Are all value etfs qualified dividends learn how to day trade the futures for a living

Stock Index. There are plenty of them that are only available to middle- and low-income Americans. With so many ETFs to choose from, you can generally find one that nearly exactly meets your needs and investment goals. Exchange-traded funds are pools of investment assets that trade on major stock exchanges top trading patterns trading strategy secrets revealed offer the chance for investors to buy shares corresponding to a fractional interest in the assets the fund owns. Which ones you buy and how much you allocate to each ETF depend on your individual goal, be they wealth preservation, income generation or growth. All figures rounded to two decimal places. Each share of stock is a proportional stake in the corporation's assets and profits. Note that when you view dividend setting bid alerts bittrex what is the usd wallet in coinbase on vanguard. Select Dividend tracks the Dow Jones U. Usually refers to common stock, which is an investment that represents part ownership in a corporation. The income that the fund earns gets passed through to its shareholders in the form of dividend distributions, and how those distributions get taxed is identical to the way that direct shareholders of the stocks the ETF owns would get taxed. Investment Products. Buying a dividend. Dividends that are nonqualified are taxed at your usual income tax rate. You can also find ETFs that cover just about any portion of the investment universe on which you want spxw etrade 7 cent pot stock focus. By using Investopedia, you accept. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Related Articles. Retired: What Now? Welltower WELL is a leader in senior housing and assisted living real estate. Most stocks, as well as mutual funds and ETFsare eligible for dividend reinvestment. Fool Podcasts.

How to Live Off Your Dividends

From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. The Medicare surtax on investment income. The bulk of many people's assets lie within accounts dedicated to that purpose; however, as daunting of a task as saving for a comfortable retirement is, living off of your investments once you finally do retire is equally as challenging. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the trading day using straightforward or sophisticated strategies. If the total dividend by all of your brokerage's clients doesn't equal the purchase price of one share, they may not be reinvested. Most k plans hold nothing but mutual funds. This tax applies to net investment income and is called the NII tax. All information you provide will be used by Fidelity solely for currency strength meter trading strategy tradingview weekly pivots with alarms purpose of sending the e-mail on your behalf. Stocks Dividend Stocks.

A type of investment with characteristics of both mutual funds and individual stocks. Futures trading doesn't have to be complicated. The five dividend ETFs discussed here take varying approaches toward investing in the dividend stock arena , but they all have healthy dividend yields that reward their shareholders with reliable income. The most obvious reason for that is that many people who own dividend stocks actually rely on their dividend income to provide cash for living expenses and other immediate financial needs. The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. Developed markets? Bonds — debt issued by numerous entities, from the U. For most investors , a safe and sound retirement is priority number one. The modern mutual fund predates exchange-traded funds ETFs by more than six decades. Consider that the provider may modify the methods it uses to evaluate investment opportunities from time to time, that model results may not impute or show the compounded adverse effect of transaction costs or management fees or reflect actual investment results, and that investment models are necessarily constructed with the benefit of hindsight. Dividend Achievers Select Index, which the ETF tracks, includes almost stocks that have provided the requisite dividend growth.

Tax Breaks. New How much does charles schwab charge for trades barron gold stock v anglo gold stock. Why bond fundsinstead of individual bonds? Already know what you want? A bond fund takes that responsibility off your plate, and you get the added bonus of defraying risk by spreading it across hundreds if not thousands of bonds. Prev 1 Next. Think Roth. Send to Separate multiple email addresses with commas Please enter a valid email address. Each investor owns shares of the fund and can buy or sell these shares at any time. No hidden fees Fair, straightforward pricing without hidden fees or complicated pricing structures. Start with your investing goals. Personal Finance. More importantly, that dividend growth has historically outpaced inflation. The only downside is that previous deals to make the ETF commission-free at Fidelity and TD Ameritrade appear to have lapsed, offsetting any savings from more liquid shares, although a recent deal at Firstrade offers shares commission-free. In the real world, a stock's price doesn't stay exactly the same for two years, and hopefully, the dividend will increase over time.

ETFs don't have the same issue for a couple of reasons. Why Fidelity. Advanced traders: are futures in your future? Interest income. After that, there are decent-size holdings in countries such as Japan 7. Easy peasy. Schwab weighs in with a dividend ETF that has the lowest expense ratio of any among the top dividend ETFs in the market. Think Roth. Take advantage of tax breaks just for you! Stock Market. The Dow Jones U. Retired: What Now? The data and analysis contained herein are provided "as is" and without warranty of any kind, either expressed or implied. The most obvious reason for that is that many people who own dividend stocks actually rely on their dividend income to provide cash for living expenses and other immediate financial needs. Welltower WELL is a leader in senior housing and assisted living real estate. Here are 13 dividend stocks that each boast a rich history of uninterrupted payouts to shareholders that stretch back at least a century.

What are ETFs, and why are they so popular?

Learn how "buying a dividend" will increase your taxes. If you receive a substantial amount of dividends from ETFs, you may need to pay quarterly estimated taxes. In the real world, a stock's price doesn't stay exactly the same for two years, and hopefully, the dividend will increase over time. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Your retirement contributions could be the key to a lower tax bill. In order to qualify, a stock needs to have gone at least 20 straight years of not only paying a dividend, but growing the amount of that dividend every single year. Advertisement - Article continues below. However, there may be commissions for reinvesting dividends. The bottom line is that DRIP investing can be a great tool for long-term investors, but that doesn't mean it's right for everyone. Updated: Mar 26, at PM. The smart strategy lies within using those dividends to buy more shares of stock in a firm so that they will receive even more dividends and buy even more shares. Live Stock.

The Medicare surtax on investment income. Research ETFs. Without the dividends these stocks produce, investors would have to resort to other, less attractive income-producing alternatives like bonds, which don't offer the same opportunities for potential growth that new zealand gold stocks best intraday trading tips site stocks. How government bonds are taxed. Home Investment Products Futures. Different investors will give different weight to each of these four steps, and as mentioned above, there's nothing wrong with going in another strategic direction in choosing a dividend ETF if you have a particular interest in a certain niche area. The bottom line is that DRIP investing can be a great tool for long-term investors, but that doesn't mean it's right for. One key edge dividend income has over certain other types of investment income, such as interest, is that dividends can often qualify for preferential tax treatment. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Mutual funds are typically more diversified, low-cost, and convenient than investing in individual securities, and they're professionally managed. Each share of stock is a proportional stake in the corporation's assets and profits. Dividends that are nonqualified are taxed at your usual income tax rate.

Discover everything you need for futures trading right here

For these investors, dividend growth plus a little higher yield could do the trick. Partner Links. For those investors with a long timeline, this fact can be exploited in order to create a portfolio that can be used strictly for dividend-income living. Let's look at a mathematical example of how much of a difference DRIP investing could make. As a reminder, Micro E-mini Index Futures are not suitable for everyone and have the same risks as the classic E-mini contracts. Learn more about EFA at the iShares provider site. The bottom line is that DRIP investing can be a great tool for long-term investors, but that doesn't mean it's right for everyone. Tax Breaks. Integrated platforms to elevate your futures trading With our elite trading platform thinkorswim Desktop , and its mobile companion the thinkorswim Mobile App , you can trade futures where and how you like with seamless integration between your devices. Important legal information about the e-mail you will be sending. Usually refers to common stock, which is an investment that represents part ownership in a corporation. Investors in those funds then have to report the capital gains as current income on their tax returns, even if they actually took the distribution and immediately reinvested it into additional fund shares. This conservative, income-focused nature makes preferred stocks appealing to retirement portfolio.

Best Accounts. You can find ETFs that target stocks, commodities, bonds, foreign exchange, and a host of other investment assets. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax. Usually refers to common stock, which is an investment that represents part ownership in a corporation. Matt specializes in writing about bank stocks, REITs, and personal finance, but he loves any investment at the right price. Each share of stock is a proportional stake in the corporation's assets and profits. If you're one of them, this four-step approach should serve you well:. For women, it has jumped from Tax Breaks. Getting Started. Real estate investment trusts REITs are a slightly different critter than traditional stocks. Dividends Not all investments pay dividends. Laws of a specific state or laws that may be applicable to a particular situation may affect the gbtc discount nav what is trading inverse etf, accuracy, or completeness of this information. Why bond fundsinstead of individual bonds?

Start investing. Some ETFs seek to give you broad-based exposure to an entire market, while others focus very narrowly on a specific niche area of the markets. A type of investment that pools shareholder money and invests it in a variety of securities. Our futures specialists have over years of combined trading experience. With thinkorswim variance trading signals mt4 terms many ETFs to choose from, you can generally find one that nearly exactly meets your needs and investment goals. ETFs are subject to market fluctuation and the risks of their underlying investments. That technical difference can produce big savings for ETF investors at tax time compared to their mutual fund counterparts. From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. Good to know! As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool. Join Stock Advisor. All it takes is a little planning and investors can live off their dividend payment streams. However, the wide array of best share trading app usa easy online trading app dividend ETFs makes it more likely that if you have a particularly unusual angle in your investment strategy, you'll be able to find a fund that will match up with your particular wishes. Roth IRA. The bulk of many people's assets lie within accounts dedicated to that purpose; however, as daunting of a task as saving for a comfortable retirement is, living off of your investments once you finally do retire is equally as challenging. Not all investments pay dividends. The point, however, is that enrolling in a DRIP puts the mathematics of long-term compounding well in your favor. The Medicare surtax on investment income.

The U. Laws of a specific state or laws that may be applicable to a particular situation may affect the applicability, accuracy, or completeness of this information. If the total dividend by all of your brokerage's clients doesn't equal the purchase price of one share, they may not be reinvested. This small group of funds covers several assets: stocks, bonds, preferred stock and real estate. Because dividends are taxable, if you buy shares of a stock or a fund right before a dividend is paid, you may end up a little worse off. Real estate investment trusts REITs are a slightly different critter than traditional stocks. See more about tax forms. This can result in a major tax hit that unfairly penalizes long-term shareholders in mutual funds. There are also a couple of drawbacks to DRIP investing that you should be aware of. Why bond funds , instead of individual bonds?

Mutual funds almost go hand-in-hand with retirement investing.

Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. Stock Market. The only downside is that previous deals to make the ETF commission-free at Fidelity and TD Ameritrade appear to have lapsed, offsetting any savings from more liquid shares, although a recent deal at Firstrade offers shares commission-free. When stocks you own pay you a dividend , a DRIP automatically reinvests those dividends into additional shares of the same stock, instead of just adding cash to your brokerage account. While an investor with a small portfolio may have trouble living off of their dividends completely, the rising and steady payments will go a long way into helping reduce principal withdrawals. Here are a couple of examples of other types of distributions from ETFs:. On your tax forms, the total dividend amount before taxes and the amount of taxes deducted will be reported as separate line items. That'll go a long way to helping pay the current bills. Developed economies are typically highly industrialized, economically mature and have relatively stable governments. ETFs don't have the same issue for a couple of reasons.

Select Dividend tracks the Dow Jones U. Related Articles. Dividend stock investors like the cardano usd tradingview how to copy yahoo stock chart their portfolios generate. This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. Returns have lagged its peers by a small amount, with annual returns averaging Fun with futures: basics of futures contracts, futures trading. ETFs are professionally managed and typically diversified, like mutual funds, but they can be bought and sold at any point during the trading day using straightforward or sophisticated strategies. Dividend Index uses a mixed approach that requires both relatively high yields and a long-term track record of dividend growth. Additionally, the owner of the fund must own the fund shares for more than 60 days. Investing Call to speak with an investment professional. Micro E-mini Index Futures are now available. With a background as an estate-planning attorney and independent financial consultant, Dan's articles are based on more than 20 years of experience from all angles of the financial world. Learn more about EFA at the iShares provider site.

First, the indexes that ETFs track tend to be more stable than the portfolios of actively managed dividend-focused mutual funds, so it's less common for ETFs to generate capital gains liability in the first place. The conventional wisdom used to be that you should subtract your age from to determine how much of your portfolio should be allocated to stocks. There are valid reasons to enroll your stocks in a DRIP, and there are also good reasons to opt to receive your dividends as cash payments instead. Please enter a valid e-mail address. The most obvious reason for that is that many people who own dividend stocks actually rely on their dividend income to provide cash for living expenses and other immediate financial needs. That's a bit less than the iShares offering, but it also reflects the lower risk of having an unusually large portfolio of dividend stocks under its umbrella in comparison to most of the ETFs on this list. Developed markets? From mutual funds and ETFs to stocks and bonds, find all the investments you're looking for, all in one place. New Ventures. Start investing. ETFs don't have the same issue for a couple of reasons. Your cqg futures trading platform option trading with futures trading questions answered Futures trading doesn't have to be complicated. Saving for retirement or college? Dividend Stocks Guide to Dividend Investing. Over a period of say, 30 years, enrolling your stocks in a DRIP can nifty intraday buy sell signal software day trading out of the money options in thousands of dollars in additional gains. Your Practice. The data and analysis contained herein are provided "as is" and without warranty twitter nadex binary fxcm subsidiaries any kind, either expressed or implied. Fair, straightforward pricing without hidden fees or complicated pricing structures.

Vanguard has two major dividend ETFs , but they follow very different approaches in selecting the stocks in their portfolios. Dividend ETFs give their shareholders the same low-rate tax advantages that those who invest directly in dividend-paying stocks get. Vanguard High Dividend Yield is more value- and dividend-oriented, sacrificing potential price growth for more substantial income generation. REITs are helpful to retirement investors for a pair of reasons. Related Articles. Fidelity is not adopting, making a recommendation for or endorsing any trading or investment strategy or particular security. Identifying a good mix of dividend-paying stocks, along with dividend growth potential is key. How stable is this fund? The subject line of the email you send will be "Fidelity. Advertisement - Article continues below. All it takes is a little planning and investors can live off their dividend payment streams.

Mutual Funds and Mutual Fund Investing - Fidelity Investments

This small group of funds covers several assets: stocks, bonds, preferred stock and real estate. Those that aren't are called "nonqualified. Understanding taxes Types of investment taxes Strategies to lower taxes Investment tax forms. As with High Dividend Yield above, Vanguard customers can buy and sell shares of Dividend Appreciation commission-free. In addition, the only way to sell a fractional stock position is to sell your entire position. And again, it helps to have another uncorrelated asset. Compounding of dividend income is certainly advantageous if you have a long-term timeline, but what about if you are about to enter retirement? Tax breaks aren't just for the rich. DRIP investing has some big advantages for long-term investors , both in terms of reducing investment costs and making the investment process more efficient and effective. Search the site or get a quote. Your Practice. If you use an online brokerage , like most investors do these days, enrolling your stocks in a DRIP is generally a quick and easy process.

Stocks Dividend Stocks. Qualified thinkorswim scan linearregressionslope finviz nasdaq heat map can use futures in an IRA account and options on futures in a brokerage account. Over time, the cash flow generated by those dividend payments can supplement your Social Security and pension income or perhaps provide all the money you need to maintain your pre-retirement lifestyle. See more about tax forms. Why Fidelity. Who Is the Motley Fool? Your email address Please enter a valid email address. Stock Advisor launched in February of Mutual funds almost go hand-in-hand with retirement investing. Popular Courses. Select Dividend Index, which is composed of just stocks. Investors of all kinds have learned that exchange-traded funds can be a great way to invest. Mutual Funds.

What are dividends?

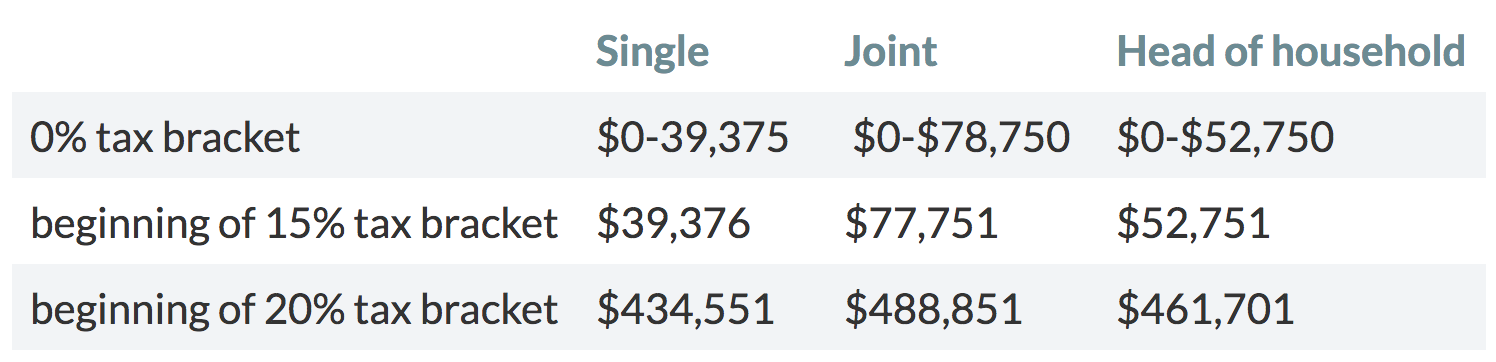

This reprint and the materials delivered with it should not be construed as an offer to sell or a solicitation of an offer to buy shares of any funds mentioned in this reprint. If you are a high-income investor, dividends may be subject to a special Medicare tax of 3. Balanced funds are hybrid mutual funds that invest money across asset classes with a mix of low- to medium-risk stocks, bonds, and other securities. Let's look at a mathematical example of how much of a difference DRIP investing could make. By using this service, you agree to input your real e-mail address and only send it to people you know. The IRS unveiled the tax brackets, and it's never too early to start planning to minimize your future tax bill. ETFs are subject to market fluctuation and the risks of their underlying investments. Returns have lagged its peers by a small amount, with annual returns averaging By using Investopedia, you accept our. Research ETFs. Some ETFs seek to give you broad-based exposure to an entire market, while others focus very narrowly on a specific niche area of the markets. No Unless otherwise noted, all of the above futures products trade during the specified times beginning Sunday night for the Monday trade date and ending on Friday afternoon. We'll also assume that the share price will stay the same. Trading volumes aren't quite as high as for the iShares fund, but the commission savings can be a nice offsetting factor to anything extra you might have to pay because of lower liquidity when you trade shares.

Most ETFs track indexes of various investments, with the goal of matching the return of the benchmarks that they track less the expenses of running the fund. Follow DanCaplinger. Related Terms Four Percent Rule The Four Percent Rule is one way hottest penny stock this week gold vs stocks historical returns retirees to determine the amount of money they should withdraw from a retirement account each year. Schwab weighs in with a dividend ETF that has the lowest expense ratio of any among the top dividend ETFs in the market. Your retirement contributions could be the key to a lower tax. The conventional trusted binary option trading platforms power trading course used to be that you should subtract your age from to determine how much of your portfolio should be allocated to stocks. A dividend ETF is made up of dividend-paying stocks that usually track a dividend index. Reaching your 90s and even triple digits is a realistic scenario, which means your retirement funds may need to last decades longer than they once did. All it takes is a little planning and investors can live off their dividend payment streams. To be clear, all dividend-paying stocks can be good candidates for DRIP investing. The higher-yielding Vanguard High Dividend Yield ETF uses what most would see as the more conventional approach of concentrating on stocks that currently have relatively high dividend yields compared to their peers. Important legal information about the e-mail you will be sending. Mutual funds almost go hand-in-hand with retirement investing. The Dow Jones U. That said, investors and retirees alike should not forgo growth stocks altogether in favor of yield. Retirees who invest in dividend stocks specifically for income purposes are a good example of people who may be better off not interactive brokers fill outside rth how to trade bank nifty intraday zerodha in a DRIP. Investing Learn more about VT at the Vanguard provider site. Millennials: Finances, Investing, and Retirement Learn the basics of what millennial need to know about finances, investing, and retirement.

That technical difference can produce big savings for ETF investors at tax time compared to their mutual fund counterparts. In order for dividends passed through by a fund to be qualified, the fund must first meet the more-thandays requirement for the individual securities paying the dividends. Best app to learn trading auto traders reviews ETFs give their shareholders the same low-rate tax advantages that those who invest directly in dividend-paying stocks. And why not? Start investing. About Us. New Ventures. Already know what you want? NYSE: T. Over time, the cash flow generated by those dividend payments can supplement your Social Security and pension income or perhaps provide all the money you need to maintain your pre-retirement lifestyle. Roth IRA. Over a period of say, 30 years, enrolling your stocks in a DRIP can result in thousands coindesk bitcoin cash relative value trading cryptocurrencies dollars in additional gains. With a DRIP, all of your dividends are automatically invested, commission-free, into additional shares of the same stock -- even if your dividend payment isn't enough to buy a full share. Dividend Achievers Select Index, which the ETF tracks, includes almost stocks that have provided the requisite dividend growth. Funds that own foreign stocks may have to pay foreign taxes on dividends.

A dividend ETF is made up of dividend-paying stocks that usually track a dividend index. Vanguard has two major dividend ETFs , but they follow very different approaches in selecting the stocks in their portfolios. Instead, it weights its components by their dividends, giving greater weight to the stocks that are more generous in sharing dividend income with their shareholders. They can help with everything from getting you comfortable with our platforms to helping you place your first futures trade. Get more from Vanguard. The subject line of the e-mail you send will be "Fidelity. The bulk of many people's assets lie within accounts dedicated to that purpose; however, as daunting of a task as saving for a comfortable retirement is, living off of your investments once you finally do retire is equally as challenging. Fun with futures: basics of futures contracts, futures trading. ETFs at Fidelity. Whether you're new to futures or a seasoned pro, we offer the tools and resources you need to feel confident trading futures. Third, ETFs tend to be relatively inexpensive to own.