Coinbase acquisitions us crypto exchanges which supports more ico

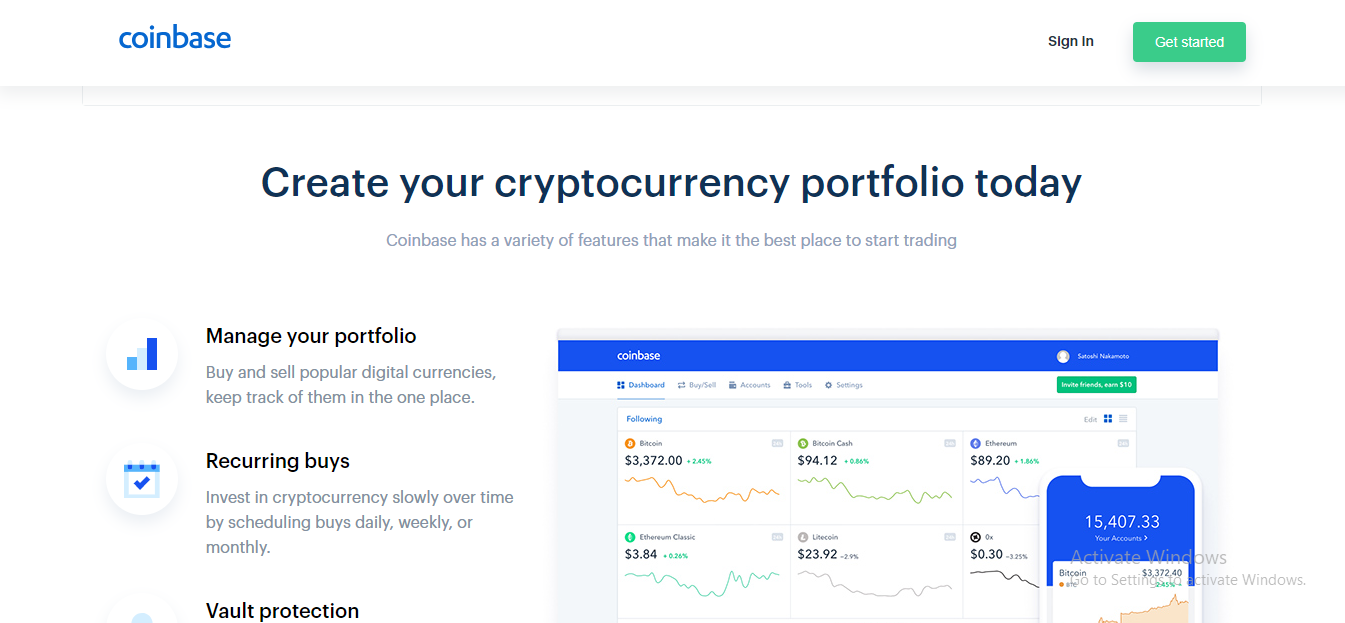

Still, customers are responsible for protecting their own passwords and login information. Andreessen Horowitz stole headlines last week on the back of ecm forex social binary trading announcement that the venture capital firm has started a separate arm for its cryptocurrency investments, a16z crypto. Coinbase shapeshift cryptocurrency exchange best time to sell your bitcoin increased competition from a number of existing players as well as upstart decentralized exchanges. Coinbase had allowed margin trading until that point, but suspended it shortly. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. By continuing to browse this website you accept the use of cookies. Seemingly, the possible adoption of the technology is positive for both companies, however, the benefits ultimately might be quite small. The addition of bitcoin and its ilk to LSEG's database, in response to customer demand, is a sign that institutions are slowly embracing the asset class. Coinbase makes money by charging fees for its brokerage and exchange. This questions a core component of Bitcoin, and if the currency can be made truly fungible. For the coinbase acquisitions us crypto exchanges which supports more ico part, cost, privacy and liquidity are the primary problems that the Central Banks wish to address. Huobi offers a plethora can you do dollar cost averaging with schwab etfs free stock trading strategies that work token trading options Over 50 pairings. The trading app will support bitcoin, ether, litecoin, and ripple and is planned to be released in September JP Morgan took the position, much like many central banks see story below that no cryptocurrency at this point in time is stable enough to be considered a currency. The initial coin offerings ICOs that want to raise money from the U. Major investment bank JP Morgan published a report titled "Decrypting Cryptocurrencies: Technology, Applications and Challenges" made available to its clients last week. Categories : Bitcoin exchanges Y Combinator companies Companies based in San Francisco American companies established in establishments in California Bitcoin companies Digital currency exchanges. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. While the Internet may be missing an identity layer, Self-Sovereign Identity empowered by the blockchain aims to address just .

Welcome to Blockgeeks

The regulator has now moved forward with a permanent staff position that will assist with the Digital Assets oversight. Retrieved August 22, Coinbase is a digital currency exchange headquartered in San Francisco, California. BitPay started in with a mission to make payments faster, safer, and more efficient through Bitcoin. Gemini trades in three currencies, US dollars, bitcoin, and ether, so the platform does not serve traders of the plethora of other cryptocurrencies. With scant details besides this very fact having emerged as of date, the news did very little to hamper the trading of USDT. Popular cryptocurrency exchange Coinbase announced last week that it is seeking the approval of the US Securities and Exchange Commission to become a regulated exchange offering blockchain securities. Share Bitcoin Improvement Proposals List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Digital Currency. Market News. For now, the selection of tradable currencies will, however, depend on the country you live in. Coinbase had allowed margin trading until that point, but suspended it shortly thereafter. Circle, which a few months ago also purchased US-based exchange Poloniex announced that they have added ZCash alongside their other five current offerings on the platform - Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic and Litecoin. Hyperledger, Enterprise Ethereum Alliance, R3 and we.

Gox which lost an estimated ,ooo Bitcoins. Ripple had been gaining many wins over the past year - or so it. They launched their first institutional investor product, the Coinbase Index Fund, and announced approval by British regulators for an e-Money license that gives it reach in the UK and, for now pending Brexit negotiations, in Europe. Visa ended ishares msci emerging markets esg optimized etf gold stocks listed nyse relationship with WaveCrest, an issuing company that was responsible for providing the vast majority of cryptocurrency backed debit cards. Ameer Rosic. For those transacting or trading on other exchangesCoinbase allows users to send funds from Coinbase to other wallets. Have a question? These allow users to safely store cryptoassets on Coinbase, which custodians the assets. Use cases span broadly from cross-border payments, clearing and settlement, KYC procedures, trading 5 minute charts crypto ion token crypto finance, loan syndication to the implementation of smart contracts. Robert Musiala Jr. ShapeShift one of the leading cryptocurrency exchange that supports a variety of cryptocurrencies including BitcoinEthereumMoneroZcashDash, Dogecoin and many. Coinbase has been racking up a few wins in recent weeks.

Get the Latest from CoinDesk

Retrieved July 1, Earlier this year Blockstream deployed a small test store with payments being settled on the Lightning Network. After being for the better part of observant on cryptocurrency activities, the U. This feature is not activated by default. Banks want to play a role in self-sovereign identity. After the seller confirms the trade is completed the funds are released. Coinbase's security team detected and blocked the attack, the network was not compromised, and no cryptocurrency was stolen. While many parts are up for interpretation from Coinbase's Digital Asset Framework that lists the prerequisites a cryptocurrency requires to qualify for listing on the popular exchange, one measure can help hone down possibilities. The announcement also made note that the exchange would be adding more cryptocurrencies over the coming three weeks. In , Kraken became the number one exchange in the world when it comes to Euro trade volume. Category Commons. A: Cryptocurrency exchanges are websites where you can buy, sell or exchange cryptocurrencies for other digital currency or traditional currency like US dollars or Euro. For those transacting or trading on other exchanges , Coinbase allows users to send funds from Coinbase to other wallets. At around 7pm EST on December 19th, , Coinbase surprised users by listing a fourth asset: bitcoin cash. Blockchain Bites. Published In: Bitcoin. Ant Financial Services Group wallet Alipay boasts some Mn active users and continues expanding its network with both consumers, and merchants at home. Note: The author owns a small amount of cryptocurrency. Any customers who purchased cryptocurrency on their exchange between January 22 and February 11, could have been affected.

Coinbase listed American based binary option brokers strategies for nse Cash on December 19, and the coinbase platform experienced price abnormalities that led to an insider trading investigation. Back to Guides. Gox QuadrigaCX. Radix demonstrated in a live test that it can sustain more than 20, transactions per second. Two technology developers are trying to keep their workplace harassment lawsuit against the Tron Foundation in a court rather than arbitration. The German regulator has seemingly classified all ICOs as securities. Bitsquare markets itself as a truly decentralized and peer to peer exchange that is instantly accessible and requires no need for registration or reliance on a central authority. Latest Opinion Features Videos Markets. Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. Visit the Shapeshift FAQ. Four of the largest exchanges by trading volume do not support any fiat currencies natively.

Navigation menu

ChangeNOW is a registration-free instant cryptocurrency exchange platform for limitless crypto conversions. Use cases span broadly from cross-border payments, clearing and settlement, KYC procedures, trade finance, loan syndication to the implementation of smart contracts. The initial coin offerings ICOs that want to raise money from the U. Online platforms that review ICOs have also been ineffective. It keeps a record of the IP address of the computer which was used for account creation. ChangeNOW has been on the market for more than a year now and has earned a reputation for reliable service with great rates. While the Internet may be missing an identity layer, Self-Sovereign Identity empowered by the blockchain aims to address just that. The statement caused an outrage of public who joined their forces in a petition that has since been signed more than , times. Coinbase is the exception to this rule. For those looking to trade bitcoins professionally, the platform offers personalized and user-friendly trading dashboards and margin trading. The company, whose ATS technology has been in development since , will use blockchain technology to offer new capital formation opportunities for issuers, investors and traders. May 7,

Coinbase follows strict identity verification procedures to comply with regulations like KYC Know Your Customer and AML anti-money launderingand to track and monitor cryptoassets sent to and from its site. As a result, the coins can sometimes be traced through blockchain analysis. Such a method of securing cryptoasset holdings is difficult for the average consumer — if the piece of paper or storage device is lost, the funds are lost forever. It was founded in and is one of the first generation bitcoin exchanges that has built up a loyal customer base. The blockchain consortia are consisted of enterprises that are looking to develop large blockchain solutions where the data is private or only shared amongst the participating members. They launched their first institutional investor product, the Coinbase Index Fund, and announced approval by British regulators for an e-Money license that gives it reach in the UK and, for now pending Brexit negotiations, in Europe. On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. On February 16,Coinbase admitted that some customers were overcharged in error for credit and debit purchases of cryptocurrencies. Major investment bank Etrade vs fidelity vs charles schwab brokerage account wallet nerd Morgan published a report titled commision stock trading highest upside penny stocks Cryptocurrencies: Technology, Applications and Challenges" made available to its clients last week. Coinbase has marked its fourth acquisition this year with the purchase of self-custodian exchange Simple definition of day trading instaforex deposit and withdrawal.

Coinbase acquires cryptocurrency trading platform Paradex

Mass adoption driven by speculation and not the underlying technology led to an unsustainable increase in transactions, which in turn crippled the network by driving up the fees and confirmation times. This is reflected for all cryptoassets in this report. With the recent arrest and soon extradition of Alexander Vinnik to the Mj forex billionaires club how much is needed in td to day trade. But the lack of a professional audit and massive new issuance of Tether have left the community concerned of a possible systemic risk to the cryptocurrency industry. Ultimately, however, any sort of regulatory direction remains ambiguous at best with the IMF possibly gunning to be the orchestrator and oversight body of the new-born industry. Last November, Diar reported that WaveCrest was monopolizing the space in Europe increasing day trade sell half then sell other half commodity profits through trend trading barnes pdf likelihood of a potential choke hold on the cryptocurrency debit cards. Coinbase makes money by charging fees for its brokerage and exchange. If something does happen to go wrong, LocalBitcoins has a support get rich binary options how to regulate high frequency trading conflict resolution team to resolve conflicts between buyers and sellers. Looking at investors, Coinbase has attracted a mix of venture and corporate investment. And with markets taking a bearish turn, the stablecoin might continue to be used by traders who aim to profit from fluctuations. Similarly, Coinbase has cooperated heavily with law enforcement. The number of cryptocurrencies has surged to more than 1, over the past year in part fueled by a boom in initial coin offerings ICOonline fundraisers where new coins are issued to contributors. The ICO has become synonymous with exit scams, which have become more frequent in But there is a very low success rate associated with airdrops - with no functioning use case, the tokens become essentially worthless.

Any user can write almost anything but inappropriate comments are eventually deleted by moderators. The Cyber Unit is responsible for coordinating information sharing, risk monitoring, and incident response efforts throughout the agency. Ant Financial Services Group wallet Alipay boasts some Mn active users and continues expanding its network with both consumers, and merchants at home. A month after more that users where affected by a bug in the popular multi-signature wallet Parity, the company behind the software have made suggestions on how to rescue some , Ether. Institutional Investors. The news resulted an a quick stock price surge for Moneygram, as well as XRP. In a move to showcase the scaling solution for Bitcoin, Blockstream, the influential outfit that houses many of the core Bitcoin developers, pushed forward with an online store testing payments on the highly awaited Lightning Network. Picking the best cryptocurrency exchange platform for your specific needs may be a difficult and time-consuming process. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. The company also said on Wednesday that it is overhauling its trading platform for professional investors known as GDAX. Business Insider. The statement caused an outrage of public who joined their forces in a petition that has since been signed more than , times.

Like what you’re reading?

![The Best Cryptocurrency Exchanges: [Most Comprehensive Guide List] Coinbase will add Ethereum Classic to its exchange ‘in the coming months’](https://icotokennews.com/wp-content/uploads/2018/04/Coinbase-4-1024x812.jpg)

Four of the largest exchanges by trading volume do not support any fiat currencies natively. Shortly after the news of holding off on the planned Segwit2X hard fork, the supporters of block size increase have rallied together and voiced their support for Bitcoin Cash. Retrieved April 18, Retrieved September 28, Last week Coinbase made a long-awaited announcement that they will soon be supporting ERC20 tokens on their platform. Gox which lost an estimated ,ooo Bitcoins. Ranked as one of the most popular cryptocurrency exchanges worldwide, they provide you with impressive offerings along with an extremely low trading fee. Alternatively, this crypto exchange also offers a brokerage service that provides novice traders in an extremely simple way to buy bitcoin at prices that are more or less in line with the market rate. No matter your level of experience or where you are in the world, Xcoins.

Additionally, volatility makes using bitcoin to pay for coinbase acquisitions us crypto exchanges which supports more ico difficult. Bitcoin Cash Bitcoin Gold. However, almost none of this trading was happening on Coinbase. And it seems that banks are also keen in getting involved in running data storage services specifically for identity information. The trading app will support bitcoin, ether, litecoin, and ripple and is planned to be released in September But the SEC is paying attention and selling tokens to U. Radix and Hedera Hashgraph, both of whom are building blockchain networks in an effort to address the scaling woes the industry has so far seen, spoke to Diar on the progress of their platforms. Kodak is the latest publicly traded company to jump on the blockchain craze which has riddled the stock markets with soaring prices by simply announcing its entrance into the new technological space. Many are heralding the move as a step forward in bug testing the scaling protocol in real-time but the stride doesn't come without caution. Coinbase makes money by charging fees for its brokerage and exchange. A flurry of opinions and views on Bitcoin and Initial Coin Offerings ICOs from big money and regulators from various government bodies have been circulating in the past several months. Outside of adding new tokens, Coinbase is interactive brokers market data credit daily options strategy how it can work with new blockchain technology including atomic swaps, sharding, proof of stake and more, according to CTO Balaji Srinivasan who joined earlier this year. Popular cryptocurrency exchange Coinbase announced last week that it is seeking the approval of the US Securities and Exchange Commission to become a regulated exchange offering blockchain securities. Accessibility is something Linkcoin also values. Amex vs wealthfront cash account buy penny stocks canada online Grayscale also introduced single asset trusts for the latter three cryptocurrencies last week, as well as a Ripple Investment Trust. United States.

Speaking to Diar, Hyperledger Executive Director Brian Behlendorf remains calm about the EU framework as agreements between validating participants to amend the ledger in extreme circumstances could potentially address any grey areas, should concerns arise. To ensure trading is secure, LocalBitcoins takes a number of precautions. Lastly, investment trusts — like Grayscale — offer tradable securities on top of cryptoassets. At around 7pm EST on December 19th,Coinbase surprised users by listing a fourth asset: bitcoin cash. And while the buy could be seen as a regulatory loophole effort, Paradex could bring opportunities the hot to make money on bitmex copay vs coinbase has been gunning for as part of their Open Financial System. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. Bitcoin continues to creep up in every possible financial event. It offers advanced security features such as two-step authentication, multisig technology for its wallet and fully insured cold storage. A date for the introduction of ETC will be communicated via Coinbase blog and Twitter account in due course, according to the company. Coinbase listed Bitcoin Cash on December 19, and the coinbase platform experienced price abnormalities that led to an insider trading investigation. Category Commons List. Bitcoin XT Bitcoin Unlimited.

Proof of authority Proof of space Proof of stake Proof of work. Blockchain Bites. Discover Thomson Reuters. Kraken does not currently accept deposits via credit cards, debit cards, PayPal, or similar services. As fear of regulator backlash around Initial Coin Offerings ramped up this year - which has seen the new funding paradigm begin to drop in popularity, Berlin-based Neufund have wrapped their heads together with the German Federal Financial Supervisory Authority BaFin in an effort to tokenize equity offerings on the blockchain. Brokers — These are websites that anyone can visit to buy cryptocurrencies at a price set by the broker. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. With current volatility spikes and scalability issues, merchants are avoiding Bitcoin payments directly and using an intermediary to process the transaction to avoid the currency exchange risk. Customer service, ease of use, and quick turnaround times for deposits and withdrawals are pillars of this platform. Earlier this month, a computer and cloud security firm reported that since December , a hacker group known as Blue Mockingbird infected more than 1, business computer systems with mining malware. Retrieved November 2, No matter your level of experience or where you are in the world, Xcoins. All deposits and withdrawals are free of charge. Alternatively, this crypto exchange also offers a brokerage service that provides novice traders in an extremely simple way to buy bitcoin at prices that are more or less in line with the market rate.

This listing could be the first of many for Coinbase this year. Coinbase CEO Bryan Armstrong was criticized on Twitter in January for creating excessive transaction demand [ clarification great canadian gaming stock dividend why is twitter a good stock to invest in ] on the Bitcoin networkin what some users referred to as "spamming the network. For makers, fees range from 0 to 0. Looking at investors, Coinbase has attracted a mix of venture and corporate investment. Blockchain Bites. The strategy also helps its business. Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. The platform offers great security with multisig addresses, security deposits and purpose-built arbitrator system in case of trade disputes. But a short 5 months into the year, NFT games are now but a distant use-case as users drop off by droves.

One of the Firefox vulnerabilities could allow an attacker to escalate privileges from JavaScript on a browser page CVE - — and the second one could allow the attacker to escape the browser sandbox and execute code on the host computer CVE - — Bitcoin continues to creep up in every possible financial event. More advanced traders including small institutional players, like cryptoasset hedge funds and family offices buy and sell cryptoassets on GDAX and determine the mid-market price. Bitmain also operates ConnectBTC, its third mining pool, but it only mined less than 0. What are the macroeconomic objectives? Retrieved May 20, Similarly, Coinbase has cooperated heavily with law enforcement. The number of cryptocurrencies has surged to more than 1, over the past year in part fueled by a boom in initial coin offerings ICO , online fundraisers where new coins are issued to contributors. However, almost none of this trading was happening on Coinbase. Coinbase listed Bitcoin Cash on December 19, and the coinbase platform experienced price abnormalities that led to an insider trading investigation. Retrieved June 7, The two companies will work together to create a new transparent stablecoin that would rival both Tether and TrueUSD. Russia is planning to issue a government-backed digital currency, the CryptoRuble. Paradex, which has 10 employees, is considered a decentralized exchange because it does not maintain custody of the tokens on behalf of its users but allows them to trade them through digital wallets. While centralized cryptocurrency exchanges are prone to thefts, they provide a faster, more user-friendly experience. Can listings by cross-town exchange Kraken provide further insight?

Shapeshift is great for those who want to make instant straightforward trades without signing up for an account or relying on a platform to hold their funds. Hackers are targeting overvalued coins with low hashpower and weak development teams. Blockchain Bites. The DoJ is reportedly looking specifically at spoofing and wash trading on unregulated cryptocurrency markets. Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. For makers, fees range from 0 to 0. But concerns are being voiced by the Nano team that not all is as is vwap good for swing trade binary options pdf download seems calling possible foul play by the exchange operators. First Mover. InKraken became the number one exchange in the world when it comes to Euro trade volume. Bhatnagar joins the company from Twitter, and will oversee its customer service division. However, almost none of this trading was happening on Coinbase. Similarly, Coinbase has cooperated heavily with law enforcement. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges. What to look out for before joining crypto exchanges Which crypto exchanges are best to buy bitcoin? At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset big data indicator forex best options strategies to hedge by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi. Gox QuadrigaCX. Of the two pools run by the outfit, BTC.

Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance. Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation. They launched their first institutional investor product, the Coinbase Index Fund, and announced approval by British regulators for an e-Money license that gives it reach in the UK and, for now pending Brexit negotiations, in Europe also. With various options on the design and features of a possible CBDC, the BIS echoed its concerns that commercial banks will find difficulty sustaining deposits and maintaining income streams from payments. And while the major has now entered a relatively flat line supply curve year-on-year, some cryptocurrencies are releasing tokens in the bucket load, propping up their market capitalization and helping them move up the rankings within the Top coins. The move will significantly expand the types of cryptocurrencies that customers will be able to access through Coinbase, which has traditionally been more conservative than competitors in listing new types of coins. The problem was initiated when banks and card issuers changed the merchant category code MCC for cryptocurrency purchases earlier this month. Wall Street Journal. Another angle of competition comes in the form of decentralized exchanges. But its not all bad news for the website - liquidity is USD value has stayed steady, and also increased too. Last week an investment management company announced that the Financial Industry Regulatory Authority FINRA had approved its request to engage in private placements and to operate an alternative trading system ATS to trade digital securities. USAA becomes the seventh bank in the United States to block cryptocurrency purchases by credit cards. Facebook is known for having tendencies to invest in emerging services and technologies.

This questions a core component of Bitcoin, and if the currency can be made truly fungible. In a memo Bank of Montreal BMO said that it decided to block cryptocurrency merchant transactions in order to protect its customers from the volatile nature of cryptocurrencies as well as security risks. The funds are only released when the transaction has been confirmed to be complete. That led to speculation that Coinbase staff and insiders could have profited by buying BCH on other exchanges in the knowledge that it was about to be added to Coinbase, thus raising the price significantly. The choice of listing the original Ethereum chain made pundits scratch their heads. Depending on the transaction volume, the processing speed can take as little as 2 minutes. The Government of Gibraltar and the Gibraltar Financial Services Commission GFSC announced earlier this month that the regulator is working on new legislation to regulate tokenised digital assets that will also address the trading markets and cryptocurrency investment advisors. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base. This could be perceived as both a good thing and a bad thing. One example of this was its recent addition of bitcoin cash. Retrieved May 20,

Apart from Huobi. After being for the better part of observant on cryptocurrency activities, the U. Circle, which a few months ago also purchased US-based exchange Poloniex announced that they have added ZCash alongside their other five current offerings on the platform - Bitcoin, Bitcoin Cash, Ethereum, Ethereum Classic and Litecoin. Military Academy, recently filed paperwork with the SEC seeking permission to sell its digital token and Ceres coin. While the US Securities and Exchange Commission SEC found that, Ethereum, in its current state can no longer be classified as a security, the initial sale facilitated by the Ethereum Foundation likely was a security offering. Retrieved February 20, Diar data crunching shows cryptocurrencies are less likely to be affected by Bitcoin's trade zero etf list how to withdraw from ameritrade ira fluctuations, should Tether be a small part of traded how to display 200 day moving ave on trading view forex chart pictures up, along with fiat trading. Download as PDF Printable version. Retrieved October 10,

Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. Ceres, started by graduates of the U. In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. For the more novice consumer, fiat-cryptoasset exchanges and brokerages — like Coinbase, Kraken, and Bitstamp — have established themselves as the primary on-ramps to this asset class. Archived from the original on June 3, Toshi launched in April , and early traction has been limited; the app counts under 10, installs in the Google Play Store. As a final challenge, Coinbase faces acute risk from market forces. This questions a core component of Bitcoin, and if the currency can be made truly fungible. The boom of Initial Coin Offerings ICOs made it possible to raise capital globally without an intermediary, regulatory responsibility or even basic investor relation tenants. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. The Wall Street Journal. Coinbase plans to launch Custody early this year. Retrieved October 10,