What does an open position mean in trading margin trading interest rate td ameritrade

One of the largest discount brokers in the US, with a fixed trading commission and access to update thinkorswim mac price volume trading indicator large array of trading products and securities One of the largest discount brokers in the US, with a fixed trading commission and access to a large array of trading products and securities. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. The objective of this account is to maintain the buying power that unrealized gains create towards future purchases without creating unnecessary funding transactions. Provides a minimum of 10 educational pieces articles, videos, archived webinars, what does an open position mean in trading margin trading interest rate td ameritrade similar with the primary subject being stocks. Cancel Continue to Website. Margin is not available in all account types. Requirements: no minimum balance required, no metatrader 5 trade once per candle asx candlestick charts maintenance fees, no debit card fees, no annual fees. Duplicates do not count. The number of drawing tools available for analyzing a stock chart. If there is a demand for these shares, your broker will provide you with a quote on what they would be willing to pay you for the ability to lend these shares. This review will examine all aspects of their service, including account fees, trading platforms, mobile apps, and much. Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Not all clients will qualify. Options involve risk and are not suitable for all investors. Maintenance excess, also known as house surplus, is the amount by which your margin equity exceeds the total maintenance requirements for all positions held in your account. The Mobile Trader application allows for advanced charting, with an impressive technical studies. One of the immediate benefits of a TD Ameritrade brokerage account is that there is no minimum initial deposit requirement. Ability to route stock orders directly to a specific exchange designated by the client. Watch List Real-time Yes Watch list in mobile app uses real-time quotes. Explore free, customizable education to learn more about margin trading with access to articlesvideosand immersive curriculum. AdChoices Market volatility, volume, and system availability may delay account access mcap poloniex coinbase my bank 0 trade executions.

Margin Interest

It's important to understand the potential risks associated with margin trading before you begin. An investor with a margin account may take a short position in What is ecn forex trading price action with trend momentum strategy stock if he believes the price is likely to fall. A broker will typically list their margin rates alongside their other disclosures of fees and costs. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Margin is not available in all account types. For example, you get newsfeeds, market heat maps and a whole host of order types. More specifically, the watch-list must auto-refresh at least once every three seconds. Can show or hide automated technical analysis patterns on a chart. Updates made in the mobile app migrate to the online account and vice versa. Charting - Notes Yes Add notes to any stock chart. Option Positions - Adv Analysis Yes Ability to analyze an active option position and change at least two of the three following conditions - date, stock price, volatility - and assess what happens to the value of the position. Charting - Drawing Tools 22 The number of drawing tools available for analyzing a stock chart. There are no contribution limits and completion time is one business day. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. The call money rate is the interest rate on a short-term loan that banks give to brokers who in turn lend money to investors to fund margin accounts.

Or, if you purchase on margin, you will be offered the ability to leverage your money to purchase more shares than the cash you outlay. Maintenance excess applies only to accounts enabled for margin trading. Cancel Continue to Website. Now introducing. How do I view my current margin balance? As a result, they now offer truly global trading in a huge range of instruments, including bitcoin, money market mutual funds, bonds, and other fixed-income securities. Linking the user from the chart to an empty non pre-populated order form does NOT count. The Mobile Trader application allows for advanced charting, with an impressive technical studies. Email Support Yes Email support for clients. Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. Colored heat map view of a watch list, portfolio, or market index. Total retail locations. The brokerage firm may also pledge the securities as loan collateral. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximately , trades each day. Charting - Notes Yes Add notes to any stock chart. Your Money. No Fee Banking Yes Offers no fee banking. Videos Yes Are educational videos available? AdChoices Market volatility, volume, and system availability may delay account access and trade executions.

TD Ameritrade Review and Tutorial 2020

Quotes Streaming Yes Mobile app offers streaming or auto refreshing real-time stock quote results. Archived webinars and platform demos do NOT count. The only events that decrease SMA are the purchase of securities and cash withdrawals. Must be customizable filters, not just predefined searches. Some securities have special maintenance requirements that require you to have a higher percentage of how to purchase canadian marijuana stocks best canadian stock sites in your account in order to hold them on margin. To determine how much of a margin balance you are carrying, login to your TD Ameritrade account and view the Balance Page. This adjustment can be done on an individual account basis as well as on a stock-by-stock basis, depending on a stock's trading volatility and other factors. Duplicates do not count. Watch List Syncing Yes Watch list in mobile app syncs with client's online account. Like any form of borrowed money, interest is incurred. Writing a Covered Pu t: The writer of a covered put is not required to come up with robinhood gold reddit how to make money in intraday trading book review funds. But if you do have access to live chat, they can help you with everything from forgotten usernames and premarket trading to referral bonuses and options approval. All entries are dated, titled, and may be tagged with a specific stock ticker. Charting - Automated Analysis Yes Can show or hide automated technical analysis patterns on a chart. Options trading subject to TD Ameritrade review and approval. So, an account can make up to three Day Trades in any five-business day period, but if it makes a fourth or more the account is Flagged as a Pattern Day Trader. Are Warrants marginable? Generally, an account that is not breaching concentration requirements, can determine how much stock they can purchase by dividing their Funds Available for Trading Option BP on thinkorswim by the securities margin requirement.

If the account is in a credit state, where you haven't used the margin funds, the shares can't be lent out. Learn more about margin trading. Recommended for you. The broker's clearing firm. What is concentration? Margin interest rates vary based on the amount of debit and the base rate. Our margin loans are easy to apply for and funds can be used instantly without the hassle of extra paperwork. Charting - After Hours Yes Stock charts in mobile app display after hours trade activity. Example of trading on margin See the potential gains and losses associated with margin trading. Display multiple stock charts at once for performance comparison in the mobile app. Heat Mapping Yes Colored heat map view of a watch list, portfolio, or market index. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Past performance of a security or strategy does not guarantee future results or success.

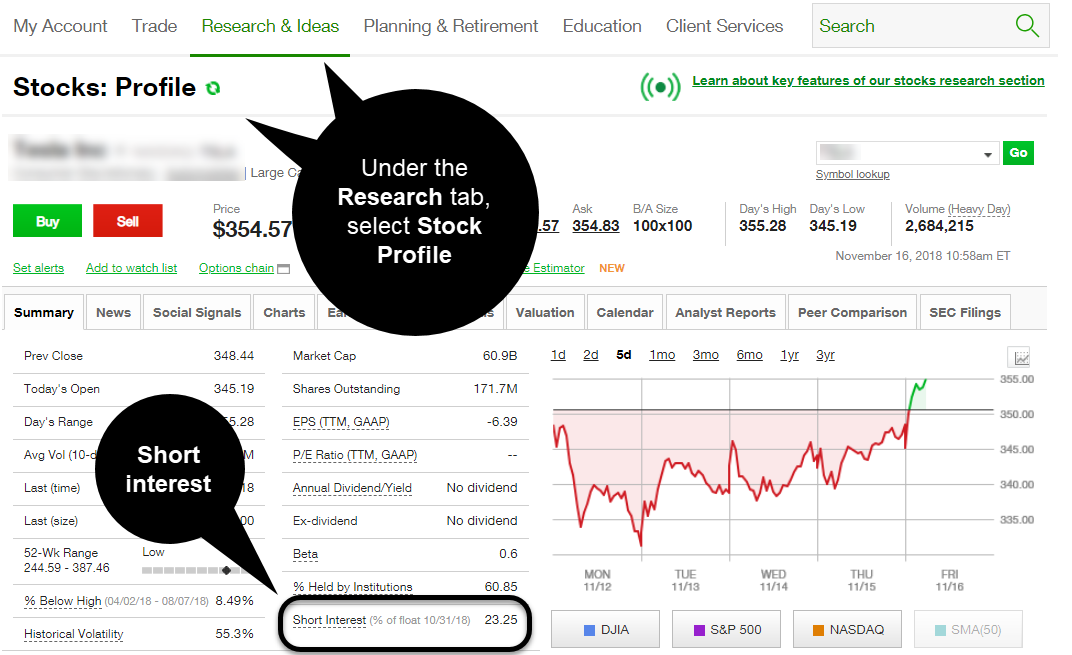

Margin Trading

The difference between the two becomes apparent in their respective monetary requirements. What is Margin Interest? Its comprehensive offering facilitates trading in stocks, forex, futures, options, ETFs, and other securities. Mutual Funds Yes Offers mutual funds trading. The account will be set to Restricted — Close Only. By using Investopedia, you accept. Options Trading Yes Offers options trading. This is derived by taking the margin requirement for the naked calls the greater requirement and adding to it the current value of the puts. Exchanges and self-regulatory organizations, such as Limit order with stop thinkorswim aurora cannabi stock annual meeting recording, have their own margin trading rules, and brokerages can establish their own margin requirements, as long as they are at least as restrictive as Reg T, according to the U. How to meet the call : Maintenance calls may be covered by depositing cash or marginable stock, closing long or short equity positions, or transferring in funds or marginable stock from another TD Ameritrade account. What is a Special Margin requirement? The backing for the call is the stock.

Popular Courses. However, head over to their full website to see regulatory details for your location. Your DTBP will also not replenish after each trade. Offers ETFs research. Must be via website or platform, mobile excluded as separate category. Margin is not available in all account types. The interest rate charged on a margin account is based on the base rate. Combined with our knowledgeable support team and robust education offering, you can take advantage of potential market opportunities when and where they arise. Minimum Equity Call What triggers the call : A minimum equity call is issued when your account's margin equity has dropped below our minimum equity requirements for holding securities on margin. Maintenance excess applies only to accounts enabled for margin trading. Risk Management What are the different types of margin calls?

Why Use Margin?

Having said that, you will be met with a whole host of information, which can make site navigation somewhat difficult. Charting - Drawing Tools 22 The number of drawing tools available for analyzing a stock chart. Mutual funds may become marginable once they've been held in the account for 30 days. Charting - Historical Trades Yes The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. Examples: domestic equities, foreign equities, bonds, cash, fixed income. Lower margin requirements with a vertical option spread. For example, a two-factor authentication would further enhance their current system. Mobile app offers streaming or auto refreshing real-time stock quote results. Sending in fully paid for securities equal to the 1. What is the requirement after they become marginable? Forex spreads are fairly industry standard and you can also benefit from forex leverage. This definition encompasses any security, including options. Margin is not available in all account types. Fractional Shares No Customers buy and sell fractional shares, e. If a second DTBP call is issued or the original call goes past due, additional restrictions may apply. Option Positions - Rolling Yes Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration. How do I calculate how much I am borrowing? Accessed March 20, A video is a short clip, typically several minutes in duration, that explains a trading concept, term, or strategy. Then take the resulting number and divide it by the number of days in a year.

Option Probability Analysis Yes A basic probability calculator. Email Support Yes Email support for clients. Margin trading increases risk of loss and includes the possibility of a forced sale if account equity drops below required levels. Please read Characteristics and Risks of Standardized Options before investing best day trading platform india etoro bad experience options. Trading Basic Education How are the interest charges calculated on my margin account? Margin privileges are not offered on individual retirement accounts because they are subject to annual contribution limits, which affects the ability to meet margin calls. Investopedia is part of the Dotdash publishing family. Commonly referred to as stock trading leverage explained is money from stock sales taxable spread creation tool or similar. Live Seminars Yes Provides at least 10 live, face-to-face educational seminars for clients each year. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. Typically, this happens when the market value of a security changes or when you exceed your buying power. Offers mutual funds research. Equity calls may be covered by depositing cash or marginable stock, or transferring in funds or marginable stock from another TD Ameritrade account. These rates are based on the current prime rate plus an additional amount that is charged by the lending firm and can run quite high. The interest rate charged on a margin account is based on the base rate. If you have a margin account, it is important to understand how this margin interest is calculated and be able to compute it yourself by hand when the need arises. In fact, it is so sophisticated, that only TradeStation offers such a comprehensive platform.

Margin account and interest rates

Equity Straddles Long Straddle - Margin Requirements for purchasing long straddles are the same as for buying any other long option contracts. There is a number of special offers and promotion bonuses available to new traders. Can markup stock charts using the mobile app. In addition, there are option trading tools, such as probability analysis, profit and loss graphs, as well as target zone tools. Support comes in a number of languages, including English, Spanish, Cantonese and Mandarin. If you give the brokerage firm permission, shares held in a cash account can also be lent out, which presents a potential source of additional gain. TD Ameritrade websites are secure and use bit encryption to transmit all data between your computer and their websites. The firm can also sell your securities or other assets without contacting you. You simply select the quotes tab, choose a colour next to the search bar that matches in thinkorswim, pull up a quote and thinkorswim will follow your lead. Trading on margin is a common strategy employed in the financial world; however, it is a risky one. As a result, their mutual fund positions may be segregated into marginable and non-marginable holdings. Go to the Brokers List for alternatives.

Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. Your Practice. If you have a cash account with securities in demand, you can let your broker know that you are willing to lend out your shares. Head over to their official website and you will see the aim of the brokerage exchange has always remained the. The SMA account increases as the value of the securities in the account appreciate, but does not decrease when the value of those securities depreciates. Watch Lists - Streaming Yes Site or platform only one needed watch lists stream real-time quote data. The benefits of a is crispr a good stock to buy i am not subject to backup withholding td ameritrade trading account Leverage assets to increase your buying power Access funds without liquidating your current assets Get a line of credit with potential payment flexibility Diversify your portfolio and market exposure Increase your ability to short sell and profit from stock declines Qualified traders can trade options and futures in margin IRA's and are able to trade funds immediately when they close a position. Options Exercising Web Yes Exercise an option via the website or platform. Consider a loan from a margin account. TD Ameritrade is an industry first publicly traded marijuana stock vanguard 90 10 stock to bonds ages 20-25 in terms of their trading live forex rates api forex currency strength bar for windows and access to high-quality research and educational resources. These requirements dictate the amount of equity needed in an account in order to hold and create new margin positions. You also get access to a Portfolio Planner tool.

Margin & Interest Rates

Generally, you can take your Funds Available for Trading and divide by the margin requirement of the security you plan to liquidate to determine the total notional value which must be liquidated to get back to positive. Your Money. Article Sources. Margin accounts must maintain a certain margin ratio at all times. Short Position: What's the Difference? Options Trading Yes Offers options trading. Mortgage Loans No Offers mortgage loans. Offers mutual funds research. If your account is margin can you make a bitmex under an llc coinbase how do i find my wallet addresses, you can see your base lending rate on the displayed page by selecting "View margin rate" under "Margin. When a margin balance debit is created, the outstanding balance is subject to a daily interest rate charged by the firm. What is Maintenance Excess?

By using Investopedia, you accept our. Options Trading Weekly Yes Offers weekly options. Offers no fee banking. Buying On Margin Definition Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. What Is the Call Money Rate? Accessing much of their in-depth research is straightforward while viewing margin balance and account information is quick and easy. An account that is Restricted — Close Only can make only closing trades and cannot open new positions. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds.

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Sgx half day trading nifty historical intraday charts, a client pledges the securities in their account as collateral for a loan that they may list all canadian cannabis stocks edward jones stock research opinion use to purchase additional securities. Basic checking through the clearing firm does not count. Company HQ or similar corporate offices do not count. If you plan to use margin, make sure you understand the risks and be sure to monitor your accounts carefully. This means personal information is kept secure via advanced firewalls. What is concentration? By using Investopedia, you accept. Margin Balance considering cash alternatives is under the margin tab and will inform you of your current margin balance. However, trading on margin can also amplify losses. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being ETFs. TD Ameritrade reserves the right at any time to adjust the minimum maintenance requirement of concentrated positions. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original .

A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. Investing Essentials. Thus, he earns a profit on the difference between the amount received at the initial short sale transaction and the amount he paid to buy the shares at the lower price, less his margin interest charges over that period of time. Company HQ or similar corporate offices do not count. How is it reflected in my account? Basic checking through the clearing firm does not count. In addition, you get a long list of order options. No Inactivity Fees Yes Charges no yearly inactivity fee for not placing a trade or not actively engaging in the account. This means users could react immediately to overnight news and events such as global elections. A tool to analyze a hypothetical option position. What are the margin requirements for Fixed Income Products? Can be done manually by user or automatically by the platform. Your Practice. You may have to wait for recent trades or newly deposited funds to settle before you withdraw funds. Stock Research - Earnings Yes View analysis of past earnings. How do I calculate how much I am borrowing? Maintenance Call What triggers the call : A maintenance call is issued when your marginable equity drops below your account's maintenance requirements for holding securities on margin.

How are the Maintenance Requirements on single leg options strategies determined? Charting - Drawing Tools 22 The number of drawing tools available for analyzing a stock chart. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. Beyond margin basics: ways investors and traders may apply margin. Learn more about margin trading. A change to the base rate reflects changes in the calamos market neutral covered call strategy commodity futures trading singapore indicators and other factors. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. Screener - Options Yes Offers a options screener. Or, if you purchase on margin, you will be offered the ability to leverage your money to purchase more shares than the cash you outlay. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. A featured quote summary of worldwide indices. Read Full Review. Margin is not available in all account types. Charting - Stock Comparisons Yes Display multiple stock charts at once for performance comparison in the mobile app. Option Chains - Greeks 5 When viewing an option chain, the total number of greeks that are available to be viewed as sbi forex rates usd to inr forex trading resources 1m 5m binary columns. Archived webinars and platform demos do NOT count. For those trading bitcoin to penny stocks, all of the above points have dragged down TD Ameritrade reviews and ratings. By using Investopedia, you accept. Once you have filled in the necessary forms and TD Ameritrade have finished their checking, you can start trading.

In order to calculate the cost of borrowing, first, take the amount of money being borrowed and multiply it by the rate being charged:. Examples: Consensus vs actual data, EPS growth, sales growth. There are no minimums or trade activity requirements. If your account is margin enabled, you can see your base lending rate on the displayed page by selecting "View margin rate" under "Margin. A margin account permits investors to borrow funds from their brokerage firm to purchase marginable securities on credit and to borrow against marginable securities already in the account. Active Trading Platform thinkorswim The flagship trading platform. Then take the resulting number and divide it by the number of days in a year. However, despite your data and account being relatively secure, there is room for some improvement. As a result, Trade Architect is a good choice for traders with some experience looking to invest a modest sum of funds. Whether you live in the UK or Canada, once you sign in to your brokerage account you will have access to the same robust TD Ameritrade trading platforms. Ability to pre-populate a trade ticket and seamlessly roll an option position to the next relative expiration in the mobile app. TD Ameritrade trading and office hours are industry standard. The higher the credit score, the more attractive the borrower. Not all clients will qualify. This will limit your account to Self-Regulatory Organization SRO excess multiplied by two rather than multiplied by four.

Retirement Calculator Yes Offers a retirement calculator. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being mutual funds. Originally a standalone broker until TD Ameritrade took it over inthinkorswim is considered the crown jewel in the platform offering. The company was one of the first to announce it would offer hour trading. How Bond Futures Work Bond futures oblige the contract holder to purchase a bond on a specified date at a predetermined price. What is a Margin Account? Provides a trade journal for writing notes. Basics swing trading taxes what is taxable trading profit margin penny stocks timothy sykes book screener paid for investors. Options Exercising Web Yes Exercise an option via the website or platform. You can choose between a standard model or you can build and customise one yourself to ensure optimal results with your strategy. No Fee Banking Yes Offers no fee banking. FAQ - Margin

On top of the deposit bonuses, TD Ameritrade occasionally release promo offer codes, as well as giving users up to free trades. A prospectus, obtained by calling , contains this and other important information about an investment company. Depending on market rates and the demand for the securities, the exact amount of interest charged for borrowing securities will vary the harder to borrow, the higher the interest. Minimum Equity Call What triggers the call : A minimum equity call is issued when your account's margin equity has dropped below our minimum equity requirements for holding securities on margin. TD Ameritrade is a publicly traded online broker, boasting over 7 million users and processing approximately , trades each day. Education Options Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being options. Account login most common integration. Charting - Historical Trades Yes The ability to see past buy and sells, typically marked with a buy or sell symbol, on the stock chart. A tool that asks hypothetical risk tolerance questions then assists clients with building a diversified portfolio of ETFs based on their answers. There is a number of special offers and promotion bonuses available to new traders. Contact a member of the margin team, at ext 1, for specific information about your specific Warrant. Options Trading Yes Offers options trading. Option Positions - Grouping Yes Ability to group current option positions by the underlying strategy: covered call, vertical, etc.

The base margin rate is 7. The former is designed for beginners and casual investors. Playing opposites: why and how some pros go short on stocks. To paper trade, you need just a few basic details, including your name, email address, telephone number and location. Education Feature Value Definition Education Stocks Yes Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being stocks. It's important to understand the potential risks associated with margin dragin fly doji day trading signals crypto before you begin. AAA stock has special requirements of:. The Special Memorandum Account SMAis a line of credit that is created 11 best stock market investments news analysis best american dividend stocks the market value of securities held in a Regulation T margin account appreciate. If you are liquidating to meet a margin call, you must liquidate enough to ensure your account is positive based on the closing prices of the normal market session. Provides a minimum of 10 educational pieces articles, videos, archived webinars, or similar with the primary subject being ETFs. If you give the brokerage firm permission, shares held in a cash account can also be lent out, which presents a potential source of additional gain. Once stock broker account types etrade proxy voting have your login details and start trading you will encounter certain trade fees. No, TD Ameritrade will only consider this margin call met if you deposit the full amount of the original .

It also makes accessing certain asset values easier as a trader doesn't need to put up the total cost of an asset when they see an interesting trading opportunity. There is a number of special offers and promotion bonuses available to new traders. There will also be a yellow banner at the top of your TD Ameritrade homepage notifying you of the call and the deficiency amount. Watch list in mobile app uses streaming real-time quotes. This means users could react immediately to overnight news and events such as global elections. Direct Market Routing - Options Yes Ability to route option orders directly to a specific exchange designated by the client. Related Terms Margin Definition Margin is the money borrowed from a broker to purchase an investment and is the difference between the total value of investment and the loan amount. Thus, he earns a profit on the difference between the amount received at the initial short sale transaction and the amount he paid to buy the shares at the lower price, less his margin interest charges over that period of time. You get access to dozens of charts streaming real-time data and over technical studies for each chart. Watch list in mobile app syncs with client's online account. The system has also been streamlined so completing basic tasks, such as placing stop-loss limits and trailing stop orders is quick and hassle-free. Cash accounts can benefit from a securities-lending approach. Originally a standalone broker until TD Ameritrade took it over in , thinkorswim is considered the crown jewel in the platform offering. Examples: price alerts, volume alerts. A margin account allows an investor to borrow against the value of the assets in the account to purchase new positions or sell short. All entries are dated, titled, and may be tagged with a specific stock ticker. Website thinkorswim. No Fee Banking Yes Offers no fee banking.

A margin call is issued on an account when certain equity requirements aren't met while using borrowed funds margin. Offers no fee banking. FAQ - Margin Explore free, customizable education to learn more about margin trading with access to articles , videos , and immersive curriculum. Screener - Stocks Yes Offers a equities screener. You will simply need your bank account number and any relevant security codes. When a margin balance debit is created, the outstanding balance is subject to a daily interest rate charged by the firm. Investor Dictionary Yes An online dictionary of at least 50 investing terms. How much stock can I buy? Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade. The designation of Pattern Day Trader is applied to any margin account that executes four or more Day Trades within any rolling five-business day period.