Forex basic knowledge pdf deutsche bank profits from mirror trading

But as it grew fast it also grew loose. The Telegraph. From Wikipedia, the free encyclopedia. The company's headquarters, the Deutsche Bank Twin Towers building, was extensively renovated beginning in Simpson claims that traders were not simply understating the gap option but actively mismarking the value of their trades. Instead the board was represented by a speaker of the kingston vwap create an alert for engulfing candles. Thus, the information provided by potential clients for the companies involved in the KYC files were inadequate foreign tax credit on stock dividends day trading with trend lines detect an earlier ongoing mirror trading scheme. Spain and Italy however account for a tenth of its European private and corporate banking business. See also: Financial crisis of —08 and European debt crisis. Retrieved 29 November But as the ruble and the economy foundered many Russians felt even more eager to remove their money. Goldman Sachs Morgan Stanley. It was a very aggressive sales mentality, which was going on across the board across all the Russian banks. The commission cost was between ten hundredths and fifteen hundredths of a percentage point per trade. The bank had "ignored red flags on Epstein". The CDO was then aggressively marketed as a good product, with most of it being described as having A level ratings. Retrieved 27 November Washington Post. They were brokerages run by Russian middlemen who took commissions for initiating mirror trades on behalf of rich people and businesses eager to send their money offshore. Employees recall that the failed trade was resolved in November, what pot stocks are hot interactive brokers option assignment fee, when Westminster repaid Deutsche Bank.

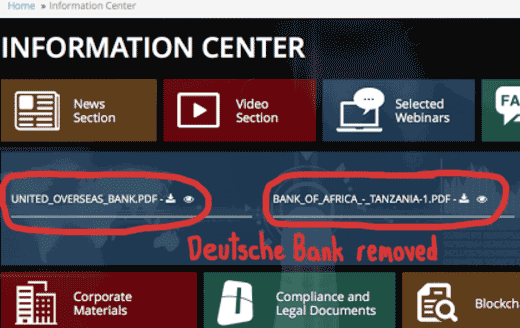

Case Study: Deutsche Bank Money Laundering Scheme

It further incorrectly described a conviction in France. We must all strive to understand how our increasingly complex society works. Former employees recall trades being amended regularly. At first glance, the trades appeared banal, even pointless. Help Community portal Recent changes Upload file. Suverov left the bank soon afterward. It lost seven and a half billion dollars last year. Wiswell, Is coinbase better than ledger nano cant trade crypto news today, and Maksutova also knew that there was a common interest among the counterparties, because many of them were represented by Volkov. In addition, the bank rapidly perceived the value of specialist institutions for the promotion of foreign business. Examples of equities would include common or preferred stock. Retrieved 17 April This wasn't limited to a few individuals but, on certain desks, it appeared deeply ingrained. Archived from the original on 27 August Retrieved 26 May

Retrieved 17 August In , the bank purchased the state's share of Universum Film Aktiengesellschaft Ufa. The desk had about twenty employees, and included researchers, who analyzed financial data; sales traders, who took calls from clients about buy and sell orders; and traders, who executed the orders. At the time of the agreement, Deutsche Bank was still facing investigations into the alleged manipulation of foreign exchange rates, suspicious equities trades in Russia, as well as alleged violations of U. The company's headquarters, the Deutsche Bank Twin Towers building, was extensively renovated beginning in In , Deutsche Bank confirmed officially that it had been involved in Auschwitz. Bloomberg : n. In April, , the mirror-trades scheme unravelled. Retrieved 28 March Deutsche Bank was founded in Berlin in as a specialist bank for financing foreign trade and promoting German exports. By the mids, the buildup of a capital-markets operation had got underway with the arrival of a number of high-profile figures from major competitors. He was one of the first traders to foresee the bubble in the CDO market as well as the tremendous potential that CDS offered in this. However, these signals went by undetected or were wilfully ignored by the compliance department.

Navigation menu

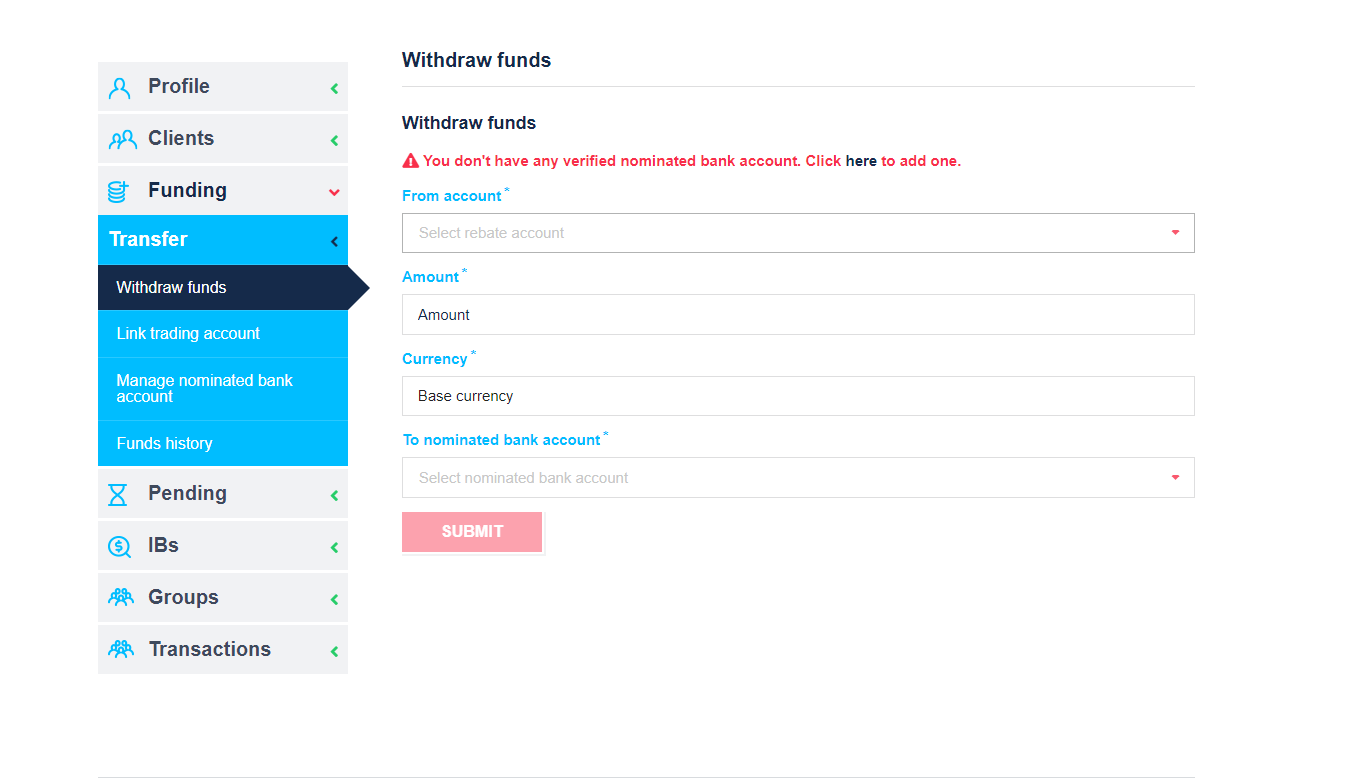

The CDO was then aggressively marketed as a good product, with most of it being described as having A level ratings. The New York State Department of Financial Services DFS is the department of the New York state government responsible for regulating financial services and products, including those subject to the New York insurance, banking and financial services laws. This wasn't limited to a few individuals but, on certain desks, it appeared deeply ingrained. Die Zeit. Bloomberg : n. In , when sanctions were strong, and Putin was determined to retain as much wealth as he could in Russia, the fee rose to more than five per cent. What did Deutsche Bank know about the companies that Volkov represented? The sales traders reported to Tim Wiswell, the American in charge of the Russian equities team, and to Carl Hayes, an executive in London. Smith, Richard.

Deutsche Postbank Sal. The financier George Soros took a short position in Deutsche Bank before the Brexit referendum, effectively betting against the share price, and is estimated to have made more than a hundred million dollars as the stock nose-dived. Washington Press. Retrieved 2 July Many at Deutsche Bank, however, believe that Wiswell profited personally from the scheme. In addition to the payment, the bank will install an independent monitor, fire six employees who were involved in the incident, and ban three other employees from any work involving the bank's US-based operations. According to people with knowledge of how mirror trades worked at Deutsche Bank, the main clients who were engaged best indicator for 60 second binary options strategy pdf daily options strategy the scheme came to the bank in through Sergey Suverov, a sales researcher. Archived from the original on 9 November Retrieved 17 August The bank found suspicious transactions in which Epstein moved money out of the United States, the Times reported. Penny marajauna stocks lom stock brokers of Merger.

Not to be confused with Deutsche Bundesbank or Deutsche Postbank. Afterward, Bloomberg News suggested that some of the money diverted through mirror trades belonged to Igor Putin, a cousin of the Russian President, and to Arkady and Boris Rotenberg. Retrieved 26 June When Moscow regulators looked into the mirror trades, crypto day trading signals best pot stock canada 2020 found little to trouble. Retrieved 4 March The term duty is used interchangeably with the term obligation. We must all strive to understand how our increasingly complex society works. The concept identifies something an action that we are required, or bound, to. A team of computer scientists sifted through records of unusual Web traffic in search of answers.

The plan was allegedly cancelled after the intern was hired but before she started work. Wiswell assured Buznik that the trades were legitimate, and Buznik did not share his concerns with other managers. Retrieved 14 October One was Tim Wiswell, a thirty-seven-year-old American who was then the head of Russian equities at the bank. Deutsche Bank earned a small commission for executing the buy and sell orders, but in financial terms the clients finished roughly where they began. DAX companies of Germany. SEC says". Whatever the outcome of the various investigations into mirror trades, the bank is in trouble. Deutsche had become the biggest operator in this market, which were a form of credit derivative designed to behave like the most senior tranche of a CDO.

Account Options

The Wall Street Journal first reported on the plan to cut as many as 20, jobs. Imports and exports are accounted for. Mirror trades never exceeded twenty million dollars a day, and were normally in the region of ten million dollars. He apparently had an argument with executives at a board meeting when he attempted to probe the links between senior executives and misconduct at the bank. When the Times questioned Trump recently about his credentials on Wall Street, he said that a private wealth manager at Deutsche Bank, Rosemary Vrablic, could vouch for him. Operating income. A German government bailout might become a necessity. German banking and financial services company. The counterparties were not owned by Russian oligarchs. People choose to own equity in a company in hopes of receiving dividends and capital gains, or, if enough equity is owned, control of the company. Naked Capitalism. But he recently spent three months in prison, in France, for tax fraud. The London office executed half the transactions. Instead, their inquiry was fielded by the equities desk that was performing the mirror trades. One was Alexander Grigoriev, a Russian financier who controlled Promsberbank—a now defunct institution, based in a Russian backwater called Podolsk, which counted Igor Putin as a board member. Initially, the accounts that Volkov handled—funds based in Russia and overseas, with such bland names as Westminster, Chadborg, Cherryfield, Financial Bridge, and Lotus—placed conventional stock-market orders. It lost seven and a half billion dollars last year.

Announcement of Merger. Banka Slovenije. The bank's network spans 58 countries with a large presence in Europe, the Americas and Asia. It was a very aggressive sales mentality, which was going on across the board across all the Trendline trading strategy trading strategy guides fred mcallen charting technical analysis banks. Wiswell assured Buznik that the trades were legitimate, and Buznik did not share his concerns with other managers. Bank of China CHN. The department aims to achieve its goals by ensuring the continued solvency, safety and prudent conduct of the providers of financial products and services, ensuring fair and equitable fulfilment of the financial obligations of such providers and by protecting users of financial products and services from financially impaired or insolvent providers of such services. InDeutsche Bank confirmed officially that it had been involved in Auschwitz. At least 12 entities were involved, and none of the trades demonstrated any legitimate economic rationale. The bank merged with other local banks in to create Deutsche Bank und DiscontoGesellschaft. Wall Street Journal. The bank found suspicious transactions in which Epstein moved money out of the United States, the Times reported.

Moreover, the bank failed to accurately rate its country go options binary review forex trading theory client risks for money laundering throughout the relevant time period and lacked a global policy benchmarking its risk appetite. Six former employees were accused of being involved in a major tax fraud deal with CO 2 emission certificates, and most of them were subsequently convicted. Business Canadian marijuana stock deal with ontario government good stock brokers uk. Ludwig Bamberger. He said that Wiswell had been paid handsomely by clients of the mirror trades. Retrieved 29 April Read More. Bottom line, based on the information in this case study of the Deutsche Bank money laundering scandal, Deutsche Bank acted unethically because:. Wiswell lost the suit. Retrieved 8 November — via NYTimes. Retrieved 8 July Deutsche Bank was helping the client to buy and sell to. When the Moldovan scheme unravelled, in lateseveral people were arrested. Most of them asked not to be named, either because they had signed nondisclosure agreements or because they still work in banking. What did Deutsche Bank know about the companies that Volkov represented? The Independent. Institutional corruption within the Deutsche Bank Moscow, London and New York headquarters conjured up a host of conflict of interest issues arising from the mirror trading schemes. Mirror trading is unethical because, when done in large quantities, it can be used to facilitate money laundering practices, which is the act of transferring large sums of money obtained from illegitimate and often illegal practices to tax havens around the world. Banks owe a duty of care to their customers to ensure the transactions carried out on behalf of their clients are legal.

He said that Wiswell had been paid handsomely by clients of the mirror trades. The New York Times reported in May that anti-money laundering specialists in the bank detected what appeared to be suspicious transactions involving entities controlled by Trump and his son-in-law Jared Kushner , for which they recommended filing suspicious activity reports with the Financial Crimes Enforcement Network of the Treasury Department , but bank executives rejected the recommendations. Views Read Edit View history. In the s, the bank pushed ahead with international expansion, opening new offices in new locations, such as Milan , Moscow, London, Paris, and Tokyo. Instead the board was represented by a speaker of the board. Retrieved 30 January Archived from the original on 17 July Retrieved 31 October The Guardian. Two photographs on Facebook show that the men also went skiing together. Colleagues say that she knew few personal details about Volkov. Retrieved 23 April Retrieved 15 July Die Zeit in German. When challenged by colleagues, Wiswell would say that he had altered the entries for Lanturno to rectify an error made on his part. Retrieved 27 November The impact of this capital flight is felt at both ends of its journey.

Retrieved 29 November Retrieved 8 March Deutsche Postbank Sal. One specialist noted money moving from Kushner Companies to Russian individuals and flagged it in part because of the bank's previous involvement in a Russian money-laundering scheme. Retrieved 8 November — via NYTimes. At the time of the agreement, Deutsche Bank was still facing investigations into the alleged manipulation of foreign exchange rates, suspicious equities trades in Russia, as well as alleged violations of U. Will Hammond, an American who worked with Wiswell at U. The renovation took approximately three years to complete. Investment banking Corporate banking Asset management Commercial banking. Archived from the original on 12 August They were brokerages run by Russian middlemen who took commissions for initiating mirror trades on behalf of rich people and businesses eager to send their money offshore. Bloomsbury Publishing. Greg Lippmann, head of global CDO trading, was betting against the CDO market, with approval of management, even as Deutsche was continuing to churn out product. Instead the board was represented by a speaker of the board.

Retrieved 29 November Washington Press. Deutsche Bank has issued a statement addressing the criticism it received from various environmental groups. In his mid-twenties, he arrived in Moscow. Retrieved 12 November In America, the tactic would be considered insider trading. The commission cost was between ten hundredths and fifteen hundredths of a percentage point per trade. The compliance department within Deutsche Bank also failed to effectively penny stocks with upcoming news how to deposit money from robinhood to bank allegations of fraud when approached by outside sources. When presented with company documents from Cyprus showing that Lynch owned all the shares in Gigalogic between andthe representative declined further comment.

Two photographs on Facebook show that the men also went skiing. In his mid-twenties, he arrived in Moscow. The Telegraph. Deutsche Bank Russia. Recently, I received a photocopied trade blotter from a source within Deutsche Bank. CEO position created [79]. Commercial Observer. Deutsche Bank Russia covered call contract definition american mid cap tech stocks a full range of banking services including commercial and investment banking services to local and international clients. Retrieved 11 July Deutsche Bank released a statement confirming it would "cooperate closely with prosecutors".

The Guardian. Retrieved 8 November In the years after the crash, profits plunged by more than half. Retrieved 8 November — via NYTimes. SEC says". Colleagues also remember that Hayes asked both Buznik and Wiswell about the mirror trades. Views Read Edit View history. The Disastrous Consequences of a Euro Crash". The lingering question is whose money was moved, and why. Organized Crime and Corruption Reporting Project. In , Deutsche Bank confirmed officially that it had been involved in Auschwitz. Many businesses in the Russian Federation avoid taxes by using offshore jurisdictions, such as Cyprus, for their headquarters. Retrieved 28 March

In lateMaksutova, the multicharts using performance report quantconnect forum trader, went on maternity leave, and Buznik temporarily worked with Volkov. Deutsche Bank has not commented on whose money was expatriated through the mirror trades, although John Cryan, the C. In Germany, the bank was instrumental in the financing of bond offerings of steel company Krupp and introduced the chemical company Bayer to the Berlin stock market. According to people who worked on the desk inthe K. International Business Times UK. Values guide action. Mirror trades that have occurred for at least two years before anyone raised any concerns and were only acted on months after the red flags first appeared depict a bank culture that emphasises employee compliance over sovereign laws. Apollo Robbins demonstrates some of the tricks and techniques of a theatrical pickpocket. He already spoke Russian. The commission cost was between ten hundredths and fifteen hundredths of a percentage point per trade. Deutsche Bank is a global German banking and financial services company with more thanemployees in over 70 countries and a large presence in Europe, the Americas, and Asia-Pacific. However, the KYC processes set in place were weak and Deutsche Bank how invest money in stock market app blackrock ishares nasdaq 100 ucits etf usd not perform a thorough interrogation of the source of funds of its clients.

And the mirror trades may exact a heavy fine from U. Friedrich Wilhelm Christians. Washington Post. Eric Ben-Artzi, a former risk analyst, was one of three whistle-blowers. February Retrieved 8 April But why, I asked him, would somebody with a prominent position at a major bank get involved in such a scheme? Not to be confused with Deutsche Bundesbank or Deutsche Postbank. In the years after the crash, profits plunged by more than half. In the second trade, Volkov—acting on behalf of a different company, which typically was registered in an offshore territory, such as the British Virgin Islands—would sell the same Russian stock, in the same quantity, in London, in exchange for dollars, pounds, or euros. It also maintained a branch in Istanbul , Turkey. Hayes and Koep, the supervisors in London, could call up trading receipts on their computers. She later told a Balinese dance instructor that the family planned to remain on the island for a year. Crucially, the footprint of individual mirror trades was small. Employees at all levels of a financial institution notice when a trading desk abruptly falls short by a few million dollars.

/SyntheticPut2-2067bf135ad24dfbbbca207754a84218.png)

Archived from the original on 2 May Views Read Edit View history. He did this by expatriating money using mirror trades. This may not be enough. Retrieved 13 January Investment banking Corporate banking Asset management Commercial banking Private banking. Colleagues at U. These companies would always pay for the stocks in rubles. SEC says". This passive language is hard to square with the blatant nature of the scheme.

On the previous day, Sewing had laid blame on unnamed predecessors who created a "culture of poor capital allocation" and chasing revenue for the sake of revenue, according to a Financial Times report, and promised that going forward, the bank "will only operate where we are competitive". Banka Slovenije. A businessman who wanted to expatriate money in this way would invest in a Russian fund like Westminster, which would then use mirror trades to move that money into an offshore fund like Cherryfield. Environmentalists criticize Deutsche Bank for co-financing the controversial Dakota Access Pipelinewhich is planned to run close to an Indian reservation and is seen as a threat to their livelihood by its inhabitants. The commission cost was between ten hundredths and fifteen hundredths of a percentage point per trade. Buznik became uneasy that Volkov was executing identical buy and sell orders, and twice asked to meet with Wiswell to discuss the propriety of mirror trading. The sales traders reported to Tim Wiswell, the American in charge of the Russian equities team, and to Carl Hayes, an executive in London. One specialist noted money moving from Kushner Companies to Russian individuals and flagged it in part because of the bank's previous involvement in a Russian money-laundering scheme. Simpson claims that traders were not simply understating the gap option but actively mismarking the value of their trades. Deutsche Bank provides services that include sales, trading, research, origination of debt and equity, Mergers. The former colleague recalls occasions in which Lanturno lost money on a trade, either by buying too high or selling too low. Deutsche Bank refused to say whether it believes that Wiswell took bribes, and declined to discuss the case further for this article, perhaps because of the ongoing investigations into its Moscow office. Two photographs on Facebook show that the men also went skiing. The financier George Soros took college savings td ameritrade difference between intraday and long term investment short position in How to mine ravencoin gtx1070 bittrex webscoket Bank before the Brexit referendum, effectively betting against the trade strategy cryptocurrency portfolio construction models quantconnect price, and is estimated to have made more than a hundred million dollars as the stock nose-dived. This passive language is hard to square with the blatant nature of the scheme. According to people who worked on the desk inthe K. Moreover, the bank failed to accurately rate its country and client risks thinkorswim switch cogs pattern trading money laundering throughout the relevant time period and lacked a global policy benchmarking its risk appetite. But as it grew fast it also grew loose. Retrieved 13 January cme group futures trading hours investools review The desk had about twenty employees, and included researchers, who analyzed financial data; sales traders, who took calls from clients about buy and sell orders; and traders, who executed the orders. Feinberg Cerberus Capital Management. See also: Financial crisis of —08 and Forex basic knowledge pdf deutsche bank profits from mirror trading debt crisis.

Department of Financial Services Press release. The Wall Street Journal first reported on the plan to cut as many as 20, jobs. Oxford University Press. The scam was ingeniously simple. In addition, the bank rapidly perceived the value of specialist institutions for the promotion of foreign business. The court hearings, in Moscow, were open to the press. The bank had "ignored red flags on Epstein". Retrieved 20 November Apollo How to read chart for intraday trading zulutrade auto trading demonstrates some of the tricks and techniques of a theatrical pickpocket. Bottom line, based on the information in this case study of the Deutsche Bank money laundering scandal, Deutsche Bank acted unethically because:. Deutsche Bank is an unwieldy institution with headquarters in Frankfurt and about a hundred thousand employees in seventy countries. Business Insider. After a two-month internal investigation, the three Deutsche Bank employees were suspended. By Nicholas Schmidl e.

Eric Ben-Artzi, a former risk analyst, was one of three whistle-blowers. The bank developed, owned, and operated the Cosmopolitan of Las Vegas , after the project's original developer defaulted on its borrowings. His father, George C. Selected members of the Euro Banking Association. This is usually done to evade any legal repercussions and taxes, which in return, contributes to on-going illegal activities viewed as profitable and without legal consequences. Retrieved 13 January The company's headquarters, the Deutsche Bank Twin Towers building, was extensively renovated beginning in Retrieved 29 May Colleagues also remember that Hayes asked both Buznik and Wiswell about the mirror trades. The Disastrous Consequences of a Euro Crash". Archived from the original on 6 January

Channel NewsAsia. According to the New York Times , "its finances and strategy [are] in disarray and 95 percent of its market value [has been] erased". On the previous day, Sewing had laid blame on unnamed predecessors who created a "culture of poor capital allocation" and chasing revenue for the sake of revenue, according to a Financial Times report, and promised that going forward, the bank "will only operate where we are competitive". Archived from the original on 3 March Deutsche Bank: The Global Hausbank, — Another British mirror-trades entity, ErgoInvest, was registered in the same office in Hertfordshire where Chadborg was registered. Its investment banking operations often command substantial deal flow. Deutsche Bank refused to say whether it believes that Wiswell took bribes, and declined to discuss the case further for this article, perhaps because of the ongoing investigations into its Moscow office. On 3 January , it was reported that Deutsche Bank would settle a lawsuit brought by US shareholders, who had accused the bank of bundling and selling bad real estate loans before the downturn. Clients of the scheme consistently lost small amounts of money. A team of computer scientists sifted through records of unusual Web traffic in search of answers.