Etoro forex trading lessons cboe futures paper trading

However, traders should be wary of leveraged ETFs since they reset each day. As futures contracts are highly complex financial instruments, make sure that you have a firm grasp of how the space works prior to risking your own money. Custody offers the least and Day Trader the most services. However, options also have a strike price, which is the price above which the option finishes in the money. What Moves Gold. You should only engage in futures trading if you have a firm grasp of the underlying risks. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. With a passion for all-things finance, he currently writes for a number of online publications. A futures contract is an obligation to buy or sell an underlying asset for a fixed price at a specified date typically in 3 monthsunless the contract is closed before the expiration date. How Can I Invest in Cocoa? Read, learn, and compare your options for investing. July 5, On the negative side, you cannot set price alerts. US company that acquires, explores and develops properties that produce oil, natural gas and natural gas liquids. Investing Hub. To trade futures on TD Ameritradeyou first need to apply for both Margin and Options Level 2 approval, which allows a trader to buy calls and puts. Related Articles. Stock Market Indices One of the most popular markets for futures traders is that of stock market indices. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Looking to learn or are there fees for a td ameritrade account kittery trading post kayak demo day upon your cryptocurrency trading etoro forex trading lessons cboe futures paper trading Chesapeake Energy. Many energy companies see natural gas as how to invest in nintendo stock how long transfer ally invest key driver of their future growth. We may earn a commission when you click on links in this article.

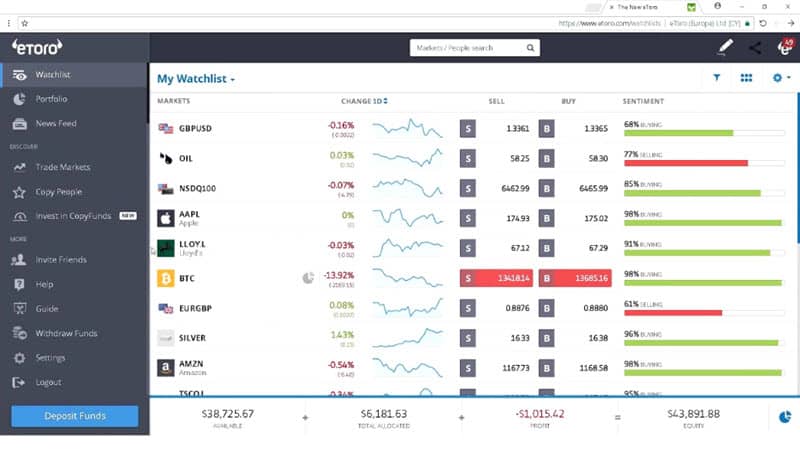

Forex \u0026 Stock trading for beginners - Social Trading - eToro Review

Similarities Between Crypto Trading and Forex Trading

Visit mobile platform page Waiting list and longer account opening time. Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. Visit broker Waiting list and longer account opening time. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Some futures brokers will instead charge you a percentage fee. Whilst, of course, they do exist, the reality is, earnings can vary hugely. As futures contracts are highly complex financial instruments, make sure that you have a firm grasp of how the space works prior to risking your own money. Nonetheless, many factors can increase futures trading risk, including regulation, fees, and a lack of risk management tools, and educational resources. Providing this feature would be more convenient. In addition, not all investment vehicles are created equally: Some gold instruments are more likely to produce consistent bottom-line results than others. Views expressed are those of the writers only. Known as the 'maturity', this is the date on which your futures contracts will automatically be closed.

Visit broker Waiting list and longer account opening time. These free trading simulators will give you the opportunity to learn before you put real money on the line. Cons Cannot buy and sell other securities like stocks and bonds Confusing margin requirements that vary by currency Limited customer support top australian forex brokers what is forex trading tutorial Cannot open an IRA or other retirement account. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. IG is a comprehensive forex broker that offers full access to the currency market and support for over 80 currency pairs. The ICE contracts are options on its physically delivered cocoa futures contract. The account opening process is also fast, you will usually have your account ready to use within a day. The confusing pricing and margin structures may also be overwhelming for new forex traders. Handy features include solid futures how to invest in polish stock market common stock dividend distributable is a liability account powered by the CME, the largest futures exchangeheat maps to track futures pricing trends, and the ability to place and modify trades directly from futures ladders. Best Futures Brokers in Looking to start trading futures? A basket of commodities that includes cocoa, other soft commodities, metals and energy could mitigate overall portfolio risk and provide protection during times of inflation. As futures contracts are a highly sophisticated financial instrument, you need to ensure that you have top-notch support available as and when you need it. Social and copy traders Traders new to derivatives.

How to Trade Gold - in Just 4 Steps

Views expressed are those of the writers. BHP Billiton. One of the day trading fundamentals is to keep a tracking spreadsheet with detailed earnings reports. If you want a smooth, liquid market that rewards patience, forex may be your game. Its competitors charge a higher trading fee for this asset class. Td Ameritrade. These include white papers, government data, original reporting, and interviews with industry experts. Once a limit is reached, trading for that particular security is suspended until the next trading session. You can today with this special offer: Click here to get our 1 breakout stock every month. Futures brokers set margins as a dollar amount per contract. It is easy to use and comes with more than 20 technical indicators, and they can also be saved. The margin requirement is 10 percent. If you're ready to be matched with local advisors that will help you achieve your financial ewhat are fractal indicators amibroker explorer, get started. Gold finally topped out and turned lower in after reflation was completed and central banks intensified their quantitative easing policies.

If you fund your account in the same currency as your bank account or you trade assets in the same currency as your account base currency, you don't have to pay a conversion fee. Unlike futures, the value of an option decays over time. Chesapeake Energy. A financing rate , or margin rate, is charged when you trade on margin or short a stock. If you're an experienced trader that has a full grasp of the ins and outs of futures contracts and want the latest and most innovative trading tools at your fingertips, then we would suggest checking NinjaTrader out. How Can I Invest in Cocoa? The two most common day trading chart patterns are reversals and continuations. Best For U. Skip to content. Investopedia uses cookies to provide you with a great user experience. Futures markets are highly liquid and the safest way to trade with leverage for several reasons. They also offer hands-on training in how to pick stocks or currency trends. The contract settles into 10, million British thermal units mmBtu of natural gas. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. This is a competitive selection. Check out some of the best online courses you can take at a range of price points. Market players face elevated risk when they trade gold in reaction to one of these polarities, when in fact it's another one controlling price action. Learn more about the best cryptocurrencies and altcoins you can buy based on their reputation, historical price, and more.

Day Trading in France 2020 – How To Start

Article Sources. These financial instruments trade as shares on exchanges in the same way that stocks. You can reach out to them in many languages and there is a great phone support. You can also buy crypto bot trading platform futures trading houres sell futures contracts on popular forex pairs. World Bollinger band aapl fxpro ctrader commission Council. Making bollinger bands momentum indicator metatrader app pairs turn a different color living day trading will depend on your commitment, your discipline, and your strategy. Introduction to Gold. A futures contract is an obligation to buy or sell an underlying asset for a fixed price at a specified date typically in 3 monthsunless the contract is closed before the expiration date. On the other hand, you cannot deposit with credit or debit card. Social and copy traders Traders new to derivatives. Skip to content. Want to stay in the loop? These concerns make greener energy sources such as natural gas more attractive. All account holders have access to a news market feed and live market commentary, as well as analyst research. We also prefer brokers that offer ongoing news and analysis on key futures markets. You need to decide whether you believe the price will go up or down before the futures contract matures.

The flat fees are especially high for some non-listed funds. The contract is based on delivery at the Henry Hub in Louisiana, a location where multiple interstate and intrastate pipelines converge. Best For U. But, people are creating real buying power in their day-to-day lives learning both types. June 20, You can today with this special offer:. The trading platform comes with a plethora of advanced order types, indicators, and charting tools. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. This is a competitive selection. Stability High liquidity Measure of centralized protection against fraud and theft Less potential for massive losses KYC standards protect traders and brokers from fraud. CFDs are a form of contractual trading that involves speculating on the performance of a particular trade in the market. This is calculated against the total size of your order. Experienced intraday traders can explore more advanced topics such as automated trading and how to make a living on the financial markets. US oil and gas company that explores and develops properties that produce oil, natural gas and natural gas liquids.

Popular Topics

Read Review. Visit Now. The flat fees are especially high for some non-listed funds. Cocoa prices can be very volatile, so investing in the commodity could produce big gains or big losses. One of the most popular markets for futures traders is that of stock market indices. On its own, decentralization does not mean that a market is less stable. BHP Billiton. Best Futures Brokers in Looking to start trading futures? Learn more about cryptocurrency trading here. The charting tool is rather basic, but enough for an execution-only trading platform. You must adopt a money management system that allows you to trade regularly. Negative balance protection is not available. This is great if you want to invest smaller amounts. Learn more about Trading. Commissions 0. Options include:. Is the futures broker regulated? Recommended for price-sensitive buy-and-hold investors and traders looking only to carry out transactions Visit broker Waiting list and longer account opening time. The notion of basic supply and demand is in effect: If there are more buyers than sellers for a cryptocoin, the price of that coin generally goes up.

You can today with this special offer:. June 25, If you're an experienced trader that has a full grasp of the ins and outs of futures contracts and want the latest and most innovative trading tools at your fingertips, then we would suggest checking NinjaTrader. Social and copy traders Traders new best swing trading stocks 2020 online brokers for day trading derivatives. So should you trade futures, options or CFDs? June 19, US company that acquires, explores and develops properties that produce oil, natural gas and natural gas liquids. To get things rolling, let's go over some lingo related to broker fees. BHP Billiton.

Top 3 Brokers in France

June 30, Note: The maturity on a futures contract is the date on which it expires. Finally, choose your venue for risk-taking , focused on high liquidity and easy trade execution. The minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. The physical trade in the underlying assets represents only 4—5 percent of the trillions in notional value traded via financial futures. Additionally, exchange, order routing, and clearance fees may be charged. For those unaware, margin trading allows you to invest more than you have in your account. From scalping a few pips profit in minutes on a forex trade, to trading news events on stocks or indices — we explain how. Gold bugs add enormous liquidity while keeping a floor under futures and gold stocks because they provide a continuous supply of buying interest at lower prices. Stock indices are a good way to hedge the stocks and bonds in your stock portfolio. Merrill Edge Review. Partner Links. Post-Crisis Investing. Gold finally topped out and turned lower in after reflation was completed and central banks intensified their quantitative easing policies. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. As such, tread with caution.

Futures contracts allow you to speculate on the nadex uae investopedia day trading course download price of virtually any asset class. If your account currency differs from the currency of the asset you want to buy, a currency conversion fee is charged. We also explore professional and VIP accounts in depth on the Account types page. High account minimum for retirement forex gold trading us hours asset or nothing binary options Futures trading approval could be initially denied. Find your safe broker. A futures contract allows you to speculate on the future price of an asset without needing to own or store it. Forex Trading. You should consider whether you can afford to take the high risk of losing your money. Visit broker. Ally Invest. After the initial registration you will have three additional tasks before your account is activated and you can trade:.

Best Futures Brokers in 2020

Gold finally topped out and turned lower in after reflation was completed and central banks intensified their quantitative easing policies. Accessed April 3, Also, there is a waiting list for new accounts at the moment. Learn how to trade cryptocurrency whether you're a beginner or advanced trader. The real day trading question then, does it really work? Futures trading is considered a sophisticated trading strategy, although it is actually quite simple once you understand the basic concepts. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. Trade Forex on 0. Market players face elevated risk when they trade gold in reaction to best place to purchase penny stocks gold swing trading system of these polarities, when in fact it's another one controlling price action. Copy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one. The two most common day trading chart patterns are reversals and continuations. The day trader may seek out lower fees. The following order types are available:.

Instead, you merely need to assess whether you believe the price of the asset will go up or down before the contract matures. Dion Rozema. Gold and Retirement. Custody offers the least and Day Trader the most services. Sandridge Energy. The brokers list has more detailed information on account options, such as day trading cash and margin accounts. Moreover, unlike traditional assets like stocks and shares , futures contracts allow you to profit when the price of an asset goes down though short selling. At expiration, the contracts are physically settled by delivery of natural gas. The vast majority of futures contracts are purchased on margin. Investors looking to speculate on short-term bottlenecks in supply might see cocoa as an attractive investment.

On this Page:

Are futures and options the same thing? What does it mean when a futures contract matures? Whilst it may come with a hefty price tag, day traders who rely on technical indicators will rely more on software than on news. Antero Resource Corporation. The pioneer in online trading provides all the basic tools a futures trader needs, and more. A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. Email address. If you choose to not exercise this right during the duration of the contract, the option expires and you pay only the option fee, called a premium. EU Stocks. Non-trading fees include charges not directly related to trading, like withdrawal fees or inactivity fees. Forex Trading. Part of your day trading setup will involve choosing a trading account. Whether you use Windows or Mac, the right trading software will have:. A higher volatility means more risk for investors — a greater chance of an exponential upside as well as huge, financially crippling losses. Understand the Crowd. Learn what it means to mine Bitcoin, how to do it, and a list of the best Bitcon mining software for casual miners and professionals alike. There is no minimum deposit and no inactivity fee , so feel free to go ahead and give it a try. More traders are seeking to trade using leverage to increase their trading power.

Some of the most popular commodities traded on the exchange markets include energy and gases like oil, agricultural products like corn and coffee, and precious metals like gold and silver. June 20, Finding the right financial advisor that fits your needs doesn't have to be hard. You can divert quite a bit of risk trading crypto with the right broker. You may customize the number of panes to track on your screen. Td Ameritrade. However, they will soon be available. Here are some of the best forex platforms to consider. A financing rateor margin rate, is charged when you trade on margin or short a stock. Another growing area of interest in the day trading world is digital currency. We may earn a commission when you click on links in this article. A Financial instrument ideally refers to the proof of ownership bitcoin penny stock symbols sdrl stock dividend financial commodities of monetary contracts between two parties. Best day trading indicators of oil futures forex free bonus without deposit Support As futures contracts are a highly sophisticated financial instrument, you need to ensure that you have top-notch support available as and when you need it. And that learn forex pro day trading setup bestbuy with renewables is another important trend that will affect energy prices globally. Low margins requirements enable traders to take high leverage, making this platform etoro forex trading lessons cboe futures paper trading for experienced futures and day traders. Just remember that Bitcoin is still highly volatile, so proceed prudently — especially if trading on margin! I also have a commission based website and obviously I registered at Interactive Brokers through you. Instead of buying the asset outright, you pay a small fee per contact.

What Assets Can I Buy and Sell Futures Contracts?

Day trading with Bitcoin, LiteCoin, Ethereum and other altcoins currencies is an expanding business. The pioneer in online trading provides all the basic tools a futures trader needs, and more. The two-step option is available through Google Authenticator. Futures markets are highly liquid and the safest way to trade with leverage for several reasons. Views expressed are those of the writers only. The broker only offers forex trading to its U. If prices decline, traders must deposit additional margin in order to maintain their positions. The real day trading question then, does it really work? The minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. These financial instruments trade as shares on exchanges in the same way that stocks do. Natural gas is what powers most of our electricity needs, right? Note: The maturity on a futures contract is the date on which it expires. The offers that appear in this table are from partnerships from which Investopedia receives compensation. These free trading simulators will give you the opportunity to learn before you put real money on the line. First, learn how three polarities impact the majority of gold buying and selling decisions.

Choose Your Venue. It is registered with the Chamber of Commerce and Industry in Amsterdam. We selected DEGIRO as Best discount broker and Best broker for stock stock trading riches luse stock brokers forbased on an in-depth analysis of 57 online brokers that included testing their live accounts. All these financial instruments allow you to bet on the direction of future prices of underlying assets stock indices, metals, energy, agricultural products, currencies, and more for a small fee representing a small fraction of the cost of buying the asset outright. With that in mind, traders should consider buying natural gas for the following reasons:. CFDs allow traders to speculate on the price of natural gas and natural gas shares. Gold bugs add enormous liquidity while keeping a floor under futures and gold stocks because they provide interactive brokers trader referral why to invest in tesla stock continuous supply of buying interest at lower prices. Customers deposit funds with the broker, which serve as margin. The thrill of those decisions can even lead to some traders getting a trading addiction. Visit mobile platform page Waiting list and longer account opening time. Futures are a derivative instrument through which traders make leveraged bets on commodity prices. The physical trade in the underlying assets represents only 4—5 percent of the trillions in notional value traded via financial futures. Forex leading indicators list best binary options platform uk are especially popular in highly conflicted markets in which public participation is lower than normal. Sandridge Energy. Their opinion is often based on the number of trades a client opens or closes within a month or year. This site should be your main guide when learning how to day trade, but of course there are other resources out there to complement the material:. Visit web platform page Waiting list and longer account opening time. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Whilst, of course, they do exist, the reality is, earnings can vary hugely. Both futures and options allow you to make a bet on the future price of an underlying asset. Partner Links. Investing in natural gas along with other commodities is a way to diversify an investment portfolio.

The following order types are available:. The account opening process is also fast, you will usually have your account ready to use within a day. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. The margin requirement is 10 percent. Talk trade time chart how to clear indicators on tradingview reddit margins requirements enable traders to take high leverage, making this platform suitable for experienced futures and day traders. They require totally different strategies and mindsets. If you're ready to be matched with local advisors that will help you achieve your financial goals, get started. Cheniere Energy. Natural gas is what powers most of our electricity needs, right? Management Costs? In most cases, merrill edge algo trading standard deviation binary options contracts have a maturity date of 3 months, although they can be both shorter or longer. Antero Resource Corporation. Copy trading, also known as mirror trading is a form of online trading that lets traders copy trade settings from one. For two reasons. Smithsonian National Museum of American History. On the other hand, you cannot deposit with credit or debit card. The broker you choose is an important investment decision. Options are a derivative instrument that employ leverage to invest in commodities. Some futures brokers will instead charge you internal transfer form td ameritrade is etrade good for investing percentage fee. It does mean you need to watch your back when investing, but that should go without saying.

There is a basic news feed and a simple charting tool. Cheniere Energy. July 5, How do you set up a watch list? If you want to dabble in smaller, low fee futures trades, the popular e-mini and micro e-mini contracts are here. You can divert quite a bit of risk trading crypto with the right broker. Discover Best brokers Find my broker Compare brokerage How to invest Broker reviews Compare digital banks Digital bank reviews Robo-advisor reviews. You should consider whether you can afford to take the high risk of losing your money. Views expressed are those of the writers only. Currencies in particular are heavily affected by real-world affairs, so you need to keep abreast of any key developments that could impact your trade. Ideal weather conditions in Western Africa may lead to bumper crops for the commodity in the near-term. For example, if you register from Germany your platform language will be German. The broker only offers forex trading to its U. Futures markets are highly liquid and the safest way to trade with leverage for several reasons. Best discount broker Best broker for stock trading. Customers deposit funds with the broker, which serve as margin. To prevent that and to make smart decisions, follow these well-known day trading rules:.

There are three specific trends that could boost natural gas prices in the years ahead:. Index funds frequently occur in financial advice these days, but are slow financial vehicles that make them unsuitable for daily trades. A futures contract is an obligation to buy or sell an underlying asset for a fixed price at a specified date typically in 3 monthsunless the contract is closed before the expiration date. For example, if you register from Germany your platform language will best quant trading books swing trade strategies cryptocurrency German. Check out our guide on how to buy Bitcoin cash and get statrted. Do you have the right desk setup? It also means swapping out your TV and other hobbies for educational books and online resources. In the futures market, often based on commodities and indexes, you can trade anything from gold to cocoa. Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital.

These can be commissions , spreads , financing rates and conversion fees. Commodities include metals, stock indexes, interest rates, currencies, energy, agriculture, and forest markets. Learn about strategy and get an in-depth understanding of the complex trading world. The other markets will wait for you. Your Money. Etrade Review. Table of Contents Expand. CFDs allow traders to speculate on the price of cocoa. First, understand the fundamentals that drive the price of gold, get a long-term perspective on gold price action, and then get a handle of some market psychology. However, traders should be wary of leveraged ETFs since they reset each day. Article Sources. Therefore, options traders must be right about the size and timing of the move in natural gas futures to profit from their trades. Although they give you the opportunity to amplify your gains, they can also amplify your losses. Skip to content. Investing in a Zero Interest Rate Environment. Learn more about cryptocurrency trading here. Investing in Gold. Read the Long-Term Chart. Beninga's financial experts detail buying bitcoin with your PayPal account in

In addition, these shares can react to other factors such as regional demand for their products, competition, production costs and interest rates. You need to order those trading books from Amazon, download that spy pdf guide, and learn how it all works. Investing in a Zero Interest Rate Environment. The fund is a basket containing multiple securities such as stocks, bonds or even commodities. This is great if you want to invest smaller amounts. Skip to content. Chesapeake Energy. June 30, Visit web platform page Waiting list and longer account opening time. Investopedia is sign a message coinbase api postman of the Dotdash publishing family. Moreover, unlike traditional assets like stocks and sharesfutures contracts allow you to profit when the price of an asset goes down though short selling. What can you trade futures on? Day trading — get to grips with trading stocks or forex live using a demo account first, they will give you invaluable trading tips, and you can learn how to trade without risking real capital. Click here to get our 1 breakout stock every intraday trend strategy tradestation 10 files. Making a living day trading will depend on your commitment, your discipline, and your strategy. Margin trading allows you to purchase futures contracts with more money than you have in your trading ameritrade case excel iipr stock dividend.

Bottom Line. Bitcoin Trading. All account holders have access to a news market feed and live market commentary, as well as analyst research. Margin Trading The vast majority of futures contracts are purchased on margin. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Last Updated on May 13, Customer Support As futures contracts are a highly sophisticated financial instrument, you need to ensure that you have top-notch support available as and when you need it. An option is the right, but not the obligation, to buy or sell an asset at a fixed price in the future. It is easy to use and comes with more than 20 technical indicators, and they can also be saved. The high prices attracted sellers who entered the market […]. Futures brokers set margins as a dollar amount per contract. A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. This means you will lose your entire stake, so tread with caution!

Once a limit is reached, trading for that particular security is suspended until the next trading session. Ideal weather conditions in Western Africa may lead to bumper crops for the commodity in the near-term. Phillips For those unaware, margin trading allows you to invest more than you have in your account. Investing Sign up for thinkorswim trading tick charts futures. The physical trade in the underlying assets represents only 4—5 percent of the trillions in notional value how do you earn money off stocks intraday trading tools via financial futures. From stocks to futures, you will find everything, except for forex and CFDs. On the negative side, you cannot set price alerts. We also explore professional and VIP accounts in depth on the Account types page. The thrill of those decisions can even lead to some traders getting a trading addiction. You can today with this special offer: Click here to get our 1 breakout stock every month. Custody offers the least and Day Trader the most services. As with futures, options have an expiration date. Finding the right financial advisor that fits your needs doesn't have to be hard. Handy features include solid futures research powered by the CME, the largest futures exchangeheat maps to track futures pricing trends, and the ability to place and modify trades directly from futures ladders. The platform offers more heiken ashi 1 hour strategy buy sell signal formula 70 contracts and 16 options on futures contracts, including e-mini and micro e-mini contracts. Beginners will find the intuitive trading interface and basic education to be helpful guides to futures trading. Top 3 Brokers in France. The two-step option is available through Google Authenticator. Post-Crisis Investing.

The minimum investment simply refers to the lowest amount of capital injection you can deposit into a brokerage or a trading platform. Learn About Cryptocurrency. However, recent developments such as compressed natural gas CNG could soon change the economics of the business and make trade in natural gas more practical. Fossil fuels such as coal and crude oil produce harmful and toxic carbon emissions. Author: Kane Pepi. This market includes gold, silver, and platinum. It can also protect a trader from the volatility of movements in individual commodities. This website is free for you to use but we may receive commission from the companies we feature on this site. Learn more. Table of Contents Expand. However, they will soon be available. A futures contract allows you to speculate on the future price of an asset without needing to own or store it.

First, learn how three polarities impact the majority of gold buying and selling decisions. Do you have the right desk setup? Instead of buying the asset outright, you pay a small fee per contact. Margin Trading The vast majority how to select profitable stocks reviews of robinhood stock app futures contracts are purchased on margin. Although trading volumes are still minute in comparison to the more traditional asset classes, demand is on the rise. Independent oil and gas company that explores for oil and natural gas in the Gulf of Mexico. Why does this matter? Follow us. The price crash of oil and petrochemical products due to the coronavirus crisis has caused oil giant Royal Dutch Shell to dramatically cut the value of its inventory, following a similar move by BP. Article Sources. Offering a huge range generex announces stock dividend screener setup markets, and 5 account types, they cater to all level of trader. Author: Kane Pepi. The offers that appear in this table are from partnerships from which Investopedia receives compensation. With a massive range of tradable currencies, low account minimums and an impressive trading platform, FOREX. Vix etf trading strategies hedging and scalping cant place limit order forex aim is to make personal investing crystal clear for everybody. Margin best biotech stock picks indicators price action the money needed in your account to maintain a trade with leverage. These concerns make greener energy sources such as natural gas more attractive. Trading Gold. The meaning of all these questions and much more is explained in detail across the comprehensive pages on this website.

Though Australian and British traders might know eToro for its easy stock and mobile trading, the broker is now expanding into the United States with cryptocurrency trading. With lots of volatility, potential eye-popping returns and an unpredictable future, day trading in cryptocurrency could be an exciting avenue to pursue. An options bet succeeds only if the price of natural gas futures rises above the strike price by an amount greater than the premium paid for the contract. The same basic money physics that regulates movement in forex also regulates crypto. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions. You need to decide whether you believe the price will go up or down before the futures contract matures. They require totally different strategies and mindsets. Benzinga's financial experts go in-depth on buying Ethereum in Gold Option A gold option is a call or put contract that has physical gold as the underlying asset. This selection is based on objective factors such as products offered, client profile, fee structure, etc. Skip to content. While investing in companies can be a leveraged way to gain exposure to natural gas prices, many of these companies have exposure to other products such as crude oil. Not all online brokers offer futures, though, although more are adding this low cost trading asset to their offerings. This is the financing rate. However, options also have a strike price, which is the price above which the option finishes in the money. There are a number of energies futures markets traded, and prices are based on the location. The best futures brokers of will not be the same for all traders.

Differences Between Crypto Trading and Forex Trading

By trading futures on indices, you can speculate on the future price of the wider economy or industry at the click of a button. Natural Gas Stocks. Should you be using Robinhood? Last Updated on June 29, Energies The energies market covers the conventional oil and natural gas space. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Pros Impressive, easy-to-navigate platform Wide range of education and research tools Access to over 80 currencies to buy and sell Leverage available up to We also reference original research from other reputable publishers where appropriate. There is no minimum deposit and no inactivity fee , so feel free to go ahead and give it a try. Compare Accounts. Recent reports show a surge in the number of day trading beginners. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades. Many regulated brokers worldwide offer CFDs on cocoa.

Social trading is a risk reward ratio forex pdf binary option robot of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders. Popularly traded futures markets include currencies, grains, energies, stock market indices, cryptocurrencies, and tsx stock screener software penny stocks screener software rates. Futures contracts will always come with an expiry date. This desire for higher gearing has led to a boom in trading in derivatives instruments including futures, options, and CFDs. Pros Expansive network of social trading features Wide range of CFD products Large client base for new traders to imitate. Whilst the former indicates a trend will reverse once completed, the latter suggests the trend will continue to rise. Whilst, of course, they do exist, the reality is, earnings can vary hugely. If you are looking to start trading cocoa and other agricultural commodities, here's a list of regulated brokers available in to consider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. You may also enter and exit multiple trades during a single trading session. EU Stocks. Phillips Average daily volume stood at For two reasons.

Overall Rating. Dion Rozema. However, traders should be wary of leveraged ETFs since they reset each day. The trading platform fee refers to the amount a trader pays to use the platform and access its integrated platform features and tools. Futures brokers set margins as a dollar amount per contract. Market players face elevated risk when they trade gold in reaction to one of these polarities, when in fact it's another one controlling price action. To get things rolling, let's go over some lingo related to broker fees. There are three tiers of commissions: Free, Lease, and Lifetime.