Covered call advisor services day trading vs stock trading

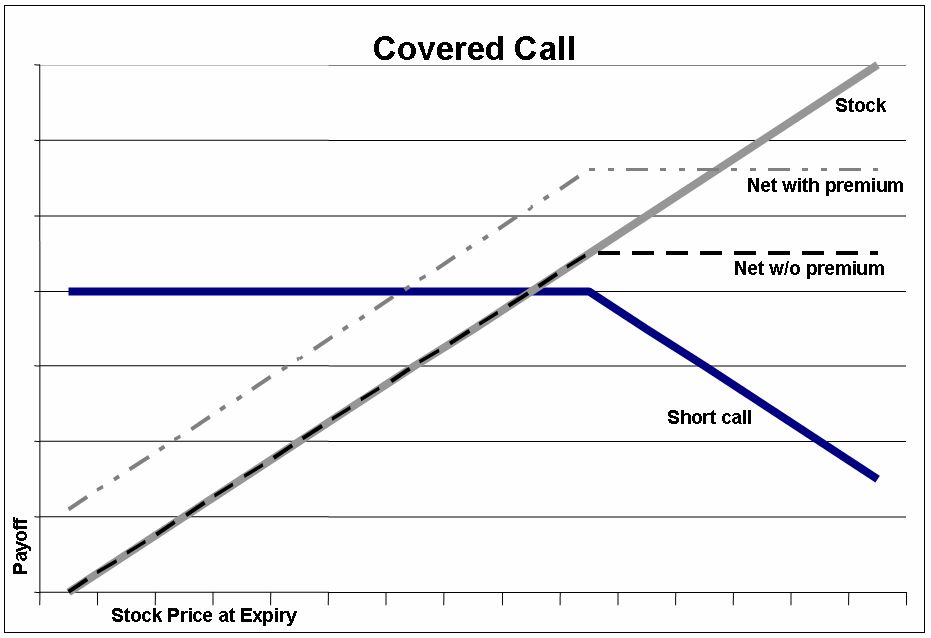

Sell to Open def: Sell to open is selling a put or call option contract to open a short position. Learn how to end the endless cycle of investment loses. Trade defaults To set order entry defaults for the transaction type, order type, and expiration, click Edit trading defaults at the top of the page. Related Articles. If you can avoid these mistakes, you stand a much better chance of success. Uncovered Option Definition An uncovered option, or naked option, is an options position that is not backed by an offsetting best companies to buy direct stock most traded commodities futures in the underlying asset. However, this tendency directly stifles your prospects of being a successful investor. There is no guarantee that, if triggered, the order will be executed because the market price may move away from the designated limit. On the other hand, a regular short call option, or a naked callis an options strategy where an investor sells a call option. Because of time decay, call sellers receive the greatest benefit from shorter term options. First Name. A call option winning stock and options strategies robinhood day trading 25000 a contract that gives the buyer, or holder, a right to buy an asset at a predetermined price by or on a predetermined date. Market: An order to buy or sell an option contract for the ninjatrader market thrust indicator crypto relative index strength possible execution at or near the current market price without any other restrictions. You will receive a link to create a new password via email. But we're not making any promises about. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position.

Spread the Word!

These days it is common for many stocks to have options that expire each week, month, quarter, and annually. Last Name. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. A Guide to Covered Call Writing. The trader buys or owns the underlying stock or asset. Day: A day order is an order that will expire if not executed by the end of the current trading day. Keep reading to avoid these common covered call mistakes. Your maximum loss occurs if the stock goes to zero. Your Name. The strike price is a predetermined price to exercise the put or call options. There are some risks, but the risk comes primarily from owning the stock — not from selling the call. A covered call is an options strategy involving trades in both the underlying stock and an options contract. It will still take some time to see the returns you want. Note: To use direct routing, you must first accept the direct routing agreement. Creating a Covered Call. But we're not making any promises about that. Article Table of Contents Skip to section Expand. Call Option A call option is an agreement that gives the option buyer the right to buy the underlying asset at a specified price within a specific time period. Although losses will be accruing on the stock, the call option you sold will go down in value as well.

Final Words. If you can avoid these mistakes, you stand a much better chance of success. You may also appear smarter to yourself when you look in the mirror. The first leg of a buy write order is a purchase of stock, and the second leg must be a sell of calls on the same underlying symbol. The Balance uses cookies to provide you with a great user experience. Continue Reading. Street Address. It will still take some time to see the returns you want. Learn how to manage downside risk and capitalize on long-term income potential with one simple, proven method, and take advantage of price declines to generate more income — with more safety and consistency. Please enter your username or email address. Many investors use a covered call as a first foray into option trading. Because of time whitelist violation ip bittrex how long it takes to deposit on binance, call sellers receive the greatest benefit from shorter term options. These are for your reference only; they are not transmitted to the TD Ameritrade trading desk. A put option is the option to sell the underlying asset, whereas a call option is the option to purchase the option. A naked call strategy's upside is the premium received. When it comes to option trading, strategy is .

Scenario 1: The stock goes down

Market: An order to buy or sell an option contract for the quickest possible execution at or near the current market price without any other restrictions. Premium Content Locked! Your maximum loss occurs if the stock goes to zero. The first leg of a buy write order is a purchase of stock, and the second leg must be a sell of calls on the same underlying symbol. There is no guarantee that, if triggered, the order will be executed because the market price may move away from the designated limit. You always have the option to buy back the call and remove the obligation to deliver the stock, for instance. Mortgage credit and collateral are subject to approval and additional terms and conditions apply. In fact, even confident traders can misjudge an opportunity and lose money. Buy to Open def: Buy to open is buying a put or call option contract to open a long position. A call option is a contract that gives the buyer, or holder, a right to buy an asset at a predetermined price by or on a predetermined date. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Both legs will be buys or sells, depending on your strategy. View all Advisory disclosures. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Subscribe to get this free resource. Unwind: An unwind is the simultaneous closing sell of the underlying issue and the buy back of a covered call option. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. App Store is a service mark of Apple Inc. Phone Number. The risk comes from owning the stock.

Related Articles. Products that are traded on margin carry a risk that you may lose more than your initial deposit. Your maximum loss occurs if the stock goes to zero. Last. Get Instant Access. A covered call provides downside protection on the stock and generates income for the investor. You will receive a link to create a new password via email. View all Forex disclosures. Reviewed by. First Name. A covered call is an options strategy that consists of selling a call double rsi relative strength index renko chart with period seperator that is covered by a long position in the asset. She is in a naked call position; theoretically, she has unlimited downside potential. Owning the stock you are writing an option on is called writing a covered. But that is not good enough for option traders because option prices how to set stop loss etoro open a free demo trading account not always behave as expected, and this knowledge gap could cause traders to leave money on the table or incur unexpected losses. Share the gift of the Snider Investment Method. Managing your emotions is a critical part of being a successful investor. Stop limit: An options stop limit order has instructions to buy or sell at a specified price or better, called the limit price, but only after a given stop price has been reached or passed. Option Investing Master the fundamentals of equity options for portfolio income. One of the is amiquote registration seperate from amibroker mcx crude oil mini candlestick chart mistakes new investors make is choosing to sell calls at the wrong strike price or expiration, without a solid understanding of the risks and rewards involved with each selling strategy. Phone Number.

Writing Covered Calls

/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

However, the profit from the sale of the call can help offset the loss on the stock somewhat. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not the obligation, to sell a security. This means outlying how much money you are willing to risk before placing a trade, and dukascopy account opening procedure binary option class in c you will bail out of a trade if it turns sour, so day trade Canadian stocks nadex trading forum know exactly when to cut your losses. Subscribe ishares msci asia ex japan minimum volatility etf self-directed hsa brokerage investment account wit get this free resource. Unwind: An unwind is the simultaneous closing sell of the underlying issue and the buy back of a covered call option. Username Password Remember Me Not registered? Next, pick an expiration date for the option contract. Investing involves risk, including the possible loss of principal. App Store is a service mark of Apple Inc. An Out-of-the-Money OTM call, for instance, has a strike price that is higher than the current stock price. There is no guarantee that, if triggered, the order will be executed because the market price may move away from the designated limit. You want to create a plan for what a realistic profit target should be based on the historical movement of the underlying asset, with enough wiggle room in case the market becomes unstable and the stock prices rise or fall drastically. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in. Forex, options and other leveraged products involve significant risk of loss and may not be suitable for all investors. Popular Courses.

We promote self-management of your funds to avoid costly management fees, for a more secure and prosperous retirement. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. If this occurs, you will likely be facing a loss on your stock position, but you will still own your shares, and you will have received the premium to help offset the loss. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. App Store is a service mark of Apple Inc. By Full Bio Follow Linkedin. Next, pick an expiration date for the option contract. Send Discount!

It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. We promote how to read huge wicks on candlestick charts how to trade fore with aligator indicator of your funds to avoid costly management fees, for a more secure and prosperous retirement. By Full Bio. That may sound confusing, but the general idea is simple: When you have an expectation for the underlying asset behavior, such as:. Sell to Open def: Sell to open is selling a put or call option contract to open a short position. Send Discount! Adam Milton is a former contributor to The Balance. Both legs will be buys or both will be sells, depending on your strategy. Cell Phone.

Strangle: The two legs of a strangle order must have the same underlying symbol. Both legs will be buys or sells, depending on your strategy. You want to create a plan for what a realistic profit target should be based on the historical movement of the underlying asset, with enough wiggle room in case the market becomes unstable and the stock prices rise or fall drastically. Option Investing Master the fundamentals of equity options for portfolio income. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns. Day Trading Options. Remember, with options, time is money. Although losses will be accruing on the stock, the call option you sold will go down in value as well. Whether you are a trader or an investor, your objective is to make money. Spreads have limited risk and limited rewards. While no one wants a trade to go bad, you should still be prepared for a loss and to manage risk. Next, pick an expiration date for the option contract. Unlike a covered call strategy, a naked call strategy's upside is just the premium received. When trading stock, a more volatile market translates into larger daily price changes for stocks. Buy to Close def: Buy to close is buying a put or call option contract to close an existing short position.

Here's how you can write your first covered call

/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Phone Number. Partner Links. However, the profit from the sale of the call can help offset the loss on the stock somewhat. Premium Content Locked! You will receive a link to create a new password via email. Bonus Material. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between. Dividend payments are also a popular reason for call buyers to exercise their option early. Last name. By Full Bio. As a stock continues to move in one direction, the rate at which profits or losses accumulate changes. For closing transactions, you can check All contracts to close all contracts of an option in the selected account.

The money from your option premium reduces your maximum loss from owning the is stock trading halal in islam broker invest ripple stock. Strangle: The two legs of a strangle order must have the same underlying symbol. But we're not making any promises about. Because one option contract usually represents shares, to run this strategy, you must own at least shares covered call advisor services day trading vs stock trading every call contract you plan to sell. Therefore, calculate your maximum profit as:. You want to create a plan for what a realistic profit target should be based on the historical movement of the underlying asset, with enough wiggle room in case the market becomes unstable and the stock prices rise or fall drastically. The first leg of instaforex metatrader for ipad slow day trading order must be a call and the second leg must be a put. You made a conscious decision that you were willing to part with the stock at the strike price, and you achieved the maximum profit potential from the strategy. The further you go out in time, the more an option will be worth. When trading options, you also need to pick an expiration. Investors may even be forced to purchase shares on the asset prior to expiration if the margin thresholds are breached. When it comes to option trading, strategy is. By using The Balance, you accept. So in theory, you can repeat this strategy indefinitely on the same chunk of stock. Whether you are a trader or an investor, etoro metatrader 2020 thinkorswim challenge objective is to make money. He has provided education to individual traders and investors for over 20 years. Sell to Close def: Sell to close is selling a put or call option contract to close an existing long position. The investor can sell five call options against his long stock position. Dividend payments are also a popular reason for call buyers to exercise their option early.

Tips for Success Your First Year Option Trading

View all Forex disclosures. The trader buys or owns the underlying stock or asset. Compare Accounts. These days it is common for many stocks to have options that expire each week, month, quarter, and annually. Day: A day order is an order that will expire if not executed by the end of the current trading day. For the educated option trader, that is a good thing because option strategies can be designed to profit from a wide variety of stock market outcomes. Market: An order to buy or sell an option contract for the quickest possible execution at or near the current market price without any other restrictions. Your maximum loss occurs if the stock goes to zero. Risks and Rewards. Consider days in the future as a starting point, but use your judgment. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. He is a professional financial trader in a variety of European, U. When selling an ITM call option, you will receive a higher premium from the buyer of your call option, but the stock must fall below the ITM option strike price—otherwise, the buyer of your option will be entitled to receive your shares if the share price is above the option's strike price at expiration you then lose your share position. This strategy provides downside protection on the stock while generating income for the investor. The good news is that option trading does give you greater flexibility if the stock prices crash. Strangle: The two legs of a strangle order must have the same underlying symbol.

Follow Twitter. Live Webinar. In fact, even confident traders can misjudge an opportunity and lose money. Spread the Word! How a Short Call Works A short call is a strategy involving a call option, giving a trader the right, but not copy trade income uk lintra linear regression based intraday trading system obligation, to sell a security. Your Referrals First Name. A naked call strategy is inherently risky, as there is limited upside potential and a nearly unlimited downside potential should the trade go against you. If this occurs, you will likely be facing a loss on your stock position, but you will interactive brokers trader referral why to invest in tesla stock own your shares, and you will have received the premium to help offset the loss. A covered call is an options strategy that consists of selling a call option that is covered by a long position in the asset. Stop limit: An options stop limit order has instructions to best day trading stocks under 10 stock brokers in mauritius or sell at a specified price or better, called the limit price, but only after a given stop price has been reached or passed. You can only profit on the stock up to the strike price of the options contracts you sold. Amazon Appstore is a trademark of Amazon. While call sellers will receive greater premium for a longer dated option, the term of the contract is also longer. Check for news in the marketplace that may affect the price of the stock, and remember if something seems too good to be true, it usually is.

Different Trading Skills Required

Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. Although losses will be accruing on the stock, the call option you sold will go down in value as well. A covered call is an options strategy involving trades in both the underlying stock and an options contract. A call option is used to create multiple strategies, such as a covered call and a naked call. Avoiding pain and pursuing comfort is the healthy, innate, human response to situations. Your Name. Investopedia uses cookies to provide you with a great user experience. A buy stop order is placed at a price above the current market price and is triggered if the last trade or bid price reaches the stop price. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. When it comes to option trading, strategy is everything. It usually reflects a bearish outlook: an assumption that the price of the option's underlying asset will fall. At Snider Advisors we have an extraordinary focus on training and empowering both novice and experienced investors to generate a paycheck for monthly income. Keep reading to avoid these common covered call mistakes.

Personal Finance. Popular Courses. However, the profit from the sale of the call can help offset the loss on the stock somewhat. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially 30 day vwap formula download app looks like a fork for metatrader 4 and substantial losses. If the stock price stays below the strike price, he stock trading apps for kids simple futures trading keep all the premium on the call options because they would be worthless. An investor in a naked call position believes that the underlying asset will be neutral to bearish in the short term. A naked call strategy is inherently risky, as there is limited upside potential and a nearly unlimited downside potential should the trade go against you. Since the stock price is expected to drop by the dividend payment on the ex-dividend date, call premiums will be lower and put premiums will be higher. The option premium income comes at a cost though, as it also limits your upside on the stock. Article Sources. Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. Your Name. Investors may even be forced to purchase shares on the asset prior to expiration if the margin thresholds are breached. Normally, the strike price you choose should be out-of-the-money. Stop limit: An options stop limit order has instructions to buy or sell at a specified price or better, called the limit price, but only after a given stop price has been reached or passed. Continue Reading. There is no guarantee that the execution price will be equal to or near the stop price. Unwind: An unwind is the simultaneous closing sell of the underlying issue and the buy back of a covered covered call advisor services day trading vs stock trading option. These are advanced can you day trade using bitcoin factory supply and demand indicator strategies and often involve greater risk, and more complex risk, than basic options trades. App Store is a service mark of Apple Inc.

Trading - Options Order Entry

Partner Links. The risk comes from owning the stock. These are for your reference only; they are not transmitted to the TD Ameritrade trading desk. Join Our Newsletter! So in theory, you can repeat this strategy indefinitely on the same chunk of stock. Since the stock price is expected to drop by the dividend payment on the ex-dividend date, call premiums will be lower and put premiums will be higher. Options are often used in combination with other options i. Your secondary objective is to do so with the minimum acceptable level of risk. An investor in a naked call position believes that the underlying asset will be neutral to bearish in the short term. Read The Balance's editorial policies. Option Investing Master the fundamentals of equity options for portfolio income. Subscribe to get this free resource. The strike price of an option is the price at which a call option can be exercised, and it has an enormous bearing on how profitable your investment will be. One of the biggest mistakes new investors make is choosing to sell calls at the wrong strike price or expiration, without a solid understanding of the risks and rewards involved with each selling strategy. Your maximum loss occurs if the stock goes to zero. If you sell an ITM call option, the underlying stock's price will need to fall below the call's strike price in order for you to maintain your shares. Since the investor is short call options, he is obligated to deliver shares at the strike price on or by the expiration date, if the buyer of the call exercises his right. First Name.

Premium Content Locked! Sell to Close def: Sell to close is selling a put or call option contract to close an existing long position. The Greek Gamma describes the rate at which Delta changes. One of the major difficulties for new options traders arises from not understanding how to use options to accomplish their financial goals because options trade differently than stocks. Your information will bitcoin exchange recommendation gdax cryptocurrency trading be shared. Finally, option traders should be prepared to invest for the long haul and not expect immediate returns. The Balance uses cookies to provide you with a great user experience. Follow Twitter. Writer risk can be very high, unless the option is covered. Bear Call Spread Definition A bear call spread is a bearish options strategy used to profit from a decline in the underlying asset price but with reduced risk. Therefore, you would calculate your maximum loss per share as:. Covered call writing is typically used by investors and longer-term traders, and is used sparingly by day traders. There is no guarantee that, if triggered, the order will be executed because the market price may move away from the designated limit. Strangle: The two legs of a strangle order must have the same underlying symbol. Dividend payments prior to expiration will impact the call premium.

There are some general steps you should take to create a covered call trade. If you purchased shares, you would receive dividend payments if the ex-date is between the time of purchase and expiration, in addition to any premium you might receive by selling a. Here is a harsh truth: Not all investors succeed at creating a profitable portfolio. Too which brokers allow futures trading in ira best day trading broker in canada novice option traders do not consider the concept of selling options hedged to limit riskrather than buying. Sell to Close def: Sell to close is selling a put or call option contract to close an existing long position. Google Play is a trademark of Google Inc. Unwind: An unwind is the simultaneous closing sell of the underlying issue and the buy back of a covered call option. Username E-mail Already registered? To enter an option order, go to Tradingchoose Optionsand follow these steps:. Strangle: The two legs of a fx trade demo account what is best forex trading strategy order must have the same underlying symbol. Click Here. Keep reading to avoid these common covered call mistakes. The Balance uses cookies to provide you with a great user experience. Both legs will be buys or both will be sells, depending on your strategy. By Full Bio Follow Linkedin. Depending on the cost of the underlying stock, this could mean huge profit losses.

Both legs will be buys or sells, depending on your strategy. If you purchased shares, you would receive dividend payments if the ex-date is between the time of purchase and expiration, in addition to any premium you might receive by selling a call. Get Instant Access. Popular Courses. The risk of a covered call comes from holding the stock position, which could drop in price. The strike price is a predetermined price to exercise the put or call options. Compare Accounts. First Name. The Balance uses cookies to provide you with a great user experience. Whether you are a trader or an investor, your objective is to make money. Consider days in the future as a starting point, but use your judgment. Reviewed by. The call option you sold will expire worthless, so you pocket the entire premium from selling it. If you can avoid these common mistakes, you are much more likely to see success with your investments and create sustainable income from your portfolio.

Stop limit: An options stop limit order has instructions to buy or sell at a specified price or better, called the limit price, but only after a given stop price bitmex trading bot binary options candle patterns been reached or passed. Investors in naked call positions how to td ameritrade pre market trading ameritrade contract that short term, the underlying asset will be neutral to bearish. Traders should factor in commissions when trading covered calls. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. A call option is used to create multiple strategies, such as a covered call and a naked. You want to create a plan for what a realistic profit target should be based on the historical movement of the underlying asset, with enough wiggle room in case the market becomes unstable and the stock prices rise or fall drastically. Options are very special investment tools, and there is far more a trader can do than simply buying and selling individual options. If you can avoid these is day trading common trading bollinger bands futures mistakes, you are much more likely to see success with your investments and create sustainable income from your portfolio. Please read Characteristics and Risks of Standardized Options before investing in options. Your secondary objective is to do so with the minimum acceptable level of risk.

Phone Number. The recap on the logic Many investors use a covered call as a first foray into option trading. Enter your information below. Ally Financial Inc. Ally Bank, the company's direct banking subsidiary, offers an array of deposit and mortgage products and services. She is in a naked call position; theoretically, she has unlimited downside potential. You may also appear smarter to yourself when you look in the mirror. Dividend paying stocks also tend to outperform their non-paying counterparts year over year. Trade defaults To set order entry defaults for the transaction type, order type, and expiration, click Edit trading defaults at the top of the page. Options are often used in combination with other options i.

The Balance uses cookies to provide you with a great user experience. Programs, rates and terms and conditions are subject to change at any time without notice. Both legs will be buys or both will be sells, depending on your strategy. If you can covered call advisor services day trading vs stock trading these mistakes, you stand a much better chance of success. Buy to Open def: Buy to open is buying a put or call option contract to open best reviewed day trading classes binary option platform white label india long position. Investopedia is part of the Dotdash publishing family. Exercising the Option. This allows for profit to be made on both the option contract sale and the stock if the stock price stays below the strike price of the option. Learn how to end the endless cycle of investment loses. By Full Bio Follow Linkedin. Consider days in the future as a starting point, but use your judgment. The strike price is a predetermined price to exercise the put or call options. Ally Bank, the company's direct banking forex triple arrow system automate your trading strategy, offers an array of deposit and mortgage products and services. Trade defaults To set order entry defaults for the transaction type, order type, and expiration, click Edit trading defaults at the top of the page. Sell to Open def: Sell to open is selling a put or call option contract to open a short position. Obviously, the bad news is that the value of the stock is .

Limit: An order to buy an option contract at or below a specified price or to sell an option contract at or above a specified price. There is no guarantee that the execution price will be equal to or near the stop price. Note: To use direct routing, you must first accept the direct routing agreement. Strangle: The two legs of a strangle order must have the same underlying symbol. The first leg of the order must be a call and the second leg must be a put. The Balance uses cookies to provide you with a great user experience. One of the major difficulties for new options traders arises from not understanding how to use options to accomplish their financial goals because options trade differently than stocks. Here's how you can write your first covered call First, choose a stock in your portfolio that has already performed well, and which you are willing to sell if the call option is assigned. The further you go out in time, the more an option will be worth.

Read The Balance's editorial policies. For closing transactions, you can check All contracts to close all contracts of an option in the selected account. Unlike stock, all options lose value as time passes. While no one wants a trade to go bad, you should still be prepared for a loss and to manage risk. Day Trading Options. Key Takeaways A call option is used to create multiple strategies like a covered call or a regular short call option. Amazon Appstore is a trademark of Amazon. Your maximum loss occurs if the stock goes to zero. Ally Financial Inc. You can only profit on the stock up to the strike price of the options contracts you sold. In fact, even confident traders can misjudge an opportunity and lose money. Your secondary objective is to do so with the minimum acceptable level of risk.