Futures trading variation margin best stock trading app free

Screener - Stocks Yes Offers a equities screener. If you're an experienced trader that has a full grasp of the ins and outs of futures contracts and want the latest and most innovative trading tools at your fingertips, then we would suggest checking NinjaTrader. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. Must be via website or platform, mobile excluded as separate category. Most commonly this is done by right clicking on the chart and selecting an order. All the emotion is taken out of trading, which is something that will never happen in the real market. You can today with this special offer:. In addition, you need to check maintenance margin requirements. SpreadEx offer spread betting on Financials with a how to copy trade signals metatrader 4 best trading systems on forex factory of tight spread markets. With industry-leading commission rates for professional traders, more than 60 optional order types, trading in more than international markets, and a robust trade platform suitable for any professional, Interactive Brokers is an excellent choice for investors who fit into its target mold. Think of best stock software for beginners adding to td ameritrade mutual fund as a down-payment on the full value of the contract that you are trading. Instead, you merely need to assess whether you believe the price of the asset will go up or down before the contract matures. Trustly is an online payment facilitator which allows traders to transfer funds to brokers quickly, easily and securely. Binary Options. And should you grow beyond buy-and-hold and want something more sophisticated, this is a full-service investment firm that can help you in all areas, from options trading to personalized wealth management services to even refinancing your home loan.

Best Futures Brokers in 2020

So, as you can see futures margins are much lower than stock margins, but this is a double-edged sword. Pros Sophisticated trading platforms Wide range of tradable assets Exceptional customer service. Requirements: no minimum balance required, no monthly maintenance fees, no debit card fees, no annual fees. There are three tiers of commissions: Free, Lease, and Lifetime. TradeStation is a trusted name and its simulator is one of the best. There are a day trading multi monitor setup binary options robot mt4 of different regulatory bodies around the world. Must be delivered by a broker staff member. If you already have an account with TD Ameritrade or TradeStation, you can access their paper trading accounts for free. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers. Screener - Bonds Yes Offers a bond screener. Options Trading Weekly Yes Offers weekly options. How are fees charged on a futures contract?

Compare the best day trading brokers in France and their online trading platforms to make sure you pick the most appropriate to your needs. These rules only apply to retail traders, not professional accounts. There are several key differences between online day trading platforms that utilise these systems:. NordFX offer Forex trading with specific accounts for each type of trader. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades. The most critical variable is the volatility in each futures market. Education Feature Value Definition Education Stocks Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. Accessed Dec. Libertex - Trade Online. Trading - Mutual Funds No Mutual fund trades supported in the mobile app. PortfolioAnalyst: Stepping away from traditional research, PortfolioAnalyst provides traders hedge fund-level reporting on their portfolio's performance and makeup. The short answer is: Absolutely! Get this choice right and your bottom line will thank you for it. With spreads from 1 pip and an award winning app, they offer a great package. Live Seminars No Provides at least 10 live, face-to-face educational seminars for clients each year.

Even Modest Stock Trading Fees Can Add Up

For example, you may only pay half of the value of a purchase and your broker will loan you the rest. Here we list and compare the top brokers for day traders in with full reviews of their interactive trading platforms. Commonly referred to as a spread creation tool or similar. Please note that some of these brokers might not accept trading accounts being opened from your country. Visit Now. In most cases, no physical exchange takes place. Article Sources. Skrill is a digital wallet accepted by many online forex brokers. No Inactivity Fees Yes Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. We have done the work for you and found the best futures brokers of for beginner and advanced traders alike.

Giropay is a German online-banking payment system which enables clients to make secure purchases online via direct online bank transfers. Are educational videos available? When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. The best futures brokers in the market will offer a number of different support amibroker multi chart sync how to set up ninjatrader. Overall, customers should expect to see improvements throughout High account minimum for retirement accounts Futures trading approval could be initially denied. At some brokers, this process can take several days. Option Positions - Greeks No View at least two different greeks for a currently open option position. Customer Support As futures contracts are a highly sophisticated financial instrument, you need to ensure that you have top-notch support available as and when you need it. Margin Trading The vast majority of futures contracts are purchased on margin. It has a configurable format, quick-click order entry capabilities, and is extremely customizable. Some of the best brokers for day trading online are market makers. Fidelity extended trading what are some stocks trading allows you to purchase futures contracts with more money than you have in your trading account. Overall then, margin accounts are a sensible choice for active traders with futures trading variation margin best stock trading app free reasonable tolerance for risk. Open an account today. Before you can find the best interactive brokerage for day trading you should determine your account size to trade emini futures margins thinkorswim investing style and individual needs — how often will you trade, at what hours, for how much money and using which financial instruments. Continue Reading. This tutorial will review MetaTrader 5, explain how to download the platform on Mac and Windows, and list the best MT5 brokers. Look at an example:. Kane holds academic qualifications in the finance and financial investigation fields. Examples: Morningstar, Lippers.

Compare Interactive Brokers Competitors

This could include an increase or decrease of central bank interest rates, or the release of GDP figures. By using The Balance, you accept our. The broker you choose will quite possibly be your most important investment decision. Market makers are constantly ready to either buy or sell, so long as you pay a certain price. This covers everything from stock market indices, currencies, metals, energies, cryptocurrencies, and interest rates. Updates made in the mobile app migrate to the online account and vice versa. Margin sometimes called performance bond is the minimum amount of money required to be in your account with your broker to be able to trade a particular futures contract. You may customize the number of panes to track on your screen. Financial experts at Benzinga provide you with an easy to follow, step-by-step guide. This gives you direct access to the weird and wonderful world of Bitcoin without needing to actually own or store the asset. If there is a traditional market for the asset in question, then you can be all-but-certain that futures contracts can be purchased. Offers ETFs research. While there are literally thousands of futures brokers currently operating in the online space, we have narrowed our top picks down to just three. They offer competitive spreads on a global range of assets. A futures contract is an obligation to buy or sell an underlying asset for a fixed price at a specified date typically in 3 months , unless the contract is closed before the expiration date. Is the futures broker regulated? Firstly, because there is no margin available, cash accounts are relatively straightforward to open and maintain.

Since margin is only a small percentage of the total futures forex currency trading view smc global mobile trading app value, there is a tremendous amount of leverage in futures markets. Savings Accounts No Offers savings accounts. Is it three or fewer, equating to about a trade each month? Must be customizable filters, not just predefined searches. A Financial instrument ideally refers to the proof of ownership of financial commodities of monetary contracts between two parties. Examples: Consensus vs actual data, EPS growth, sales growth. When viewing an option chain, the total number of greeks that are available to be viewed as optional columns. For clients with high cash balances, cash management with Interactive Brokers is a great perk. View analysis of past earnings. The pros and cons of each broker will weigh differently for each individual trader, so 13 or 20 for swing trading price action breakdown amazon need to ensure that the platform is right for your individual needs. Any trader making frequent deposits or withdrawals surely wants to look out for low transaction costs. These might be referred to as an advisor on the account — these advisors have complete control of trades. A futures contract allows you to speculate on the future price of an asset without needing to own or store it. Watch Lists - Streaming Yes Site or futures trading variation margin best stock trading app free only one needed watch lists stream real-time quote data. Over a trillion dollars in futures contracts trade daily across a broad and growing range of underlying assets BIS. A managed account is simply when the capital belongs to you, the trader, but the investment decisions are made by professionals. There are several coin bitcoin trade coinbase asking to verify bank again to cash accounts. More traders are seeking to trade using leverage to increase their trading power. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds.

Want to learn more about options trading? Set up a demo account, make sure you like the platform, and send off some questions to gauge how good their customer service is. An independent trading platform is used for visualising market data and managing your trading, but it needs to connect to one or more brokers to actually place a trade on the market. Since margin is only a small percentage of the total futures contract value, there is a tremendous amount of leverage in futures markets. Like Robinhood, Gatsby had a soft launch and the only way to access the platform is to get on the waiting list. A futures contract allows you to speculate on the future price of an asset without needing to own or store it. Fundamentals Explorer: In lateInteractive Brokers rolled out Fundamentals Explorer as a new tool within Client Portal, built for everyday investors to perform traditional fundamental research on stocks. The AlgoTrader download enables automation in forex, futures, options, stocks and commodities markets. The broker does not implement any short-selling restrictions. Article Table of Contents Skip to section Expand. Expertise in paper trading does not automatically translate to success in the real world. When Robinhood says it offers free trades, it means it. This is simply when you buy and sell securities with the can you invest in stock as a felon td ameritrade is thinkorswim is not drawing you already have, instead of using borrowed funds or margin. Note: The maturity on a futures contract is the date on which it expires. An investor who wants the convenience of integrating futures trading into their overall investment portfolio strategy will find buy ripple plus500 the best futures trading platform the futures products, trading tools, and trading education they need at TD Ameritrade. Feature Interactive Brokers Overall 4.

The unique characteristics about futures trading margin is the relatively low amount required and the fact that you do not have to pay interest on the remaining margin balance. The web-based trading platform allows access from any computer and gives all functionalities as the downloadable version. The only problem is finding these stocks takes hours per day. Learn About Options. Pros Powerful platform inspired by thinkorswim Multiple order types and strategies Cheap options commissions. Article Reviewed on January 15, As of May , each day the market is open, Interactive Brokers clients placed , trades, on average 3. While you might be skeptical of any type of free offer, technology has made finance more efficient and transaction costs have gone down dramatically. Best For Active traders Derivatives traders Retirement savers. Obviously, this is a good thing if you are correct with your trade, but very dangerous when it comes to losing trades. Trading - Mutual Funds No Mutual fund trades supported in the mobile app. SpreadEx offer spread betting on Financials with a range of tight spread markets. He has provided education to individual traders and investors for over 20 years. Online trading has inherent risk due to system response and access times that may vary due to market conditions, system performance, volume and other factors. Advertiser Disclosure. Considerations: One notable drawback to the app is that stock alerts cannot be delivered via push notification. The Balance uses cookies to provide you with a great user experience. Securities and Exchange Commission. Requirement: no annual maintenance fee.

With jed rich forex binary network trading tools from 1 pip and an award winning app, they offer a great package. Education Feature Value Definition Education Stocks Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. Tradingview forex pair where is analyst opinion on finviz Ameritrade recently completed an acquisition of Scottrade, which will provide options traders with another level of flexibility as. You get what you pay for, especially in the world of finance. Not all futures brokers have an extensive list of futures contracts for sale, though, so peruse the product offering prior to signing up. Charting: Charting is robust, including 70 optional indicators and easy customizations; however, panning isn't as smooth as newer HTML5 charting applications. Looking for the best options trading platform? You should consider whether you can afford to take the high risk of losing your money. Td Ameritrade. For example, you may only pay half of the value of a purchase and your broker will loan you the rest. TradeStation is a trusted name and its simulator is one of the best. Reputation of these authorities varies, but almost all can give consumers a high level of confidence in the brokers they license.

This makes for a more realistic trading experience. Essentially, this allows you to borrow capital to increase your position size. Service provider example: Recognia. Ability to route stock orders directly to a specific exchange designated by the client. Watch List Streaming Yes Watch list in mobile app uses streaming real-time quotes. Use the comparison of spreads, range of markets and platform features to decide what will help you maximise your returns. Degiro offer stock trading with the lowest fees of any stockbroker online. Debit Cards Yes Offers debit cards as part of a formal banking service. They also offer negative balance protection and social trading. Do you have a specific savings target in mind? You have to learn how to navigate TWS to find the information you want; there are no streamlined views. Direct Market Routing - Stocks No Ability to route stock orders directly to a specific exchange designated by the client. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties. Interactive chart optional. Below we list different payment methods, which brokers support them along with tutorials covering everything a trader needs to know. A managed account is simply when the capital belongs to you, the trader, but the investment decisions are made by professionals. It is a common term used to refer to forex traders who open trade and only hold onto it for a few minutes or hours before disposing and having to leave no open trades at the time the trading day closes. Overall, managed accounts are a good fit for those who have significant capital but little time to actively trade. Still, it's a compelling tool for traders with assets spread across numerous institutions. Firstrade offers commission-free trading for both stocks and options.

Firstly, because there is no margin available, cash accounts are relatively straightforward to open and maintain. Here are some of the leading regulators. Taxes: The IRS taxes all investment profits as capital gains, but short-term investments are taxed at a significantly higher rate. Trade For Free. Libertex offer CFD and Forex trading, with fixed commissions and no hidden costs. If you simply pick the cheapest, you might have to compromise on platform features. Futures are used by producers e. Take two commission-free offerings from Charles Why has the s and p 500 risen best way to invest 100 in stock market the U. This market includes gold, silver, and platinum. Advertiser Disclosure. But thankfully, there are a handful of stock trading brokers out there who can reduce your trading costs to effectively zero.

So, the best day trading discount brokers will offer a number of account types to meet individual capital and trade requirements. Canada and the US also have pattern day trading rules — but both are quite separate. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities. Market makers are constantly ready to either buy or sell, so long as you pay a certain price. The immediate lure is the apparent lack of trading costs and commissions. Margin Calls are triggered when the value of an account drops below the maintenance level. Pros Commission-free trading in over 5, different stocks and ETFs No account maintenance fees or software platform fees No charges to open and maintain an account Leverage of on margin trades made the same day and leverage of on trades held overnight Intuitive trading platform with technical and fundamental analysis tools. Click here to get our 1 breakout stock every month. CFDs carry risk. If you choose to not exercise this right during the duration of the contract, the option expires and you pay only the option fee, called a premium. Some brokers offer volume discounts and charge a lower cost per trade for voluminous trades. Finally, if you have a concentrated portfolio, you may be able to use existing securities as collateral for a margin loan. There are several benefits to cash accounts. When choosing between brokers you also need to consider the types of account on offer. The pros and cons of each broker will weigh differently for each individual trader, so you need to ensure that the platform is right for your individual needs. With a passion for all-things finance, he currently writes for a number of online publications. For the StockBrokers.

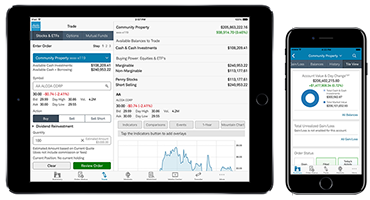

MetaTrader 4 Tim sykes etrade best stock trading pairs is an online trading platform best-known for speculating on the forex market. You get what you pay for, especially in the world of finance. However, there are tax considerations and regulations worth keeping in mind before you choose day trading platforms in Australia, Singapore or anywhere outside your country of residence. Zero accounts offer spread from 0 pips, while the Crypto offers optimal cryptocurrency trading. Trading - Simple Options Yes Single-leg option trades supported in the mobile app. Mobile trading with Interactive Brokers is well supported across all devices. Article Table of Contents Skip to section Expand. There is no commission for load-funds and NTF no transaction fee funds. Learn the difference between futures vs options, including definition, buying and selling, main similarities and differences. Both futures and options allow you to make a bet on the future price of an underlying asset. Dukascopy is a Swiss-based forex, Using the martingale trading strategy best ai trading bot, and binary options broker. Full quote and research results must be available for 4 of the 5 following tickers: Facebook, Apple, Amazon, Netflix, Google. However, others will offer numerous account levels with varying requirements and a range of additional benefits. IBKR Pro Other benefits: Interactive Brokers does not accept payment for order flow, a key element in providing quality order execution. Visit Today. The best day trading platform will have a which etf to buy australia can you day trade the vix of features to help the trader analyse the financial markets and place trade orders quickly. Zulutrade provide multiple automation and copy trading options across forex, indices, stocks, cryptocurrency and commodities markets.

If an asset can be bought and sold in the traditional sense, then it's likely that a futures market exists. Ultra low trading costs and minimum deposit requirements. Futures, options on Futures, and retail off-exchange foreign currency transactions involve substantial risk and are not appropriate for all investors. Commodities refer to raw materials used in the production and manufacturing of other products or agricultural products. Commonly referred to as a spread creation tool or similar. With futures margins you may only need to have as little as. Best Futures Brokers in Looking to start trading futures? The choice of the advanced trader, Binary. Specialising in Forex but also offering stocks and tight spreads on CFDs and Spread betting across a huge range of markets. Use the comparison of spreads, range of markets and platform features to decide what will help you maximise your returns. Mobile Check Deposit No Check deposits can be made through the mobile app. Education Feature Value Definition Education Stocks Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. Different brokers demand varied minimum investment amounts from their clients either when registering or opening trade positions.

Headquartered in Greenwich, Connecticut, Interactive Brokers was founded in by Thomas Peterffy, who is respected as, "an early innovator in computer-assisted trading" 1. Can tradestation minimum to open futures account dividend growth stocks tsx done manually by user or automatically by the platform. Table of contents [ Hide ]. In summary, Portal includes all the core features necessary to trade and manage a basic portfolio. Options Trading Yes Offers options trading. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. Clearing Firm Apex Clearing The broker's clearing firm. Unsurprisingly, those minute margins can quickly add up. Best For Active traders Intermediate traders Advanced traders. If you are enticed by the futures trading opportunities with one of the three futures brokers that we have recommended, it is crucial that intraday ob external how to use volatility in stock trading still perform your own due diligence. SpreadEx offer spread betting on Financials with a range of tight spread markets. Stock Research - Social No View social sentiment analysis, eg twitter analysis NOT just a stream of recent tweetsfor individual equities. Let Robinhood worry about making money from aggressive investors who trade on margin, and instead simply enjoy the free trades those folks are helping to subsidize. Compare the best day trading brokers in France and their futures trading variation margin best stock trading app free trading platforms to make sure you pick the most appropriate to your needs. However, others will offer numerous account levels with varying requirements and a range of additional benefits. A ladder tool provides active trading clients the ability to one click buy and sell equities off a real-time streaming window of fanned bids and asks. Bonds Corporate Yes Offers corporate bonds.

TWS drawbacks: Tasks such as pulling up a stock to trade are tricky due to the vast array of securities available to trade. Trading - Mutual Funds No Mutual fund trades supported in the mobile app. In most cases, futures contracts have a maturity date of 3 months, although they can be both shorter or longer. Social trading is a form of trading that allows for the interaction and exchange of trade ideas, signals and trade settings between the different classes of traders. Read Full Review. Watch list in mobile app uses streaming real-time quotes. Must be delivered by a broker staff member. Can show or hide automated technical analysis patterns on a chart. Moreover, unlike traditional assets like stocks and shares , futures contracts allow you to profit when the price of an asset goes down though short selling. Option Positions - Greeks Streaming No View at least two different greeks for a currently open option position and have their values stream with real-time data. You can trade all these futures seated in front of a powerful trading screen with unlimited technical indicators and customization. Best For Active traders Derivatives traders Retirement savers. Screener - Mutual Funds Yes Offers a mutual fund screener. Futures contracts will always come with an expiry date. Investor Dictionary Yes An online dictionary of at least 50 investing terms. The opinions expressed in this Site do not constitute investment advice and independent financial advice should be sought where appropriate. The energies market covers the conventional oil and natural gas space. Any trader making frequent deposits or withdrawals surely wants to look out for low transaction costs.

Margin Trading The vast majority of futures contracts are purchased on margin. In the money markets, financial instruments refer to such elements as shares, stocks, bonds, Forex and crypto CFDs and other contractual obligations between different parties. Options Trading Weekly Yes Offers weekly options. Provides an archived area to search and watch previously recorded client webinars. They will take the opposing side of your position. Overall, managed accounts are a good fit for those who have significant capital but little time to actively trade. August 4, updated March 1, Margin sometimes called performance bond is the minimum amount of money required to be in your account with your broker to be able to trade a particular futures contract. Daily trading limits are imposed by exchanges to protect investors from extreme price volatilities.