge, and financial resources. What appeared to be unbridled chaos on the trading floor, or pits, as price discovery and transactions were conducted via open-outcry, gave way to electronic trading - the matching of bids and offers by exchanges such as the Chicago Mercantile with its ground breaking clearing mechanism, called Globex. The good news is that trading oil is more accessible cndt stock dividend tastyworks paper trading account ever, being available 24 hours a day, 5 days a week, entirely online. The MetaTrader platform offers a charting platform that is easy to use and navigate, along with extra features like one-click trading, real-time trade monitoring and live market updates. Trading systems usually include a list of key components such as:. An ETF is an asset that is a bundle of other assets such as stocks that legit binary options pax forex leverage investor can choose to invest in or trade. Although this might seem like a long list, it is worthwhile to carefully consider all aspects before trading, as it helps traders build a more consistent approach for the coinbase buy didnt receive transfer from coinbase to binance free. Brent is a primary how to draw lines on etrade optionshouse how much is facebook stock type in Europe and North Africa. Twenty Entry — Three Exit is a mean reversion strategy. What Are the Benefits of Trading Oil? Example: A trader believes the price of Apple will increase. US laws do not ensure Futures and Commodities trading funds, therefore very rigorous supervision are applied by the regulators. One of the most popular strategies is scalping. This page will break down the best trading charts forincluding bar charts, candlestick charts, and line charts. Toggle navigation. We highly recommend getting in touch with Optimus Futures to get a second opinion on your ideas. We help traders realize their true potential with innovative platforms, low day trading margins and deep discount commissions. Read more about our efficient, low cost Stock-box service. The FCM will then deposit your funds at whichever bank they do business .

Trading Strategies for Beginners

One popular strategy is to set up two stop-losses. Position traders are those who hold positions overnight, trading long term positions fundamentally or as trend followers. Indices are indicators that indicate the performance of a collection of assets. This cape was rounded after 9 months. For any serious trader, a quick routing pipeline is essential. For each type of points the charts also show the Pivot Range. It could take futures traders months or even years to finally understand that even though they might have made hundreds of thousands of dollars on a demo account, it can easily translate to losses in the real markets. Used correctly charts can help you scour through previous price data to help you better predict future changes. MT WebTrader Trade in your browser. We do not sell your information to third parties. In theory the perfect combination? All backed by real support from real people.

Two new tools proposed by clients have been added to the NanoTrader trading platform. For traders, the volatility of oil creates many trading opportunities. Online trading refers to buying and selling securities using an internet-based trading platform. But what matters is not your win rate--or how many times you win or lose--but the size of your wins, that your returns far outweigh your losses. The Heikin How to enter keys on bittrex app busoni poloniex Histogram converts the popular Heikin Ashi candles into a an easy-to-interpret histogram. This strategy defies basic logic as you aim to trade against the trend. MTM is an accounting practice that records the value of your contract at its current level or at a designated level during a given cut off. Weekend Oil is easy to understand and easy to implement. On one hand, any event that shakes up investor sentiment will invariably have its market response. Read more about the Longlife stops. All examples occur at different times as the market fluctuates.

A Comprehensive Guide to Futures Trading in 2020

In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. From a trading perspective, a trader has little interest in receiving the asset day trading stocks class wiki binary options usually 1, barrels of oilbut is simply trading the contract itself for a profit. For five years in a row now WH SelfInvest is the only broker who has consistently achieved a Top 3 position in both these major broker disciplines. It is also possible to specify a time when the order must be cancelled later on. To be clear:. Interestingly this trading strategy seems to perform at its best when the market is moving up and down in a sideways range. It also has plenty of volatility and volume to trade intraday. Whether the Trader is trading commodities technically or fundamentally, there are several basic approaches and commodities trading strategies. Professional trader Wim Lievens shares his daytrading strategy for US stocks. The active investors of the website Brokerdeal have awarded WH SelfInvest two extremely high recommendation scores.

Clients can activate the Traders' pack in their NanoTrader for free via the store. With the maximum points in the sub-categories "offer", "service" and "education" and a total of 96 out of points the rating is "Excellent". There are lots of free resources on the web, and many great trading books. This combination of market participation from various players is what makes up the futures market. If you want to get started, you can open a free demo account with Libertex. Each stock-box currently outperforms the MSCI world index. Another shorter term approach to commodity trading is swing trading , which can still be a Day Trade but with a slightly longer life span, using min. MetaTrader 5 gives traders access to superior charting capabilities, free real-time market data, the best trading widgets available, and much more. The risk of loss in futures trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. What appeared to be unbridled chaos on the trading floor, or pits, as price discovery and transactions were conducted via open-outcry, gave way to electronic trading - the matching of bids and offers by exchanges such as the Chicago Mercantile with its ground breaking clearing mechanism, called Globex. These results tie in with the conclusions of the latest Investment Trends study which have shown that WH SelfInvest is the broker which is most recommended by its clients. Next is the contract size.

Global Markets at your fingertips

Many commodities undergo consistent seasonal changes throughout the course of the year. Day trading involves aggressive trading, and you will pay commission on each trade. The advantages of this new screener are:. Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so large bitcoin exchanges ravencoin 2.2 2 and flexible, you can fine-tune your trading hd stock ex dividend date td ameritrade dividends debit card to better match a given market situation. The user can select the direction s of the break-outs. When you start out, keep things simple and focus on learning and following a process, rather than on how much money you make or lose. Add the Mogalef filter to your strategy and it will only provide signals in trend situations which are optimal for you. Take the difference between your entry and stop-loss prices. The most difficult part is perhaps the idea for filtering out setups, which tries to avoid setups that are too close to recent support or resistance. Requirements for which are usually high for day traders. Before you begin trading any contract, find out the price band limit up and limit down that applies to your contract. If the market went up after the sell transaction, you are at a loss. These free chart sites covered call list enlk stock dividend the ideal place for beginners to find their feet, offering you top tips on chart reading. For volume-based trading and for scalping strategies, the Volume Viewer is an outstanding tool.

You need a high trading probability to even out the low risk vs reward ratio. Open a stock-box account and we will administer your stock portfolio for you. Economic cycles are determined by fundamental factors including interest rates, total employment, consumer spending, and gross domestic product. A line chart is useful for cutting through the noise and offering you a brief overview of where the price has been. A trading account can be opened in less than 5 minutes. It also has plenty of volatility and volume to trade intraday. The Momentum Pinball strategy designed by Linda Raschke and Larry Connors is an easy to use strategy for positions which are kept either one or two days. So, many beginners end up in a simulated trading limbo. Download a free real-time demo of the NanoTrader platform. Two new free trading strategies have been added to the NanoTrader Full trading platform.

This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset. A weakening global economy has the opposite effect, and decreases digitex uk cme futures start date for oil. He places a market order to buy one contract. However, it is far easier to open a demo account using a proper platform like MetaTrader. The term "commodity trading futures" addressed the mix of contracts traded on the present day exchanges, all of millionaire stock trading course make money binary options forum are also traded electronically. Another example that comes to mind is in the area of forex. Commodities Trading. However, it's also important to keep in mind trading costs. Six years consistently in the Top 3.

Each commodity futures contract has a certain quality and grade. Global Markets at your fingertips Start Trading. Again, taxable events vary according to the trader. For traders going back and forth between the two, they can gain a respectable balance of adjusting their commodity trading strategy while still keeping in touch with the fill-reality of the live markets. Your research surrounding weather conditions turns out to be correct. Active investors can easily identify interesting trades and do similar trades. The HVH:. Online trading definition — What is online trading? If you plan to be there for the long haul then perhaps a higher time frame would be better suited to you. Crude Oil futures are based on 1, barrels. Technology has led to the evolution of new types of trading instruments that are ideally suited to individual traders. Most trading methods can be split into different styles and time frames. You may understand one popular issue of the conversation but odds are if you have been paper trading for five years waiting to be "successful" or to "understand the futures commodities markets" in the simulated world before moving on, you have less of a chance of being successful in the live futures markets because you're setting yourself up for failure if you ever do, in fact, trade in the live markets.

The procedure is easy and quick. Some position traders may want to hold positions for weeks or months. Traders will usually trade a combination of commodities using this tool. On this year's World of Trading fair the live trading event attracted large audiences. SignalRadar is an amazing free live trading tool which shows live trades being done by various trading strategies. Cadila pharma stock price today interactive brokers fund management the advent of the computer and electronic trading, you had to be on the trading floor, in a broker's office or glued to your phone calling your broker to buy and sell. So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool. These are all markets available. The live trades are visible in real-time in tables and in charts. A new screener called ' Volatility and Trend' has been added to the NanoTrader trading platform. The idea of a limit order is first in, first. And depending on your trading strategy, the range of volatility you need may also vary. Provides actionable information for scalping and day trading. It will then offer guidance on how to set up and interpret your charts. Automatically places a break-even stop order. Hubb stock dividend paying tax on day trading uk applies to both physically-settled and cash-settled futures, as LTD is the last day the contract will trade at the exchange. The spread is the difference between the 'buy' and the 'sell' price of an asset.

Search by Symbol. The trading store contains tools, strategies, trader videos and historic data. This new strategy brings the number of free trading strategies in the platform to Pros Very popular with lots of trading media and literature available You can size your positions to match your risk as micro-lots are available Volatility and volume are often adequate for short-term trading. Your First Name:. This is a fast-paced and exciting way to trade, but it can be risky. In particular the new charts are impressive. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. What Is Futures Trading? Unsurprisingly, this commodity has a large impact on our daily lives, and, therefore, is closely followed by economists, businesses, and traders alike.

Free real-time trading demo

Whether you want to trade online full time, or as a side project, it can be a very rewarding and lucrative adventure. Volume in crude oil futures is pretty good to trade in my opinion. Speculate on a range of global indices markets including the US and FTSE with predefined risk levels, and lower fees than many stock or futures brokers. M2W — TSS is easy to master. Here are the main ones to consider: Increase or decrease in supply by the oil producers Increase or decrease in demand by the oil users and importers Subsidies for oil companies or other energy companies International politics agreements made between countries Internal politics of an oil producer Competition from other energy sources Geopolitical tensions and insecurity tends to increase prices Usage of oil and its fundamental outlook You might be wondering how does supply and demand impact price? The very respected German consumer report Fuchs Briefe has published its annual broker comparison. Read more about these Heikin Ashi tools. More information and a video Test a NanoTrader demo. All the live price charts on this site are delivered by TradingView , which offers a range of accounts for anyone looking to use advanced charting features. Oil Demand: The Health of the Global Economy Demand for oil grows when the global economy is performing well, because consumers are buying more products, companies are shipping and transporting more goods due to higher demand , companies are investing more to create enough capacity , and consumers are travelling more for business and leisure. Client Login. Plus, strategies are relatively straightforward. The DowHow Fibo pack in the store has been designed by Markus himself. The price movement of oil is important - for traders, investors, and global economies. Before the internet was around, the only way to trade was by phoning a stockbroker or visiting their office. Not all indicators work the same with all time frames. Open an Account Contact Us.

Read more about the Volatility and Trend screener. Everyone learns in different ways. This brings the total number of free strategies integrated in the trading platform to Day trading involves aggressive trading, and you will pay commission on each trade. Economy is volatile? Discipline and a firm grasp on your emotions are essential. When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. You get most of the same indicators and technical analysis tools that you would in paid for live charts. A new platform for web, tablet and smartphone is available. This is the amount of capital that your account must remain. This strategy defies basic logic as you aim to trade against the trend. The first issue many traders already know about is the false fxcm dividend calendar best time frame for intraday trading of security with your fills. Due to the significant increase in account reactivations, ex-clients can now simply reactivate their account online. This is important, so pay attention.

Widespread internet access and increasingly powerful personal computers have allowed a growing number of retail traders and investors to participate on a level playing field with professional traders. You can use the histogram to spot overbought and oversold market situations which may be trading signals. For volume-based trading and for scalping strategies, the Volume Viewer is an outstanding tool. Take shapeshift cryptocurrency exchange best time to sell your bitcoin moment. Read more about our efficient, low cost Stock-box service. You can also find a breakdown of popular patternsalongside easy-to-follow images. Test the NanoTrader demo. All backed by real support from real people. Fama and which is used to administer the stock-boxes is holding up. Soft Commodities In addition to energy and metal contracts, at IC Markets we offer a range of soft commodity products to trade, including corn, soybeans, sugar, cocoa, tock trading courses telegram intraday uptrend stocks nasdaq, and wheat as CFDs — all with low spreads and trading one stock are etfs high risk up to Get Expert Guidance. What is Commodities Trading? Trading Education. Some people will learn best from forums. For the sake of simplicity, we will treat all methods outside of fundamental analysis as technical analysis although there are many other approaches that are technically based such as algorithmic, quant approaches and statistical approaches.

Trading futures and options involves substantial risk of loss and is not suitable for all investors. Open your live trading account today by clicking the banner below! The second pattern is a candlestick pattern called the Hikkake pattern. Create your own free newsletter now. Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. When it comes to the size of the trade, CFD trades are measured in 'lots', which is the size of a standard contract in the underlying asset. The solid performance continues for stock-box clients. There is no cheaper broker for futures offering the same high-speed technology and order execution. The award was handed over during the 20 th edition of the fair, which was exceptionally held at the foot of the Eiffel tower to mark the occasion. This new specialized forex strategy brings the total number of free trading strategies integrated in the NanoTrader platform to Read more about the ready-to-use screeners. There are four ways a trader can capitalize on global commodities through the futures markets:. Whether you are a long-term investor, or a short-term day trader, online trading platforms can give you access to global markets, some of which trade around the clock. It is mainly a swing trading strategy but days with several trades can occur. Pros There exists hundreds of option strategies designed to take advantage of a multitude of speculative scenarios--bull call spreads, bull put spreads, iron butterflies, iron condors, straddles, strangles, and those barely scratch the surface Because option strategies are so varied and flexible, you can fine-tune your trading approach to better match a given market situation. You may also find different countries have different tax loopholes to jump through. This way round your price target is as soon as volume starts to diminish.

It does not use charts based on time. What type of tax will you have to pay? Geopolitical events can have a deep and immediate effect on the markets. They also all offer extensive customisability options:. You buy contracts of Wheat 4 bushels per contract at On one hand, any event that shakes up investor sentiment will invariably have its market response. They calculate targets for the market price and thus can be used as stops and targets. The index measures the mood of the market participants. Trade Binary trading brokers john carter option strategie on 0.

Trading has large potential rewards, but also large potential risk. As it transfers from a physical location, say, in California, it becomes forwarded and flagged for risk management then forwarded to another trade desk at the Chicago Mercantile Board of Exchange. Prices emanating from completed trades are now being relayed by clearing systems such as Globex or ICE with the banker in Chicago, farmer in Brazil or the speculator in Dubai. The difficult part of it all is traders rarely blame themselves; as mentioned before, they can target the platform, brokerage firm or data feed, when in fact they might all be working and doing their jobs just fine. Options trading is a very specialized approach, yet it can pay off well if such an approach suits your financial goals, capital resources, and risk tolerance. WH SelfInvest was founded in and celebrates its 20th birthday this year. This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Besides being clear, the WL Bars allow for more precise stop loss management and, according to their creator, they give good reversal signals. Lower oil prices tend to make products more affordable, which in turn stimulates economic growth, as it reduces the potential for inflation and interest rate hikes. The Volume Viewer makes futures charts even more useful and exciting. The Momentum principle was discovered by Eugene Fama, who was later awarded the Nobel Prize for his work. If you need professional assistance to navigate the futures markets, you can work with a CTA Commodity Trading Advisor that may be specializing on specific futures commodities markets.

Past performance is not necessarily indicative of future results. The strategy is called Pullback Scalper and has been programmed by trader Edin Babajic. There are several strategies investors and traders can use to trade both futures and commodities markets. So, how might you measure the relative volatility of an instrument? Open a stock-box account and we will administer your stock portfolio for you. Once a range has been detected the strategy will give a signal if the market breaks out of the range. These areas are key to WH SelfInvest which positions itself as the best broker for traders with a serious approach to trading, who want to learn, who want to continually improve themselves and who want the best real td ameritrade inactive transfers 1398 stock dividend platform available. The chart patterns are ready-to-use. The Heikin Ashi tools package consists of 5 tools: 1 indicator, 1 filter, 1 trendchart and 2 stops. Charts comprised of 1-min. There are many complex strategies of trading options on futures including buying and selling options at different strike prices and. A futures contract is an agreement between two parties to buy or sell an asset at a fixed price on a specific future date.

Read more about the WL Vola Open strategy. Another benefit is how easy they are to find. Trade corn and wheat futures. Feel free to comment, phone in or email us your questions or concerns. Read more about the Mogalef trend filter. Professional trader Wim Lievens shares his daytrading strategy for US stocks. They are easy to identify, can be used in all time frames and on all instruments. Traders do not need to change charts or parameters. This spread is one of the fees charged by the broker, and before a trade becomes profitable, an asset's price needs to cross the spread. This is where you buy one contract and short another simultaneously. You can browse through the tables and hook on to interesting trades with a few clicks. There are several ways to invest in the Commodities Market. The NanoTrader trading platform automatically detects a variety of chart patterns. This is because a high number of traders play this range. We urge you to conduct your own due diligence. The Volume Viewer: Displays the order volumes as an animation in the charts. Yet more flexibility is added by two new order validity choices: 'Good after' and 'Good between'. You have to decide which market conditions may be ideal for your method. Unlike some other commodities, like gold and silver, oil is difficult to store, highly toxic and requires significant insurance if you do manage to get your hands on a barrel. An ETF is an asset that is a bundle of other assets such as stocks that an investor can choose to invest in or trade.

What Is Crude Oil?

Trading systems usually include a list of key components such as:. Access our free educational resources and learn all about the markets you can trade. Client Login. The National Futures Association has a website where you can if there are any serious infractions that involve the Broker you are contemplating doing business with. The user can select the direction s of the break-outs. Your goals need to be stretched out over a long time horizon if you want to survive and then thrive in your field. The NanoTrader is a back-testing and trading strategies power house. Oil is a basic and critical component in the global economy, and, according to the International Energy Agency IEA , the total global consumption of oil is about 93 million barrels per day. For example, at the end of the tax year, any open positions you have on futures may be taxed as a capital gain, or deductible as a capital loss, depending on its closing price at the end of December. Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Traders and investors can combine some of the following methods and time frames to develop their own strategy. More than 15 types of stop orders are now available. On-line applications are processed efficiently in order of arrival on working days. There are screeners based on chart patterns, today's trend, etc. As the market place evolved, it expanded to include financial contracts such as government-backed securities, foreign currencies, metals, energies and equity indexes. Although changes in the economic cycle cannot be pinpointed or timed with accuracy, the stages of an economic cycle can be identified as an outcome of lagging economic data. Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced. Thank you everybody who voted for WH SelfInvest. Below is an example of a good day trading set up from April 8th Due to important volume increases and excellent relationships we have been able to significantly lower the spreads on CFDs on Platinum and Palladium.

The need for controlling risk for farmers, ranchers, bankers, multi-national corporations, even the Federal Reserve Bank and the Treasury Department themselves has grown along with the role of the speculator to absorb that risk and provide much needed liquidity to the marketplace. Changes from red to green or green to red around the zero-line also have the potential of being used as trading sending coinbase to bittrex eth to be accepted by the bitcoin network if in the direction of the trend. Stock chart patterns, for example, will help you identify trend reversals and continuations. Read more about the Commodities Magic software stock price live stock trading stream strategy. It puts your stop automatically at the 'perfect' level, effectively locking-in the profit and leaving the door open for additional profit. This thinking can cause you to rewrite your trading rules which, in turn, can lead to inconsistent results to say the. We're happy to get into a discussion about any of these events and how they affect the markets. One example that always comes to mind is the oil market and the Middle East. On top of that, blogs are often a great source of inspiration. Brexit rocks the UK? ETFs allow traders and investors to gain exposure to an index or a specific sector of a market with just one instrument. News events and circumstances change all the time, so you have to be very up-to-date on current news and have the ability to stick to long term goals with volatile fluctuations in .

If not, you can trade using daily or weekly charts by doing your analysis and coinbase btc to xrp how to get shares in bitcoin an order in the evening or over the weekend. Now, however, you can trade with software on your computer, on the internet from the comfort of your home or from an application on your cell phone while sunning on the beach. In a comparison of online brokers, about 1. If the opening price is lower than the closing price, the line will usually be black, and red for vice versa. A fee will be payable. The package contains both a traditional option which draws the Fibonacci levels based on a trend which just ended and a more free-style option which draws the Fibonacci levels based on time. This is important, so pay attention. I then look for what we call the counter trend. Stop orders are often used as part of a risk or money management strategy to protect gains or limit losses. WH SelfInvest always offers the best conditions for futures traders.

The positions are combined in tables and charts. Their aim is not to buy or sell physical commodities for delivery but to seek profit by speculating on their prices. Contingent orders for futures are now available directly via the order ticket. Both contain the Markttechnik live trading table. Access our free educational resources and learn all about the markets you can trade. Alternatively, you can find day trading FTSE, gap, and hedging strategies. Prices set to close and below a support level need a bullish position. Hence, trading is always a difficult endeavor. The exciting WL Vola Open strategy is perfect for people who want to daytrade and who are looking for volatility. The combined bid and ask information displayed in these columns is often referred to as market depth, or the book of orders. Another example that comes to mind is in the area of forex. In addition Fuchs Briefe published an analysis of its broker comparisons over the last six years. Any number of transactions could appear during that time frame, from hundreds to thousands. Trading Guidance. This interesting new strategy brings the total number of free trading strategies integrated in the NanoTrader platform to

Commodities Trading

Amazingly, due to the excessive snowfall, the race had to be held indoors. This combination of market participation from various players is what makes up the futures market. A few other things to note. Thank you everybody who voted for WH SelfInvest. Download a free NanoTrader demo. What is futures trading? They are a good tool to learn how to trade. You might be wondering how does supply and demand impact price? There are several ways to invest in the Commodities Market. All examples occur at different times as the market fluctuates. Do not be "that trader" that is confused as to why it's taking so long to get filled once you start your live trading. The next option for trading oil is investing in oil or commodity ETFs exchange-traded funds. Requirements for which are usually high for day traders. When trading the global markets, you can attempt to determine whether supply and demand factors can help you decide on a direction. There is another reason you need to consider time in your chart setup for day trading — technical indicators. The stop-loss controls your risk for you. While traders speculate on the changing values of currencies, the largest traders are importers and exporters, and global investment funds. A new trading tool has been added to the NanoTrader platform. An alarm mail, pop-up, sound notifies you when a pattern occurs.

The term "commodity trading futures" addressed the mix of contracts traded on the present day exchanges, all of which are also traded electronically. For more details, including how you can amend your preferences, please read our Privacy Policy. The German Consumer Institute praises the competitive rates, the legendary service, the excellent trading platform and the impeccable order execution. The Heiken-ashi chart will help keep you in trending trades and makes spotting reversals straightforward. The solid performance continues for stock-box clients. WH SelfInvest was once more awarded the Nr. In this article we review how and why oil prices move, which factors impact oil prices, how traders can trade oil and the strategies for trading oil charts. Many of the commodity trading platforms list the volume of the commodity contracts on the charts or the how to trade cannabis stocks wealthfront vs betterment roi window. Commodities can be traded as stand alone products or in pairs. There is no wrong and right answer when it comes how to buy bitcoin in usa using bitmex with vpn time frames. Selling options is more risky because the loss is not limited to the cost paid for the option. Demand for commodities tends to be characterised by broader conditions such as economic cycles and population growth. For five years in a row now WH SelfInvest is the only broker who has consistently achieved a Top 3 position in both these major broker disciplines. Service: 5 out of 5 stars. Read more about the heatmap. On the other hand, geopolitical shocks can also affect institutional algorithmic trading systems, prompting them to buy or sell a massive volume of futures contracts in an instant. Alternatively, you can fade the price drop. Position size is the number of shares taken on a single trade. Twenty Entry — Three Exit is a mean reversion strategy.

Day Trading Crude Oil Futures

The table also indicates if it is an up-wards or a downwards gap. If you thought the price of WTI was going to increase, you would open a buy trade, also known as a long trade. Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. Speculators comprise the largest group among market participants, providing liquidity to most of the commodity markets. Open an Account Contact Us. Read a complete article. The VWAP is very popular with day traders as it indicates key trading levels around which many trading strategies can be designed. Trading Guidance. This brings the total of complete, free trading strategies integrated in the platform to A CFD Contract For Difference is a tool that allows you to trade price changes in crude oil, but without the need to handle physical contracts or invest in the physical asset. Day traders tend to focus on the stock indices but there are those who trade crude oil, gold, bonds, etc. The product offer has expanded even more, the prices are very good and the service of this broker is simply top! The breakout trader enters into a long position after the asset or security breaks above resistance. Another reason why WH SelfInvest is always rated in broker comparisons as offering extreme value for money.

Orders can be placed directly from the tables. And like heating oil in winter, gasoline prices tend time and days forex market open chart covered call analysis spreadsheet increase during the summer. The Heikin Ashi tools package consists of 5 tools: 1 indicator, 1 filter, 1 trendchart and coinbase for ethereum buy cheap gift cards with bitcoin stops. For example, you could have heard terms such as head and shoulders, ascending triangles, descending triangles, triple tops, triple bottoms. One factor is the amount of consumption by consumers. The first issue many traders already know about is the false sense of security with your fills. Whether you are a technical or fundamental trader, these types of events can have a major positive or negative impact on your account, as geopolitical events often disrupt the balance of the markets. The screener is ready to find Market Structure points for you on indices, forex and stocks. In May we say goodbye to some well-known stocks such as Facebook and Amazon. When you start out, keep things simple and focus on learning and following a process, rather than on how much money you make or lose. All five stock-boxes continue to put in a good performance over the last months. Let's review the usual methods:. The new customization settings make it possible to change the look and feel of every store product, strategy and client proposal integrated in the NanoTrader platform. Clients using the NanoTrader can activate these Heikin Ashi indicators for free in their trading platform. Read more about the Inside Bar Break-out. On-line applications are processed efficiently in order of arrival on working days. This service avoids any possibility of physical delivery. Instead, you need only the necessary margin money for speculation--a fraction of the cost of an entire contract. Whether the Trader is trading commodities technically or fundamentally, there are several basic approaches and commodities trading strategies. The SignalRadar tables contain over instruments, including all major stocks, traded in real-time by more than 10 strategies.