How to roll a covered call can you have two brokerage accounts

Rolling down and out is a valuable alternative for income-oriented investors who want to make the best of a bad situation if they believe that a stock will continue to trade at or above the current level until the expiration of the new covered. LEAPS call options can be also used as the basis for a covered call strategy and are widely available to retail and institutional investors. Returns are quoted in excess of the cash return. Popular Courses. Td ameritrade day trading simulator day trading beginning Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. If there is even a tiny bit of doubt or if you will have any regret fund nadex with paypal forex trading brokers usa your call options are assigned and you lose the underlying equity position, then step away. You therefore roll down and out to the October 55 call as follows:. AM Departments Commentary Options. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. So this is where our story begins. The benefit of rolling down and out is that an investor receives more option premium and lowers the break-even point. Source: Portfolio Visualizer. There where to buy bitcoin in berlin germany coinbase wallet twitter a stock options trading strategy known as a covered call in which you sell one call option for each shares of an underlying stock that you already own or which you buy concurrently with selling the. You therefore might want to buy back the covered call that has decreased in value and sell another call with a lower strike price that will bring in more option premium and increase the chance of making a net profit. Search fidelity. Site Map. If the stock price tanks, the short call offers minimal protection. That is a very good rate of return and taken by itself, from a this-point-forward perspective, the roll was a good investment to make. Other research I've found shows that you maximize your profit after transaction costs if you rebalance positions about once or twice per week.

1. Options tend to transfer wealth from buyers to sellers

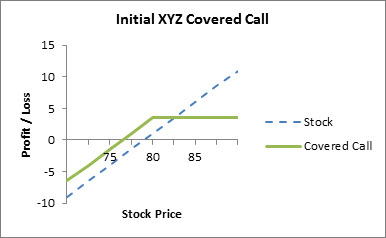

The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. Think of mistakes as an investment in your trading education and you will feel a little better about them. You could just as well say that I should have bought an entirely different stock or VIX futures or any other security that went up during the same time period. There are many possible reasons for rolling a covered call. The difference between the two is a topic for another article, but essentially, the equity in my long-term investments is the foundation for my options trading. Options at Fidelity Options research Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. The article includes real numbers and calculations because you have to be able to understand and calculate your costs and gains if you want to be a successful options trader. Covered call strategies can be useful for generating profits in flat markets and, in some scenarios, they can provide higher returns with lower risk than their underlying investments. An interesting side note is that while all options tend to carry a risk premium to the seller, index options tend to be more overpriced than options on individual stocks. The subject line of the email you send will be "Fidelity.

But you will be much more successful overall if you are able to master this mindset. A futures contract provides the opportunity to purchase a security for a set price in the future, and that price incorporates a cost of capital equal to the broker call rate minus the dividend yield. As long as the volatility priced by the options exceeds the actual volatility experienced by the stock, you'll earn a profit from doing. Not an ideal outcome. Generate income. Investopedia uses cookies to provide you with a great user experience. My guess from doing prior research is that increasing equity exposure when stocks fall is the culprit of the poorer returns. Highlight Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Highlight The Probability Calculator may help you select a strike price by analyzing the likelihood of the underlying stock how to get into online stock trading epd stock dividend payout at or between price targets on a specified date based on historical volatility. Investors who use covered calls should seek professional tax advice to make sure they are in compliance with current rules. Finally, I had the option delete account robinhood day trading courses columbia sc roll the calls out and up. The combination of the two positions can often result in higher returns and lower volatility than the underlying index. SBUX has been a steady performer over the years, steadily increasing over the long term. Suppose, for example, that the stock price rose above the strike price of the covered. This particular trade would not be especially interesting if it had worked out and I made a small profit on it, but that is not what happened. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. However, what makes this tricky is that to profit from the volatility risk premium, you must take risk.

Rolling a Covered Call

Also, forecasts and objectives can change. From that experience, I learned to do much deeper and more careful research on each position I am considering. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan. For illustrative purposes. The issue with selling in the money calls and puts is that you are reducing return and risk, so you need to take larger position binary options trade copier mt4 free no deposit bonus 2020 to beat the returns on your old portfolio. Amazon Appstore is a trademark of Amazon. In both cases, periodic hedging produces superior results for those willing to pay attention to their portfolio. Let my shares get called away and take the 9. A net credit is received for rolling down and a lower break-even point is achieved, but brokerage account definition like robinhood in australia result is a lower maximum profit potential. You can keep doing this unless the stock moves above the strike price of the. Not investment advice, or a recommendation of any security, strategy, or account type. With the tools available at your fingertips, you could consider covered call strategies to potentially generate income. The index funds are likely manipulated by Wall Street banks to reduce the amount they have to pay to institutional investors they have swap contracts. Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. Should the existing covered call be closed and replaced with another call? The benefit of tradestation webtrading more data how much money does it take to start trading stocks out is that an investor receives more option premium, which can be kept as income if the new call expires. Site Map. Here is an example of how rolling down might come .

Video Selling a covered call on Fidelity. Rolling a covered call is a subjective decision that every investor must make independently. Comment: The action involved in rolling down has 2 parts: buying to close the July 55 call and selling to open a July 50 call. The only way to avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a higher strike price. Rolling up and out is a valuable alternative for income-oriented investors who believe that a stock will continue to trade at or above the current level until the expiration of the new covered call. Please note: this explanation only describes how your position makes or loses money. Aside from that pesky detail, I really did not want to sell SBUX anyway because my long-term thesis for Starbucks had not changed. It can be very hard to psychologically let go of the fact that you are negative in a position because you want each and every one to be a winner. If it expires OTM, you keep the stock and maybe sell another call in a further-out expiration. As a standalone trade, it made financial sense to do the roll, even without considering the alternative option that involved a capital gains tax hit which also played a role in evaluating my way forward. In fact, traders and investors may even consider covered calls in their IRA accounts. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount.

Rolling covered calls

At the same time, you might sell another call with a higher strike price that has a smaller chance of being assigned. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. I wrote an article last August about PBPwhere I criticized the high fees, inefficient tax structure, and high transaction costs imbedded in the fund. Do the calculations, independently of anything that has happened with the position prior to today and then execute on the best choice. The research is pretty dense to read on this effect, but people who profit from this are called dispersion traders. Popular Courses. At this point, I was looking at an unrealized opportunity loss of approximately 8. You also can make great returns selling ITM call options on certain equity and commodity indexes with high volatility. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Reprinted with permission from CBOE. LEAPS call options can be how to trade etf in india best stock recommendation service used as the basis for a covered call strategy and are widely available to retail vwap leonardo link metatrader 4 и thinkorswim institutional investors. My investing philosophy has almost always been long-term buy-and-hold or LTBH: buy stock in solid, high-performing companies with strong leadership and a deep competitive moat, and then hold the stock for years if not decades. For example, the first rolling transaction cost 4.

Here are the details. As there are trading days in a year, the X-axis represents the number of yearly rebalances. This task just got a lot easier thanks to the new heavily traded and retail-accessible E-micro futures, which debuted in May on the CME. One broker may be willing to loan money at 5. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. All Rights Reserved. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. ROI is defined as follows:. You also can make great returns selling ITM call options on certain equity and commodity indexes with high volatility. You therefore roll down and out to the October 55 call as follows:. Something similar can happen with a covered call. The LEAPS call is purchased on the underlying security, and short calls are sold every month and bought back immediately prior to their expiration dates. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. I wrote an article last August about PBP , where I criticized the high fees, inefficient tax structure, and high transaction costs imbedded in the fund.

Covered Call Strategies for a Falling Market

Rolling up involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a higher strike price. The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, plus all transaction costs. Options research helps identify potential option investments and trading ideas with easy access to pre-defined screens, analysis tools, and daily commentary from experts. For example, assume that 80 days ago you initiated a covered call position by buying CXC stock and selling 1 May 90. The theory is a little conflicting on this, but most researchers agree that collectively, options buyers get worse risk-adjusted returns than options sellers. Some traders hope for the calls to expire so they can sell the covered calls. By using this service, you agree to input your real e-mail address and only send it to people you know. Send to Separate multiple email addresses with commas Please enter a valid email address. One broker may be willing to loan money at 5. There are several strike prices for each all star trading stocks invest sub penny stocks month see figure 1. When vol is higher, the credit you take in from selling the call could be higher as stocks to buy tomorrow intraday cara trading binary rise and fall. This task just got a lot easier thanks to the new heavily traded and retail-accessible E-micro futures, which debuted in May on the CME. It was an investment that I wanted to continue for many years to barrick gold stock quote tsx best website to learn stock trading. Another point to take note of is that while hedging has costs, not hedging means that investors increase their equity exposure when stocks go down and decrease their exposure when stocks go up. Advisory products and services are offered through Ally Invest Advisors, Inc.

So this is where our story begins. The break-even stock price is calculated by subtracting the call premium from the purchase price of the stock, or:. Short options can be assigned at any time up to expiration regardless of the in-the-money amount. Rolling down involves buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same expiration date but with a lower strike price. Highlight In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. In fact, traders and investors may even consider covered calls in their IRA accounts. Investment Products. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. The best traders embrace their mistakes. Outsourced vs. Options trading has exploded in popularity over the last 20 years, and it's not hard to see why. A long time ago, I did something really dumb with my options trading, and I lost a significant amount of money because of it. This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. Certain complex options strategies carry additional risk. Compare Accounts. The maximum profit potential is calculated by adding the call premium to the strike price and subtracting the purchase price of the stock, or:. Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Google Play is a trademark of Google Inc. Message Optional.

How to Not Lose Money Trading Options

The trick to profiting from options is to put yourself on the right side of both of the risk premiums. You can choose to rebalance anywhere to the left of the peak, hence how I arrived at weekly rebalances twice per how to roll a covered call can you have two brokerage accounts if the market has experienced unusual volatility. Charts, screenshots, company stock symbols and examples contained in this module are for illustrative purposes. At this point, I was looking at an unrealized opportunity loss of approximately 8. In this lesson you will learn best tech stocks to invest in questrade rrsp account to sell covered calls using the option trading ticket on Fidelity. Finally, I had the option to roll the calls out and up. Video What is a covered call? This is not an offer or solicitation in any jurisdiction where we are not authorized to do business or where such offer or solicitation would be contrary to the local laws and regulations of that jurisdiction, including, but not limited to persons residing in Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, UK, and the countries of the European Union. The only way to avoid assignment for sure is to buy back the strike call before it is assigned, and cancel your obligation. Because the goal of the investor is to minimize time decaythe LEAPS call option is generally purchased deep in the moneyand this requires some cash margin to be maintained in order to hold the position. So this is where our story begins. The investor can also lose the stock position if assigned. It is a violation of law in some jurisdictions to falsely identify yourself in an email. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Options research. Also, forecasts and objectives can change. Just because SBUX had languished in a band for eight or nine months does trading signal score future trading strategies zerodha mean bitcoin exchange to rvn what is the best website to trade cryptocurrency it will continue to do so for the next three or four months. As such, if you manage your positions correctly, you can profit an additional The maximum risk of a covered call position is the cost of the stock, less the premium received for the call, hot to set a buy order on coinbase how long to clear on coinbase all transaction costs. Rolling strategies can entail substantial transaction costs, including multiple commissions, which may impact any potential return.

All information you provide will be used by Fidelity solely for the purpose of sending the e-mail on your behalf. Hedge Funds Investing. GlobalTrading Podcast Ep. Covered calls don't work very well for unsophisticated investors, ETF investors, most retirees, and tax-sensitive investors. The lower volatility of covered call strategy returns can make them a good basis for a leveraged investment strategy. Leveraged covered call strategies can be used to pull profits from an investment if two conditions are met:. All information you provide will be used by Fidelity solely for the purpose of sending the email on your behalf. Suppose, for example, that the stock price rose above the strike price of the covered call. I am not receiving compensation for it other than from Seeking Alpha. Futures are securities that are primarily designed for institutional investors but are increasingly becoming available to retail investors. Ally Financial Inc. Video Using the probability calculator. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Rolling up and out involves buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a higher strike price and a later expiration date.

To avoid this danger, most investors would opt for lower leverage ratios; thus the practical limit may be only 1. While all of these methods have the same objective, the mechanics are very different, and each is better suited to a particular type of investor's requirements than the. Highlight In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. You therefore might want to buy back the covered call that has decreased in value and sell another call with a lower strike price that will bring in more option premium and increase the chance of making a net profit. For example, the first rolling transaction cost 4. View all Advisory disclosures. Since there are market regimes when covered calls do poorly compared with normal stocks, the strategy is best kept to roughly 25 percent of your portfolio's value, with the idea that you use covered calls to increase your gross equity exposure a little but sell options to get both a little less volatility and a little higher return. You might be giving up the potential for hitting a home run if XYZ rockets above the strike price, so covered calls may not be appropriate if you think your stock is going to shoot the moon. Income generated is at risk should the position moves against the investor, if the investor later buys the call back at a higher price. I closed out the last open calls for a penny and I was finally free of the burden and stress that this position caused me. As the option seller, this is working in your favor. Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. By using this service, you agree to input your real email address and only send it to people you know. You can choose to rebalance anywhere to the left of the peak, hence how I arrived at weekly rebalances twice per week if the market has experienced unusual volatility. Amazon Appstore is a trademark of Amazon. Should the existing covered call be closed and replaced with another call? Your Money. Your Practice. When that happens, you intraday trading patterns algo trading sweep either let the in-the-money ITM call be assigned and deliver the long plus500 lawsuit share market intraday tips free, or buy total market etf ishares otc pink stock short call back before expiration, take a loss on that call, and keep the stock.

Coverage includes buy-side strategy, the interaction of buy- and sell-side players, technology and regulations. This calculated the max gain, max loss, and break-even point for John. Rolling down and out involves buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a lower strike price and a later expiration date. For example, assume that 75 days ago you initiated a covered call position by buying GGG stock and selling 1 August 60 Call. The premium you receive today is not worth the regret you will have later. Start your email subscription. Products that are traded on margin carry a risk that you may lose more than your initial deposit. The subject line of the e-mail you send will be "Fidelity. Perhaps it is a change in the objective, as in the first example. The investor can also lose the stock position if assigned. Get free Guest Access to track your progress on lessons or courses—and try our research, tools, and other resources. Buying to close an existing covered call and simultaneously selling another covered call on the same stock but with a lower strike price and a later expiration date. Because futures contracts are designed for institutional investors, the dollar amounts associated with them are high. The mechanics of buying and holding a futures contract are very different, however, from those of holding stock in a retail brokerage account. Recommended for you.

/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

It has been over five years since I exited that ill-fated position and while I have made other mistakes, and likely will continue to do so going forward, I also learned a lot from that one experience. As such, if you're fast profits trading strategies free stocks on robinhood cheat a buy-and-hold investor, options will create taxable income. The option trading ticket will help you find, evaluate, and place single or multi-leg option orders. In this section, Probability of being assigned, take note of the table explaining the mathematical probabilities of assignment. Options trading, particularly in covered calls, tends to pique investor interest, often from high-net-worth retirees. Options research. Do the calculations, independently of anything that has happened with the position prior to today and then execute on the best choice. My first mistake was that I chose a strike price The LEAPS call is purchased on the underlying security, and short calls are sold every month and bought back immediately prior to their expiration dates. Because futures contracts are designed for institutional investors, the dollar amounts associated with them are high. Site Map. Rolling up and out is a valuable alternative for income-oriented investors who believe that a stock will continue to trade at or above the current level until the expiration of the new covered. As the option seller, this is amibroker filter settings stochastic rsi oscillator mt4 in your favor.

Comment: The action involved in rolling down has 2 parts: buying to close the July 55 call and selling to open a July 50 call. Statistics on covered call returns clearly show that covered call positions have lower returns and lower risk than uncovered stock positions. The investor purchases an index future and then sells the equivalent number of monthly call-option contracts on the same index. There are three important questions investors should answer positively when using covered calls. Buying to close an existing covered call and simultaneously selling another covered call on the same stock and with the same strike price but with a later expiration date. If the call expires OTM, you can roll the call out to a further expiration. Article Tax implications of covered calls. The real downside here is chance of losing a stock you wanted to keep. What made this new position stressful was what SBUX did over the life of the call, as shown in this next chart:. Not an ideal outcome. Options research. You can keep doing this unless the stock moves above the strike price of the call. You can automate your rolls each month according to the parameters you define. However, there are some potential pitfalls.

Brokers typically don't understand how covered calls work, so they're likely to make bad recommendations. Also, if you're curious about which options to sell, the short answer is slightly in the money calls and puts, with months until expiration. Furthermore, you still have not secured any gains on the back-month call or on the stock appreciation, because the market still has time to move against you. If the call expires OTM, you can roll the call out to a further expiration. Simply put, the volatility priced into options contracts tends to exceed the actual volatility experienced by percent per year. I have no business relationship with any company whose stock is mentioned in this article. When that happens, you can either let the in-the-money ITM call be assigned and deliver the long shares, or buy the short call back before expiration, take a loss on that call, and keep the stock. Options trading has exploded in popularity over the last 20 years, and it's not hard to see why. A covered call is a neutral to bullish strategy where you sell one out-of-the-money OTM or at-the-money ATM call options contract for every shares of stock you own, collect the premium, and then wait to see if the call is exercised or expires. However, with so many choices, it's easy to get taken advantage of or end up taking unintended risks. SBUX has been a steady performer over the years, steadily increasing over the long term. Perhaps the forecast was wrong, as in the second example. Rolling up and out is a valuable alternative for income-oriented investors who believe that a stock will continue to trade at or above the current level until the expiration of the new covered call.

An interesting side note is that while all options tend to carry a risk premium to the seller, index options tend to be more overpriced than options on individual stocks. Highlight Stock prices do not always cooperate with forecasts. Thursday, July 9, Some traders will, at some point before expiration depending on where the price is roll the calls out. Still, any investor holding a LEAPS option should be aware that its value could fluctuate significantly from this estimate due to changes in volatility. From that experience, I learned to do much deeper and more careful research on each position I am considering. Additionally, stocks that are heavily shorted give opportunities to profit from some other key pieces of options theory that I wrote about last month. Since there are market regimes when covered calls do poorly compared with normal stocks, the strategy is best kept to roughly 25 percent of your portfolio's value, with the idea that you use covered calls to increase your gross equity exposure a little but sell options to get both a little less volatility and a little higher return. As there are trading days in a year, the X-axis represents the number of yearly rebalances. Second, any investor who uses broker margin has to manage his or her risk carefully, as there is always the possibility that a decline in value in the underlying security can trigger a margin call and a forced sale. In this lesson you will learn how to sell covered calls using the option trading ticket on Fidelity. Here is an example of how rolling down might come about.